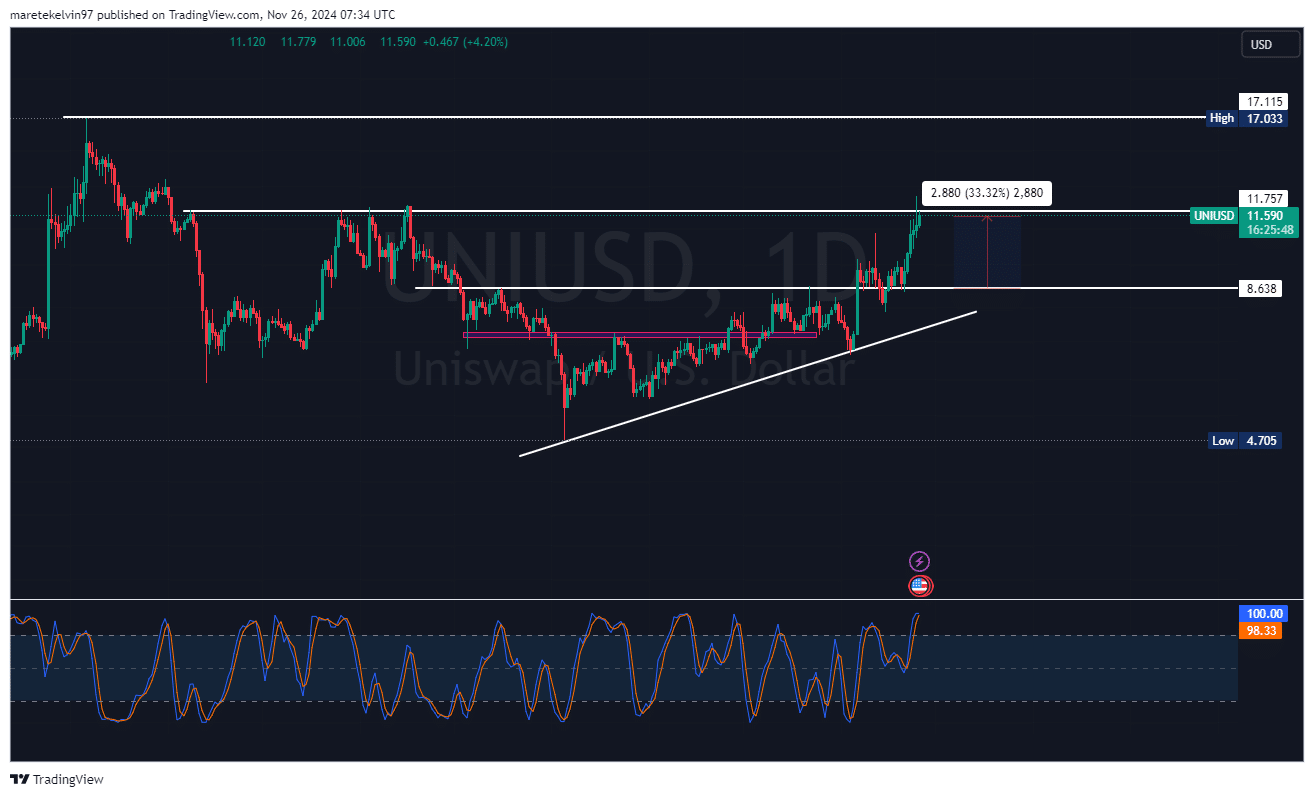

- UNI has rebounded strongly from the key support level of $8.64.

- On-chain metrics suggested increased institutional and whale interest.

As a seasoned researcher with a keen eye for cryptocurrency trends and market dynamics, I must admit that Uniswap [UNI] has been quite intriguing lately. After a strong rebound from the critical support level of $8.64, UNI’s 30% surge to $11.50 at press time is nothing short of impressive.

Despite most altcoins battling to maintain their positions amidst the presently gloomy bear market, Uniswap [UNI] has shown an unusual resistance to this downward trend.

Following a bounce back from a crucial support point at $8.64, UNI has seen its value increase by more than 30%, reaching a temporary peak of $11.50 as reported currently.

The important matter at hand is determining if UNI has enough power to overcome this significant barrier and continue its upward trend, aiming for even greater objectives.

At press time, Uniswap’s technical setup seemed to suggest a potential breakout for the token.

At the moment, the stochastic RSI for Uniswap suggests a market that’s overbought – a situation typically followed by a downtrend in the past, which could indicate a potential shift towards bearishness.

In relation to UNI’s ongoing upward trend, this could signal a broader positive outlook, potentially accompanied by a temporary downturn for a brief period.

In a rising market, overbought conditions might signal potential continued growth or escalation in prices, as the market’s momentum gains strength.

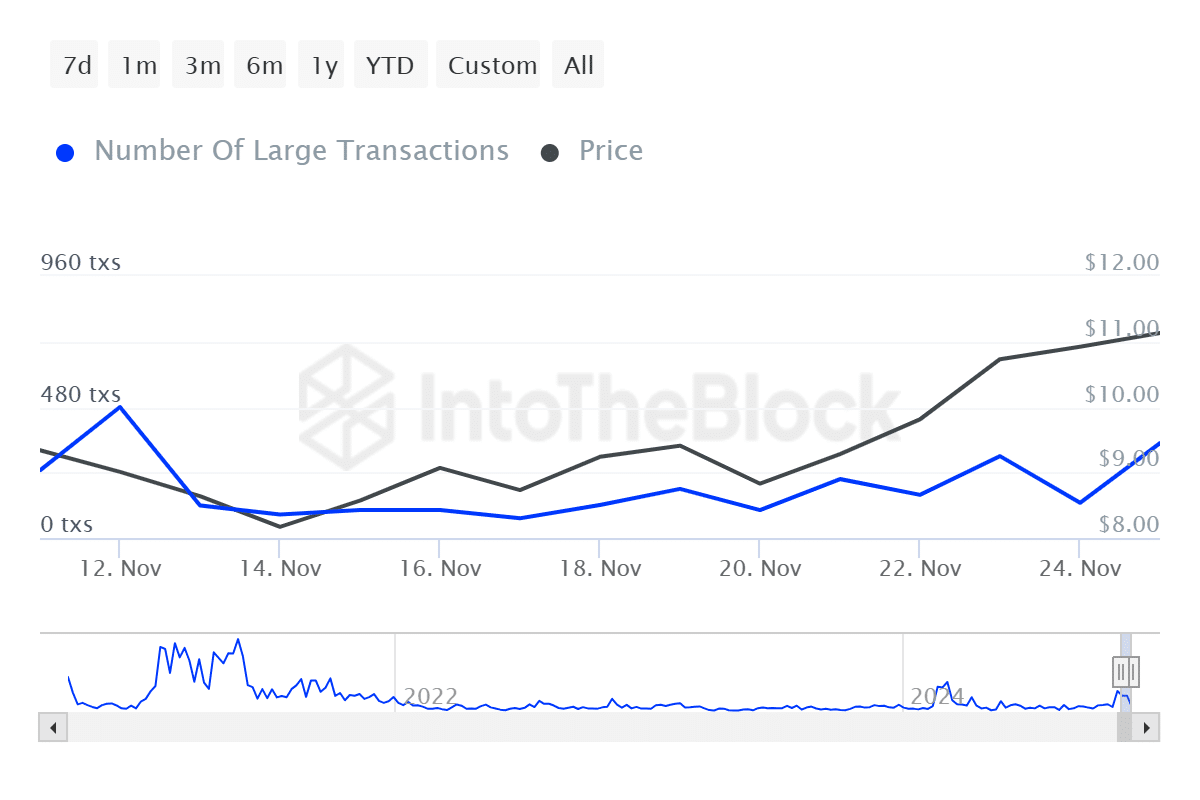

Whales and institutions flock to UNI

AMBCrypto’s investigation into the big-time investors (whales) of the altcoin has shown a significant rise in large transactions involving UNI. Over the past day, there has been more than a doubling (over 255%) in such transactions.

This suggests increased attention from large-scale investors like institutions and ‘whales’, who might be preparing to capitalize on the upcoming surge in the token’s price rise.

Short-term pullback or deeper correction?

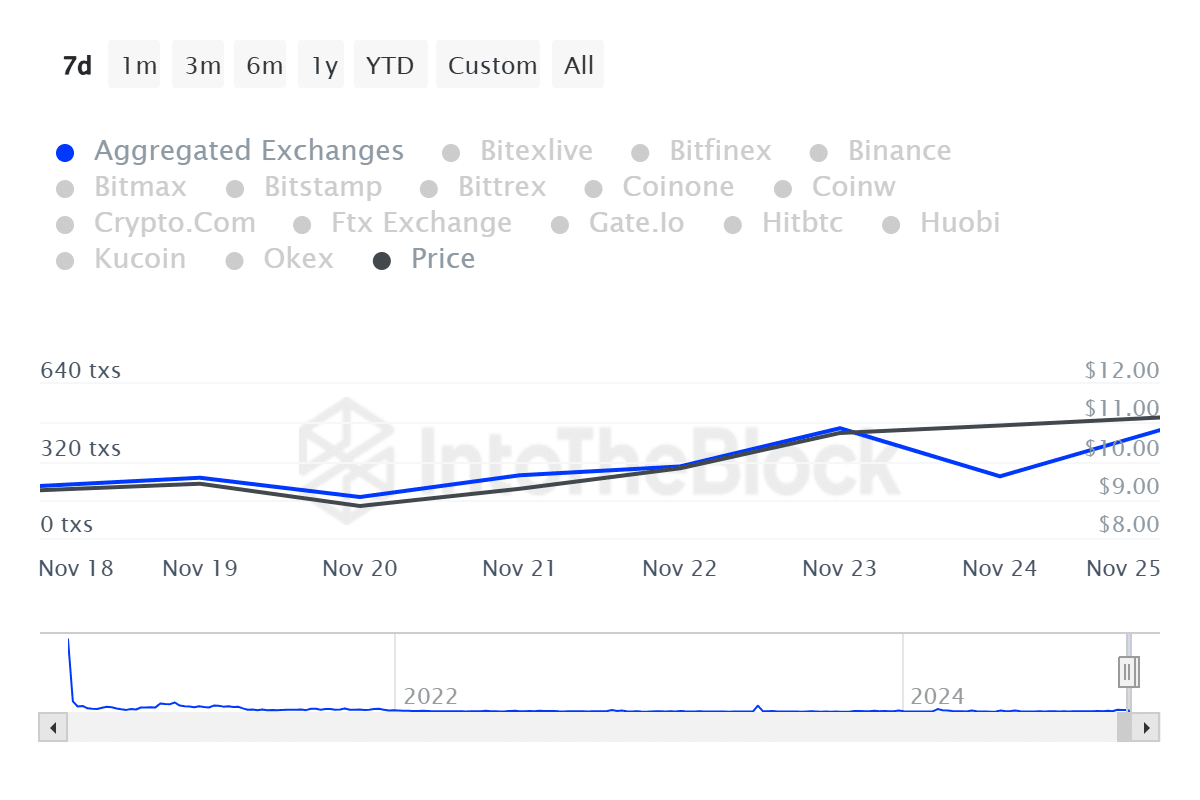

It’s worth noting that, according to data from IntoTheBlock, inflows into the Uniswap exchange have risen over the last 24 hours.

It could indicate that market participants are preparing for a possible surge (breakout), which might further bolster optimistic feelings towards UNI.

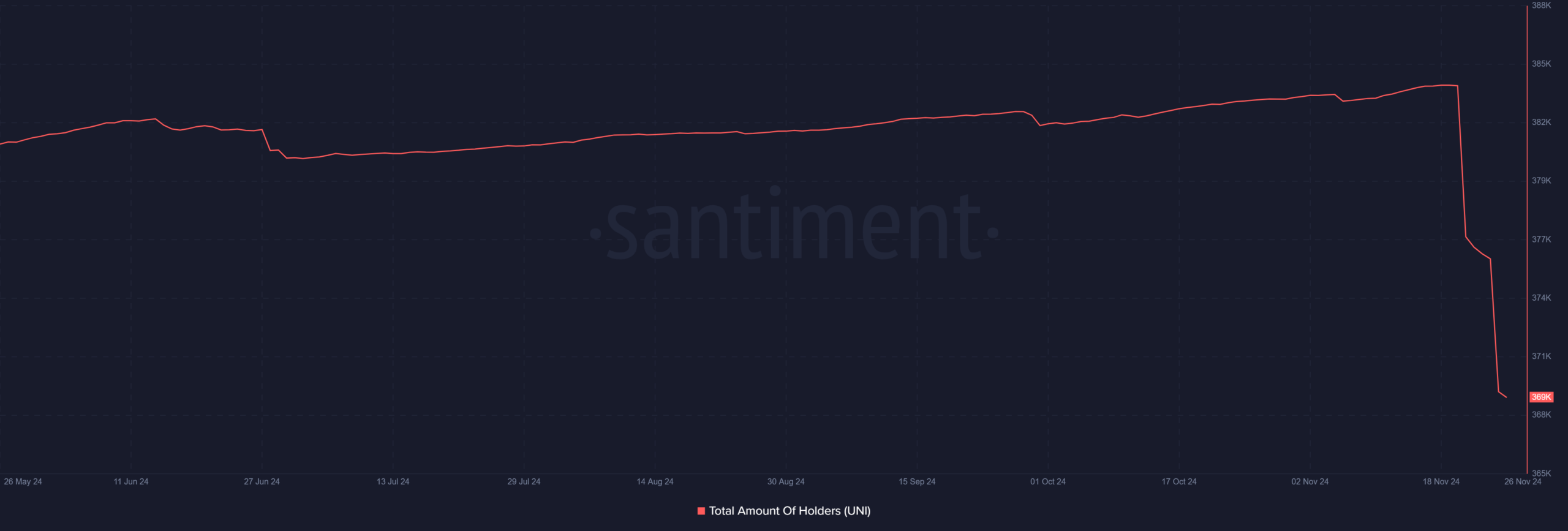

Furthermore, Santiment’s data indicated a significant drop in the count of UNI holders starting from the 20th of November.

This might indicate a short-term pause or investors cashing out their profits, generally a positive symptom during an uptrend market cycle.

Read Uniswap’s [UNI] Price Prediction 2024–2025

An intriguing argument for the future price movements of UNI can be made by considering both traditional technical analysis and on-chain data.

Showing strength against the wider market’s downturn and an increase in significant investor involvement (whales and institutions), this might signal the start of the much-anticipated price surge.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-27 03:36