-

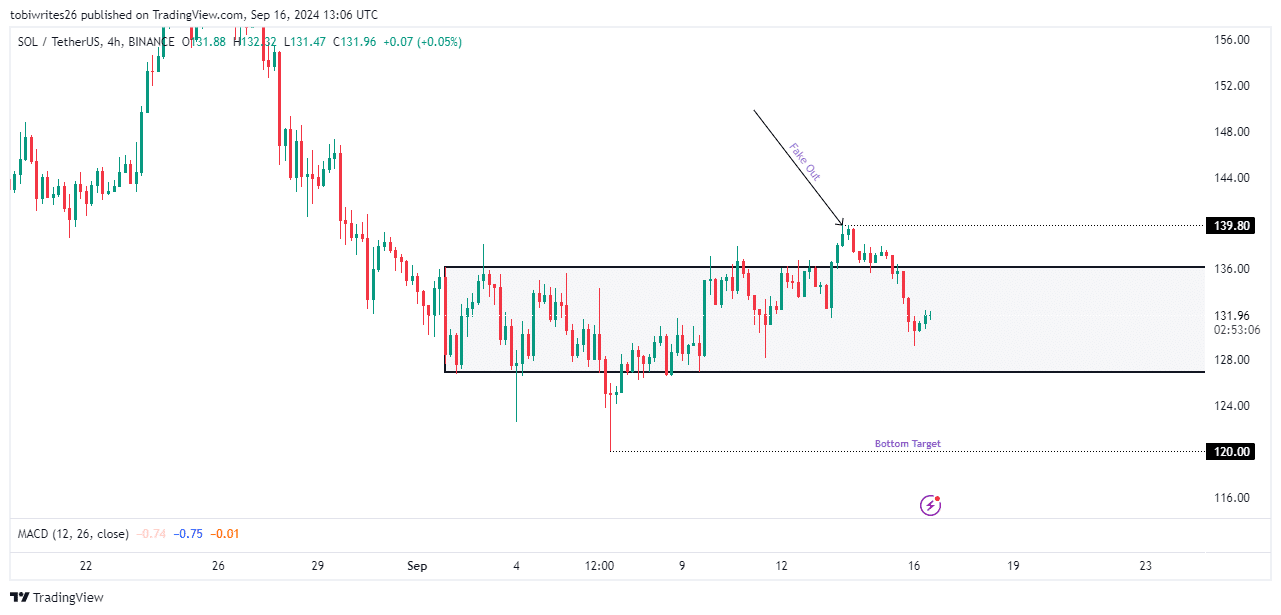

Following a misleading breakout from its consolidation channel, SOL has encountered increased selling pressure.

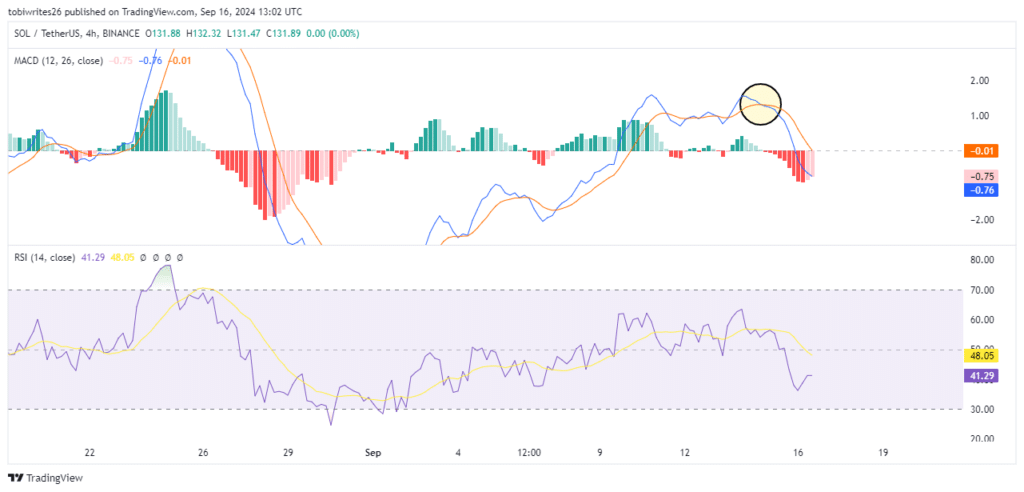

A ‘death cross’ observed in the Moving Average Convergence Divergence (MACD) indicator signals a heightened risk of a continued downtrend.

As a seasoned crypto investor with battle-scarred eyes from navigating the wild west of digital assets, I can’t help but feel a mix of anticipation and trepidation when observing Solana’s [SOL] current market movements. The recent breakout from its consolidation channel, followed by increased selling pressure, has left me with a familiar sense of déjà vu – the market’s fickle dance between hope and fear never fails to surprise.

In the past 24 hours, the Solana (SOL) market has moved into the red, experiencing a 2.49% drop, and there’s been an increase in trading activity. This pattern hints that the market could potentially show further weakness.

AMBCrypto examined whether the current pessimistic feeling could be just a temporary shift or if it might persist for an extended period.

Consolidation channel can lead to a price drop

Since early September, Solana’s price action has been contained within a range, or consolidation pattern, when viewed on a 4-hour chart.

In simpler terms, this pattern refers to a situation where the price fluctuates between tight limits because traders are looking for definite signs that could indicate the next possible direction – either an increase or a decrease.

As an analyst, I observed that SOL momentarily surpassed the upper threshold of its consolidation channel, peaking at 139.80, but subsequently, it returned to trading within the established channel boundaries.

This kind of shift is often referred to as a ‘misdirection,’ implying that the price could possibly trend in the reverse direction. For Solana, this implies a potential decrease might be on the horizon.

If the pressure continues to push prices down, there’s a possibility that SOL might fall beneath its current trendline, which could lead it towards the concentration of liquidity around 120.00.

Technical indicators suggest a bearish outlook for SOL

The Moving Average Convergence and Divergence (MACD), highlighted by a yellow circle, indicates a ‘death cross’ where the blue MACD line has crossed below the orange signal line.

This intersection indicates a downward trend, since it hints that market players are leaning towards selling rather than keeping or buying more Solana (SOL), suggesting a pessimistic outlook.

Furthermore, the Relative Strength Index (RSI) points towards a pessimistic outlook. At this moment, the RSI is at 41.29, which is lower than the 50-point neutral level, suggesting a descending trend. If the RSI continues to decrease, it might suggest that SOL could face further losses.

The Moving Average Convergence Divergence (MACD) is a tool used to spot shifts in market trends, while the Relative Strength Index (RSI) measures the rate and direction of price changes, helping identify when prices might reverse due to overbought or oversold conditions.

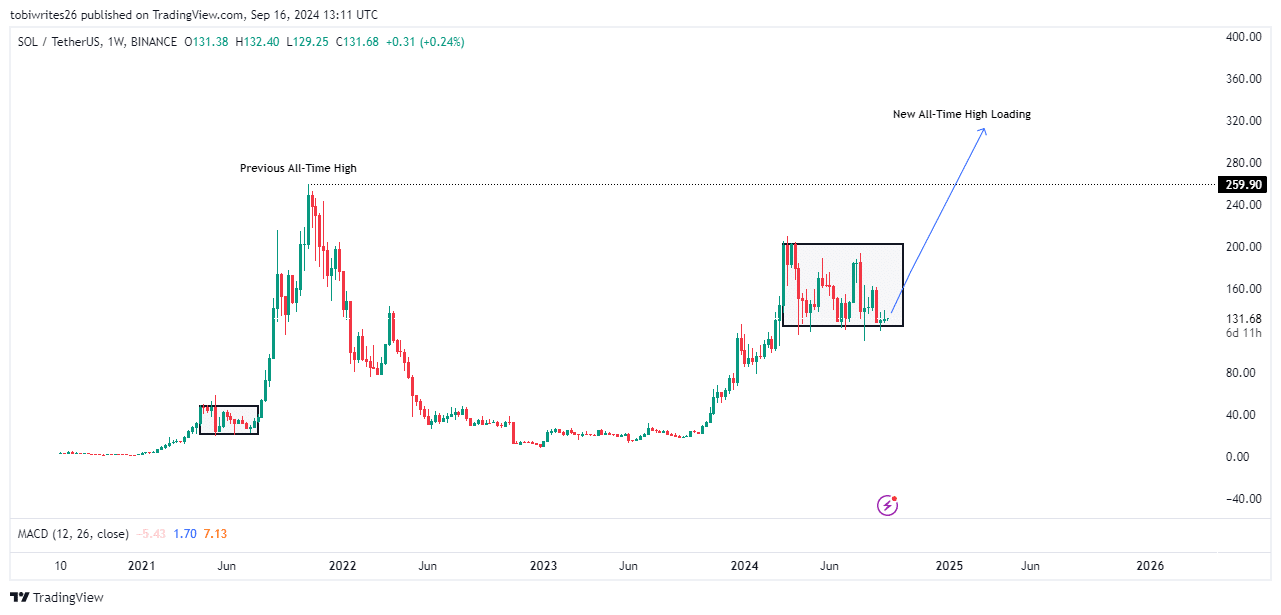

The broader market outlook for SOL remains bullish

Examining the weekly chart, it appears Solana (SOL) is presently moving within a similar consolidation stage as seen prior to its record peak in 2021.

Read Solana’s [SOL] Price Prediction 2024-25

If SOL manages to burst free from its current holding pattern, it could realistically set a new record high, mirroring its impressive performance from 2021.

Looking at the immediate trends, there seems to be a downtrend for Solana (SOL), but from a wider angle, it appears that Solana could experience a substantial surge in the near future.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-17 12:08