- The market saw significant declines in the past week.

- There is still time in the year for the market to push for one last rally.

As a seasoned researcher with years of experience navigating bull and bear markets, I find myself intrigued by the current state of the crypto market as we approach the final stretch of 2024. The Santa Claus rally is a phenomenon that has historically brought joy to investors, but this year, it seems to be playing hard-to-get.

Discussion about the Santa Claus rally, a recurring pattern in financial markets that typically sees an increase in prices during the final week of December, is currently a buzzing subject within the cryptocurrency community.

By the close of 2024, crypto enthusiasts find themselves pondering whether this recent surge in value has run its course or if it still holds the promise of pushing market prices even further upwards.

Current market overview

Right now, Bitcoin (BTC), our market’s dominant cryptocurrency, is being exchanged for around 950,000 dollars. Over the last day, its value has only slightly risen by almost 1%.

Ethereum (ETH) experiences a minimal rise of almost 1%, currently valued at approximately $3,291. Similarly, Solana (SOL) and Binance Coin (BNB) exhibit small growths. The total cryptocurrency market capitalization remains close to $3.5 trillion, staying relatively stable.

Despite the minor pullback, trading volumes remain strong. Bitcoin’s dominance, now at 55.08%, underscores its pivotal role during this seasonal period.

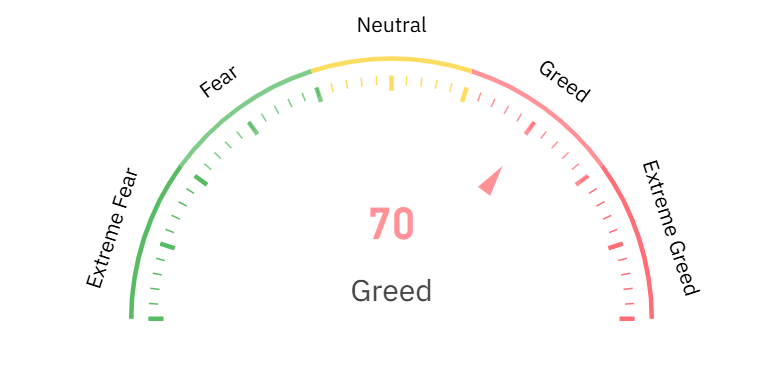

Additionally, the Fear & Greed Index, which stands at 70 (indicating Greed), indicates that the general market sentiment continues to be optimistic, although investors may be exercising some caution.

Has the Santa Claus rally lost steam?

Historically, the Santa Claus rally is associated with optimistic market feelings, purchases motivated by taxes, and a rise in consumer involvement. But lately, there’s been more market turbulence due to factors like the expiration of approximately $2.6 billion worth of Bitcoin and Ethereum options.

This options expiry often creates price swings as traders adjust their positions.

The analysis of on-chain data shows a blend of indicators. There’s been a decrease in whale activity, as larger transactions have become less frequent, but at the same time, smaller investors (retail) are consistently adding to their holdings.

Currently, technical indicators such as the Relative Strength Index (RSI) for Bitcoin (BTC) and Ethereum (ETH) are close to neutral readings, implying that there’s little obvious trending movement in either direction.

What this means for investors

In the upcoming timeframe, the success of the rally predominantly hinges on crucial resistance points. For Bitcoin, surpassing the $100,000 mark represents a significant psychological hurdle, while Ethereum must overcome the $3,500 threshold to revive its bullish trend.

Bollinger Bands indicate reduced volatility, but any breakout could be significant.

In today’s dynamic market environment, it’s essential for investors to prioritize risk management strategies. Keeping a close eye on changes in market momentum, specifically in regards to Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI), is crucial. Additionally, staying informed about broader economic trends and any updates in regulations that could potentially influence investor sentiment is equally important.

Although the Santa Claus rally hasn’t provided significant surges, it still holds some promise. The upcoming week is crucial since the market is moving towards the start of 2025.

As a researcher exploring the cryptocurrency market, staying abreast of market trends and being adaptable to changing conditions will be crucial in seizing end-of-year investment opportunities.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-24 02:15