- The altcoin market was performing well in the past five months, but the halving fears stalled it.

- The next such run could take a while to materialize, but will leave telltale signs.

In the past month, the value of many alternative cryptocurrencies (altcoins) decreased significantly due to anxiety surrounding Bitcoin‘s (BTC) upcoming halving event.

Crypto expert Ali Martinez noted on social media platform X (previously known as Twitter), that the period for altcoins to thrive typically begins soon after Bitcoin’s halving event.

During an altcoin boom, the total value of altcoins significantly increases. According to market belief in the cryptocurrency realm, this trend seldom persists for longer than a few months.

Yet, it gives investors a great opportunity to capture profits.

Is another altcoin season looming?

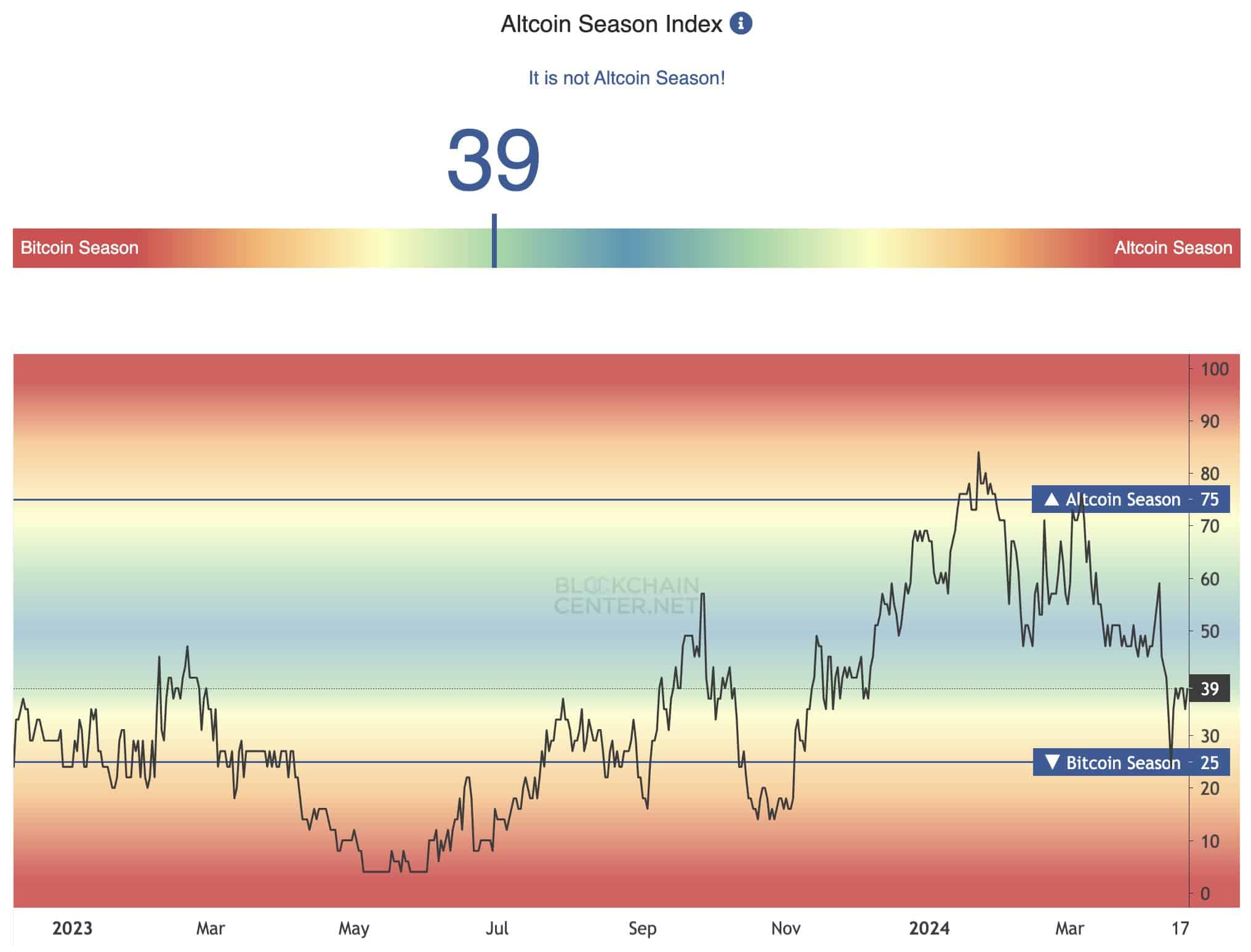

In early 2024, the altcoin season index surpassed 75. However, following the halving event, the index dipped back down to around 25 – a typical response reflecting the “Bitcoin season.” Nevertheless, during the past month, altcoins experienced significantly greater value losses compared to Bitcoin.

The selling pressure causing fear had led to this outcome for Bitcoin, with the index standing at 39 as of now and failing to indicate an upcoming altcoin boom based on current data.

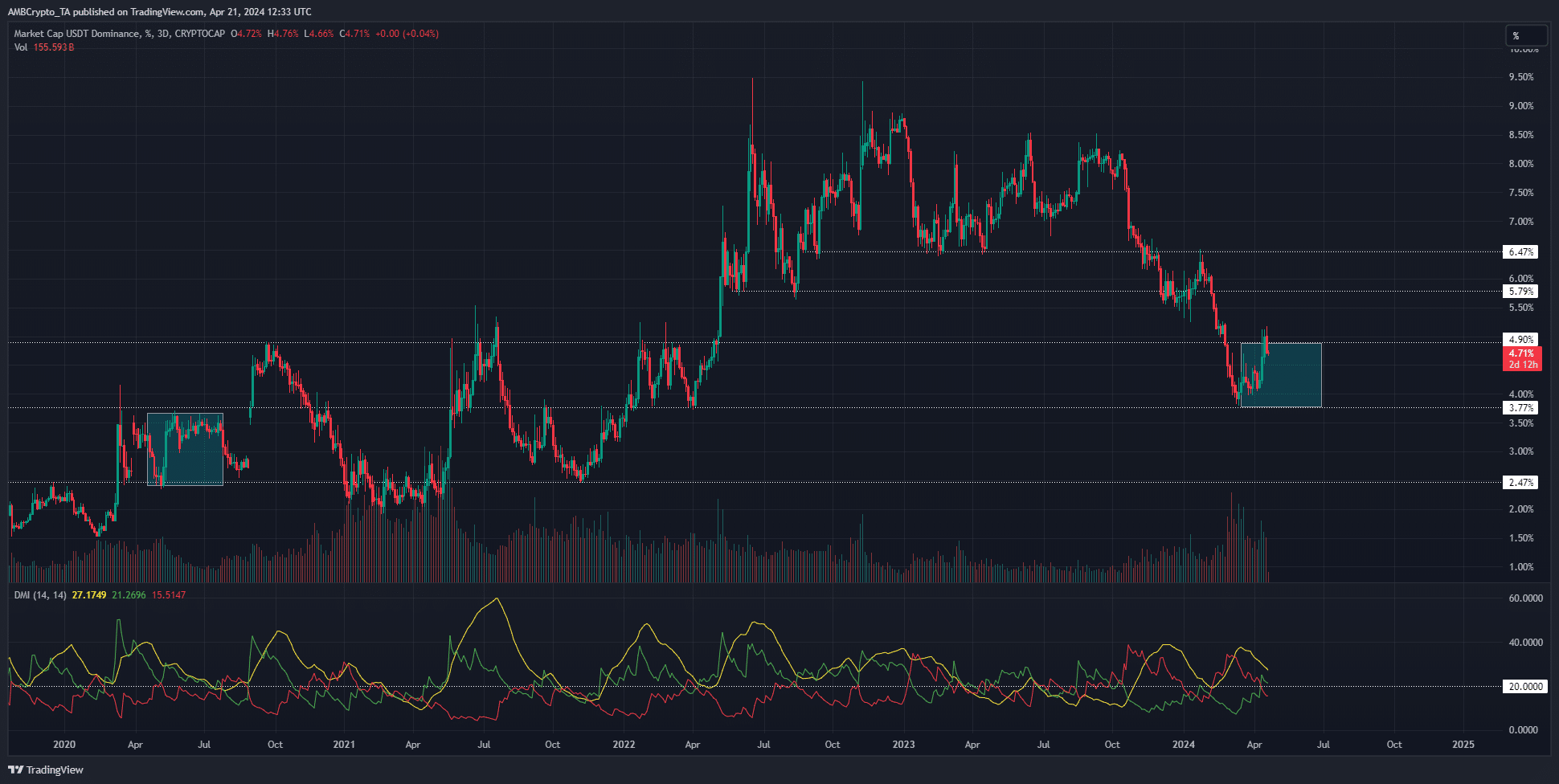

Based on the technical analysis of the Tether (USDT) market trend, it appears that its decline may be coming to a close soon.

A decrease in the USDT price is an encouraging indication as it suggests investors are willing to take on risk and trade their stablecoins for cryptocurrencies.

A USDT dominance’s upward trend would show the opposite.

During an altcoin season, it’s ideal to have a significant downward trend. Based on the Directional Movement Index analysis of the 3-day chart, there was a clear downtrend from late October until early April.

The elapsed period was substantial, indicating that the market might require some time to recuperate before experiencing another decline. Moreover, the cyan-colored boxes draw attention to the Bitcoin halvings in 2020 and 2024.

If the 2020 similarities play out, we could see altcoins lose more value in the coming weeks.

Buying power in the market was rising

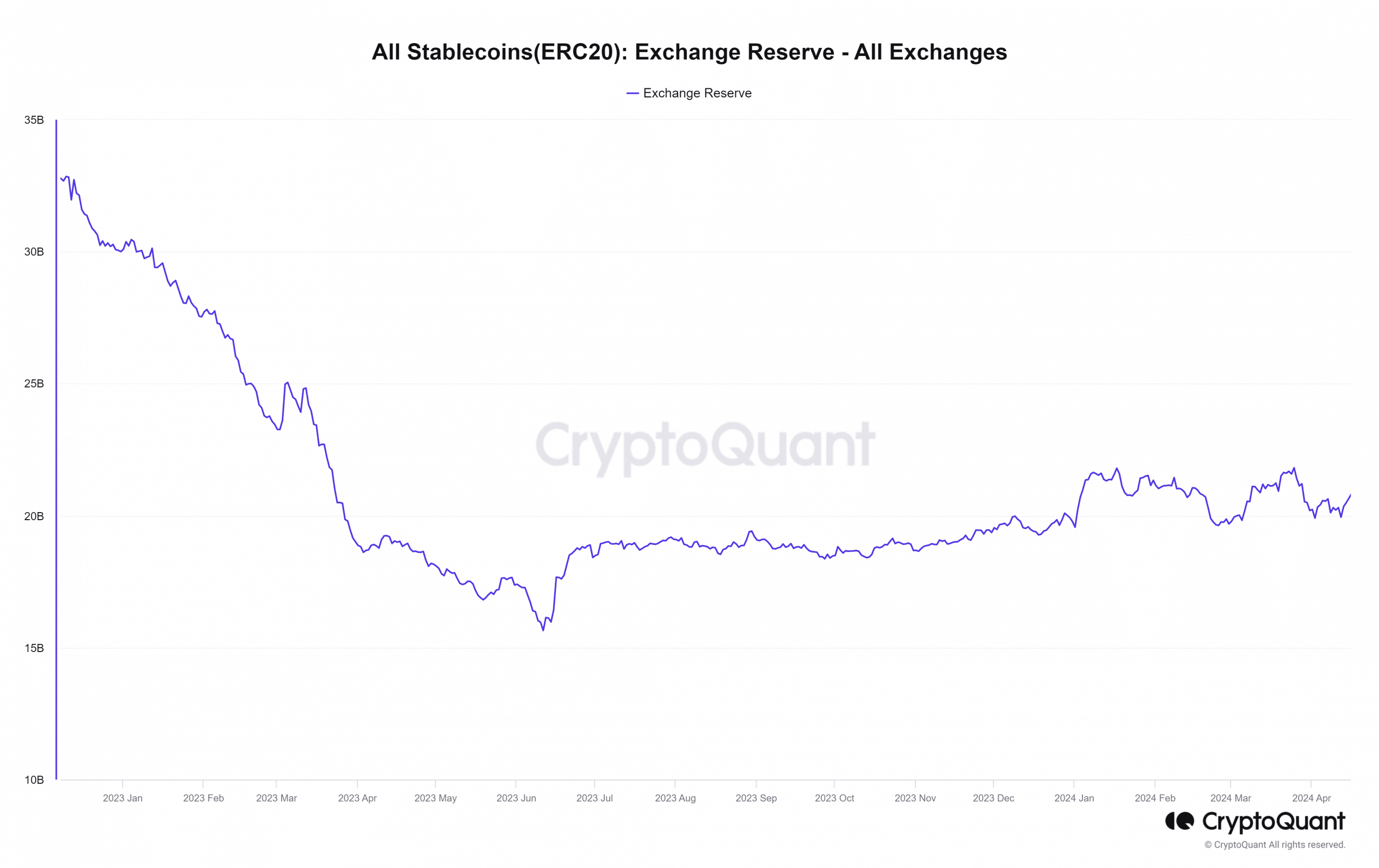

According to AMBCrypto’s interpretation of CryptoQuant’s findings, the purchasing strength in the cryptocurrency market has been growing steadily since mid-October. The amount of stablecoins held by exchanges serves as an indicator of this buying power.

In contrast to the significant increase seen during the 2020-2021 period, the metric hasn’t reached a steep upward trend, or “parabolic” growth, as it did previously. The substantial market capitalization growth in 2021 led to a remarkable surge in exchange reserves.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simple terms, a significant increase in stablecoin holdings suggests that the market for alternative cryptocurrencies is gaining momentum once again.

By merging the Tether market supremacy graph and the altcoin trend indicator, investors may gain a competitive advantage in the financial markets.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-22 03:03