- Ah, the noble QNT, grappling with the formidable resistance of $96.80, a breakout could herald a rally towards the lofty heights of $121.60.

- Yet, the ominous exchange reserves whisper of potential selling pressure, while liquidations above $98 might just ignite a tempest of price movement.

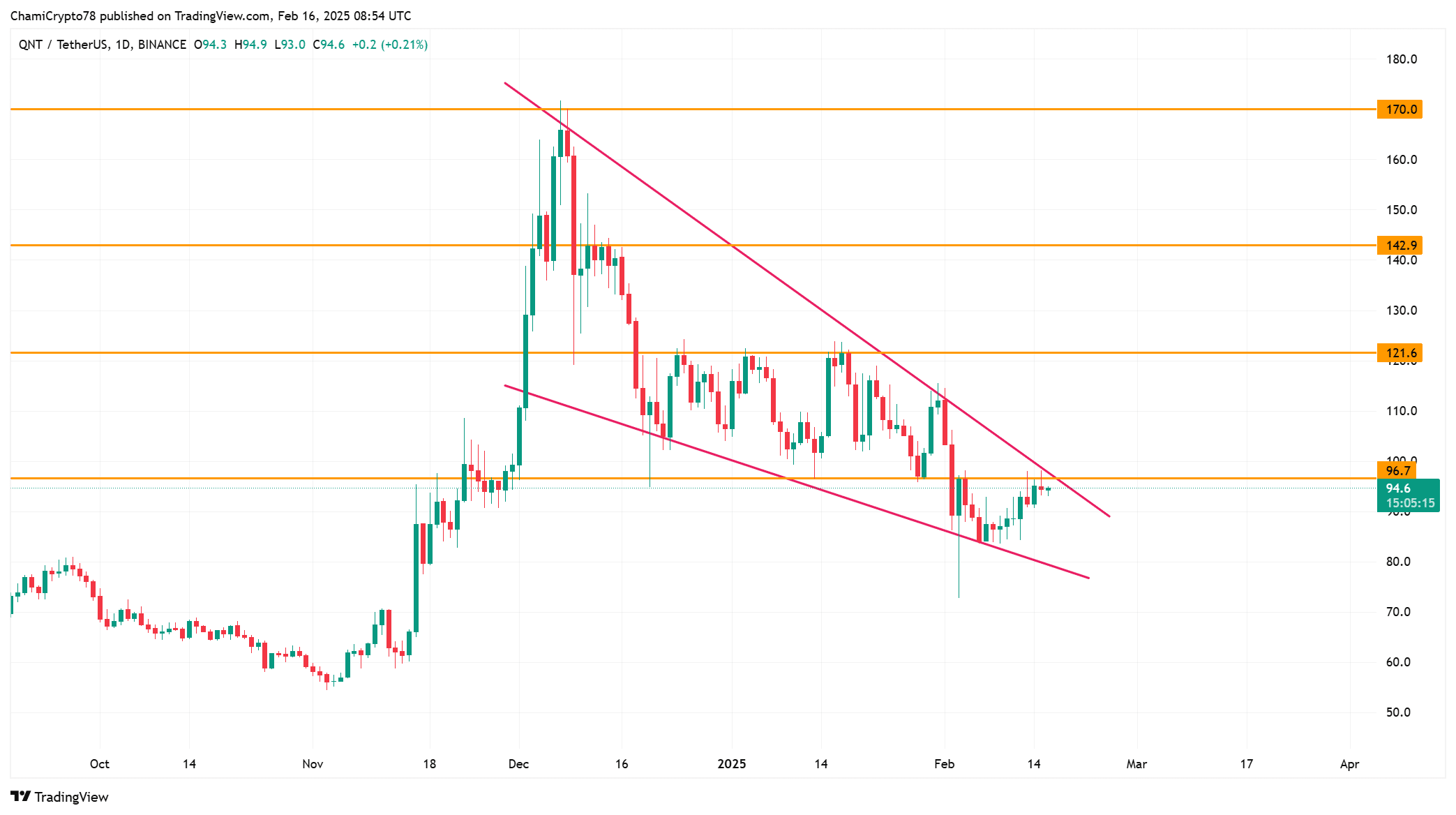

In the grand theater of cryptocurrency, Quant [QNT] finds itself at a pivotal juncture, testing the critical resistance level of $96.80. As of this moment, it trades at $94.68, a slight decline of 1.28% over the past day. The bulls, those valiant warriors, must reclaim this level to signal a shift in the winds of trend. But alas, should they falter, a decline may loom ominously on the horizon. Will QNT ascend to glory or face yet another rejection?

QNT price at a turning point

Our dear QNT has been ensnared within a falling wedge, a bullish reversal pattern that teases the imagination. The $96.80 resistance has proven to be a relentless gatekeeper, thwarting price surges time and again. Should the bulls muster their strength and breach this barrier, momentum could swell, propelling QNT towards the heights of $121.60. Further triumph could see it soar to $142.90 or even $170.00, a veritable feast for the eyes!

Yet, should they fail to ascend, a retreat towards $85.00 may be in store, where strong support lies in wait. Moreover, the movements of Bitcoin will undoubtedly cast their shadow upon QNT’s path.

Buyers must rally their forces to stave off another downturn. If volume swells near this resistance, a breakout may soon be upon us.

What do the metrics reveal?

On-chain data presents a tapestry of mixed signals. The net network growth has crept up by a mere 0.29%, a reflection of the tepid adoption that plagues our dear QNT. Without the influx of new users, the bullish momentum may wither like a flower in the frost.

However, a glimmer of hope shines through, as 1.11% of holders bask in profit, suggesting a flicker of positive sentiment amidst the gloom.

Furthermore, concentration levels remain steadfast, indicating that the whales are neither accumulating nor selling in significant quantities. Meanwhile, large transactions have dwindled by 3.61%, hinting at reduced institutional participation. If the whales decide to plunge into the market with fervor, QNT could receive the much-needed push for a breakout.

Increasing supply or hidden accumulation?

Exchange reserves have seen a slight uptick of 0.02%, a harbinger of potential selling pressure. As reserves swell, more coins become available for trading, ushering in increased volatility. Should this trend persist, Quant may find it challenging to maintain its support levels.

Conversely, a decline in reserves could signal accumulation, thereby alleviating selling pressure. Market participants must keep a vigilant eye on these reserve changes.

A drop in reserves would affirm that investors are holding their ground rather than selling, potentially bolstering the bullish outlook.

Will forced liquidations drive volatility?

The Binance liquidation heatmap reveals significant clusters of liquidations between $96 and $98. Should Quant venture into this perilous zone, forced liquidations could unleash a whirlwind of rapid price movement.

A breakout above $98 could propel QNT towards the coveted $100 mark, as short sellers face the wrath of liquidation.

However, should rejection rear its ugly head, Quant may retrace towards $90, where strong liquidity support awaits. Traders should brace themselves for volatility in these treacherous waters.

Large liquidation clusters often lead to sudden price swings, akin to a dramatic twist in a Tolstoy novel

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2025-02-16 17:15