- Bitcoin’s current downturn was “normal,” per Michael van de Poppe.

- The broader market remained positive for the king coin.

As a seasoned cryptocurrency analyst with over five years of experience in this dynamic market, I have witnessed countless ups and downs, bubbles, and crashes. The current downturn in Bitcoin’s price has raised some concerns among traders, but after careful analysis, I remain optimistic about the king coin’s future.

2024 saw a rollercoaster ride in the cryptocurrency markets, causing some investors to worry about an impending massive drop. However, analyst Michael van de Poppe confidently expresses a different viewpoint.

As a researcher studying cryptocurrencies, I believe that Bitcoin’s recent 36% correction, resulting in a price point around $54K, should be viewed as a typical market retracement within the current context.

It turned out that the concerns about a major economic downturn were exaggerated, as a more detailed examination revealed encouraging indicators pointing towards a possible rebound. Particularly noteworthy was the comparison between September 2023 and September 2024, suggesting potential growth over that period.

2024’s last quarter could potentially see a rebound in Bitcoin, similar to its past trends, even though retail traders might currently express pessimism.

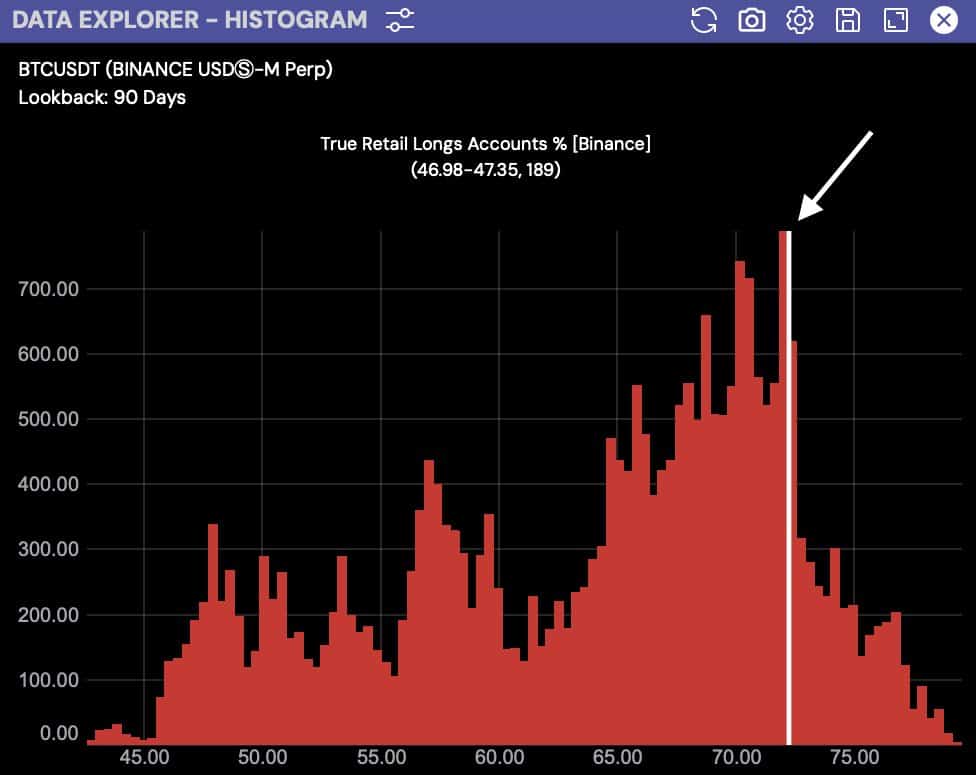

True retail longs accounts

Examining the actions of individual investors in the retail sector aligns with our perspective. In fact, it was observed that a significant 72% of these traders maintained their long positions on Bitcoin, suggesting optimism towards its price increase, even during the recent period of market stabilization.

This trend went against the notion of a forthcoming crash, since retail traders were maintaining their long positions on Bitcoin, indicating faith in its potential price increase in the near future.

Michael Poppe’s analysis emphasized that these factors reinforce the view that a crash is unlikely.

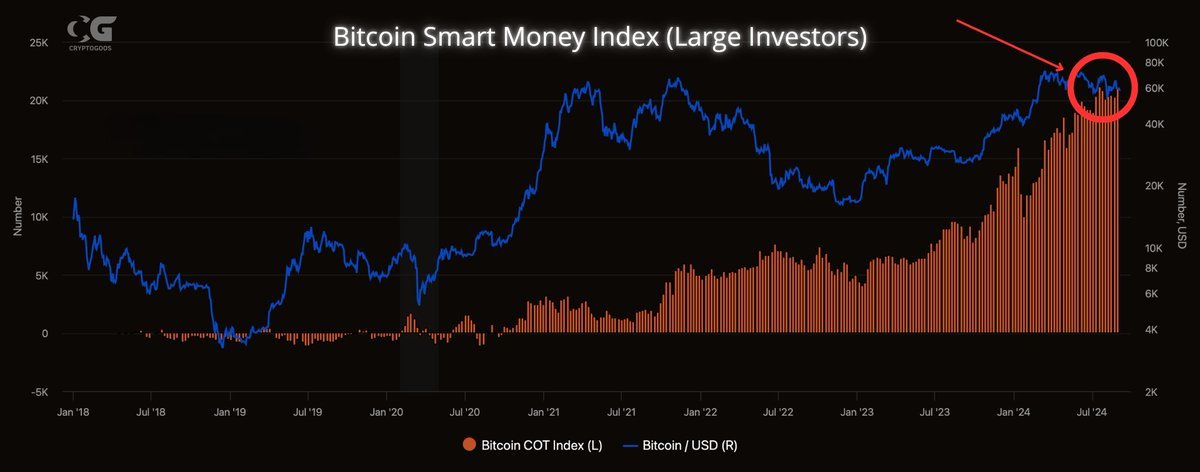

Smart money index

In simpler terms, even though there was widespread apprehension in the larger cryptocurrency market, big-time investors were seizing the opportunity presented by this fear and buying more Bitcoin, as suggested by the Smart Money Index.

By continuing to back the cryptocurrency, institutions and major holders helped rule out a significant market collapse, thus averting a major crash.

The combination of their actions and the recent stabilization of Bitcoin’s price seems to suggest a stronger possibility that Bitcoin might rise again instead of falling drastically.

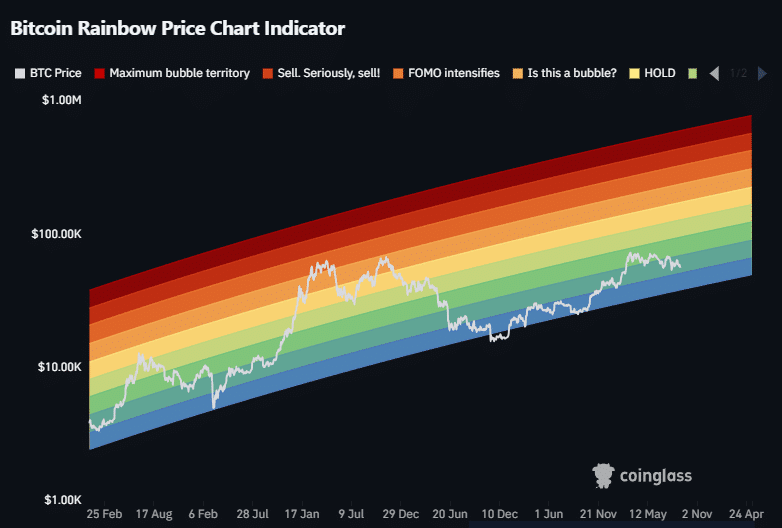

Bitcoin rainbow chart

Furthermore, the Rainbow Chart for Bitcoin provided further proof of its stability. At the moment of reporting, Bitcoin was trading in the dark green region, suggesting it was approaching a strong accumulation stage.

Historically, this area has proven to be a valuable buying opportunity on higher timeframes.

Should Bitcoin continue along its present course and adhere to this particular signal, the likelihood of a market crash will be relatively low.

A dip under $51,000 might push Bitcoin into a more robust accumulation stage, yet it remains indicative of an overall long-term uptrend.

Bitcoin Funding Rate

In conclusion, a bullish signal emerged when we looked at the Bitcoin Funding Rate. This rate was moving towards the positive side, suggesting that long-term investors (long traders) were now paying short-term investors (short traders).

This change indicates that an increasing number of investors are growing optimistic about Bitcoin’s rising trend, and they are adjusting their portfolios to take advantage of possible price increases.

As shorts continue to close their positions, it creates further buying opportunities, pushing Bitcoin’s price higher.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Regardless of the current market fluctuations and the general pessimism, the signs point towards Bitcoin avoiding a major price drop.

Rather than suggesting a downturn, signs seem to indicate a possible rebound and increased price surges approaching the last three months of 2024.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-09-10 04:08