- Bitcoin’s recent gains have been met with skepticism as exchange inflows surge, suggesting profit-taking.

- Historically, Bitcoin’s performance in September has been poor, causing market jitters.

As a seasoned crypto investor with battle-tested nerves and a knack for reading between the lines, I must say the current market dynamics are reminiscent of a game of chess – every move, no matter how small, holds profound implications.

At the moment of reporting, the value of Bitcoin [BTC] stood at approximately $56,864, marking a 3.6% rise over the past 24 hours. This growth was preceded by a significant surge in trading volumes, as evidenced by a 31% increase, according to CoinMarketCap.

As a researcher studying the cryptocurrency market, I find myself cautiously optimistic amidst the recent surge in Bitcoin’s value, even though September was particularly challenging for its price. However, there are still indicators that have yet to show signs of bullishness, which raises questions about whether we have fully navigated the Bitcoin market’s turbulence.

September bears haunt traders

Currently, the overall feeling among traders regarding the market remains cautious, as indicated by the Bitcoin Fear and Greed Index standing at 33. This number indicates that investors are preparing for another possible drop in prices similar to those seen in September.

In fact, a recent report by U.S. fund manager NYDIG noted that the market could be,

“Stuck in a seasonal slog for the next month.”

The report also stated,

As an analyst, I find myself noting a trend in Bitcoin’s performance this September. On average, it has dropped by approximately 5.9%, and the median return stands at a negative 6.0%. Regrettably, with the month only just beginning, these figures don’t seem to offer much comfort.

It seems that the attitude might shift by the end of this month, as per Rekt Capital’s prediction, Bitcoin could experience a continuous upward trend for the next three months in the final quarter of the year.

As past price declines in September haunt traders, Bitcoin’s upside potential remains capped.

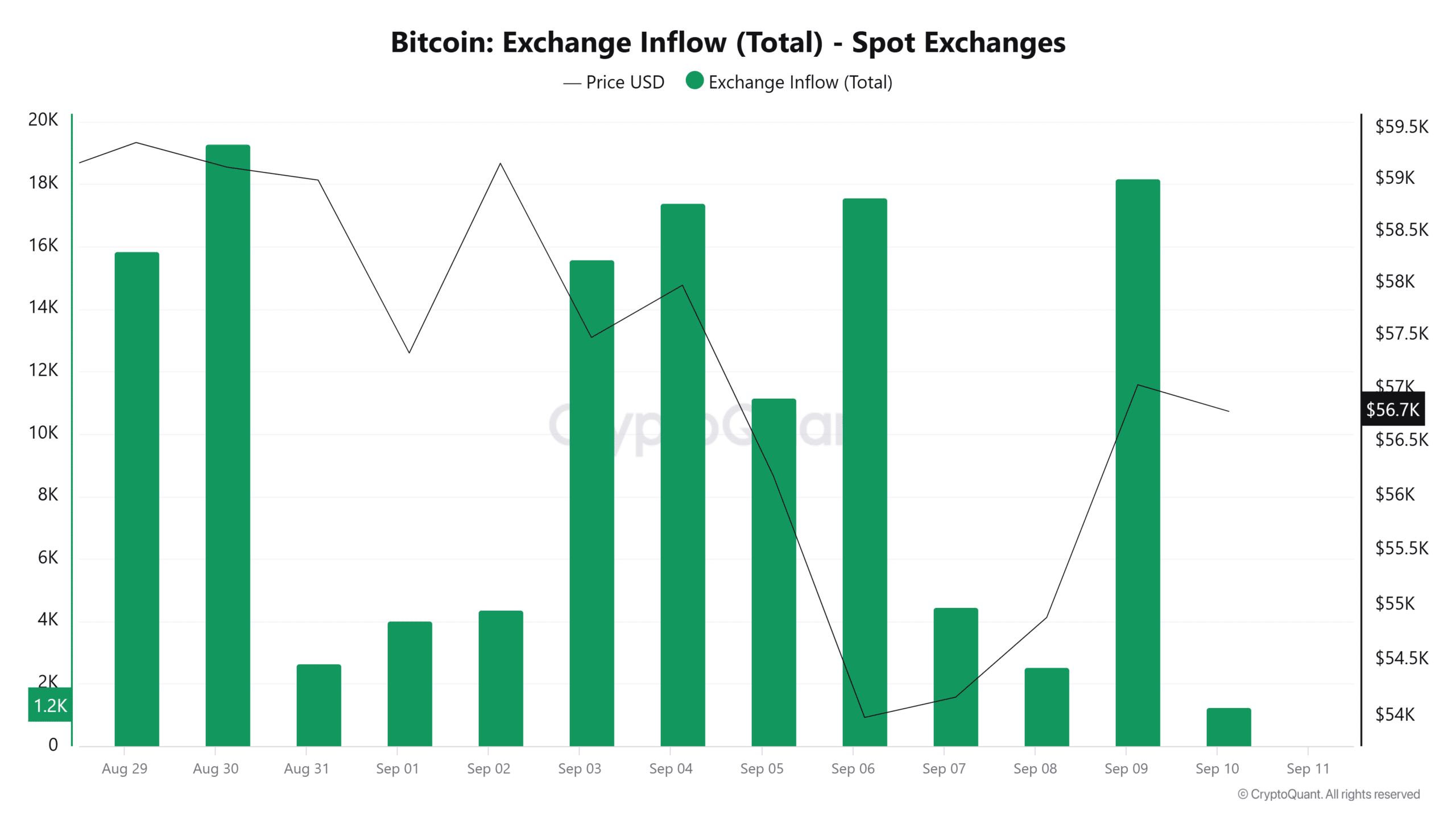

Exchange inflows reach 7-day high

Another key signal showing that a bearish trend is in play is exchange inflows.

On the 9th of September, there was a significant surge in Bitcoin deposits into trading platforms, amounting to 18,193 units. Compared to the 2,535 BTC deposited the day before, this represented a substantial increase. Moreover, this level of inflow marked the highest in the past seven days.

As Bitcoin prices began to rise again, there was an increase in investments, indicating that traders were taking profits. This suggests that these traders expect a downturn in the market and are looking to reduce their potential losses.

Based on my personal trading experience, I’ve noticed that when selling activity increases significantly like this, it often suggests traders aren’t optimistic about a significant price surge ahead. In such cases, Bitcoin’s uptrend may encounter resistance and potentially face a temporary setback. This doesn’t necessarily mean the end of the bull run, but it could indicate a pause or correction in its momentum. I’ve seen similar patterns before, so I suggest keeping a close eye on market trends and adjusting strategies accordingly.

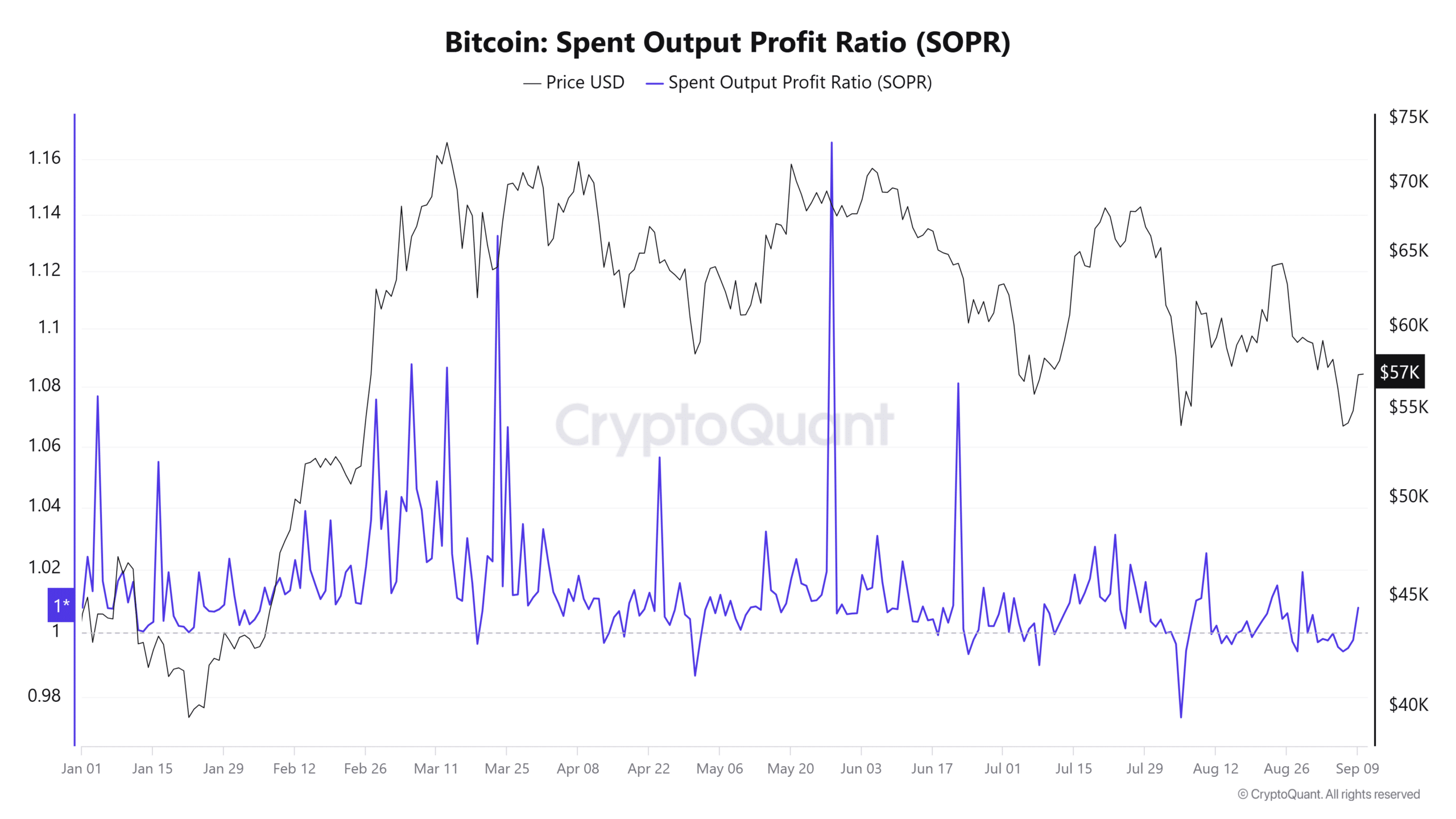

Traders’ tendency to cash out their profits is evident in the Spent Output Profit Ratio (SOPR) chart on CryptoQuant, as this ratio has climbed over 1, indicating that more sellers are offloading crypto assets to lock in their profits.

This can put a brake on Bitcoin’s gains.

Buyers hold back

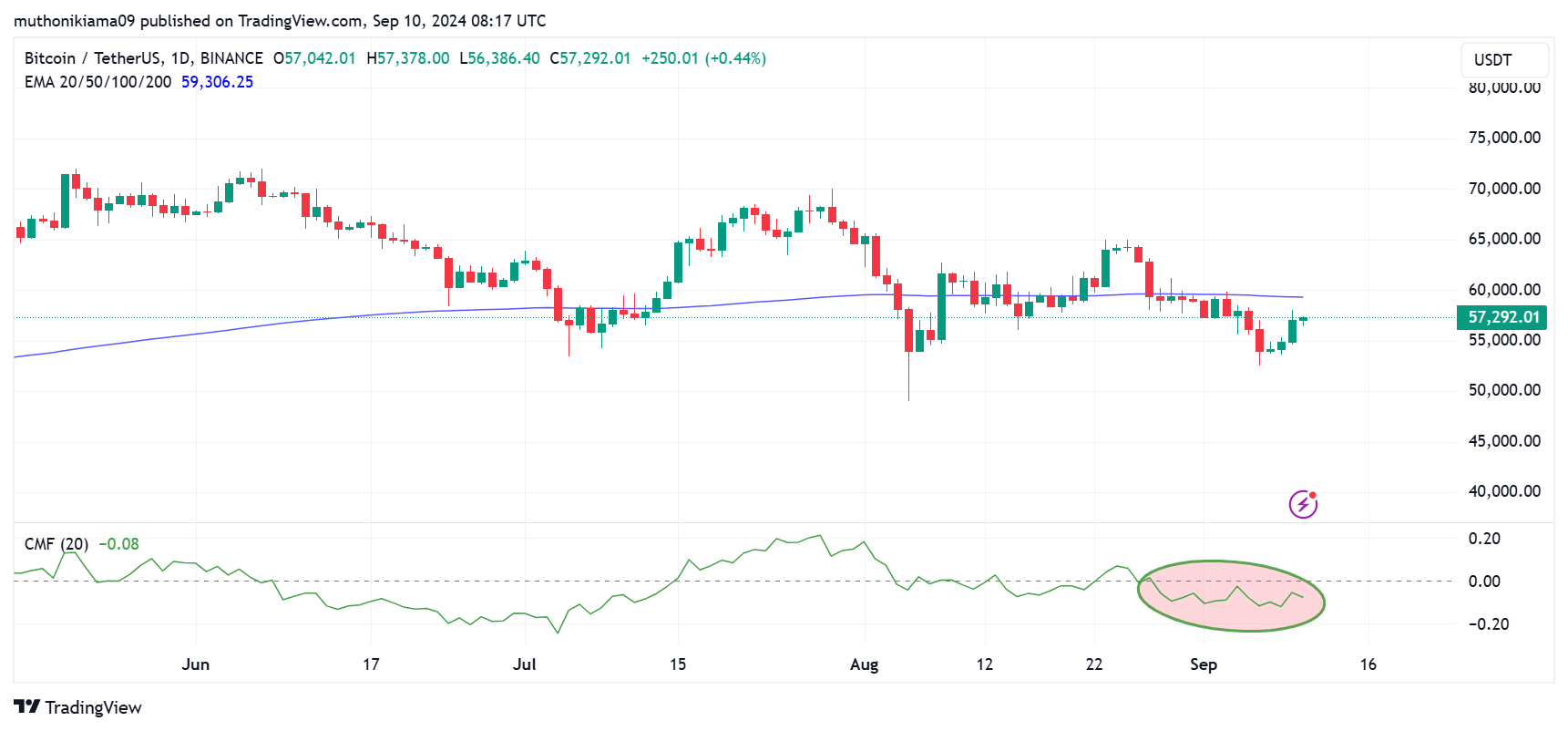

In a typical crypto bear market, buying activity remains relatively low. This trend has appeared on the Bitcoin daily chart.

Since the 27th of August, the Chaikin Money Flow has remained in the negative range. Although there have been brief periods of purchasing action, it hasn’t turned positive for the past two weeks.

This shows that Bitcoin has experienced more selling than buying within this period.

Additionally, Bitcoin (BTC) has stayed beneath its 200-day Exponential Moving Average for a fortnight straight. This indicates a generally pessimistic mood among investors.

The inability of BTC to reclaim the 200-day EMA also indicates a lack of confidence among traders in a near-term price recovery.

Upcoming CPI data

Cryptocurrency traders are starting to focus on the upcoming release of the U.S. Consumer Price Index (CPI) figures, which is set for Wednesday.

Based on Marketwatch reports, it is anticipated that the Consumer Price Index (CPI) for August will be around 2.6%, marking a decrease compared to the 2.9% recorded in the previous month.

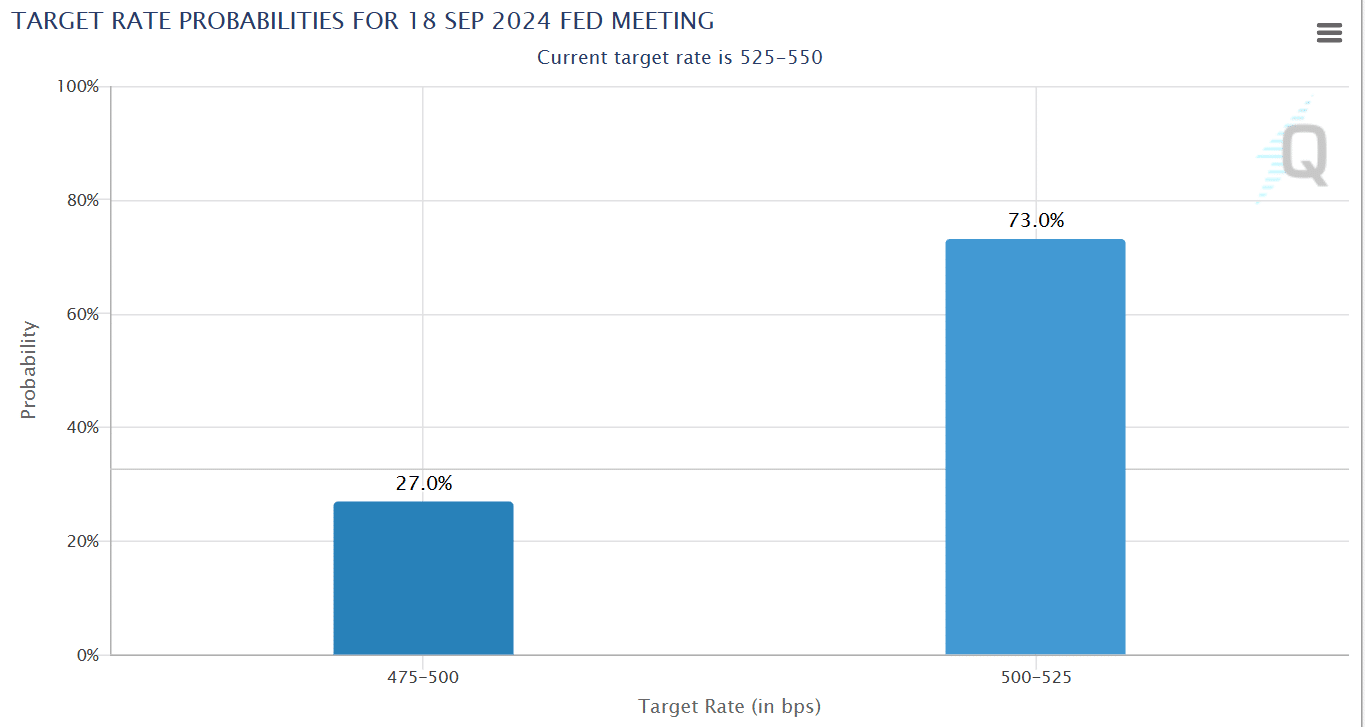

As a researcher, I am anticipating that the upcoming positive inflation data will bolster my argument for the potential lowering of interest rates by the Federal Reserve in the coming week.

As a crypto investor, based on the CME FedWatch Tool, it appears that nearly three-quarters (73%) of fellow investors are predicting a modest 0.25% reduction in interest rates, while the remaining 27% are betting on an even steeper cut of 0.50%.

Last week, U.S. Treasury Secretary Janet Yellen’s comments on the economy being strong and moving towards recovery sparked anticipation for potential interest rate reductions.

Reducing interest rates by the Federal Reserve for the first time since 2020 could increase investor’s willingness to take risks, potentially leading to a rise in risky assets like cryptocurrencies. This, in turn, could diminish the likelihood of a crypto market downturn or bear trend.

A positive sign emerges

Despite predominantly negative indicators, a hopeful signal appeared when spot Bitcoin ETFs shifted positively for the first time since late August.

On the 9th of September, inflows to spot Bitcoin ETFs came in at $28M per SoSoValue data.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Conversely, it’s important to note that the two leading Bitcoin ETFs by asset value experienced withdrawals. Specifically, the BlackRock iShares Bitcoin Trust (IBIT) and the Grayscale Bitcoin Trust (GBTC) recorded outflows totaling $9 million and $22 million respectively.

If the Bitcoin ETF data remains favorable throughout the week, it will rekindle confidence amongst cryptocurrency investors and diminish concerns about a prolonged bear market.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-11 02:16