- Ah, TRUMP’s 9% leap in the last 24 hours has some investors rubbing their hands together like a cat with a particularly shiny mouse.

- But is this a golden opportunity or just a bear in a very convincing costume?

Once upon a time, in a land not so far away, the Official Trump [TRUMP] memecoin took a nosedive of 60% from its lofty perch of $75, like a bird that forgot how to fly. Yet, lo and behold, it decided to bounce back by 9% in the last 24 hours, as if it had just remembered where it left its wings.

Is a rebound on the horizon? What does this mean for the rest of the crypto circus? Could this memecoin be siphoning off liquidity like a thirsty vampire at a blood bank?

The answer seems to be as clear as mud

Let’s take a stroll down memory lane. Just a week ago, the crypto market was thrown into a tizzy with the grand unveiling of Donald Trump’s memecoin – TRUMP.

In a mere 24 hours, its market cap ballooned to a staggering $15 billion, perfectly timed with his inauguration, because timing is everything, especially when you’re trying to sell a coin named after a former president.

It was a moment of pure serendipity. But while TRUMP basked in the limelight, the rest of the crypto world was left in the shadows, with Bitcoin [BTC] experiencing a 2.07% drop, as if it had just stepped on a rake.

But, as with all things that glitter, the hype was as fleeting as a cat on a hot tin roof. The RSI flashed ‘overbought,’ and soon after, the sell-side pressure kicked in like a disgruntled waiter at a bad restaurant. Some investors saw millions vanish from their portfolios, while others walked away with pockets full of gold.

Now, TRUMP has plummeted 60% from its all-time high of $75, with a staggering 61.33% of its market value evaporated like a magician’s rabbit. But, as always, the market offers a second chance, or at least a second cup of tea.

For the astute investor, this fall might just be the perfect opportunity to scoop up this memecoin at a bargain price. After all, a 9% jump in the last 24 hours has sparked renewed interest, like a moth to a flame.

But is this really the opportunity it seems? Data suggests it might be a trap, like a bear trap disguised as a picnic basket.

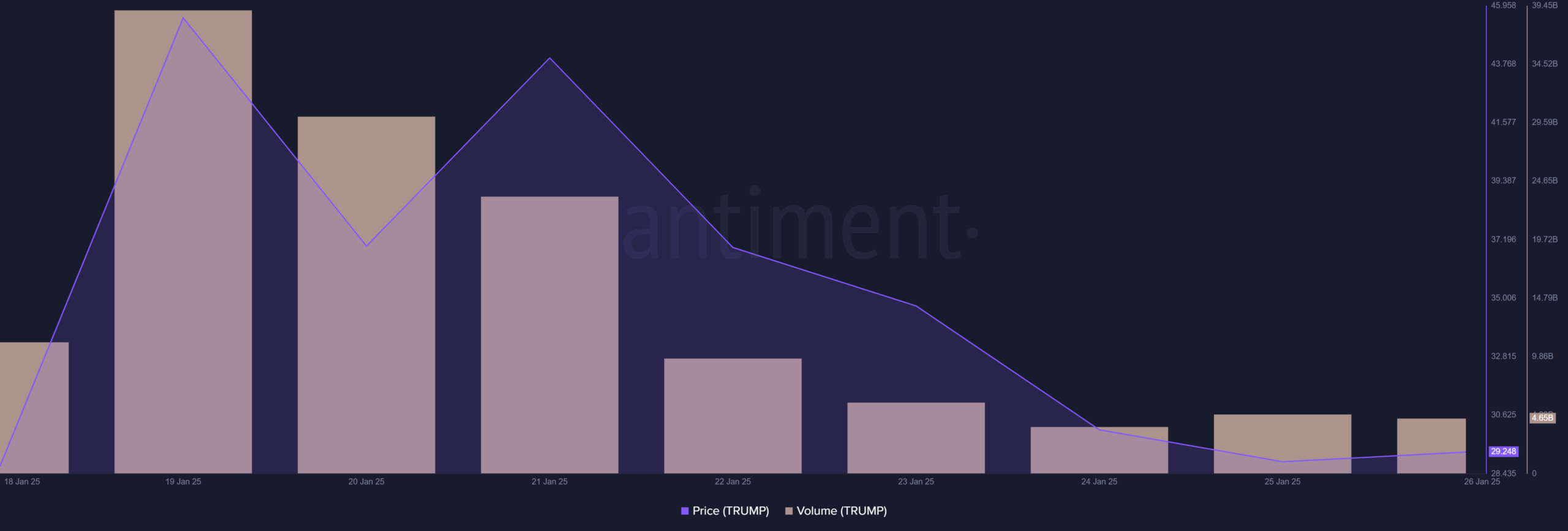

Trading volume, which soared to 39.06 billion when TRUMP hit its ATH, has plummeted faster than a lead balloon, now sitting at just 4.65 billion—only a slight 7% increase from the day before, which is about as exciting as watching paint dry.

This has set the stage for a possible short squeeze, with $6.86 million in short positions already wiped out, like a bad memory after a good night out.

But with volume still stagnant, it’s unclear whether this squeeze can spark a lasting rally. And with fresh scars from the recent crash, many risk-averse investors are likely hesitating like a cat at a vet’s office.

So, with TRUMP down, can the market bounce back?

The crypto market cap has edged up by just 0.40% from the previous day, but Bitcoin is still caught in a ‘tug-of-war’ that would make even the strongest of gym-goers weep.

Long-term holders are cashing out their gains, while fresh capital is sitting on the sidelines, waiting for the FOMC meeting in just three days, like a kid waiting for Christmas.

In the meantime, some investors are turning their attention to the memecoin market, where a few coins are posting triple-digit gains in a single day, which is about as common as a unicorn sighting.

TRUMP is among those catching attention, offering a tempting alternative in the short term. But will history repeat itself, or will it just be a rerun of a bad sitcom?

It’s unlikely that TRUMP will pull liquidity away from the broader market again, though caution is definitely advised, like wearing a helmet while riding a unicycle.

Realistic or not, here’s TRUMP’s market cap in BTC’s terms, which is about as clear as a foggy day in London.

The next few days will be crucial. If the market goes against expectations, TRUMP could see liquidity dry up faster than a puddle in the desert as investors exit and the broader market faces a bearish pullback.

However, if the FOMC meeting boosts the market, TRUMP could gain serious traction, attracting a flood of capital and even posing a challenge to Bitcoin. Keep a close watch – this could be the turning point, or just another twist in the tale.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-27 09:47