- TAO approaches critical $685 resistance level after a surge in volume and technical strength.

- Market sentiment is supported by increased open interest, a bullish MA crossover, and low social dominance.

As a seasoned analyst with years of market experience under my belt, I find TAO’s current trajectory quite intriguing. The surge in volume and technical strength suggests that this coin is ready to break some records.

Recently, the digital asset Bittensor [TAO] has seen a substantial increase in its 24-hour trading volume, climbing over half a billion dollars. This surge indicates robust investor interest and active market participation.

The surge in actions suggests increased attention since TAO’s trading value rose to $599.66, marking an 8.01% increase over the past day. This rise has also pushed TAO’s market capitalization to $4.43 billion at the present moment, suggesting a resurgence of energy as it moves closer to a significant resistance level around $685.

With bullish sentiment building, TAO could be preparing for a significant move.

Technical analysis: Signs of a bullish breakout

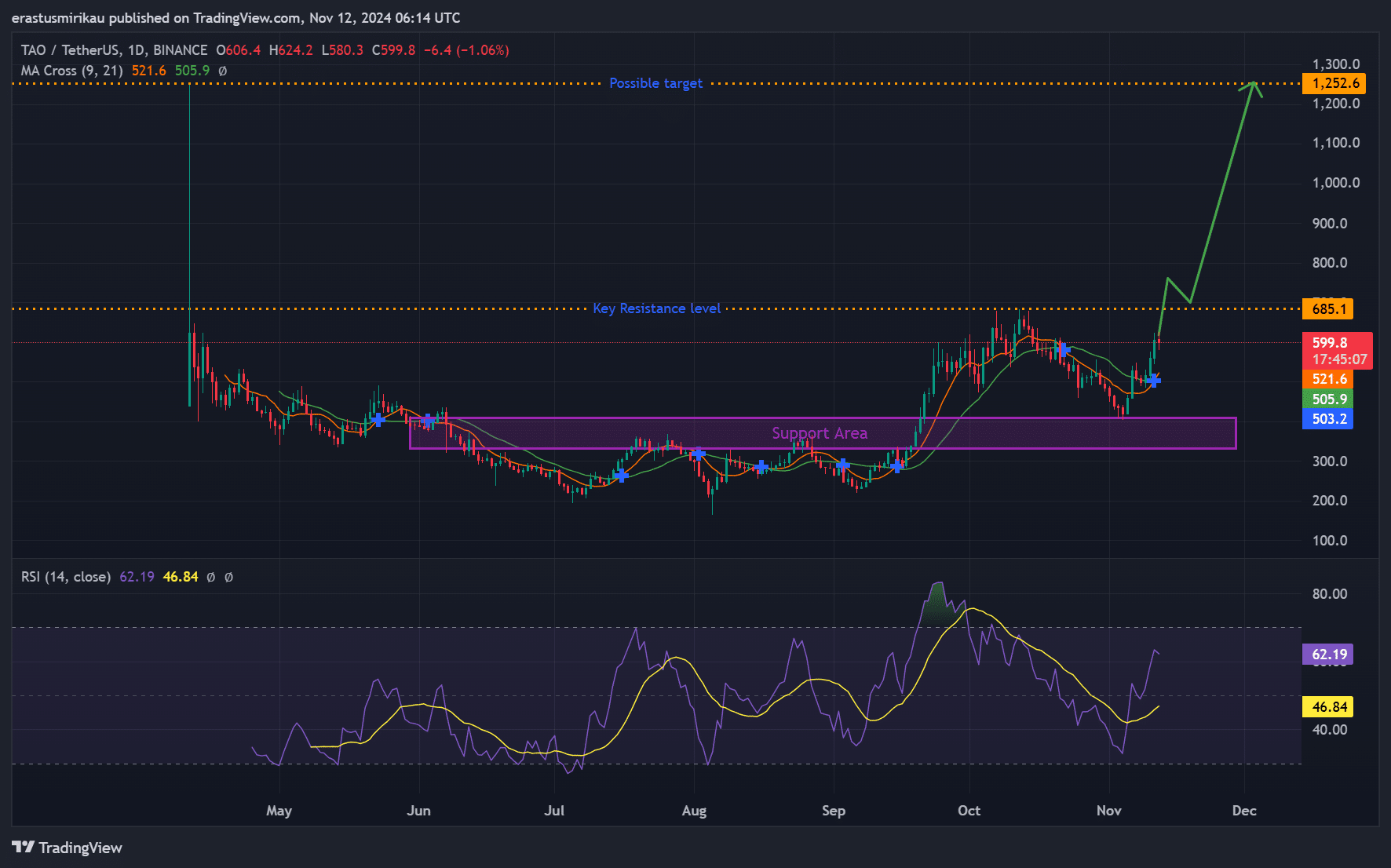

As a crypto investor, I’m closely watching TAO’s technical indicators, which suggest a possible breakout might be on the horizon. Having bounced back from a robust support zone ranging between $400 and $500, the price is now approaching a significant resistance level at $685.

Moving beyond this current level might pave the way towards our next goal at $1,252.6, potentially yielding a substantial profit. It’s crucial that we maintain strong demand to sustain this upward trend.

As a crypto investor, I’m keeping an eye on the Relative Strength Index (RSI) of TAO, which currently stands at 62.19. This suggests that TAO might be nearing overbought territory, potentially prompting some investors to take profits if buying pressure starts to decrease. However, the RSI’s upward trend still points towards a bullish outlook for TAO.

Furthermore, the latest cross-over of the short-term (9 days) and medium-term (21 days) moving averages reinforces the optimistic outlook. These averages have been steadily increasing, indicating a consistent upward trend and high demand for purchasing.

Consequently, the crossover in the MA indicates that TAO’s rally might prolong past a brief surge, suggesting a potential long-lasting upward trend.

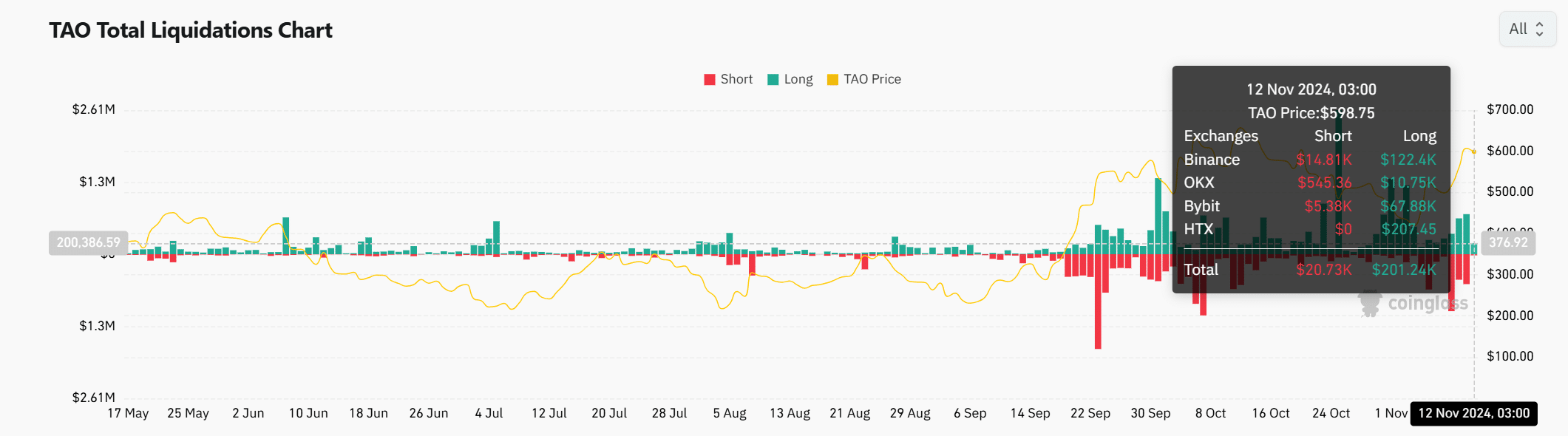

Liquidation data: A bullish imbalance

Recent liquidation figures show a noteworthy pattern: the value of long positions surpasses $200 million, far more than the short positions. This suggests that the overall market mood is leaning towards optimism (bullish).

In other words, an imbalance in TAO can lead to a higher likelihood of chain reactions of liquidations when it encounters unexpected downward pressure. This situation might escalate losses and cause market volatility.

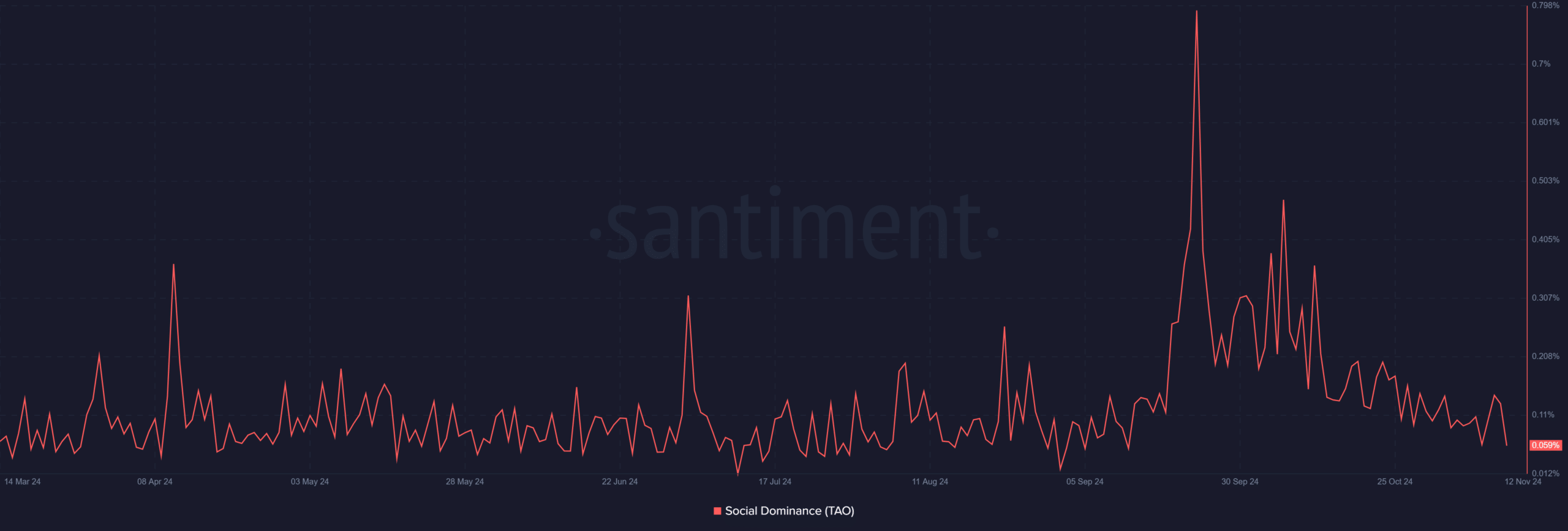

Social dominance declines amid rally

It’s intriguing to note that social dominance is now only at 0.059%, indicating that the current surge in TAO’s price might be more influenced by major investors rather than retail enthusiasm. This shift could contribute to a more stable uptrend for TAO.

Consequently, this lower social dominance could help reduce speculative volatility.

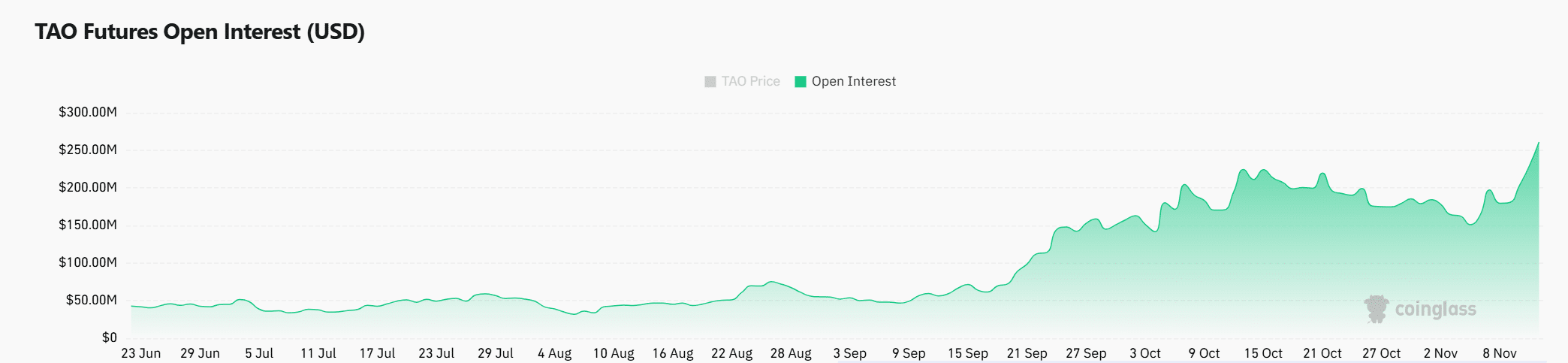

Open interest surge signals bullish sentiment

The open interest has risen by 12.58%, reaching $251.12 million. This uptick in open interest, coupled with rising trading volume, underscores strong investor confidence and commitment.

Consequently, this growth indicates that the market anticipates continued upward trend for TAO, providing additional impetus to its ongoing surge. As it approaches the $685 resistance point, the momentum of the rally is being tested.

Read Bittensor’s [TAO] Price Prediction 2024–2025

Based on TAO’s technical markers, there seems to be an impending surge past the $685 level, as indicated by increasing open interest and substantial trading activity. Yet, it’s essential to exercise caution due to the Relative Strength Index (RSI) approaching overbought levels and a decrease in social dominance.

If TAO manages to meet its aggressive goal of $1,252.6, it’s important to note that a slowdown in progress or unexpected buying pressure could potentially divert its course upwards.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-13 01:12