- Solana has seen a decline in user activity over the past two weeks

- Network fees and revenue have dropped owing to this

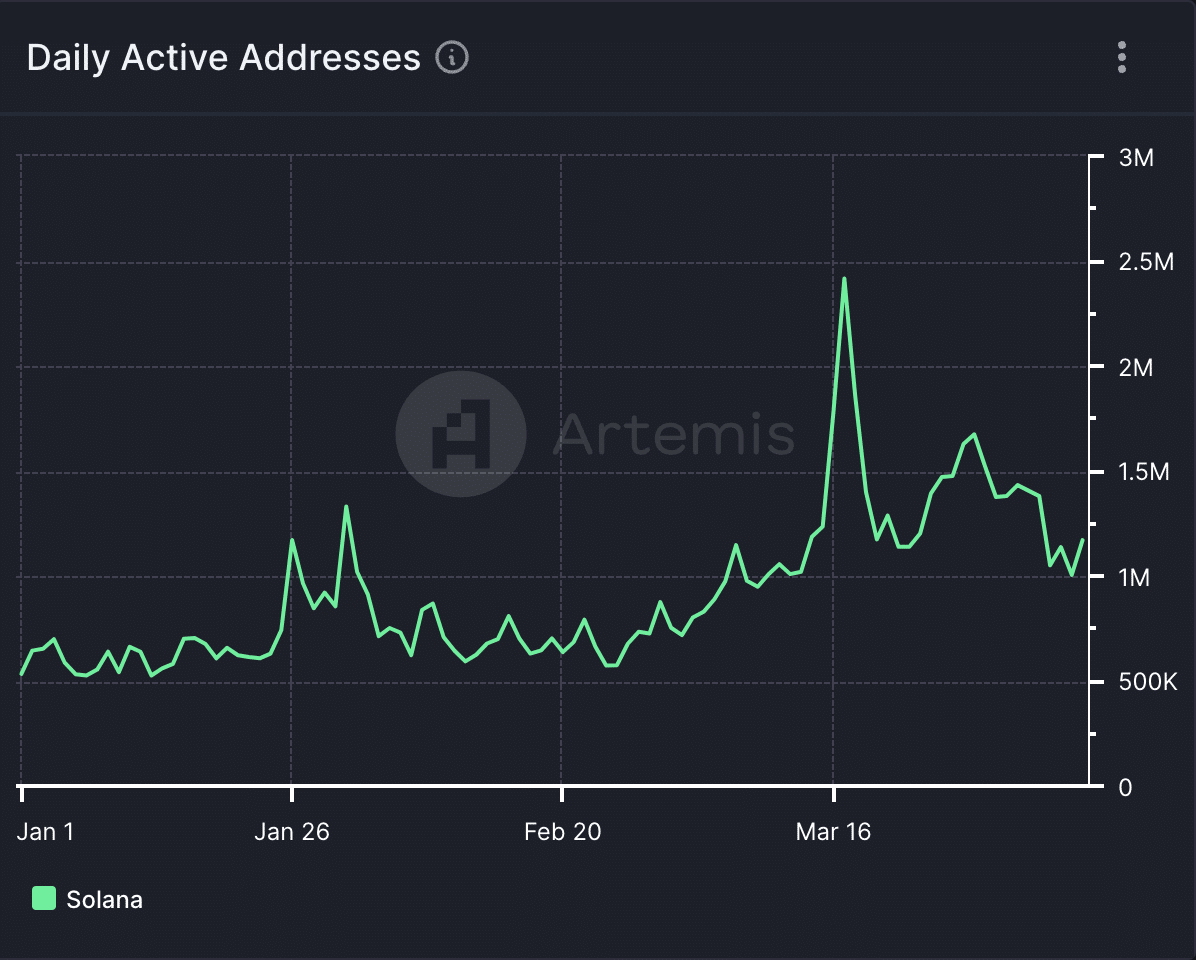

According to data from Artemis, the number of users interacting with Solana’s [SOL] network decreased as the hype around memecoins started to subside. Specifically, on-chain data indicated that demand for Solana had dropped since March 17th. As a result, there were fewer daily active addresses on its network, along with lower network fees and corresponding revenue.

Based on Artemis’ information, the number of distinct addresses carrying out even one transaction on the Solana network has decreased by half since March 17th. There were approximately 2.4 million addresses in operation on that day.

Up until the 8th of April, Solana had reached its highest point this year in terms of the number of daily active addresses, which amounted to approximately 1.2 million. However, this figure dropped by over half compared to the initial YTD high.

Because Solana’s user activity has decreased, the revenue from transaction fees on its network has dropped significantly. According to AMBCrypto, Solana’s network fees reached a YTD peak of $5 million on March 18th, and since then, they have been declining, dropping by approximately 40%.

The fee revenue for Solana’s network has decreased by 48%, dropping from $3 million on 18 March to $1.3 million as of 8 April.

DEX volume, network TVL, and NFT sales: A tale of many declines

Examining Solana’s DeFi and NFT areas provides insight into how decreased user engagement on the network is affecting its performance.

The decline in Solana’s daily active addresses from March 17th was mirrored by a reduction in transaction volumes on its decentralized exchanges.)

Realistic or not, here’s SOL’s market cap in BTC’s terms

On April 8th, Solana’s decentralized exchange (DEX) recorded a trading volume of $1.2 billion. However, this figure represents a 70% decrease from the $4 billion trading volume recorded on March 17th, as indicated by on-chain data.

Additionally, the TVL, or Total Value Locked in Solana, has seen a decrease over the past month. According to DefiLlama’s data, the current value is $4.4 billion as of now, representing an 8% drop since April 1st.

The sales volume for the network’s NFT sector has seen a double-digit decrease over the past month. To be more specific, CryptoSlam reports a drop of approximately 15% within the last thirty days.

Finally, so far this month, NFT sales volume on Solana has totalled $59 million.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-10 18:15