- Whale accumulation highlighted strong confidence as ONDO traded within key support and resistance levels.

- Technical indicators suggested oversold conditions, with large transactions signaling potential bullish momentum.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines when it comes to market trends. The recent whale activity in ONDO is reminiscent of the early days of Bitcoin, where large players would make big moves that set the tone for the market. The $7.87M accumulation by a single entity suggests strong confidence and renewed interest in the token, which could potentially lead to a significant rally.

The technical indicators also support this optimistic view, with oversold conditions hinting at a possible rebound in the short term. However, as we all know too well, cryptocurrency markets can be unpredictable, and it’s essential to remain cautious even when the stars seem to align. If ONDO manages to break its resistance at $1.79, we could see it reaching the coveted $2.30 mark, but if support breaks, a drop down to $1.20 is not out of the question.

The increase in large-value transfers and institutional activity is also promising, indicating that ONDO might be attracting significant capital flows. This trend aligns with my belief that institutional interest will play a crucial role in shaping the future of the crypto market.

That said, I’m not one to bet everything on a single horse, so while I’ll certainly keep an eye on ONDO, I won’t make any rash decisions just yet. After all, we’re still in the realm of digital unicorns and rainbows! And remember, never invest more than you can afford to lose – especially when it comes to crypto!

One significant player has returned to the Ondo market with an impressive $7.87 million spread across five digital wallets, mere days following a previous sale transaction.

1.64 million ONDO tokens were bought for a total of $2.46 million USDT, indicating increased faith in the token’s value.

Right now, ONDO is being exchanged for $1.43, representing a decrease of 2.15% over the past day, as investors evaluate its upcoming action.

Drawing from my years of trading experience, I can’t help but ponder whether this strategic buildup indicates a forthcoming strong rally or leaves the token vulnerable to more price swings. The markets have taught me that every accumulation has its own story, and it’s crucial to decipher the signals before making a move.

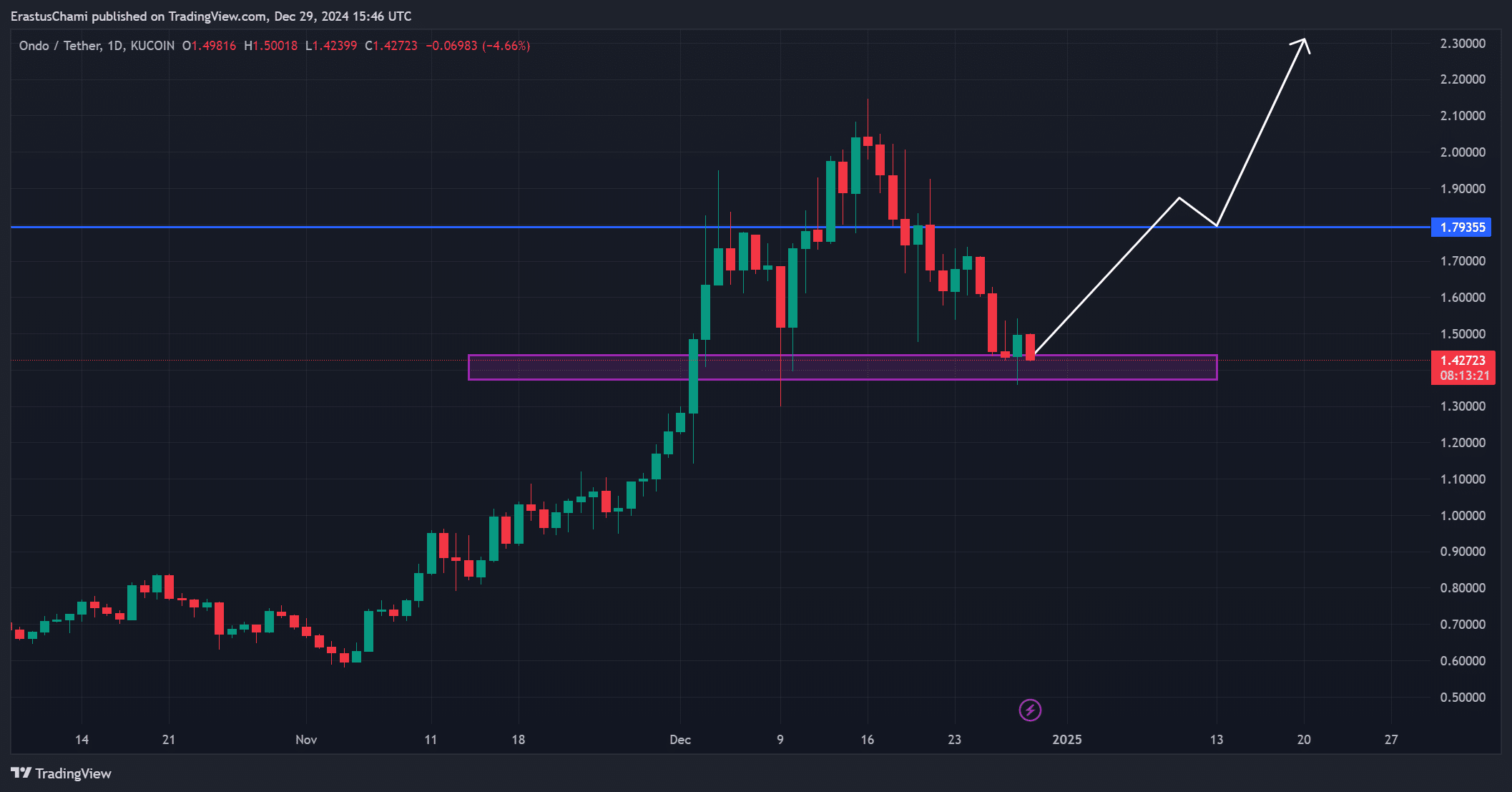

ONDO price analysis: Navigating key levels

In simpler terms, the value of ONDO has been trying to hold its important level of support, ranging between $1.40 and $1.50, following a drop from its peak of $2.00 that occurred earlier in March.

At the moment, overcoming resistance at $1.79 is proving tough for the bulls, but if they manage to do so, it could push prices up towards $2.30.

Based on my years of trading experience, I have learned to be cautious when the support for a particular asset breaks. In this case, if the price falls below a key level like $1.20, it could signal a bearish trend ahead. This is not a scenario I would want to find myself in, as I’ve seen similar situations lead to significant losses in the past. So, I recommend keeping a close eye on the market and considering exiting any positions before the support breaks if possible.

Consequently, its immediate direction depends on its success in recapturing higher levels, with a focus on strengthening its position within this significant zone.

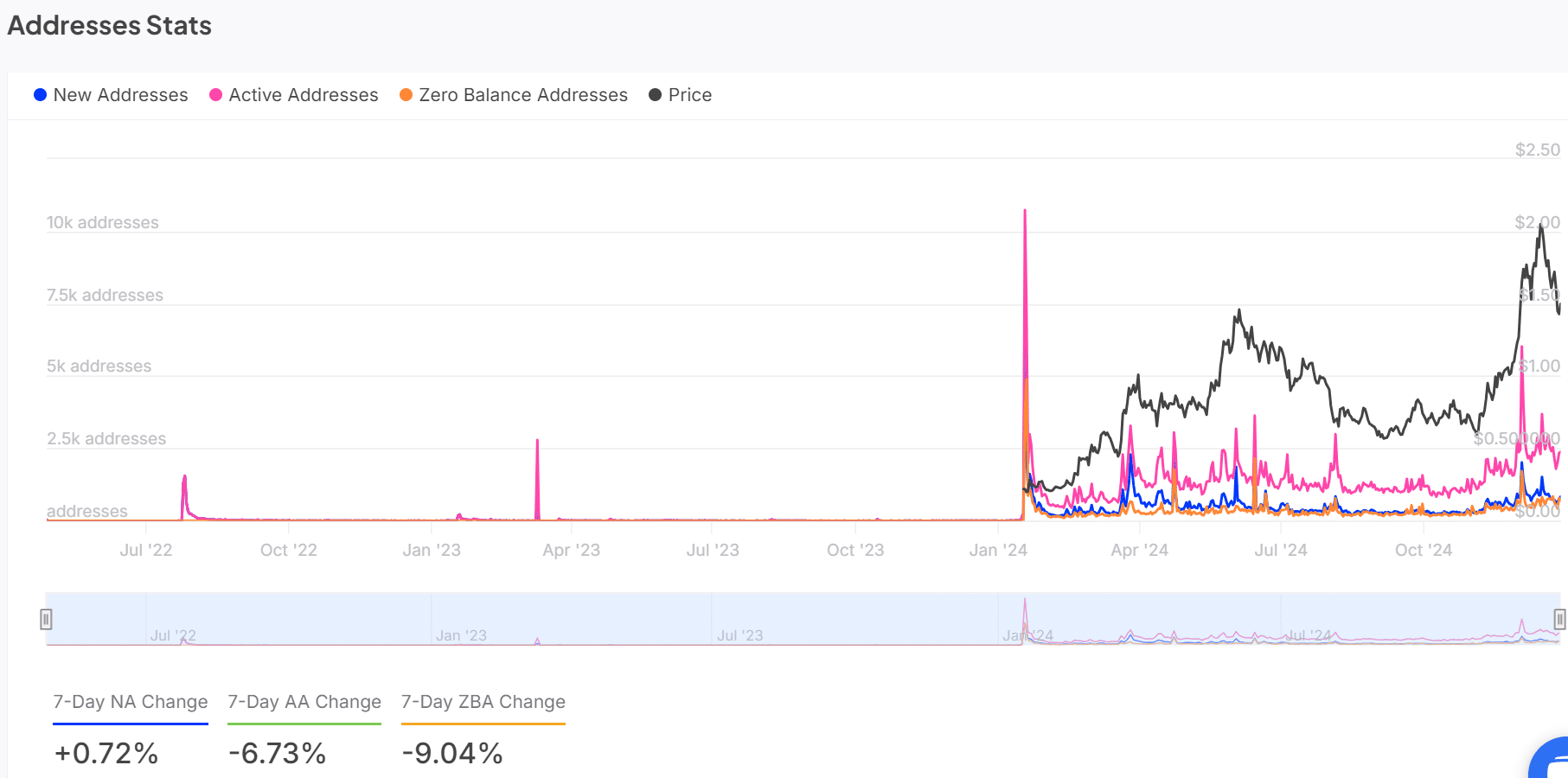

ONDO address stats: Shifting trends among holders

The creation of new addresses subtly portrays the complex dynamics within the token’s environment. A slight uptick of 0.72% in newly created addresses suggests persistent curiosity, while a decrease of 6.73% in active addresses over the last week hints at reduced engagement.

Moreover, a decrease of 9.04% in the number of zero-balanced addresses indicates that some users might be actively using their wallets again.

This adjustment shows a blend of feelings since investors are repositioning themselves, trying to strike a balance between hopefulness and vigilance while navigating the unpredictable nature of the markets.

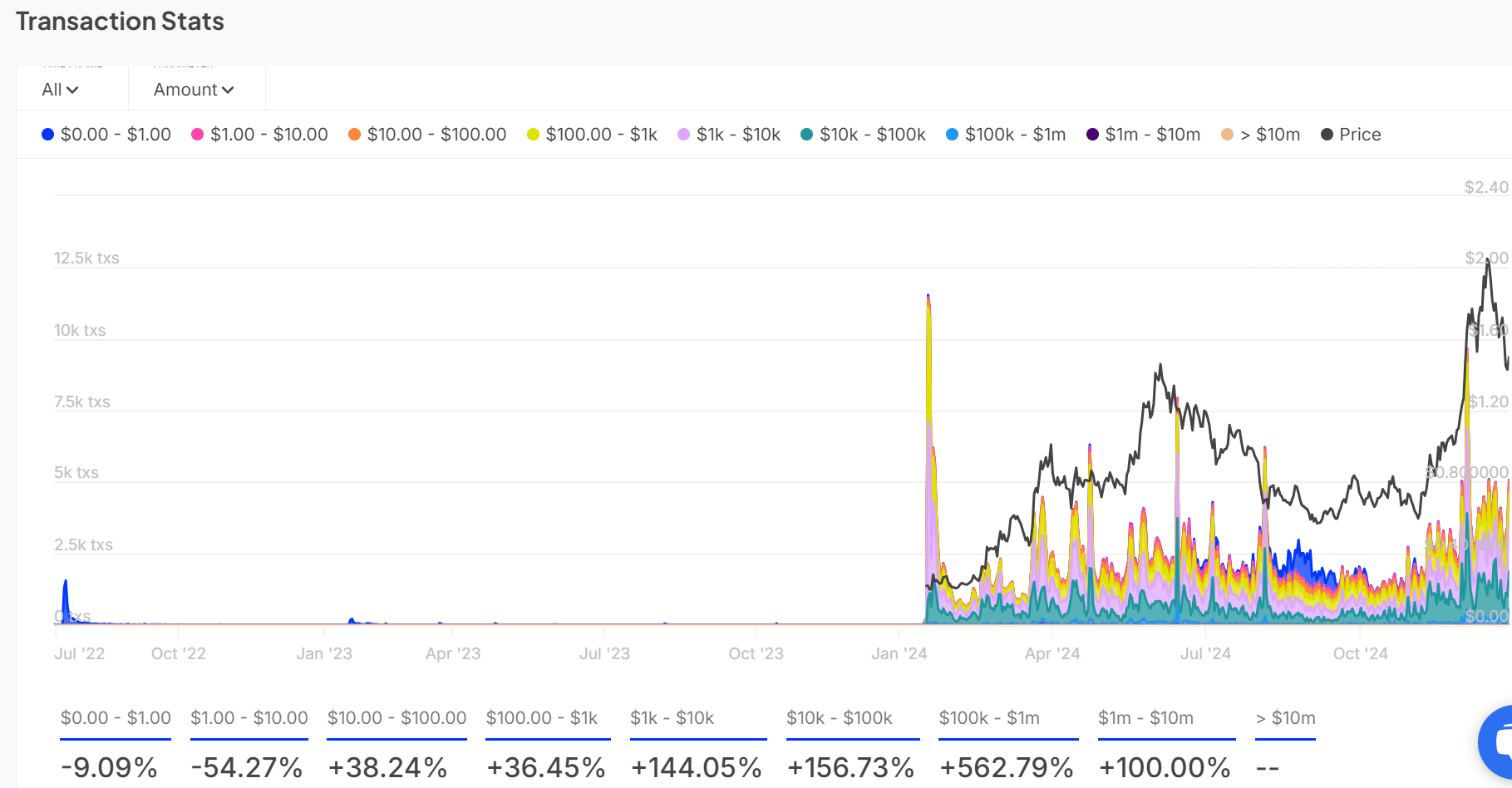

Transaction stats: Rising institutional activity?

The analysis of transaction data shows a strong increase in large money transfers, suggesting growing trust in ONDO.

The number of transactions ranging from $10,000 to $100,000 increased by a significant 156.73%, and transactions worth more than $1 million saw a remarkable jump by 100% as well.

The data indicates a rise in attention from established or wealthy investors who are looking for tactical investment opportunities.

Given this surge in transaction volume, it aligns with the larger story suggesting ONDO’s capacity to draw substantial investment funds. As an analyst, I find this trend intriguing and indicative of a promising future for ONDO.

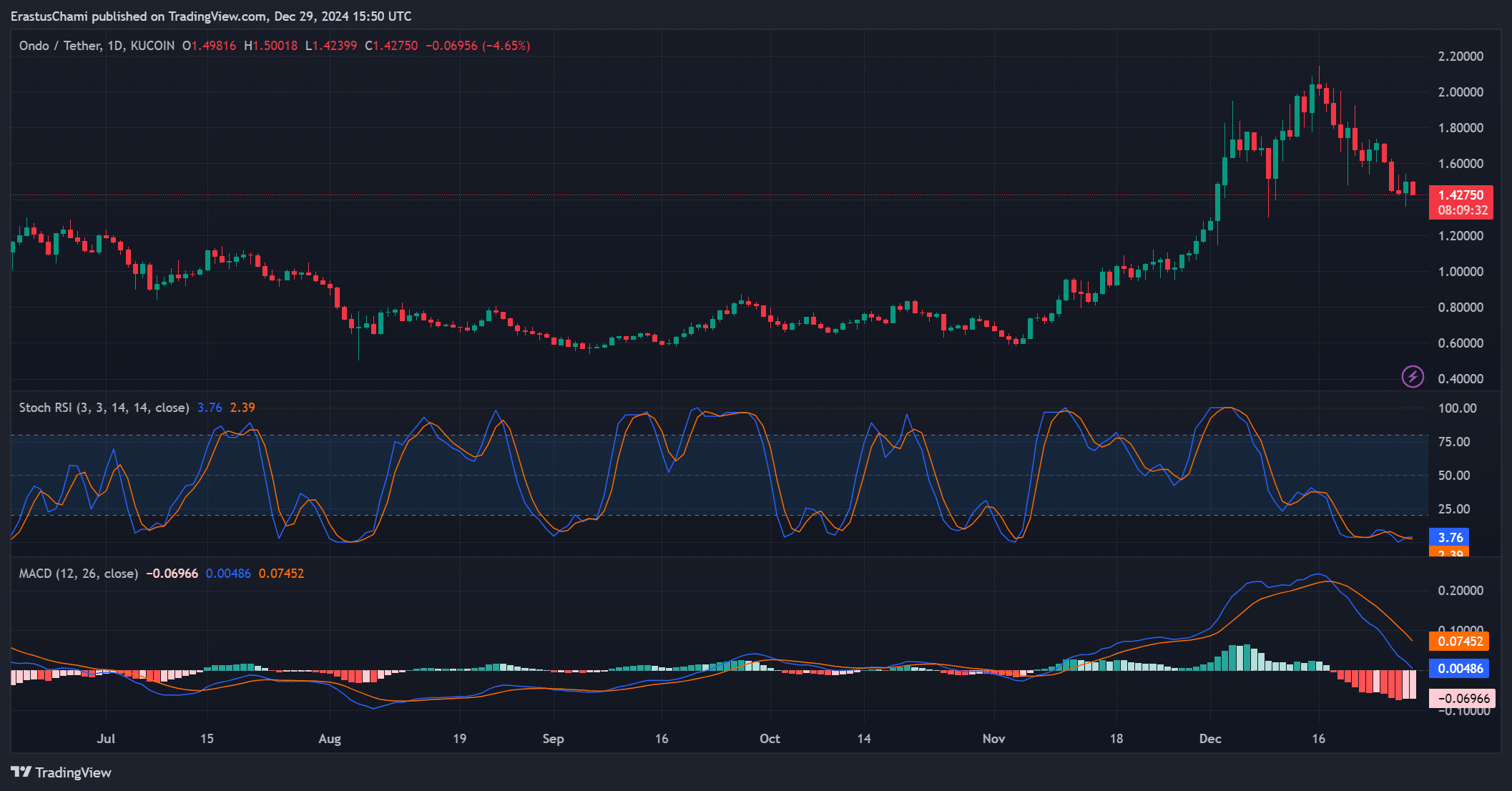

Technical indicators: Will momentum turn bullish?

Based on technical analysis, the current indicators suggest signs of an upcoming recovery. Specifically, the Stochastic Relative Strength Index (RSI) stands at 3.76, which indicates that the market may be overbought, potentially indicating a quick rebound in the near future.

Currently, the MACD is showing a negative value of about -0.069, indicating a bearish trend. However, the shrinking distance between its lines hints at a decrease in the intensity of this downward momentum.

If these indicators line up with a positive shift in outlook, the token might experience a change in its current downward trend towards an uptrend.

Read Ondo’s [ONDO] Price Prediction 2024–2025

As a seasoned crypto investor with over five years of experience in this dynamic and ever-evolving market, I’ve learned to keep a keen eye on various indicators that could potentially signal a bullish trend. Recently, I’ve been closely watching ONDO, a cryptocurrency that seems to be building a compelling case for a significant rally. The whale accumulation, increased large-value transactions, and bullish technical setups are all factors that have caught my attention, and as someone who has seen such patterns play out before, I believe this could be another opportunity worth exploring.

In the past, I’ve missed out on lucrative investments by not recognizing these signs early enough or being hesitant to act. This time around, I’m determined not to let that happen again. I’ll continue monitoring ONDO closely, keeping an eye on its price action and market sentiment, and when the timing feels right, I’ll make a move to capitalize on this potential rally.

Of course, investing in cryptocurrencies always carries risk, and it’s essential to do thorough research and due diligence before making any decisions. But based on my experience and analysis, ONDO looks like a promising investment opportunity that I don’t want to miss out on.

Despite ongoing hurdles, the market’s activity indicates that the ONDO token might be preparing for a robust price increase. Consequently, there appears to be an increased probability that ONDO may reach above $2.00 within the next few weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-30 11:04