- In the grand theater of finance, staking has danced its way to a staggering $100 million in just three months.

- Even as the market takes a leisurely stroll, spot traders have hoarded nearly $1 billion worth of SOL like it’s the last cookie in the jar.

Ah, the past week has been a real doozy for the poor souls holding Solana [SOL]. The asset took a nosedive of 10.95%, with sellers playing the role of the grumpy giants overshadowing the hopeful buyers.

But wait! Recent shenanigans hint that SOL might just be on the verge of a bullish awakening. It managed a 24-hour gain of a whopping 0.01%—a veritable rocket launch, if you squint hard enough. On-chain metrics are whispering sweet nothings about bullish momentum brewing beneath the surface.

Staked SOL: A Three-Month Rollercoaster

Nansen, the oracle of crypto, reports that the staked SOL has skyrocketed from a humble $7.7 million to a jaw-dropping $62.3 million over the last three months. Talk about a glow-up!

Staking, dear reader, is where traders cozy up with validators, depositing their precious assets to help secure the network, all while earning a cozy APY in return. It’s like putting your money in a piggy bank that promises to grow fatter over time.

When such significant staking surges occur, especially with yields lounging at a lowly 11.71%, it usually means the market is feeling a bit frisky. Traders are using staking as a long-term strategy, earning while they wait, like a cat watching a mouse hole.

With staked SOL inching closer to $100 million, buying activity has also picked up, as traders gobble up more SOL like it’s a buffet.

Buying and Trading: The Surge is Real

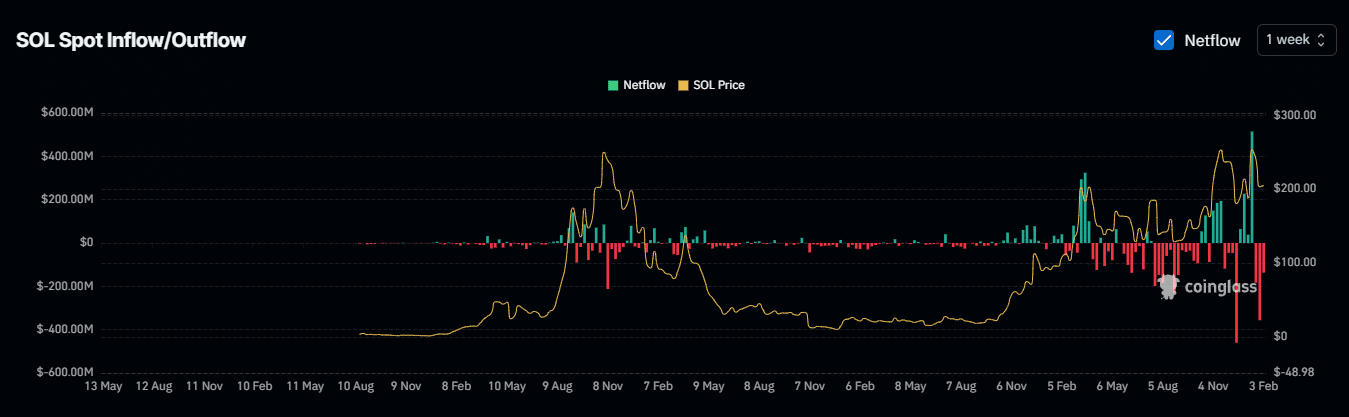

According to the wise folks at Coinglass, there’s been a veritable explosion in SOL purchases over the past three weeks.

During this time, a staggering $674.75 million worth of SOL was snatched up from the market and tucked away in private wallets for long-term snuggling. Moves like this scream market optimism, as traders seize the opportunity to buy SOL at bargain prices, like kids in a candy store.

In a similar twist of fate, the number of daily active addresses has surged from 4.4 million to 5.8 million in just three days, according to the ever-watchful Artemis data. When buying action surges and gains follow suit, it’s a sign that buyers are outpacing sellers, hinting at a potential rally. Buckle up!

Liquidity: Slowly but Surely

The Total Value Locked (TVL), that magical number that tells us how much SOL is frolicking in various Solana protocols, has been on a gradual rise lately. A surge in TVL is like a warm hug for prices, while a decline is more akin to a cold shower.

DeFiLlama, the keeper of the crypto flame, reported a growth from $9.705 billion on February 3rd to a current level of $10.22 billion. It seems SOL might just follow suit, like a well-trained puppy.

In summary, the market sentiment is leaning towards a bullish possibility for SOL, and we might just witness a major price rally in the upcoming trading sessions. Keep your eyes peeled, folks!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-02-05 15:08