- ORDI’s trading volume soared by 200%, indicating interest among traders and investors amid a potential breakout.

- Assets’ bullish thesis will only hold if it closes a daily candle above the $44.45 level, otherwise, it may fail.

As an experienced analyst with years of market observations under my belt, I see a promising opportunity in ORDI’s current market position. The recent surge in trading volume and the bullish shift in sentiment across the cryptocurrency landscape are clear indicators that ORDI is poised for a significant upside rally.

After the election outcomes, the general feeling towards cryptocurrencies has moved from a decreasing trend to an increasing one. With such a positive outlook, it’s expected that the native token of the Ordinals Protocol [ORDI] might experience a significant surge in the upcoming period.

This optimistic perspective could stem from favorable price trends, growing investor and trader attention, as well as a general sense of optimism in the market.

ORDI technical analysis and key analysis

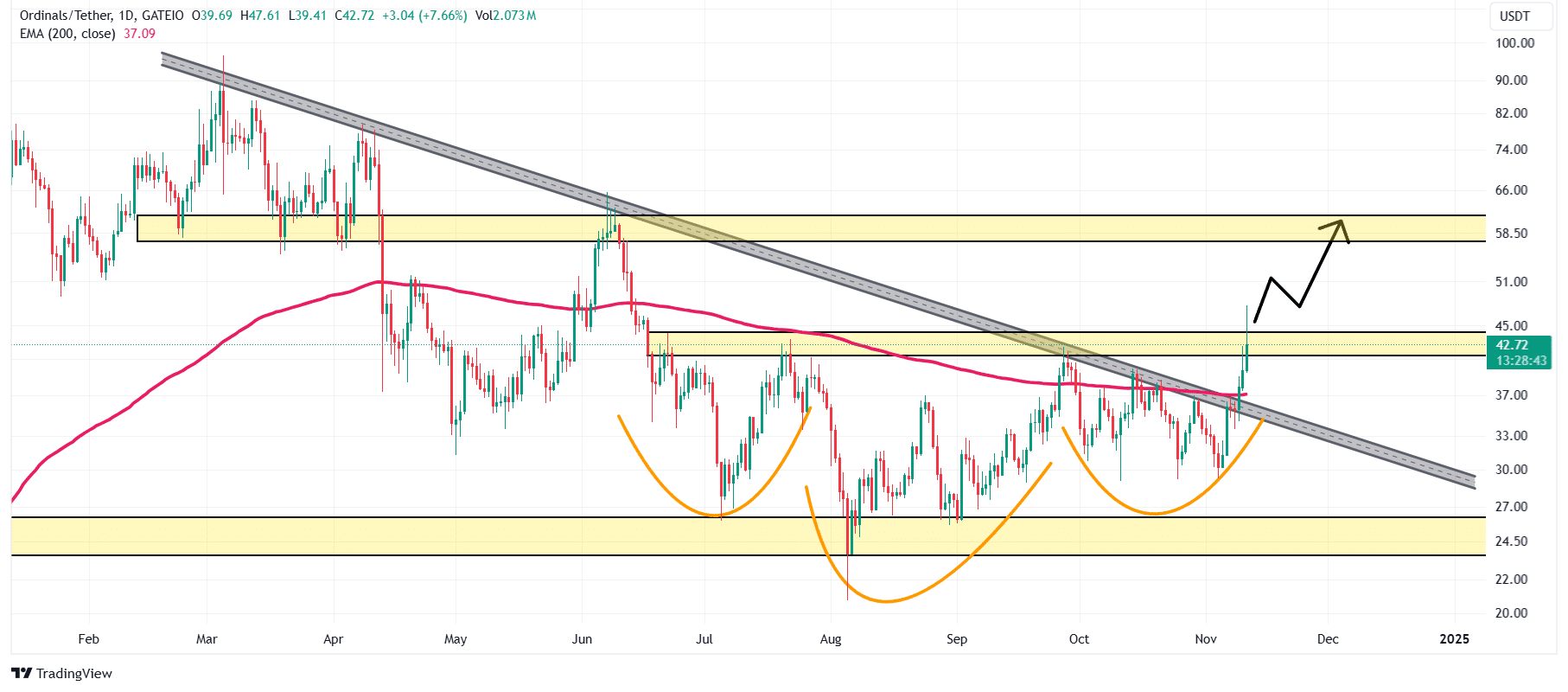

Based on AMBCrypto’s analysis, it seems that ORDI is finding difficulty surpassing a significant barrier at approximately $44.40. Remarkably, this barrier could also represent the base line for an optimistic upside reversal pattern known as an inverted head and shoulders formation.

According to current trends and past performance, if ORDI manages to surpass the $44.45 mark and concludes the daily trade above this price point, there’s a high likelihood that its value could increase by approximately 40%, potentially reaching around $62 within the near future.

As an analyst, I’m observing that ORDI is presently trading over its 200-day Exponential Moving Average (EMA), signaling a positive trending market condition. Moreover, a recent breach of a descending trendline implies continued growth in the stock price.

As a crypto investor, I’m keeping a close eye on ORDI. My optimistic outlook hinges on it closing the daily chart above $44.45. If it doesn’t, there’s a possibility that my bullish prediction might not materialize.

Bullish on-chain metrics

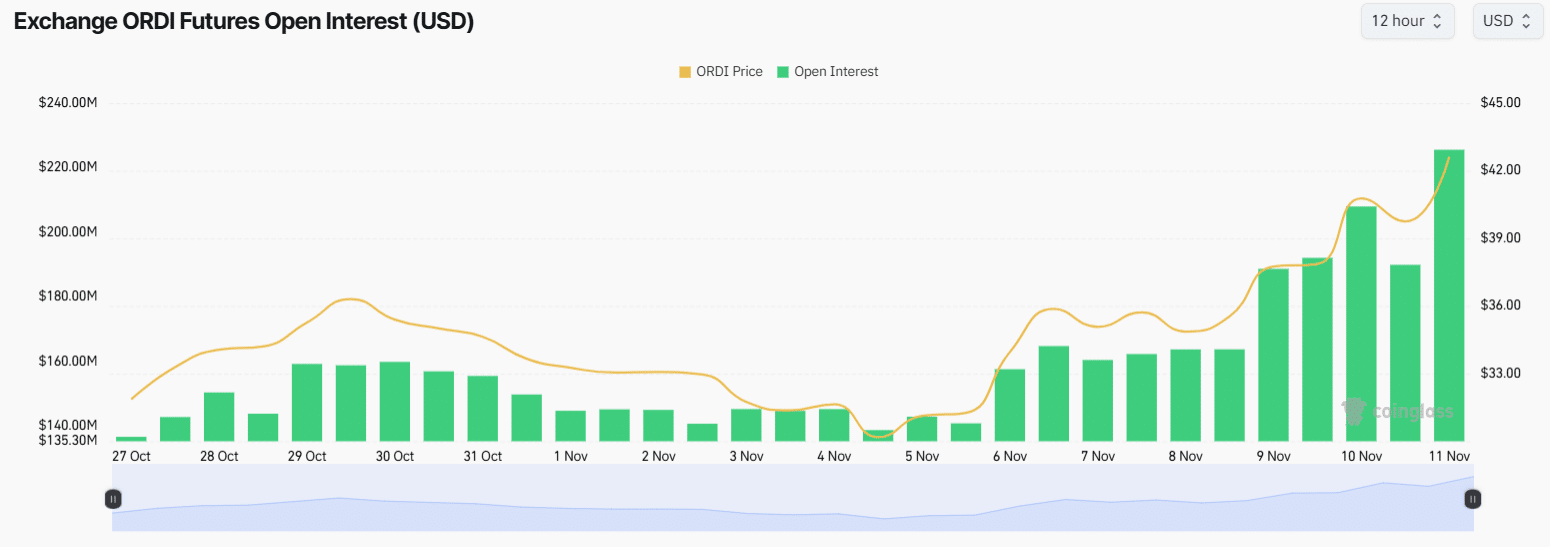

Furthermore, data from the blockchain also reinforces the optimistic perspective of the asset. As per the blockchain analytics company Coinglass, the long/short ratio for ORDI is at 1.003 right now, suggesting a robust bullish attitude among traders.

It seems that there’s a noticeable rise in trader activity as the asset’s price nears the breakout point. Data shows that ORDI’s open interest has jumped by 8.9% within the last day, and an additional 4.3% over the past four hours.

By examining these blockchain measurements alongside traditional trading techniques, it appears that large investors (whales) and traders are exerting significant influence over this asset right now. This control may facilitate its attempt to surpass the existing resistance barrier.

As of now, ORDI was almost at $43.15 per share and had experienced a 7.3% increase over the last 24 hours. Over this same timeframe, its trading activity more than doubled (up by 200%), indicating increased involvement from traders and investors, possibly due to anticipation of a potential price surge.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-12 05:43