- It appears that the recent tribulations of Toncoin‘s price have left many investors in a state of dismay, yet some whisper of a potential buying opportunity.

- However, the on-chain metrics seem to engage in a rather spirited debate, with certain signs of whale distribution making their presence known.

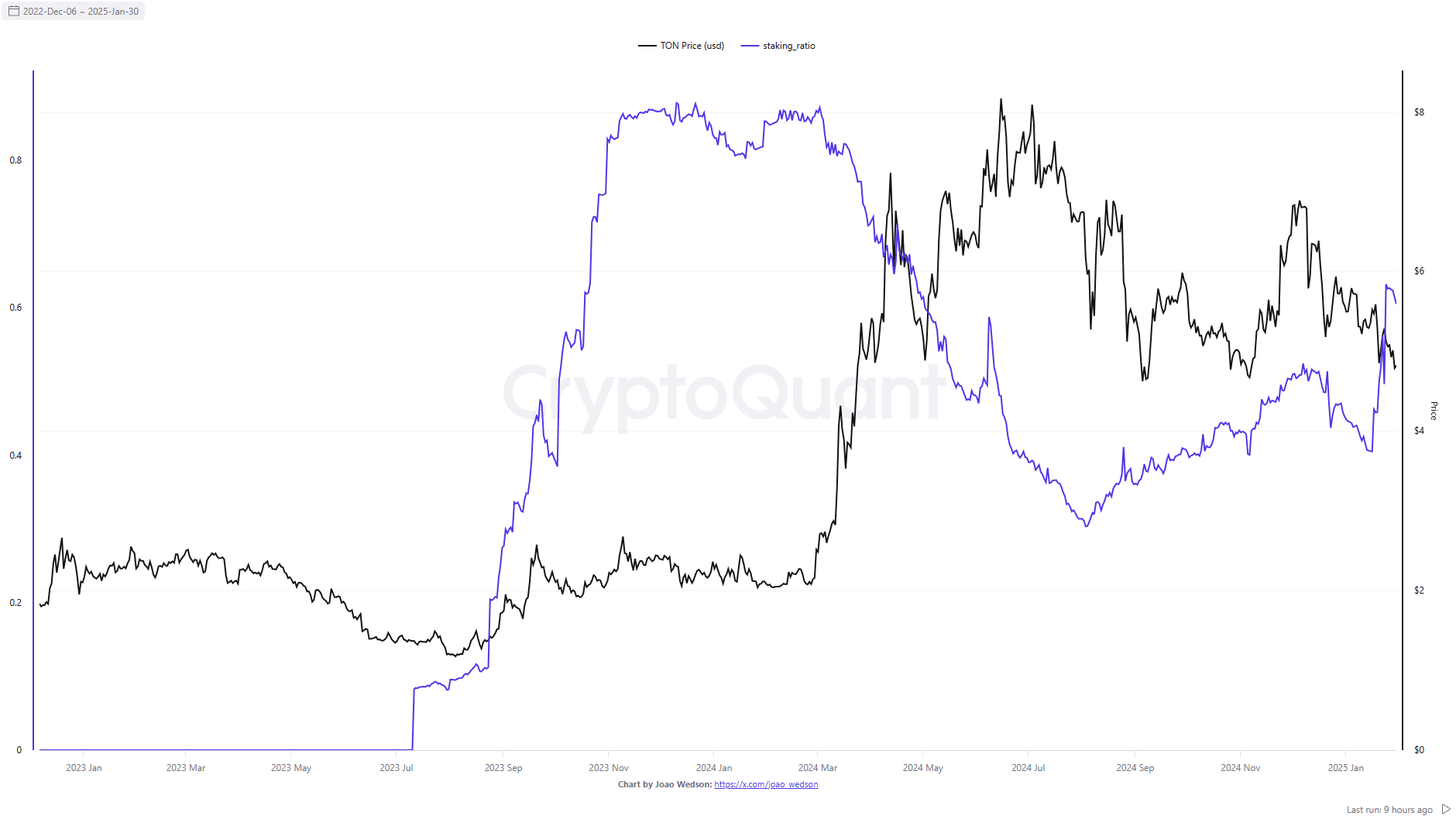

Alas, dear reader, Toncoin [TON] has experienced a most unfortunate decline in its total value locked (TVL) across both decentralized and centralized exchanges (DEX and CEX), as well as in the realms of derivatives and options. The astute CryptoQuant analyst, Mr. Joao Wedson, has suggested that this may be indicative of a de-leveraging of sorts.

His analysis, while undoubtedly insightful, suggests that traders and investors have become rather disheartened with Toncoin, leading them to reduce their exposure to this token. One might say that the steady drop in trading TVL since July 2024 is a reflection of their waning enthusiasm.

Moreover, the volatility of Bitcoin [BTC] in recent weeks, coupled with the general malaise of the altcoin market, has caused the trading TVL to plummet once more in January. Yet, one must ponder: could this also present a most fortuitous buying opportunity?

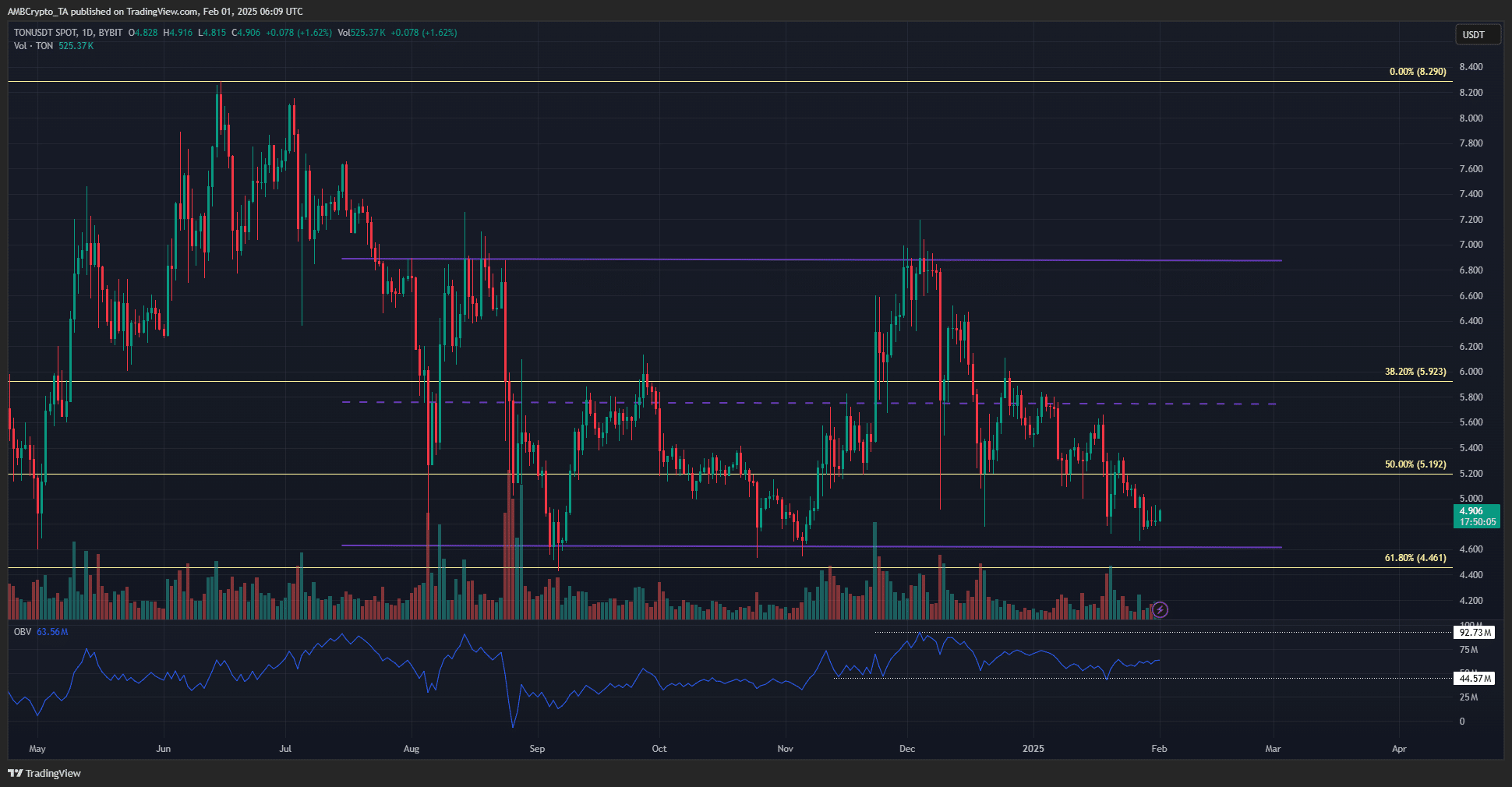

The chart depicting the price action over the course of a day reveals that Toncoin may be hovering near its six-month range lows at the rather precise figure of $4.62. These lows, it should be noted, are just above the esteemed 61.8% Fibonacci retracement level, which was plotted based on the rally that commenced in March 2024.

Thus, the region between $4.46 and $4.6 stands as a formidable demand zone, likely to be defended with great fervor upon a retest. Furthermore, the On-Balance Volume (OBV) has not sunk below its local lows, suggesting that the selling pressure is not overwhelmingly strong—much like a timid suitor at a ball.

Supply distribution and netflows displayed a most perplexing array of signs

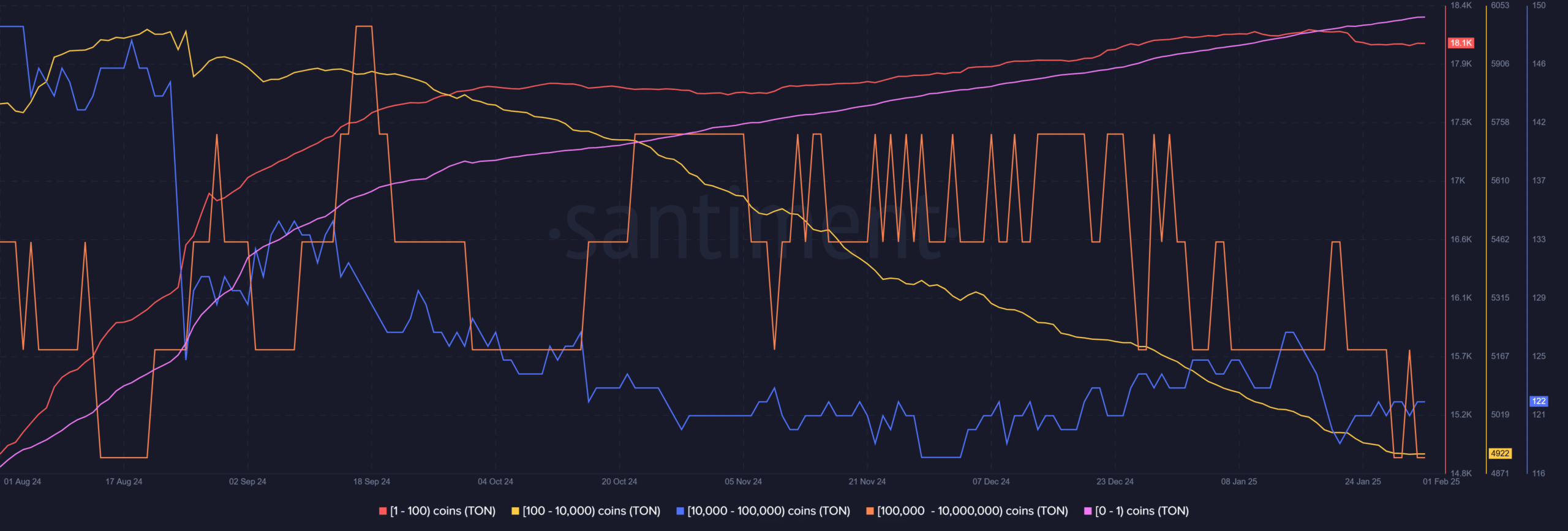

It is worth noting that the number of addresses holding less than 100 TON has steadily increased in recent months. This, dear reader, is a rather encouraging sign, hinting that more participants have entered the ecosystem and taken to purchasing Toncoin. However, one must remember that these participants do not typically possess the power to sway the markets.

The heavy lifting, as it were, is performed by the whales, whose numbers have regrettably dwindled. The addresses of sharks and whales, holding between 100 TON and 100k TON, have diminished since August 2024—a rather telling sign of distribution. The recent transfer of TON to exchanges has only heightened the likelihood of selling pressure, much like a well-timed jest at a dinner party.

The recent decline in the price of this altcoin has also contributed to an increased staking TVL ratio, which measures the percentage of total TVL allocated to staking. Its growth underscores a certain conviction among long-term holders, who seem to be holding steadfast in their resolve.

Is your portfolio green? Do take a moment to consult the Toncoin Profit Calculator—one must always be prepared! 😄

The steady increase in recent months suggests that participants have refrained from withdrawing their assets from staking to engage in more active trading, likely due to the range formation and the absence of a long-term uptrend. Combined with the drop in trading TVL, these conditions may indeed present a long-term buying opportunity for the discerning investor.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-02 01:13