- Solana jumped 4.5% in the last 24 hours, reaching highs not seen since April 2024.

- At press time, bulls were more prominent compared to short sellers, indicating that short sellers were exhausted.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely observed Solana’s [SOL] price movements and trends over the past few months. Based on my analysis of the current market situation, SOL is currently experiencing a significant surge, with a 4.5% increase in just the last 24 hours. This impressive performance has brought Solana to highs not seen since April 2024.

At the current moment, the entire cryptocurrency sector presented a optimistic outlook, as leading digital currencies showed notable gains.

Beyond its impressive showing, Solana (SOL), the globe’s fourth-largest cryptocurrency, garnered significant buzz after surpassing the pivotal resistance threshold of $187.

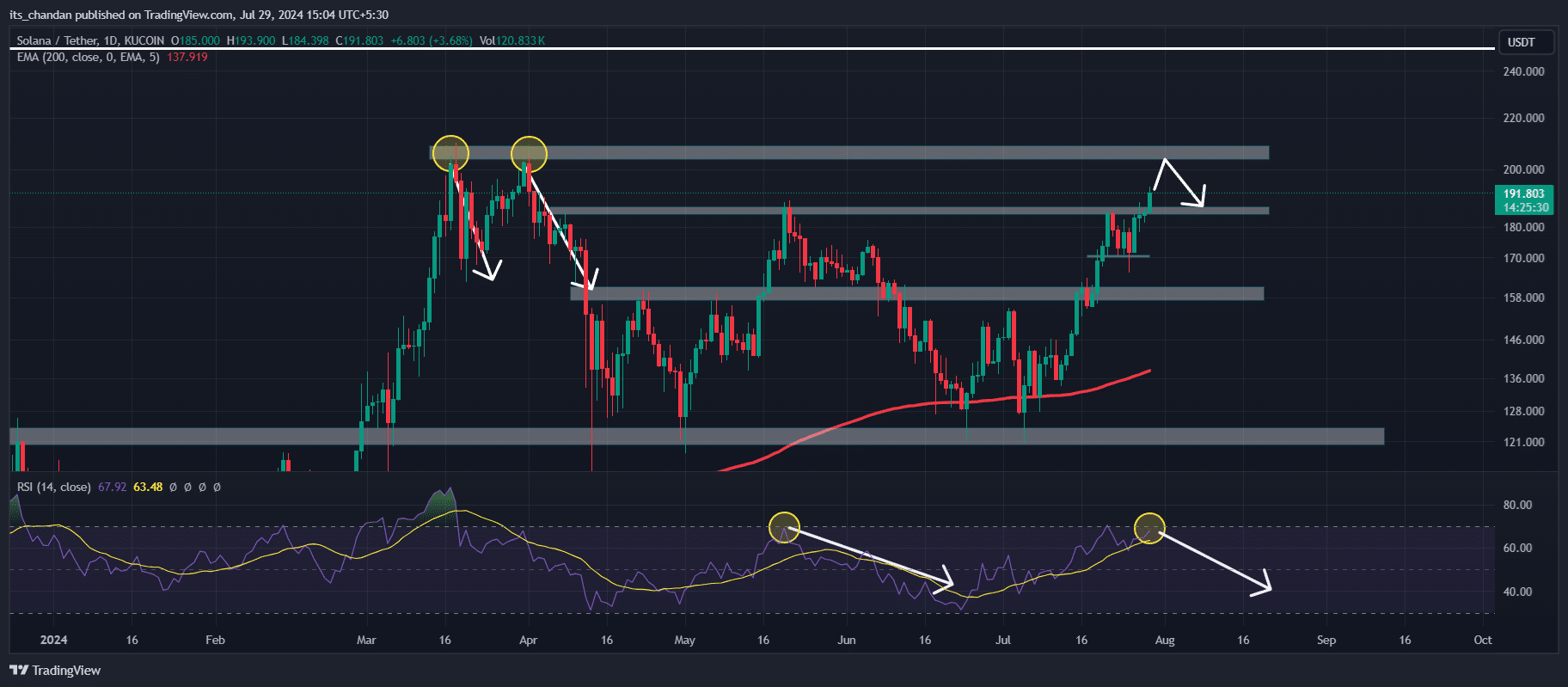

Solana price reversal concerns

After SOL experiences a significant price increase beyond its current level (SOL’s critical breakout), there’s a strong possibility that it will continue climbing towards the next resistance point, approximately located at $204.

Among new investors, there is a worry that the price may drop after hitting the upcoming resistance level.

Based on historical records and market trends, every time Solana’s (SOL) price touches the $204 mark, it typically undergoes a significant price change.

Starting from March 2024, the price of SOL has hit this point on two occasions and subsequently undergone substantial price declines. This trend raises apprehension amongst novice investors.

At present, the value of SOL is approximately $192 on the market. In the past 24 hours, there has been a noteworthy increase of 4.5%. However, the trading activity has decreased significantly, with a drop of around 18% in volume during this same timeframe.

The decrease in trading activity could be a sign that investors and traders are cautiously approaching the resistance level, given its history of causing price reversals.

Technical analysis and upcoming levels

Based on tech specialists’ assessments, Solana (SOL) surpassed the significant barrier of $187 as of the present moment, indicating a potential progression towards the subsequent resistance point at $204.

After the recent surge, it’s likely that SOL will hit the $204 mark in the near future.

The Relative Strength Index (RSI), which is a technical indicator, currently indicates that the market is overbought. This may suggest an upcoming price shift.

The stochastic level was also in the over-bought area, with its value above 80 at press time.

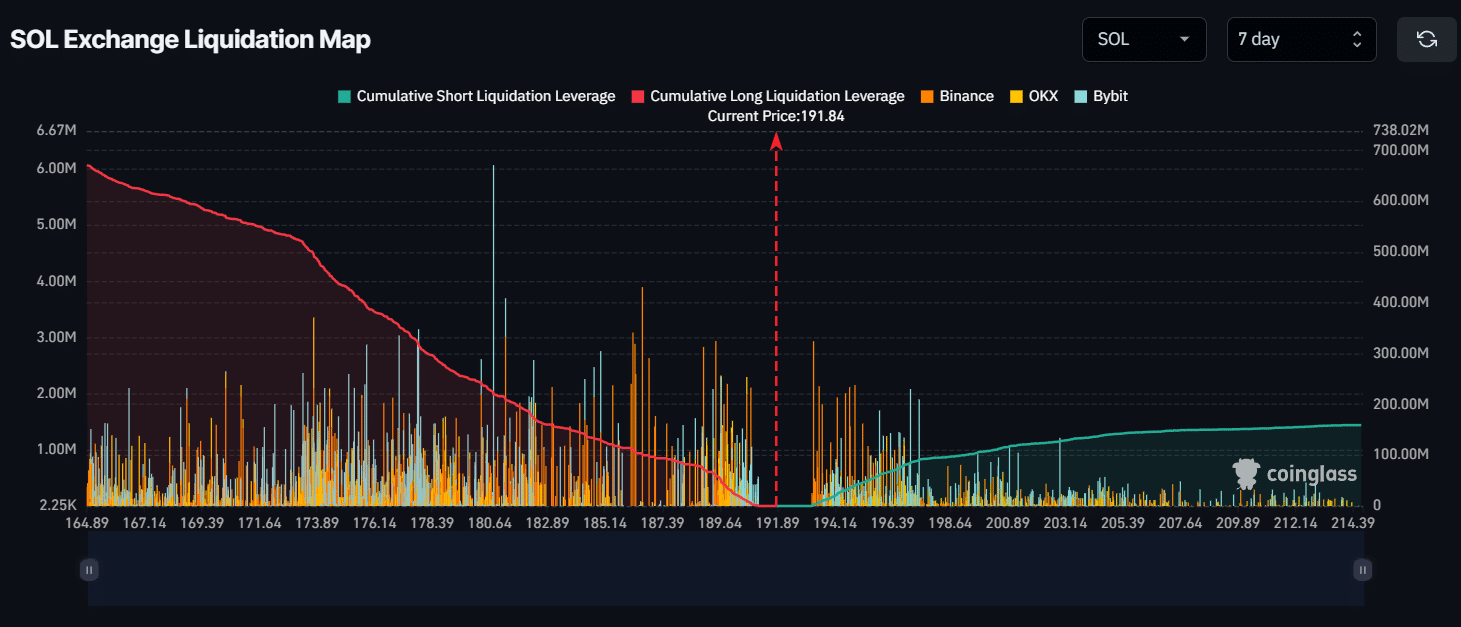

Also, major liquidation levels emerged near the $180 and $203 levels.

Based on information from cryptocurrency analytics platform CoinGlass, approximately $225 million in long positions for Solana (SOL) would be liquidated if the price were to drop and reach the level of $180.

If the price of SOL goes above $203, approximately $132 million in short positions will need to be closed.

Whales’ and investors’ activity

In spite of worries about price fluctuations, there is a buoyant outlook within the cryptocurrency realm, with major players and investors expressing growing enthusiasm for Solana (SOL).

On the 24th of July, two large investors extracted approximately $41.5 million worth of Solana (SOL) tokens from Binance (BNB), and subsequently staked them. Their decision to stake these tokens signifies a strong commitment and long-term investment in the Solana project.

Apart from the whales’ actions, Raoul Pal, the CEO of Real Vision and a renowned financial analyst, revealed in a podcast that he himself has moved 90% of his readily available funds into Solana (SOL).

Realistic or not, here’s SOL’s market cap in BTC’s terms

The collaboration of whales’ and investors’ interest in SOL could indicate a favorable buying trend, potentially signaling an upturn in the market.

According to CoinGlass, there’s been a 10% increase in Solana’s open interest, indicating a rise in investor and trader attention towards the cryptocurrency.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-07-29 19:04