- So, Solana has minted a whopping 8.75 billion USDC since January 1st. Talk about a money printer! 💸

- But seriously, has it made any difference for SOL?

Once upon a time in February, Solana [SOL] strutted around with a market cap over $100 billion. Fast forward to now, and it’s down to a mere $72 billion. Ouch! 😬

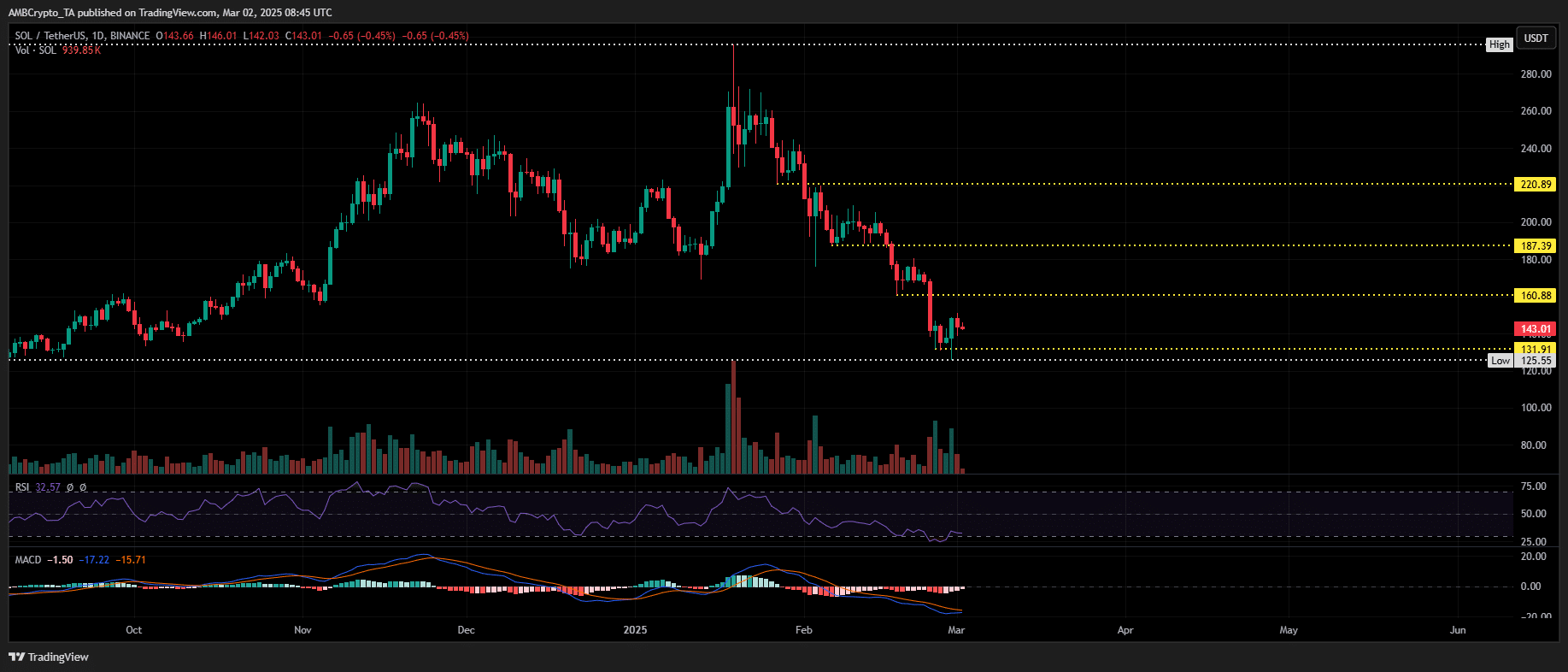

It seems like sell-side pressure is the new black, overshadowing demand and pushing SOL below the $140 support level—its lowest point in four months. Who knew crypto could be so dramatic? 🎭

Now, with 250 million USDC freshly minted, can this liquidity boost be the fairy godmother SOL desperately needs? Or is it just a pumpkin waiting to happen? 🎃

Solana’s Liquidity Strain: A Comedy of Errors

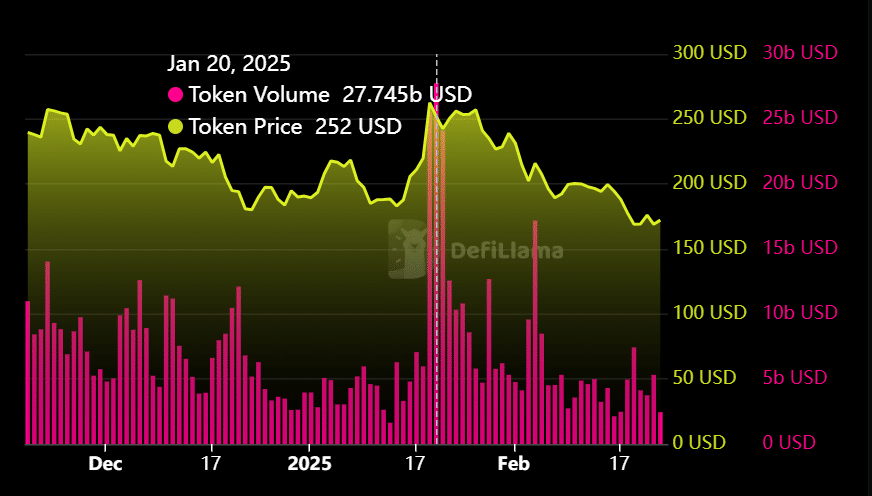

Since the New Year, 8.75 billion USDC have been minted on Solana, sending network volume soaring to an all-time high of $27.745 billion—just in time for the TRUMP memecoin launch. Because nothing says “serious investment” like a meme coin, right? 🙄

But hold your horses! That volume has plummeted to just $1 billion, while the leading Solana-based memecoins are taking a nosedive with double-digit losses. Yikes! 📉

This sharp decline suggests liquidity saturation, which is just a fancy way of saying, “We’re all out of juice!” 🍊

With meme-sector volume down over 50%, that shiny new 250 million USDC might not have the impact we hoped for. It’s like bringing a salad to a barbecue—nice gesture, but no one’s eating it. 🥗

As excess SOL liquidity floods the market while memecoin demand fades faster than my New Year’s resolutions, we’re left wondering if Solana is shifting from a long-term value asset to a short-term speculative play. Spoiler alert: it’s not looking good! 😬

Fundamentals vs. Speculation: The Ultimate Showdown

Since hitting its all-time high of $295, SOL has been on a downward spiral, failing to find solid support at key retracement levels—unlike its competitors who seem to have their act together. 🙌

In past cycles, SOL broke through key resistance levels thanks to election and memecoin “hype.” But now, with demand as weak as my coffee on a Monday morning, the market structure looks as fragile as my self-esteem after a bad haircut. ✂️

Weak bid-side liquidity is limiting any bullish absorption of sell pressure, putting that $140 support level in serious jeopardy. It’s like watching a tightrope walker without a safety net. 🎪

A short squeeze triggered $2.37 million in liquidations, which suggests that this recent rally is more about speculation than solid fundamentals. Classic! 🙃

With Solana’s fundamentals showing no significant improvement, the impact of that 250 million USDC is looking more like a drop in the ocean. Instead of a liquidity-driven rebound, SOL might just be retracing back to $125. Buckle up, folks! 🎢

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- The Battle Royale That Started It All Has Never Been More Profitable

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

2025-03-02 23:07