-

SOL has been trading sideways lately after being one of the year’s most volatile cryptos

Worth looking at if and how the Solana network’s slowdown contributed to SOL’s current situation

As a seasoned crypto investor with a knack for deciphering market trends, I find myself scrutinizing the current state of Solana (SOL) with a mix of intrigue and concern. After experiencing an exhilarating year marked by volatility and demand, SOL’s recent sideways movement has left me pondering its next move.

As a seasoned cryptocurrency investor with years of experience under my belt, I can confidently say that Solana’s native token SOL has been one of the most dynamic coins I’ve encountered this year in terms of volatility and demand. However, over the past five days, the volatility seems to have almost vanished entirely. This is quite unusual for a coin as active as SOL, and it’s intriguing to see such a dramatic shift in its behavior. It makes me wonder if this could be a sign of a larger market trend or if there’s something unique happening within the Solana ecosystem. Regardless, it’s always fascinating to observe these changes and adapt my investment strategies accordingly.

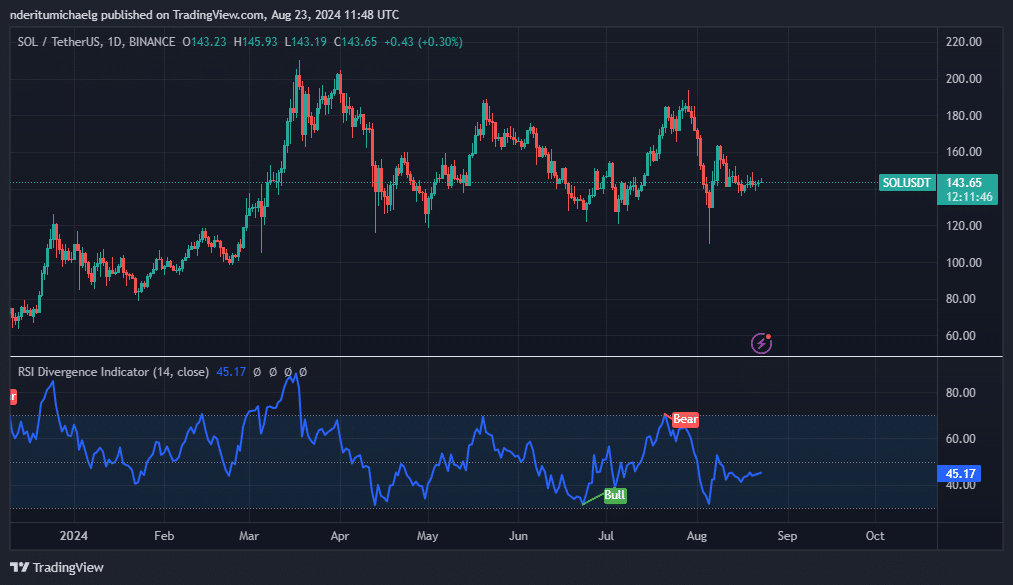

For the past seven days, Solana’s (SOL) price has stayed close to the $143 mark, marking the least volatile stretch in its price action so far this year.

It’s quite unexpected that Solana (SOL) is exhibiting low volatility in its price movement, given that it rallied significantly from its 4-week lows. Previously, its Relative Strength Index (RSI) showed a robust rebound, but it subsequently fell below the 50% mark, suggesting that the bullish momentum has waned. At the moment of press, SOL is being traded at $143.65.

Is there a chance Solana (SOL) will pick up momentum again and display increased price fluctuations? This is certainly something that SOL investors and traders would be interested in knowing. It’s important to note that SOL’s recent sluggishness isn’t an anomaly; even Bitcoin has seen a slowdown over the past few days as well.

As a seasoned crypto investor with years of experience navigating the ever-changing landscape of digital assets, I’ve witnessed numerous market cycles. This week, I observed a surge in demand for certain altcoins, which has led to a bullish trend. The influx of liquidity moving away from major players like Solana and Bitcoin towards these altcoins is noteworthy.

Assessing the state of Solana’s ecosystem

In simpler terms, the way Solana (SOL) has recovered following any downturns lately can be used as an indicator of market demand. When SOL’s price remains stable instead of rising, it may suggest a decrease in demand within the Solana ecosystem.

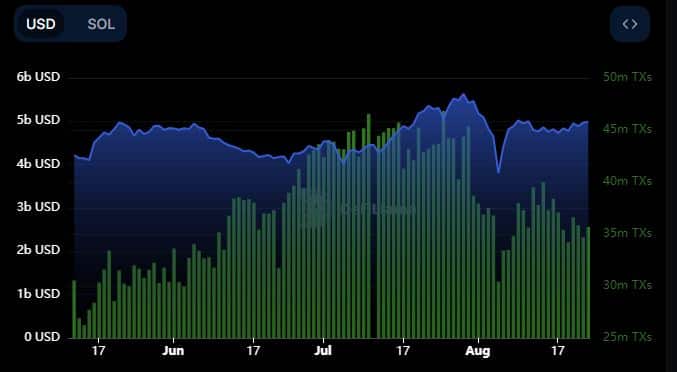

It’s not surprising that data from the blockchain shows Solana transactions dropped significantly over the past four weeks. As of July 25th, the network had processed approximately 46.83 million transactions. However, by August 5th, this number dipped to around 30.41 million transactions.

Over the past fortnight, we’ve seen some improvement in transaction volumes, but they still fall significantly short of 40 million. In fact, there’s been a slight decrease since mid-August, suggesting that Solana’s network is experiencing reduced demand, indicating a slowdown.

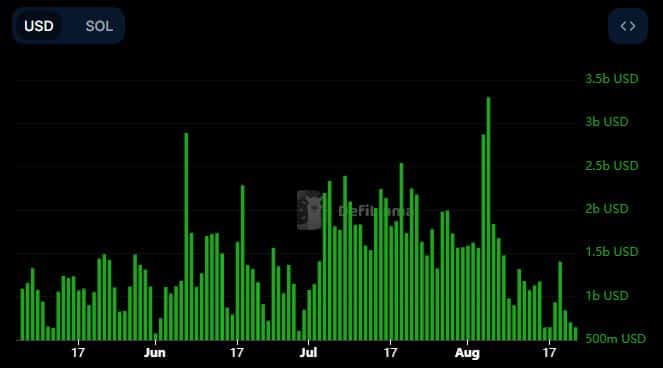

Although the number of transactions decreased, Solana’s Total Value Locked (TVL) showed resilience, indicating a strong network belief – however, this confidence doesn’t seem to be reflected in the on-chain volume. The highest volume Solana experienced was $3.3 billion during the market crash on August 5th.

1. Over the past 3 months, the network’s activity has dropped down to its minimum levels. Furthermore, over the course of the last day, Solana’s daily transaction volume averaged approximately $646.78 million.

This is a sign of the slowdown in Solana’s on-chain activity and consequently, the impact on SOL.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-08-24 03:35