Solana’s Downward Spiral: Will Q2 Be a Repeat of Q1’s Disaster? 🚨💸

- Solana’s precipitous decline in Q1 has left investors wondering if the asset will ever regain its footing.

- Without a clear catalyst for recovery, the risk of further downside remains a very real possibility.

Solana [SOL] kicked off 2025 with a dismal Q1, plummeting 34% and losing a staggering $100B in market cap, wiping out all the gains from the pre-election hype. One wonders if the asset will ever recover from this blow.

Now, back to its September 2024 low, will Q2 be any different, or is the risk of high-stakes sell-offs still too strong?

Risk of capitulation grows as FOMO fades

Solana, like many high-cap assets, has struggled due to a combination of macro and microeconomic factors. However, its Q1 downturn stands out as one of the most severe among major assets. It’s a wonder the asset didn’t completely collapse under the weight of its own expectations.

From a technical perspective, Solana’s 1D price chart lacks clear support levels. Without strong bullish demand at key levels, the asset faces a high risk of further declines, especially if HODLing sentiment weakens. One can almost hear the sound of investors frantically selling their SOL.

At the time of writing, Solana’s has reached a two-year high, with only 32% of the supply in profit. This imbalance increases the likelihood of a sell-off, as underwater holders may be more inclined to capitulate. It’s a recipe for disaster, really.

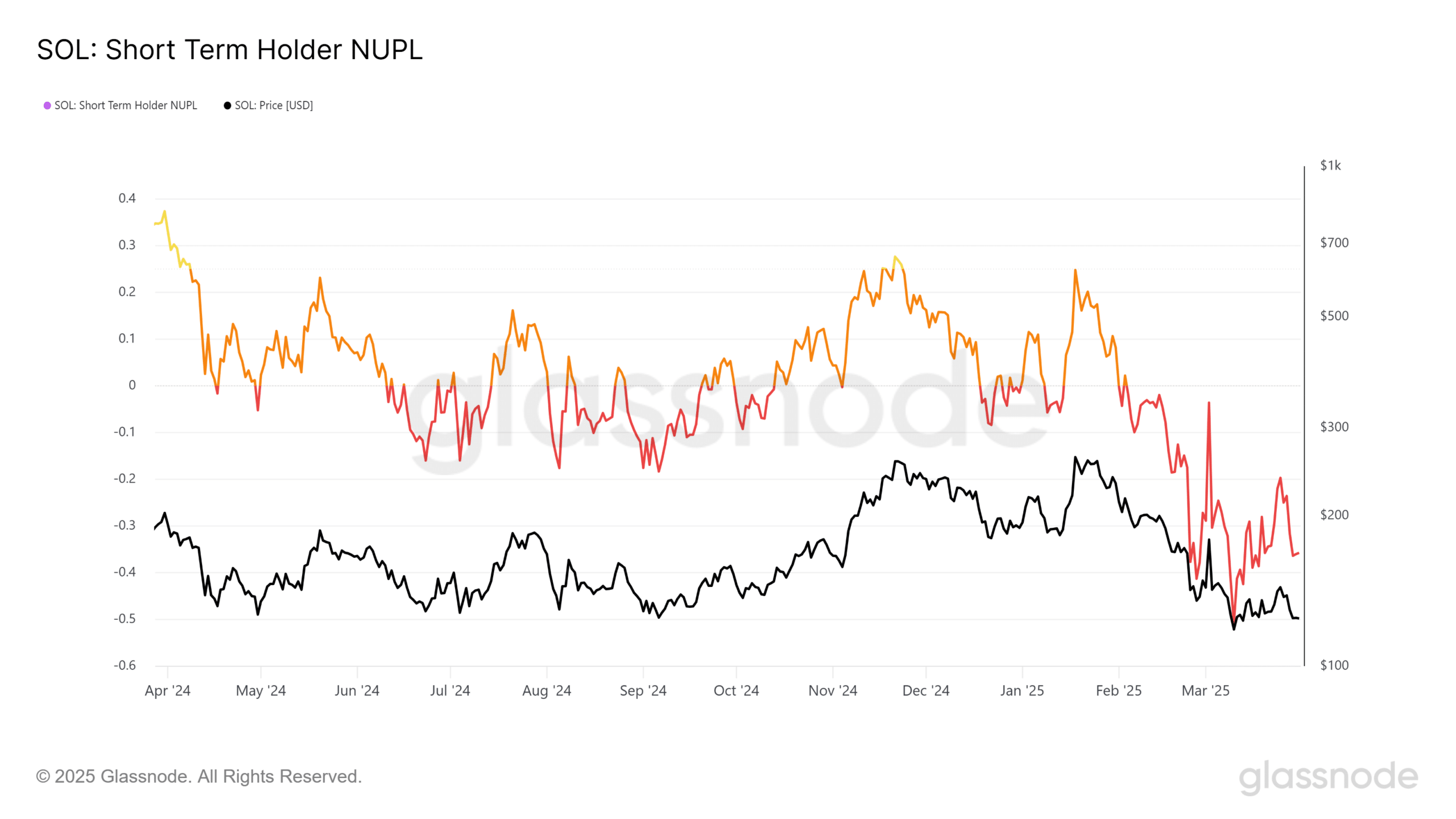

The Net Unrealized Profit and Loss (NUPL) metric indicates that Short-Term Holders (STH) have entered a capitulation phase. This could trigger a wave of sell-offs. The writing is on the wall, dear investors.

Historically, Solana has only found a local bottom when it enters the hope/fear phase, where FOMO kicks in and market confidence returns. Without this shift, sell-side pressure could continue, and the risk of further declines remains. It’s a vicious cycle, really.

Adding to the bearish outlook, the SOL/BTC pair has erased its mid-March gains, with a sharp weekly decline. The writing is on the wall, dear investors.

At press time, the MACD was on the verge of flipping bearish, signaling that SOL could soon test its $115 support. The clock is ticking, and investors are holding their breath.

Can Solana turn it around in Q2?

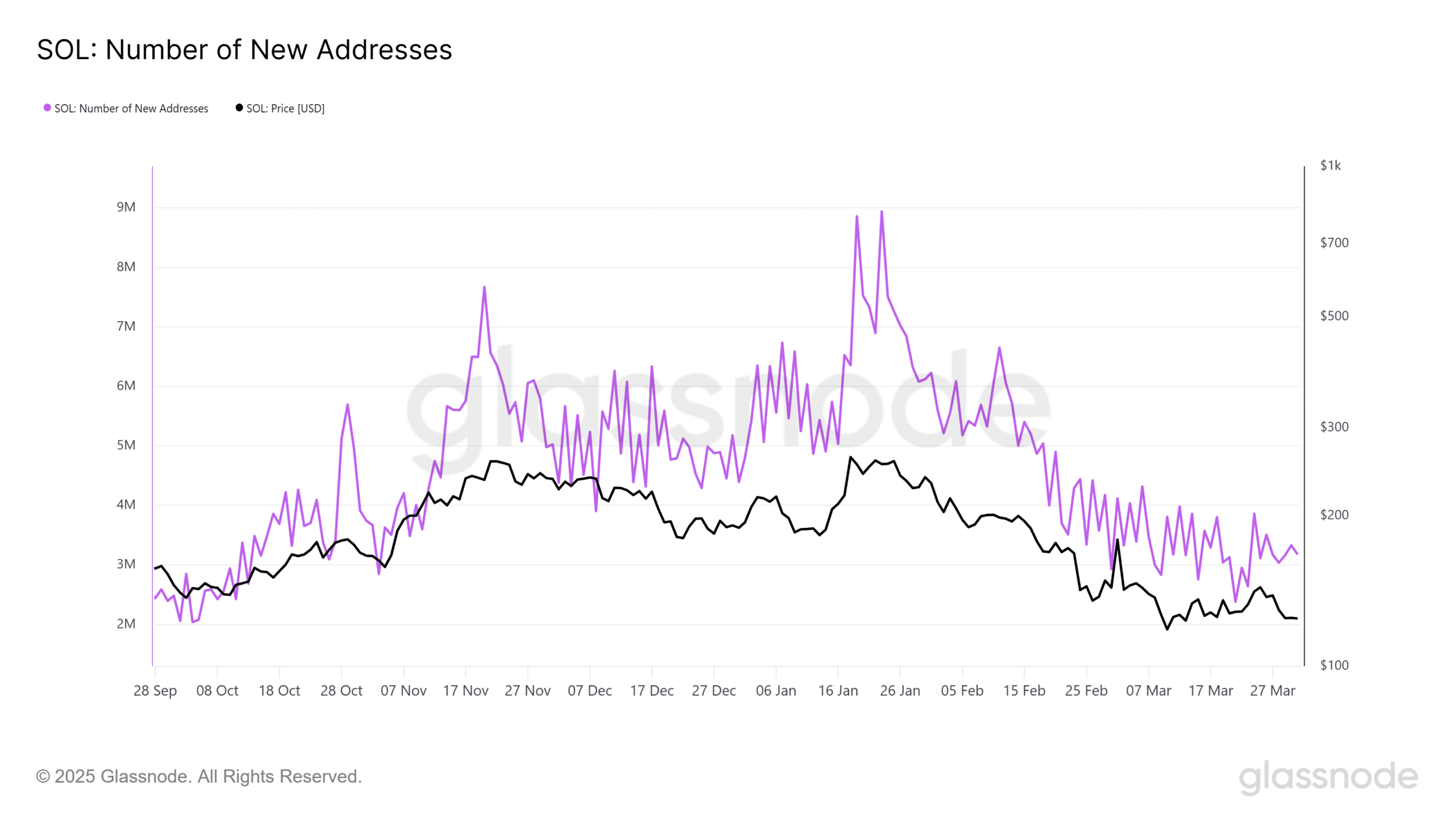

Solana started Q1 strong, with new addresses surging to 8 million by mid-January, but momentum has sharply declined, and the count has dropped to a six-month low of just 312k. It’s a stark reminder of the asset’s downward spiral.

Earlier in the quarter, Solana saw impressive spikes in staking and DEX volume, signaling healthy investor engagement. However, both metrics have since fallen significantly, dropping well below their pre-election highs. It’s a sad tale of woe.

With rising capitulation fears and a lack of spot accumulation, Solana is at risk of losing the $115 support. Unless there’s a shift in sentiment or a catalyst to spark demand, expecting a bullish Q2 seems increasingly too far-fetched. The outlook is bleak, dear investors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2025-04-02 08:11