- The 50% retracement level and the daily RSI indicated a possible range formation.

- The rising buying pressure and the liquidation heatmap gave opposing signals.

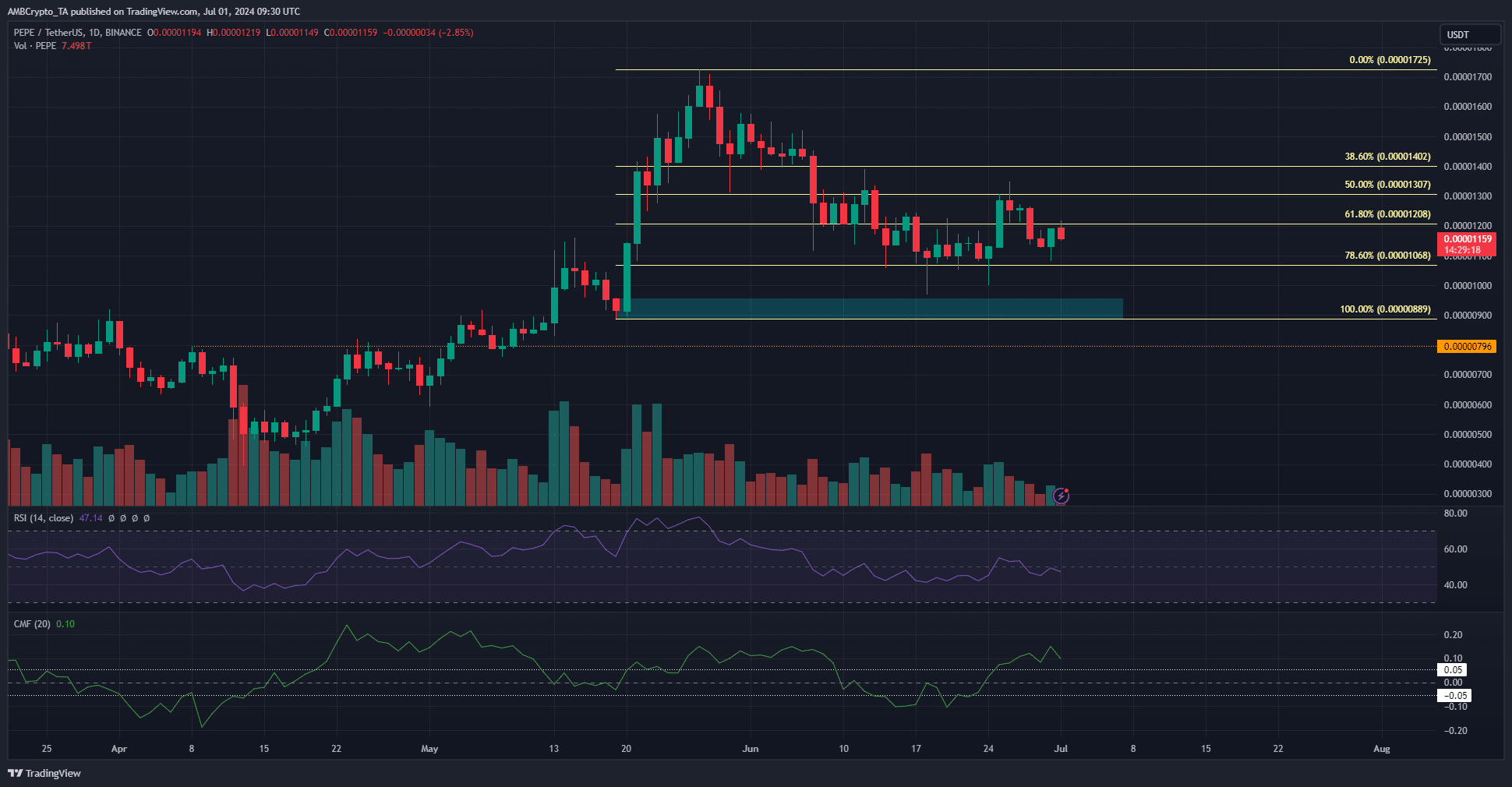

As a seasoned crypto investor, I’ve seen my fair share of market fluctuations and chart formations. Pepe [PEPE], a memecoin that has shown promise but also uncertainty, is currently in a crucial phase. The 50% retracement level and the daily RSI suggest a possible range formation, yet the rising buying pressure and opposing liquidation heatmap give conflicting signals.

As an analyst, I noticed that PEPE, the memecoin in question, encountered difficulties surmounting a nearby resistance point. Based on previous analysis by AMBCrypto, there were indications of a forming range. However, a bullish chart pattern was also a plausible outcome to consider.

As an analyst examining the on-chain data, I’ve noticed signs suggesting that selling pressure could increase in the near future.

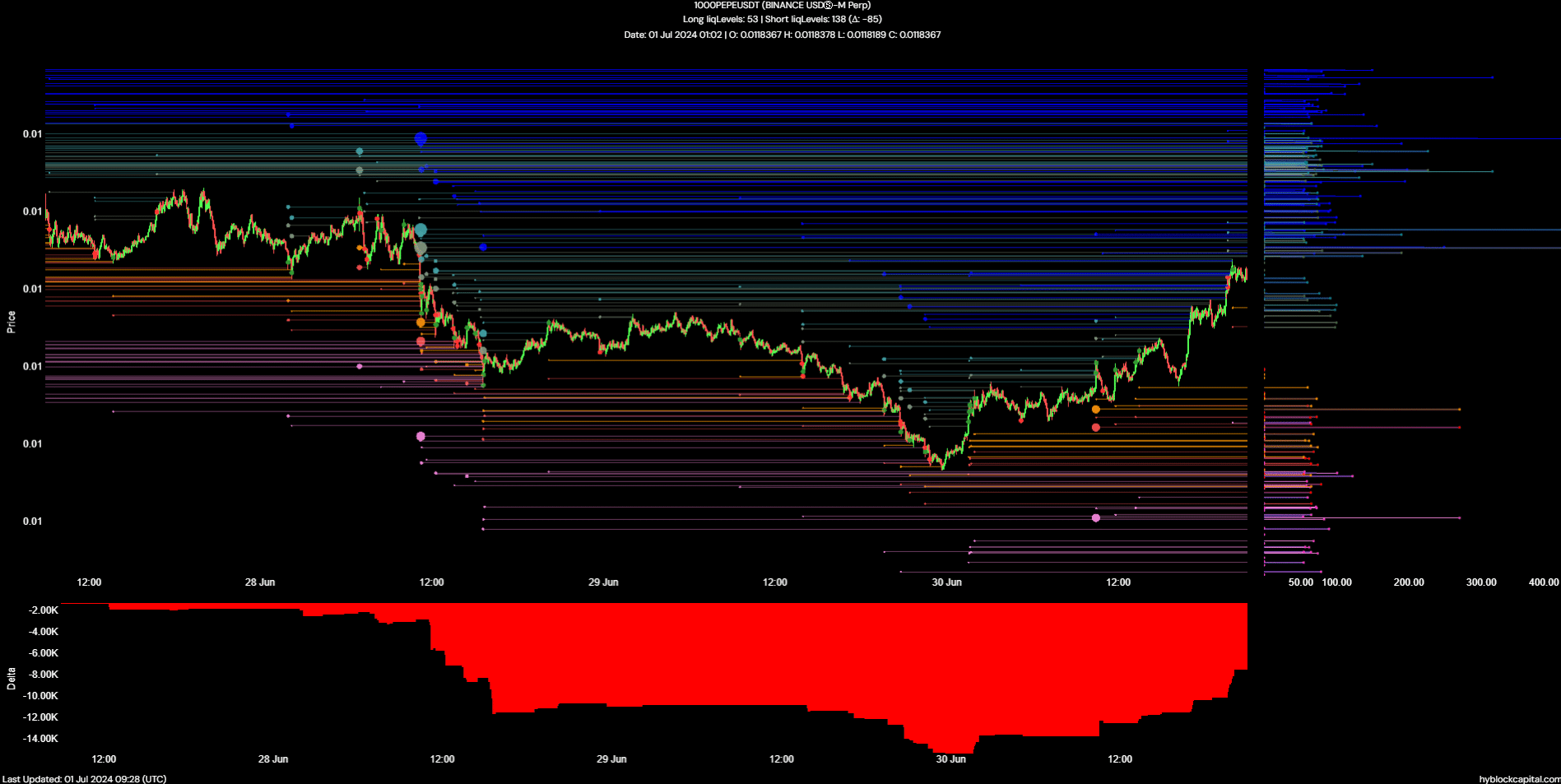

The liquidation levels data was examined in conjunction with technical analysis to determine PEPE‘s most probable path.

The key long-term Fibonacci retracement level has been defended

As I observed the market trends in May, I noticed a gradual increase in selling pressure towards the end of the month. By mid-June, this pressure intensified significantly, causing the Chaikin Money Flow (CMF) indicator to plummet below the -0.05 threshold. This ominous signal indicated substantial capital outflows from the market.

At that point, it was expected that the price of PEPE would pull back from its mid-May surge and drop down to $0.0000089.

The bulls effectively thwarted a drop below the $0.0000107 mark, representing a 78.6% retreat. However, they failed to generate enough power for a surge above the $0.000013 threshold, which denoted a 50% retracement.

The Cyclical Adjusted Free Cash Flow (CMF) surpassed the +0.05 threshold once more, yet the Daily Relative Strength Index (RSI) showed little sign of picking up pace. It hovered around the 50-neutral mark without indicating a bullish turn in momentum.

Should traders prepare for another PEPE price slump?

As a crypto investor, I’ve been closely monitoring the liquidation heatmap data from the past three months. I noticed a significant concentration of liquidation levels in the range between $0.000008 and $0.000009.

Prices were strongly drawn to them, with the 50% Fibonacci retracement level acting as a significant resistance point since then.

In simpler terms, not all groups of liquids will definitely be reached. If the bulls gain strength over the upcoming weeks, the $0.000018 area could be the next point where a large amount of buying and selling occurs.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

In the previous two days, the data from liquidation levels indicated that there were more short positions than long positions. As a result, it seemed probable that a price surge would occur to force out these short sellers, a phenomenon referred to as a “squeeze.”

The next large pockets of liquidity in the short-term are at $0.0000122 and $0.0000134.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-02 03:03