- Alas, dear reader, it appears that Solana is bereft of the steadfast buying pressure necessary to rekindle the fervor reminiscent of the glorious days of Q4 2024.

- Behold the ominous liquidation heatmap, foretelling a potential descent to the depths of $160!

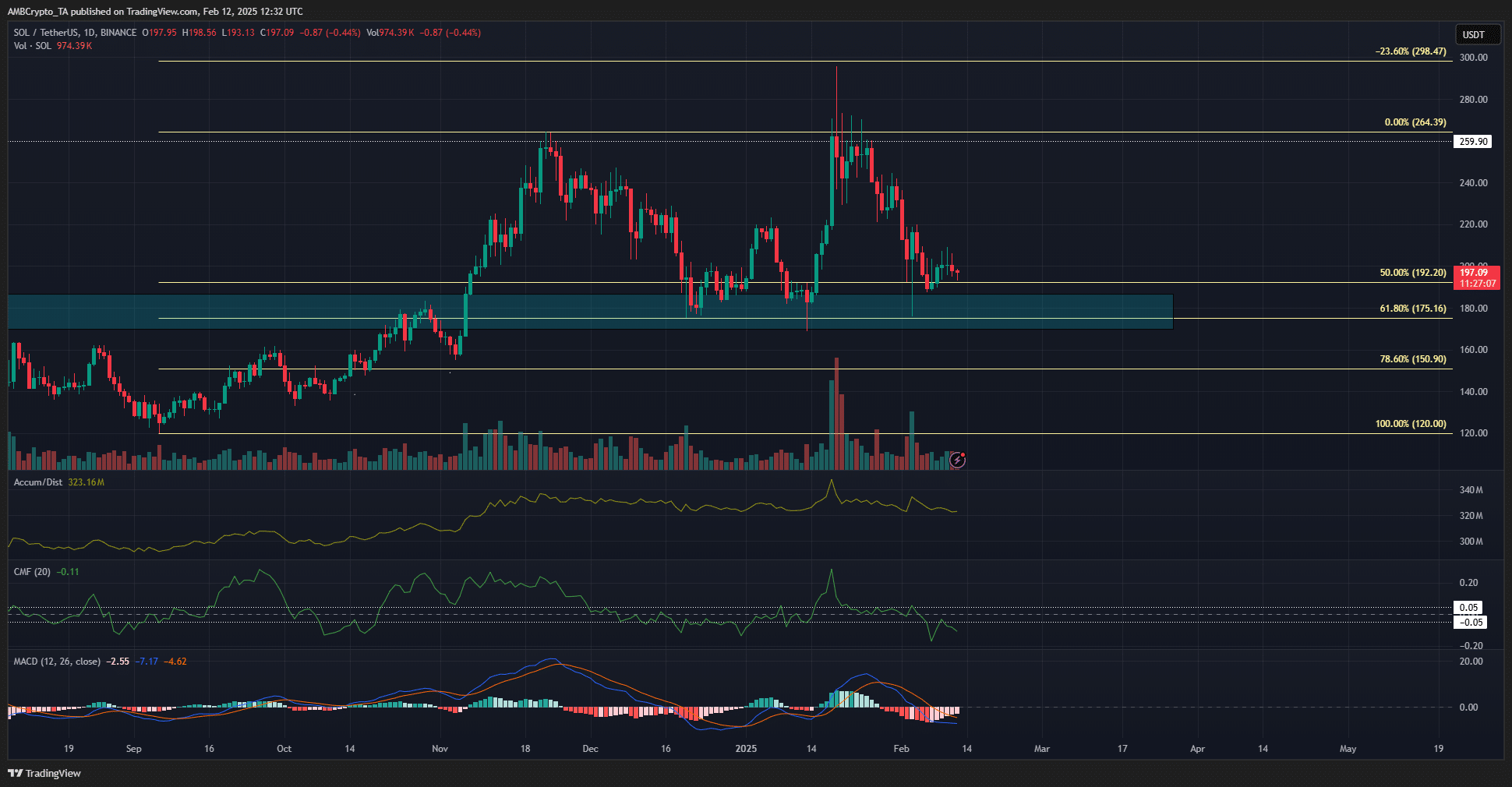

As I pen these words, Solana [SOL] finds itself ensnared in the clutches of resistance around the $205 mark, a veritable fortress that has withstood the test of time for a week. The daily chart, much like a tempestuous sea, reveals the high volatility that has gripped Solana following its robust gains at the twilight of 2024.

Since the month of November, SOL has danced between the realms of $180 and $260, with neither price point yielding to the whims of market participants. At this very moment, the bullish order block at $180 stands as a bastion of support, valiantly holding its ground.

The preponderance of long positions among the elite traders may serve as a flicker of hope in this turbulent sea. Even the whales, those great leviathans of the market, seem to be offering some signs of bullishness, albeit with a hint of skepticism.

Solana Bulls: Stronger Than a Wet Paper Towel? 🐂💪

Despite a valiant bounce from the depths of $188 just a week prior, it appears that the charts remain unmoved, as if they were carved from stone. The CMF languishes below -0.05, a testament to the heavy capital exodus from the market. The A/D indicator, much like a lost traveler, has failed to find a trend since November, mirroring the erratic price movements.

At this juncture, the MACD, that fickle friend, lies below zero, casting a shadow of bearish momentum over the daily chart. This aligns with the market structure, which has been as gloomy as a rainy day since the fall below $242 in the final week of January.

Yet, amidst this dismal landscape, Solana clings to a long-term bullish bias, as the Fibonacci retracement levels at $175 and $150 remain steadfast. As long as these levels endure, the prospect of another rally towards $260 and beyond may yet materialize, like a phoenix rising from the ashes.

The three-month liquidation heatmap reveals a veritable treasure trove of liquidation levels in the $160-$165 region. This magnetic zone may well draw Solana into its embrace, as price is irresistibly lured to liquidity.

Swing traders and investors, take heed! A drop below the $190 threshold could herald a renewed wave of pessimism, particularly if Bitcoin [BTC] decides to throw a tantrum. However, fear not! A retest of the $150-$160 range could present a golden opportunity for those who believe this cycle is far from over.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-02-13 09:14