- BlackRock’s Bitcoin ETF saw inflows of $184.4 million, boosting 2024 totals to $17.944 billion.

- Institutional ETFs are nearing Satoshi’s holdings, potentially surpassing them by year-end.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself consistently amazed by the dynamic nature and rapid growth of Bitcoin and its related assets. The recent inflows into BlackRock’s Bitcoin ETF (IBIT) are nothing short of remarkable, marking a significant turning point in this year’s market trends.

Following a phase with little action, BlackRock’s Bitcoin ETF (IBIT) has picked up speed again, experiencing significant investments since September 23rd.

Bitcoin ETF performance analyzed

On the 25th of September, IBIT experienced a significant surge of approximately $184.4 million, and collectively, all Bitcoin ETFs recorded an influx of around $105.9 million.

On the other hand, Grayscale’s GBTC, typically characterized by outflows, showed no activity or changes on that specific day.

On the other hand, it’s worth noting that there were withdrawals totaling $33.2 million from Fidelity’s FBTC and a withdrawal of $47.4 million from Ark’s ARKB.

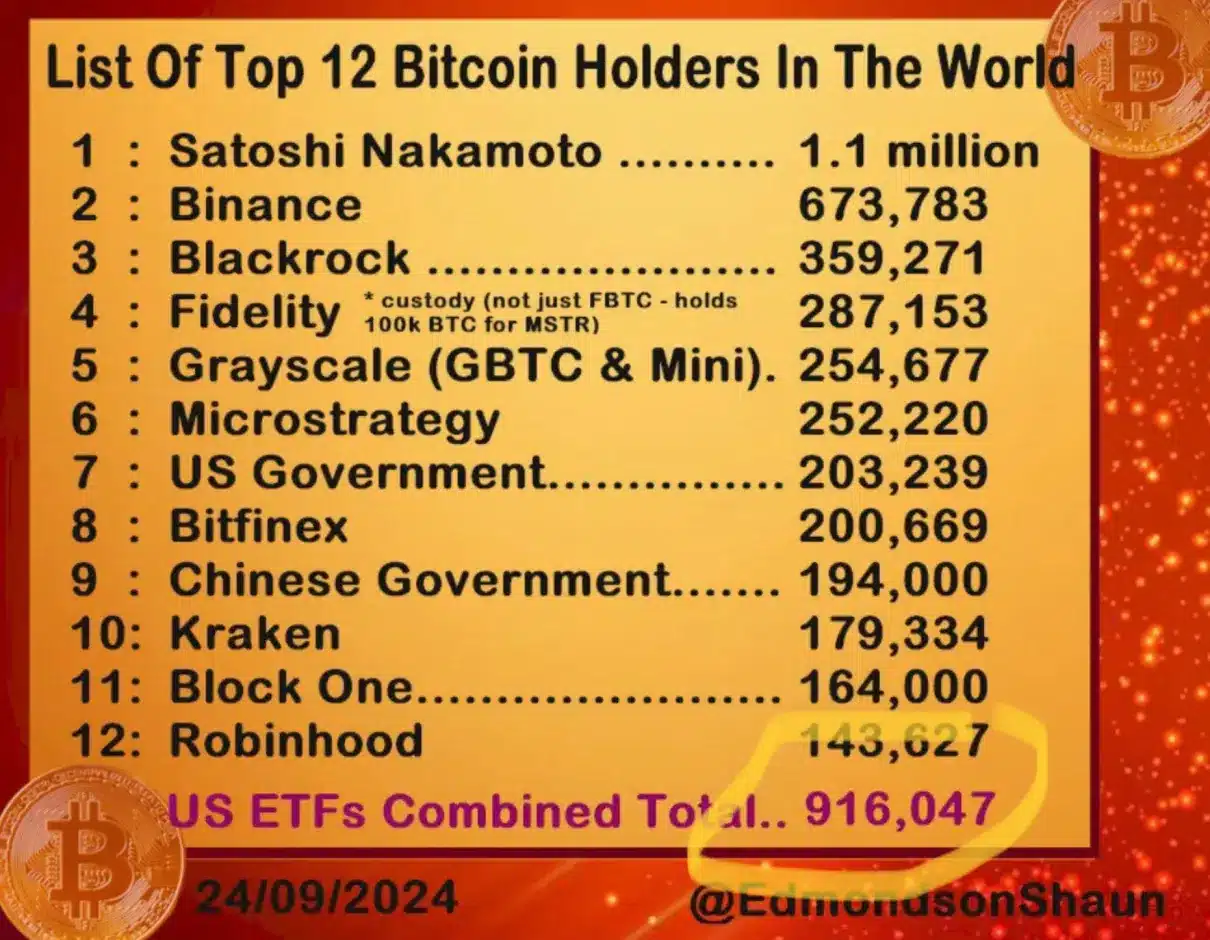

2024 has seen an incredible surge in investments towards U.S.-based Bitcoin ETFs, with a staggering $17.944 billion flowing into these funds so far. This influx has resulted in the acquisition of 916,047 Bitcoins year-to-date, which is just 84,000 BTC away from reaching the significant 1 million Bitcoin mark.

Seeing this impressive growth, Eric Balchunas, Bloomberg’s Senior ETF Analyst took to X and noted,

Yesterday was a positive day for Bitcoin ETFs in the U.S., pushing this year’s inflows to an all-time high of $17.8 billion. Currently, these ETFs are 92% close to owning one million Bitcoins, and they are 83% on their way to surpassing Satoshi Nakamoto as the largest Bitcoin holder. Time is ticking…

Is Satoshi Nakamoto’s place under threat?

Approximately 1.1 million Bitcoins, the amount believed to be owned by Bitcoin’s inventor, Satoshi Nakamoto, is not far from the amount that institutional Bitcoin Exchange-Traded Funds (ETFs) currently hold.

Recent data indicates that these ETFs have now accumulated about 83% of Satoshi’s holdings, and if the trend of increasing inflows continues, it could soon surpass him.

As an analyst, I’m currently observing that Satoshi Nakamoto appears to be at the helm of the largest Bitcoin holdings, with a significant stash of approximately 673,783 coins. Binance follows closely behind in the rankings.

It’s worth noting that prominent asset managers such as BlackRock, Fidelity, and Grayscale collectively control a substantial amount of about 901,101 Bitcoins through their exchange-traded fund (ETF) offerings. Specifically, these companies hold approximately 359,271 BTC, 287,153 BTC, and 254,677 BTC respectively.

On the other hand, the five asset managers who have Bitcoin ETFs collectively hold approximately 14,946 Bitcoins in total.

Spencer Hakimian, the founder of Tolou Capital Management, expressed views that were quite aligned with ours.

“ETF’s going to be bigger than Satoshi by Christmas Day.”

What’s more to it?

Currently, MicroStrategy, under the guidance of Michael Saylor, holds approximately 252,220 Bitcoins, placing them sixth among Bitcoin owners. They are moving towards the possibility of joining the elite group of major Bitcoin holders.

Thus, as BTC ETFs continue to capture attention, Bitcoin itself has seen a resurgence in price.

As an analyst, I’ve noticed some hurdles in surpassing the $60,000 mark for Bitcoin, but it currently stands at $64,358, representing a slight uptick of 0.91% within the last day.

Read More

2024-09-27 05:44