- PEPE seemed to be trading near its support with low RSI as it faces key resistance at $0.00002200

- Retail-driven transactions and liquidation imbalances hinted at potential short-term volatility and recovery

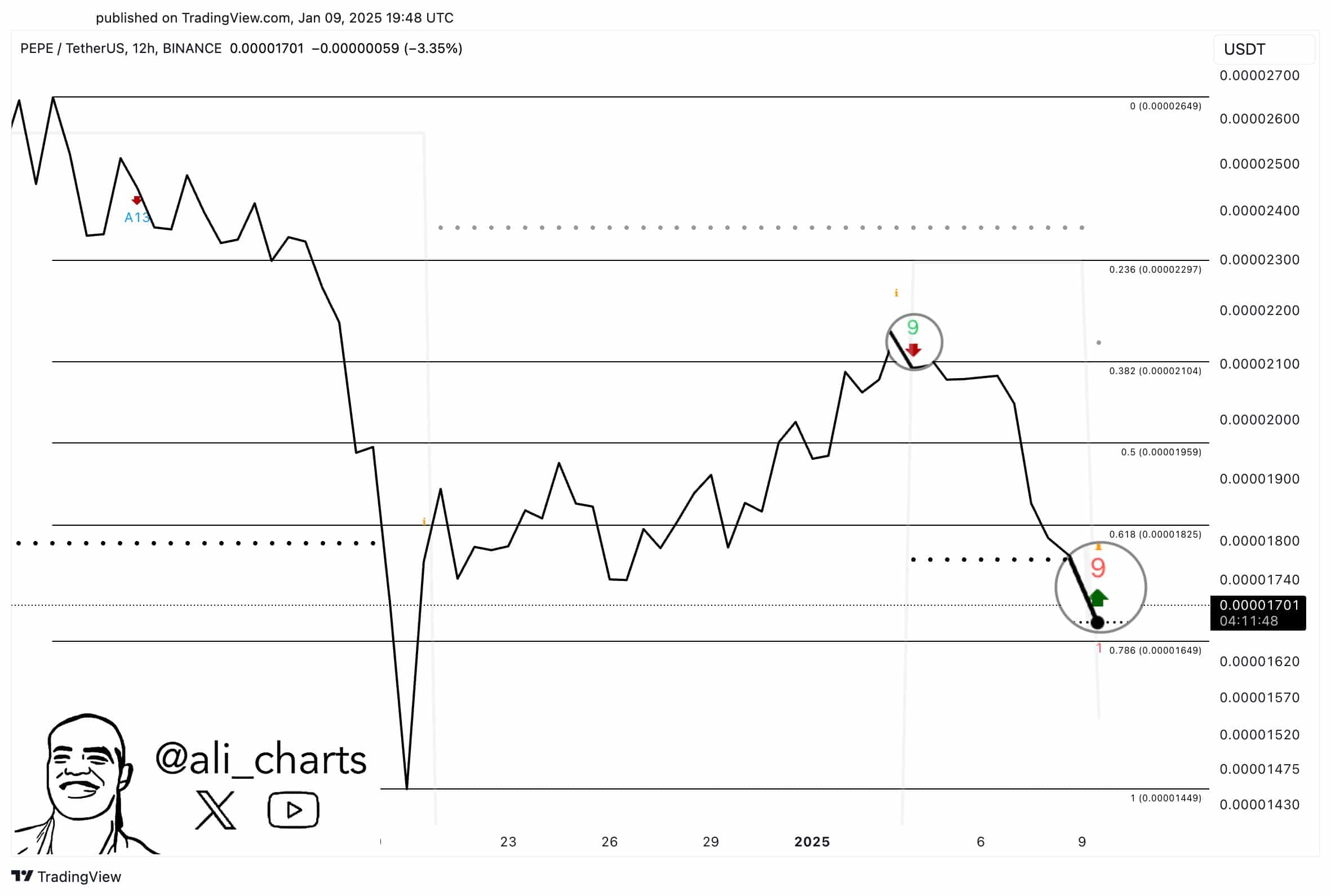

On January 4th, I observed a 20% adjustment in the price of PEPE as the TD Sequential indicator shifted from a sell to a buy signal on its 12-hour chart. This transition has ignited hope for a possible rebound, given the bullish implications of this technical indicator.

As of now, PEPE is being traded at $0.00001745 after experiencing a 1.89% decrease in the preceding 24 hours. Traders are paying close attention to crucial resistance levels as they aim to ascertain whether PEPE can recover its bullish trend and prevent any additional consolidation on the charts.

Can PEPE overcome resistance and reignite momentum?

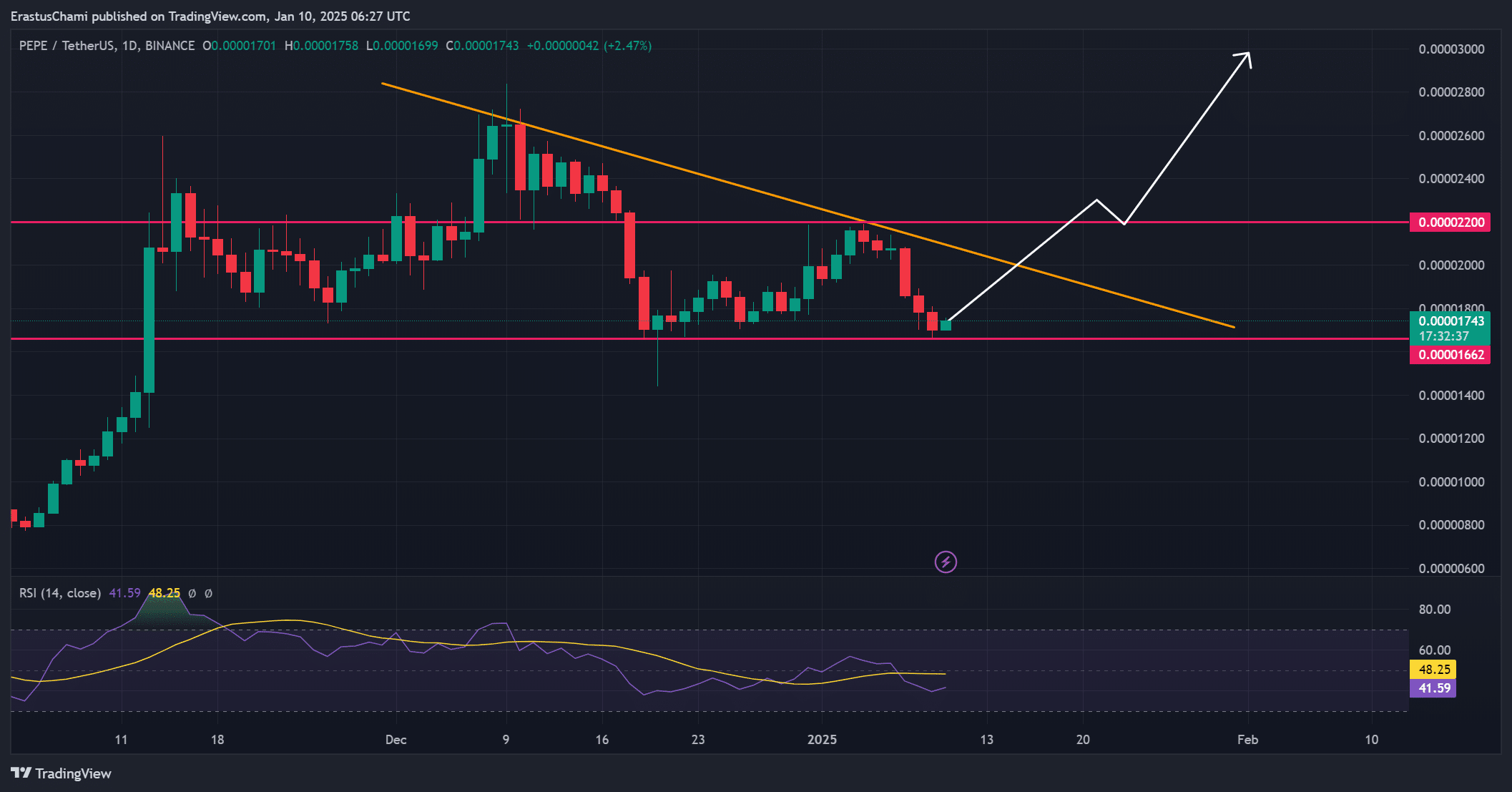

PEPE appeared to be maintaining its position above a significant support point of $0.00001662 – A crucial aspect for any possible price increase. Keeping an eye on the next substantial resistance at $0.00002200 is essential, as traders should watch it closely. The Relative Strength Index (RSI) stood at 41.59, indicating that the token was oversold.

Consequently, purchasers may view this circumstance as a chance to gather, yet it’s essential to break the falling trendline to verify bullish energy. If it fails to hold, though, it might initiate another drop.

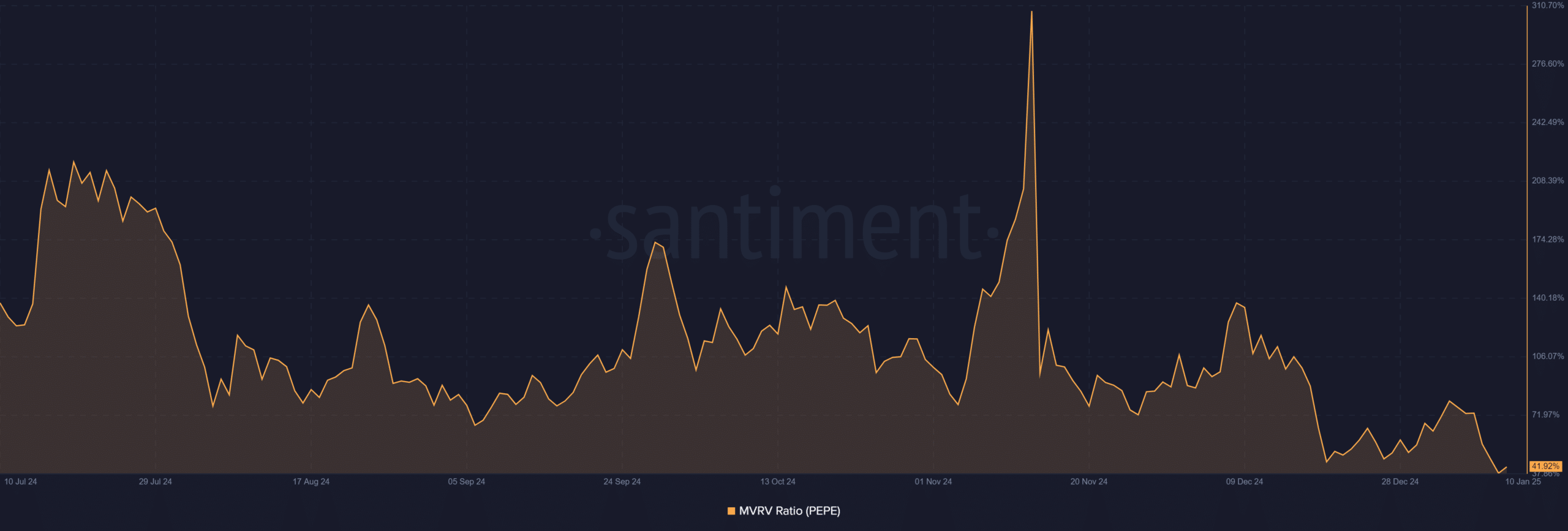

Is the low MVRV ratio signaling a buying opportunity?

Furthermore, PEPE’s Market Value to Realized Value (MVRV) ratio has decreased to 41.92%, indicating that the token could be substantially underpriced. This low figure implies that most holders are currently experiencing losses, possibly providing a profitable buying opportunity for new investors.

Yet, simply underestimating PEPE may not trigger a rally on its own; it needs the backing of increased market confidence. In other words, a surge in demand might propel PEPE upward, but for any increases to be significant and lasting, it requires continuous momentum.

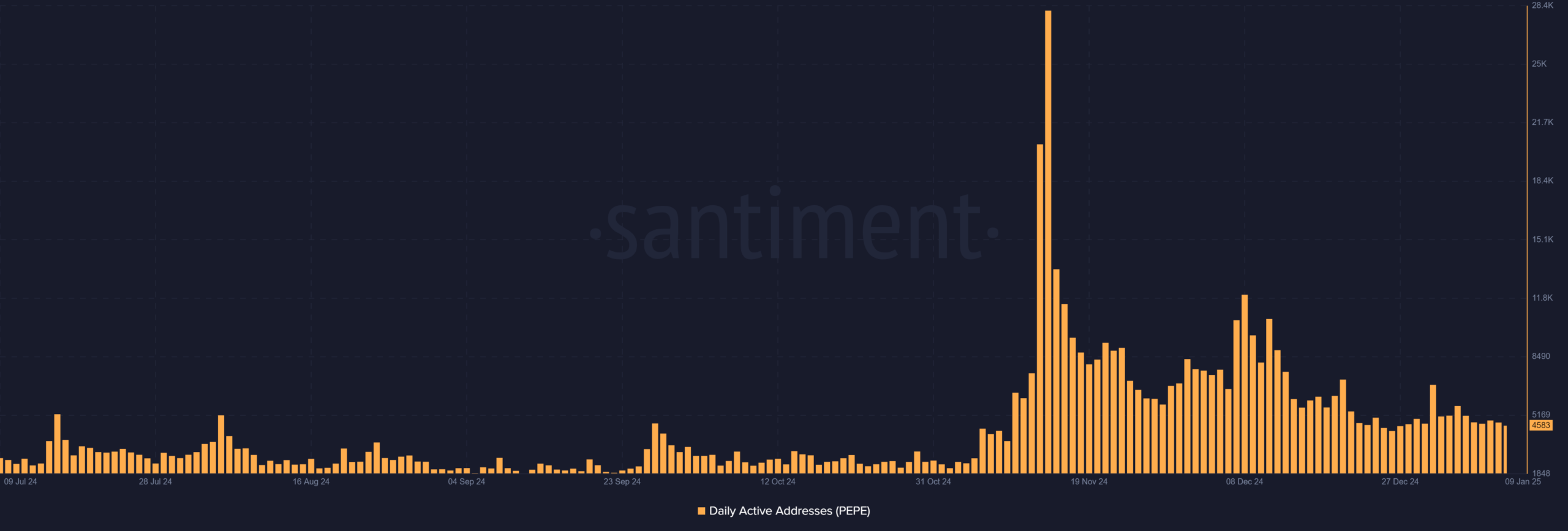

Active addresses indicate limited retail activity

Daily active participants kept a consistent level around 4,583, indicating a stable yet understated level of network interaction. This figure suggests minimal involvement from individual investors, which might curb near-term price surge potential.

Moreover, an increase in the number of actively used addresses could help rekindle enthusiasm and generate more demand. Yet, if engagement doesn’t improve, the price movement of PEPE might continue to be limited within its current trading range.

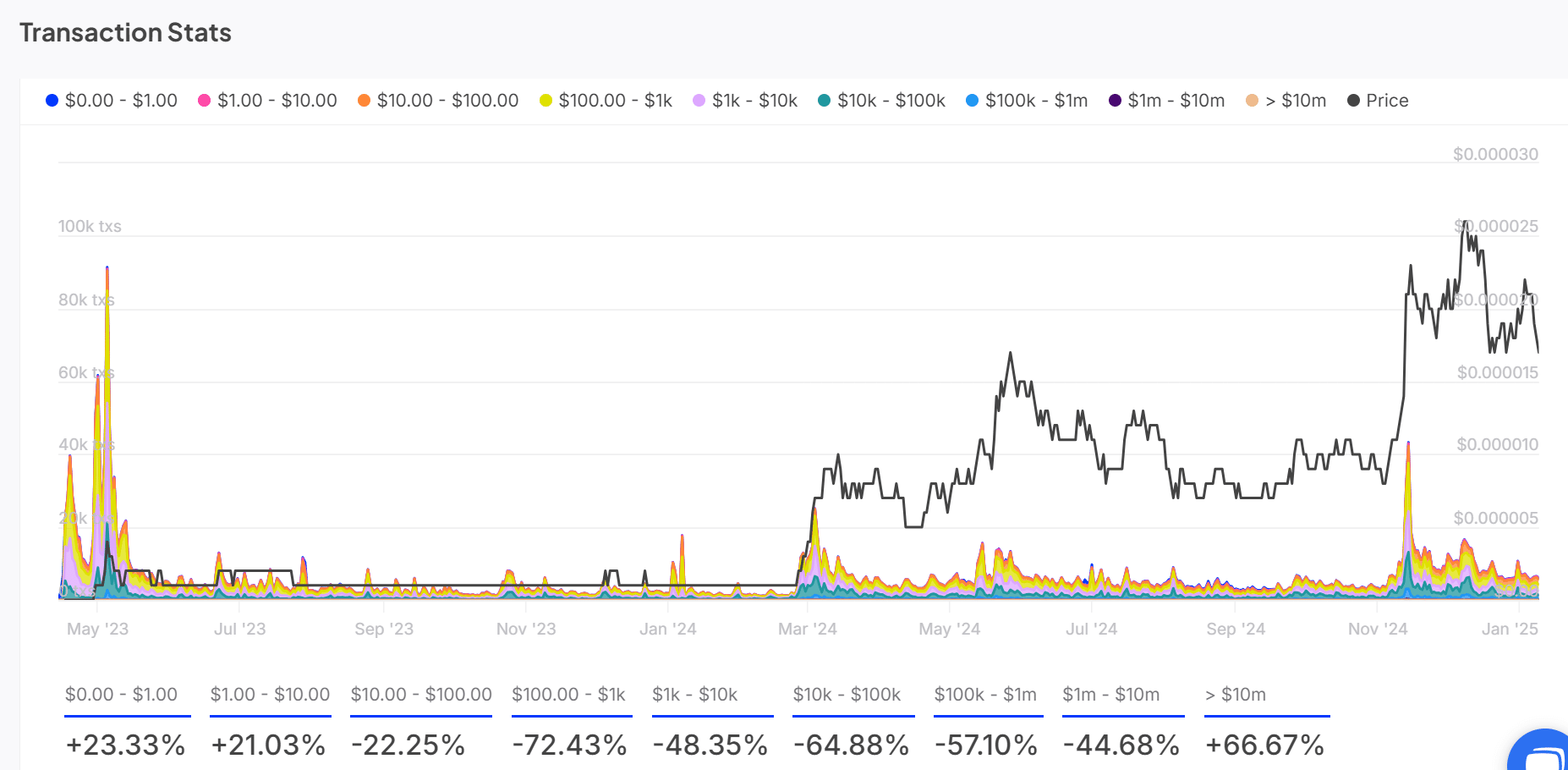

PEPE transaction trends highlight retail activity

It’s noteworthy that there was a significant jump of 66.67% in transactions falling between $10 and $100. This could point to a rise in activity among smaller investors. Moreover, this spike underscores the growing attention from retail market participants, despite larger transactions continuing at a steady pace.

As a result, this retail activity might temporarily boost the price of PEPE. But to maintain a significant upward trend, increased involvement from major investors is crucial.

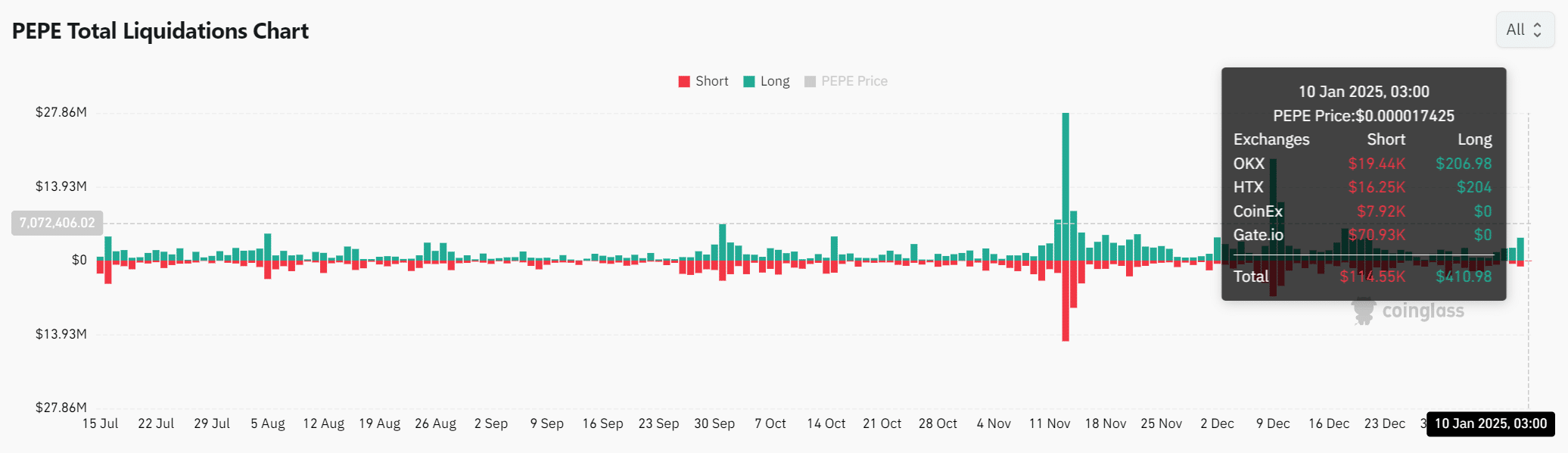

Liquidation data reveals market imbalances

In this situation, a memecoin saw a substantial disparity in market positioning, with long liquidations totaling $410,980 compared to only $114,550 in shorts. This suggests that many traders are wagering on price increases, but their over-leveraged positions might lead to increased market volatility.

In the end, since short-sellers are likely to close their investments, there could be a brief surge for PEPE stock. Yet, lasting growth will hinge on overall market trends and strong demand from buyers.

Read Pepe’s [PEPE] Price Prediction 2025–2026

As we speak, the buy signal for PEPE, coupled with its perceived undervalue and increasing smaller trades, seems to suggest a potential comeback. Yet, it’s crucial that more robust improvements are seen in aspects such as daily activity and resistance levels to validate this hypothesis.

Consequently, if the price breaks past approximately $0.00002200, it could signal a bullish trend. On the other hand, if the price fails to maintain support at around $0.00001662, there might be more consolidation in the future. At this point, the recovery of PEPE largely depends on growing demand and market trust.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-10 14:15