- XLM is strutting its stuff at $0.344, showing some early signs of recovery. Look at it go! 💃

- The 50-day and 200-day Moving Average (MA) crossover is like a dramatic plot twist—potential trend shifts ahead!

So, here we are, folks! Stellar [XLM] is trading at $0.344, and it’s like watching a baby bird trying to fly—adorable and slightly nerve-wracking. 🐦

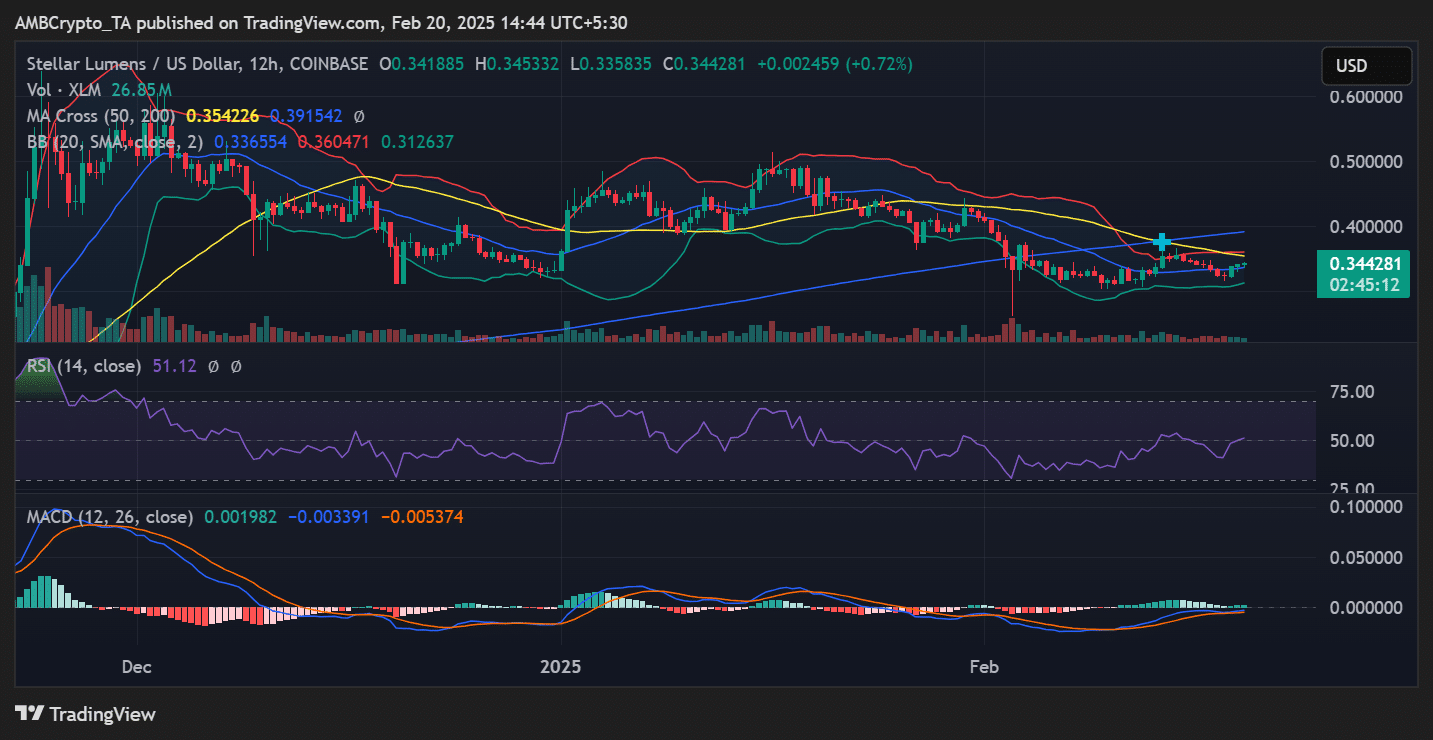

The 50-day and 200-day MA crossover is waving a little flag, suggesting a potential shift in trend. Meanwhile, the RSI is hanging out at 51, which is basically the financial equivalent of being “meh.” There’s room for movement, but don’t hold your breath! 😅

Oh, and the MACD crossover is like that friend who keeps saying, “I swear, I’m going to start working out!” If buying pressure increases, we might just see a bullish phase. Fingers crossed! 🤞

XLM market overview

XLM has been on a rollercoaster ride this past week, fluctuating between $0.320 and $0.360. It’s like watching a soap opera—full of drama and unexpected twists! 📺

With a volume of 26.85M, trading activity is moderate, but let’s be real, momentum is as uncertain as your friend’s dating life. 😬

The broader market conditions and Bitcoin’s trajectory are like the weather—totally unpredictable and could influence XLM’s next moves. 🌦️

Technical analysis suggests…

The 50-day MA (yellow) and 200-day MA (blue) recently formed a bearish crossover. It’s like a warning sign saying, “Caution: Proceed with care!” 🚧

But wait! If the price can reclaim the 50-day MA level of $0.354, XLM might just break free from its short-term downtrend. Go, XLM, go! 🏃♂️💨

At press time, the RSI is at 51.12, indicating neutral momentum—like that friend who can’t decide where to eat. If it moves above 60, we might just confirm a stronger bullish trend. 🍽️

The MACD is showing a potential bullish crossover, with the MACD line crossing above the signal line. If the histogram keeps printing green bars, XLM could be on the rise! 🌱

Bollinger Bands are indicating increasing volatility, with the price nearing the middle band, the SMA 20 at $0.336. If XLM breaches the upper band at $0.360, we could see an upside breakout. Let’s hope it’s not just a mirage! 🌈

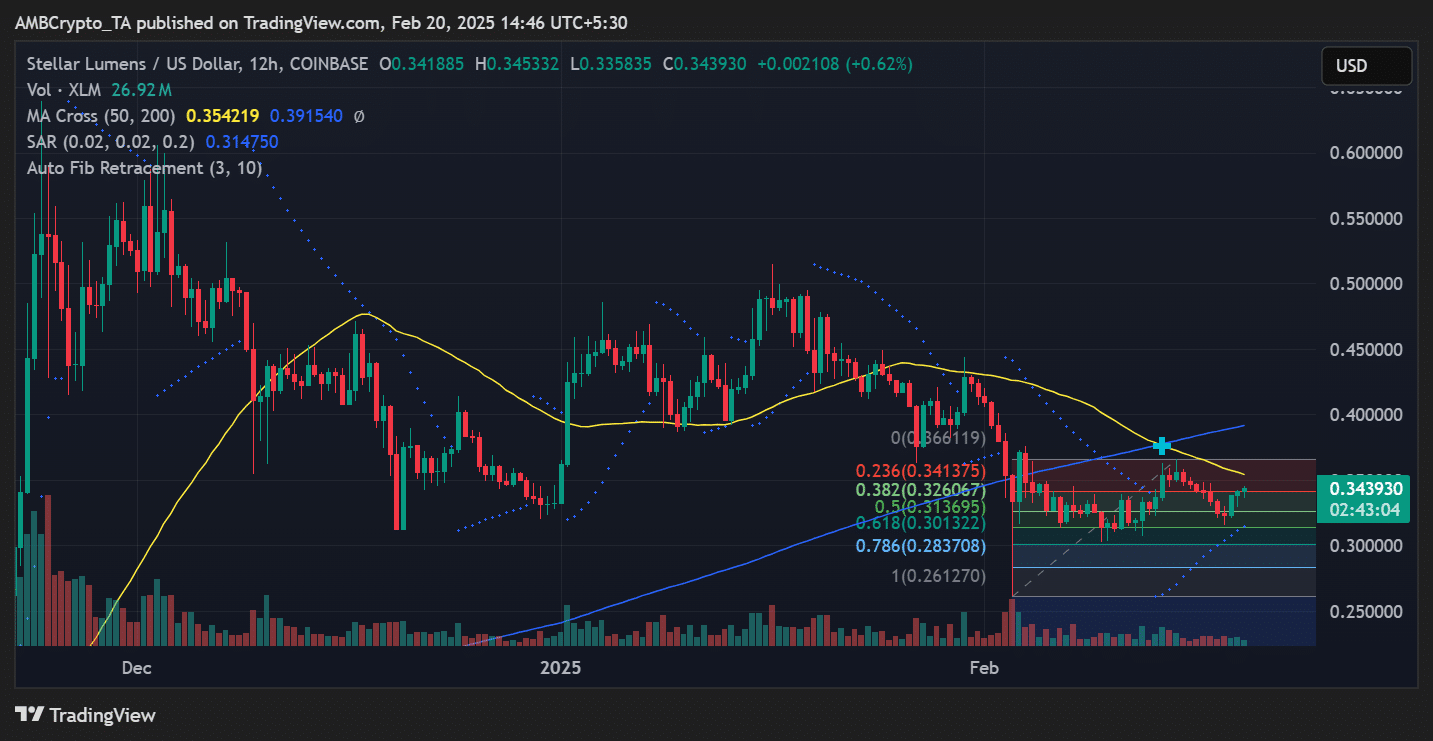

Fibonacci retracement levels are like the GPS for traders. Key levels to watch include the 23.6% retracement at $0.341 (current price region), 38.2% retracement at $0.326 (support zone), and 61.8% retracement at $0.301 (major support). 📍

A push above $0.360 (Fibonacci 0%) could pave the way for $0.380-$0.400. It’s like climbing a mountain—just don’t forget your oxygen! 🏔️

XLM price prediction: What’s next?

If XLM breaks above $0.360, it could target $0.380-$0.400, supported by RSI strength and MACD bullish momentum. It’s like a game of leapfrog—let’s hope it jumps high! 🐸

However, if XLM fails to hold $0.320, it may test $0.300-$0.283, aligning with Fibonacci retr

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-21 00:10