- Ah, the sentiment ratio of Solana has soared to a staggering 32.87, leaving BTC and ETH in the dust.

- Meanwhile, the price lingers around $132, with a stubborn resistance at $140, like a cat refusing to leave a sunny spot.

In the grand theater of the crypto market, Solana [SOL] has taken center stage, basking in a newfound glow of optimism, courtesy of institutional interest. It seems that even the most stoic of investors have found a reason to smile.

With BlackRock, that titan of finance, launching yield-bearing tokenized treasury funds on this very network, and GameStop, yes, the same GameStop that once made headlines for its stock shenanigans, integrating Bitcoin through Solana’s infrastructure, the sentiment surrounding SOL has reached dizzying heights. But, dear reader, will this social momentum translate into a price breakout, or is it merely a mirage in the desert of speculation?

Sentiment soars as institutions embrace Solana

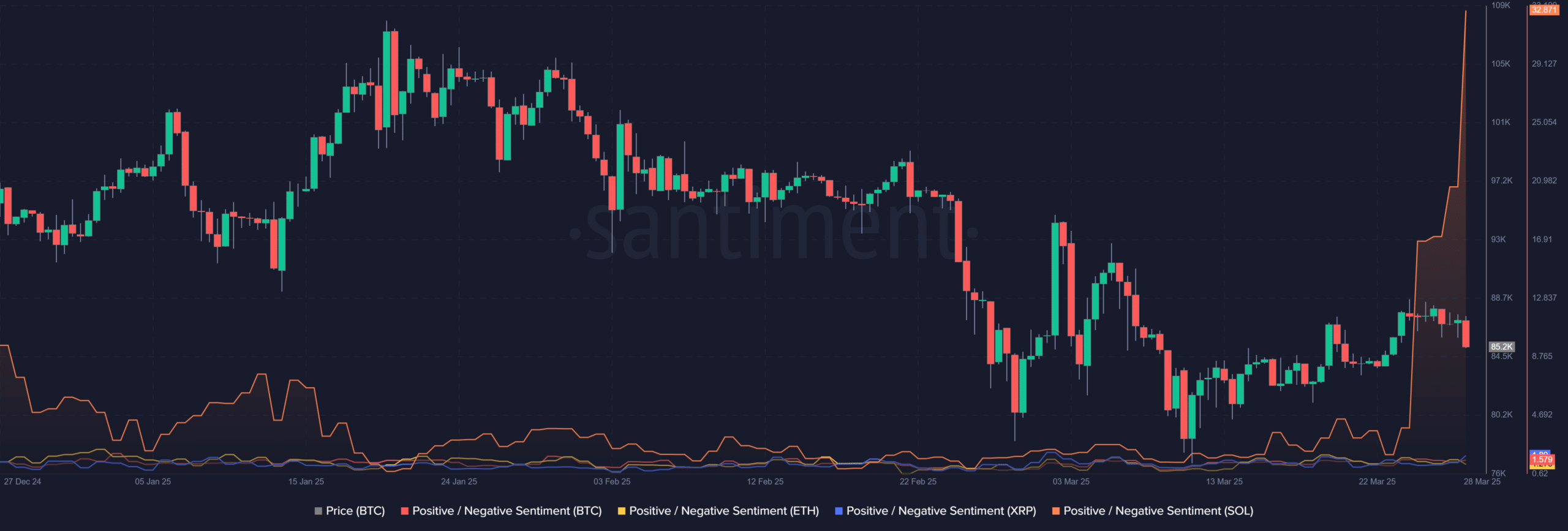

Data from Santiment reveals a sharp spike in Solana’s Positive/Negative Sentiment Ratio, climbing to 32.87 – far outpacing sentiment levels around Bitcoin [BTC], Ethereum [ETH], and Ripple [XRP]. It’s as if Solana has become the belle of the ball, and everyone wants to dance.

This sharp divergence underscores a unique bullish tilt for SOL on social platforms, suggesting that investor confidence is growing faster than a weed in spring.

The spike coincides with BlackRock’s strategic use of Solana’s infrastructure and GameStop’s broader crypto pivot, both of which have been heavily amplified by influencers and community support. It’s a delightful fusion of technological utility and mainstream integration, creating the perfect storm for a sentiment-driven rally. Or is it just a tempest in a teapot?

Price action faces resistance despite social optimism

Despite the sentiment frenzy, Solana’s price action is flashing caution like a traffic light stuck on red. At the time of writing, SOL was trading at $132.49, registering a 4.27% intraday dip. It seems that even the most optimistic of traders must face the music.

The 50-day Moving Average (MA) at $133.74 has acted as a key resistance level, while the 200-day MA at $183.04 looms far above, like a distant mountain peak that seems impossible to climb.

At press time, the Bollinger Bands were tightening, reflecting contracting volatility. Meanwhile, the Average True Range (ATR) sat at 6.18, suggesting that SOL remains in a low-volatility regime – a potential prelude to an explosive move in either direction. Or perhaps just a quiet evening at home with a good book.

Is the market underestimating Solana?

SOL’s price pattern indicates consolidation rather than a breakout, despite the overly bullish sentiment among traders. This disparity suggests a potential disconnect between emotional optimism and technical resistance levels. It’s like a party where everyone is dancing, but the music has stopped.

Historically, such euphoria can be risky, especially when unsupported by volume and price action. However, Solana’s robust developer ecosystem and real-world applications in tokenized finance, like BlackRock’s recent initiative, offer solid fundamentals. If SOL surpasses the $140 mark and turns its short-term resistance into support, a rapid upward movement could follow, fueled by persistent social sentiment. Or, it could just be another day in the life of crypto.

Read More

2025-03-29 06:21