- Ah, Bitcoin, that fickle mistress, drawing us ever closer to a high-stakes duel. A staggering $332 million short at 40x leverage hangs in the balance, like a sword of Damocles over our heads.

- Could a liquidation-fueled squeeze be lurking just around the corner, waiting to pounce?

As the market takes a moment to catch its breath, one audacious trader has thrown caution to the wind, placing a highly leveraged 40x short on Bitcoin [BTC]. This brave soul has risked their entire $8.3 million account to open a position worth a jaw-dropping $332 million. Talk about living on the edge!

At present, this short position is languishing under an unrealized loss of $1.3 million, with a liquidation price set at a precarious $85,290. With Bitcoin trading around $83,245, the trader’s fate hangs by a thread, teetering on the brink of disaster.

If Bitcoin dares to rise, a short squeeze could ignite a breakout, sending the trader’s heart racing. But beware! If the bears muster their strength to defend resistance, a swift pullback could follow, leaving our trader in a world of hurt. The battlefield is fraught with peril.

Crossing this treacherous range brings 699.2K BTC into the spotlight, as profit-taking pressure mounts. A key group of stakeholders who bought BTC at a dizzying peak of $86,391 might just be itching to cash in. 🤑

For the bulls to seize control, this sell-side liquidity must be devoured by insatiable demand. Unlike Bitcoin’s dramatic plunge to $78K—where 46k BTC flowed out, signaling robust spot demand—its $84k price level has seen no such influx of capital. A curious case of buyer’s remorse, perhaps?

This raises eyebrows about buyer strength, especially with the Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) still wallowing in the capitulation zone, indicating that many short-term holders are still swimming with the fishes. 🐟

If BTC dares to touch $85K–$86K, profit-taking could reach a fever pitch, leading some holders to capitulate and break even rather than HODL, thus increasing sell pressure and risking a long squeeze. The drama unfolds!

With supply likely to outstrip demand, our intrepid trader has positioned the short around a critical resistance zone. If the bears hold their ground, a pullback to $81K seems increasingly likely. The tension is palpable!

Volatility in the Bitcoin Derivatives Market

Despite the lackluster demand, Open Interest (OI) has surged by $2 billion in just two days, signaling aggressive positioning in the Bitcoin derivatives arena. A curious phenomenon, indeed!

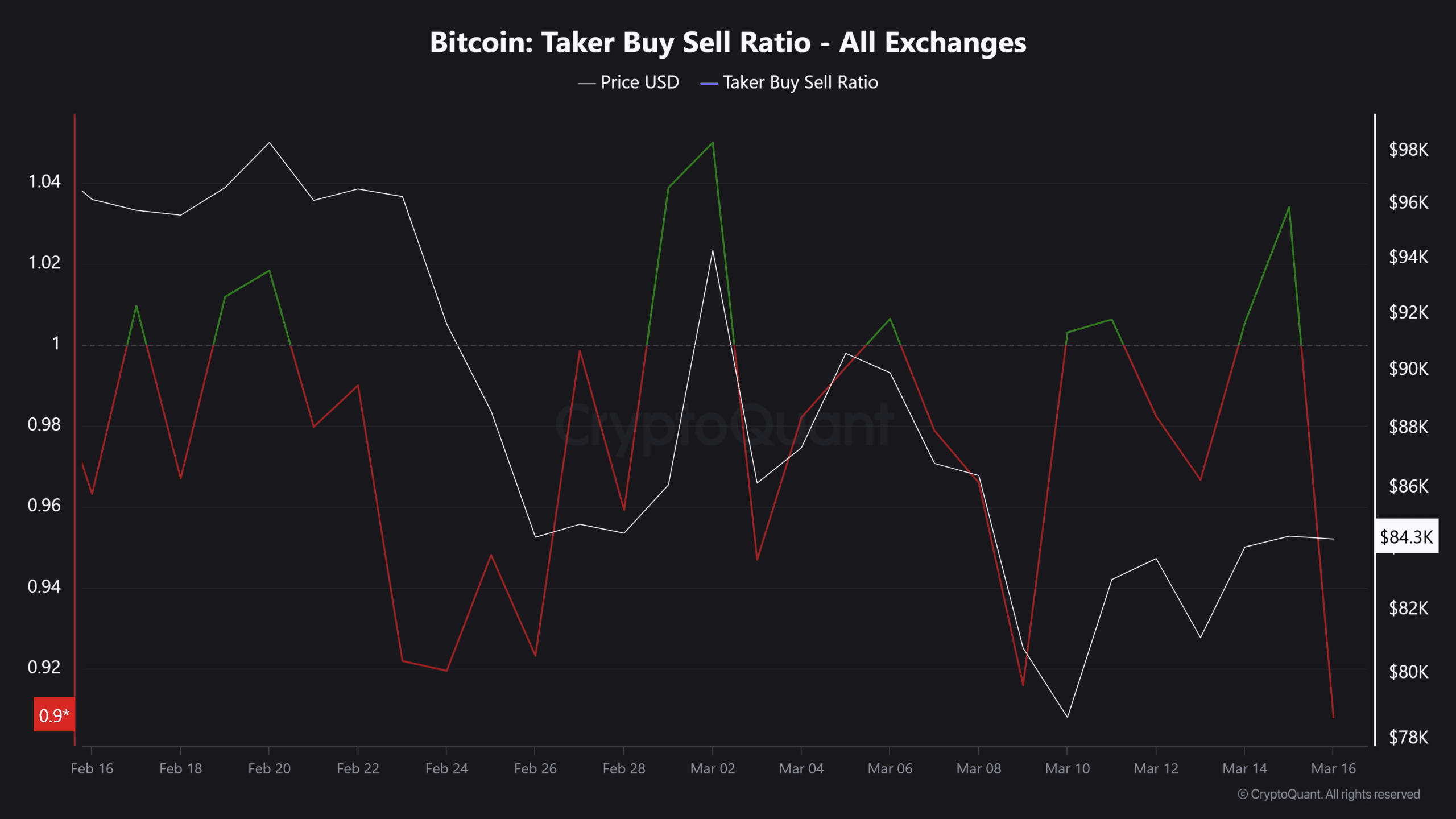

However, with the Taker Buy/Sell Ratio still languishing below 1, sell-side liquidity continues to reign supreme in perpetual markets. The bears are having a field day!

This suggests that traders are front-running a potential reversal, with many positioning themselves for profit-taking. If momentum falters, a wave of OI liquidations or closures could unleash a tempest of volatility in the days to come.

To trigger a short squeeze on the $332M short position and breach the $85K–$86K resistance, a robust demand in both spot and futures markets is essential. The stakes have never been higher!

Yet, with the taker buy/sell ratio still below 1, the sell-side dominance signals a bearish grip on the market. If conditions shift, a short squeeze could send Bitcoin soaring. Otherwise, a pullback to $80K–$81K remains a very real possibility. Buckle up, folks!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-16 18:18