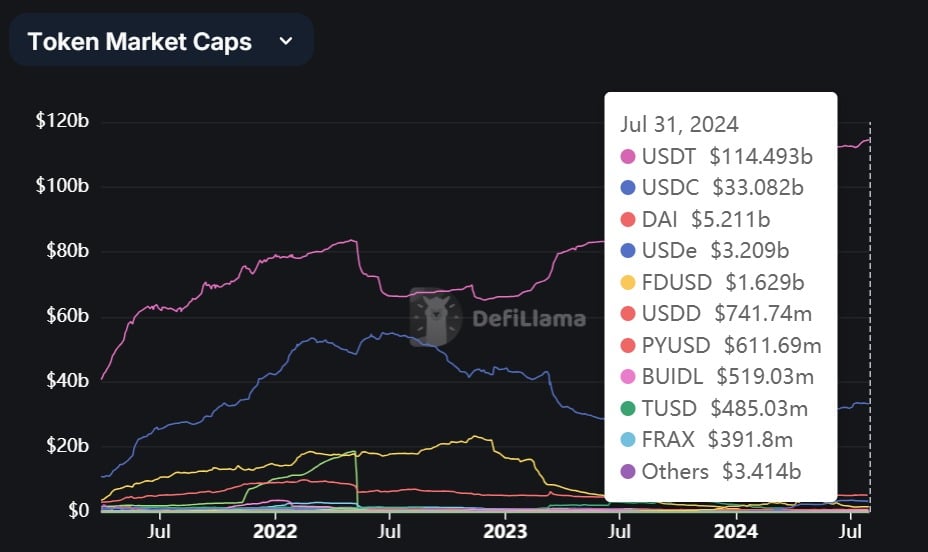

- Tether continued to dominate, hitting a market cap of $114B at press time.

- USDC recovered strongly post SVB’s collapse, with a 37% gain in its market share since.

As a seasoned researcher with a keen eye for spotting market trends, I can confidently say that the rise of stablecoins like Tether (USDT) and Circle (USDC) is nothing short of remarkable. Over the past year, I’ve witnessed an unprecedented surge in their popularity, particularly among institutional investors seeking a stable alternative to fiat currencies plagued by debasement, inflation, and local currency devaluations.

As cryptocurrency acceptance expands, particularly among institutional investors, Tether (USDT) has been thriving significantly. Over the last twelve months, USDT has seen an uptick in its market value and the number of active users.

The rise stems from the acceptability of stablecoins to avoid constant fiat debase, inflation, and weakening local currencies.

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous ups and downs, but the recent growth of Tether (USDT) has been truly remarkable. Having closely monitored the crypto market since its inception, I can confidently say that Tether’s current market capitalization of $114.4B is a testament to the resilience and adaptability of this digital asset.

USDT outpaces USDC in inflows

Significantly, at the present moment, USDT from Tether is seeing continuous influxes, as reported by IntoTheBlock. This trend indicates a rise in deposits and growing interest among various users, notably institutions and individual investors.

Numerous cryptocurrency users have chosen Tether (USDT) as a means to preserve their wealth due to its stability against the volatility of traditional currencies, local currency depreciation, and high inflation rates.

In many unstable economies, such as Argentina and Nigeria, USDT has become the last resort.

According to IntoTheBlock’s data analysis, it appears that most users are holding onto their USDT rather than using it, leading to an accumulation of these coins. This buildup could potentially create instability in the market due to increased reserves.

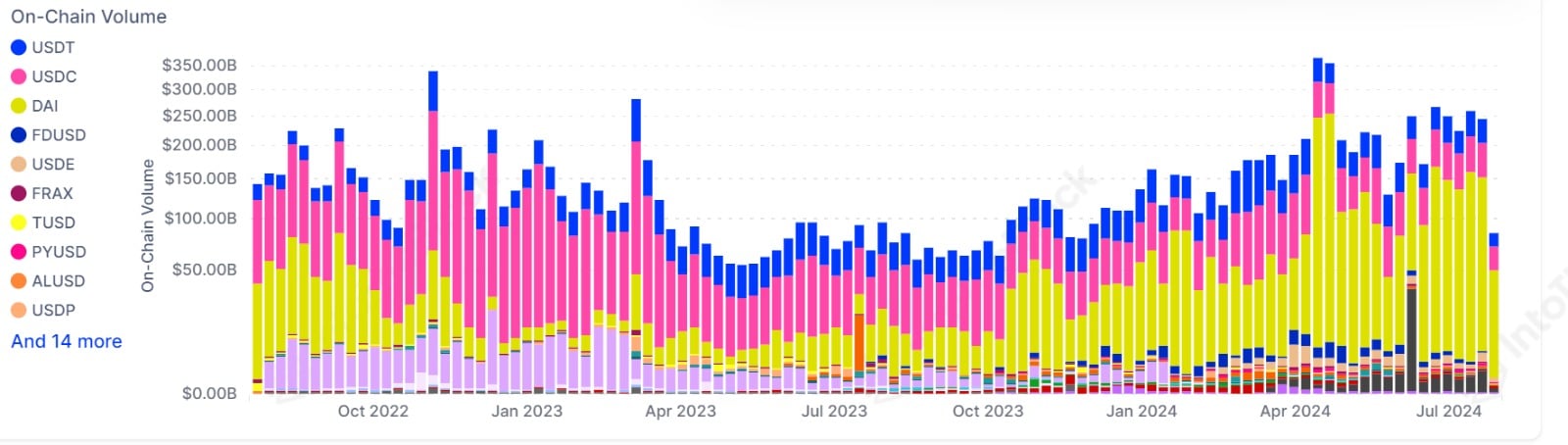

Furthermore, it was indicated by AMBCrypto’s examination that the on-chain volume consistently grew throughout the year. This trend implied an escalating interest and utilization of USDT during this timeframe.

Thus, there was widespread adoption of stablecoins by individuals and institutional investors.

USDC recovers with MiCA compliance

According to previous reports from AMBCrypto, USDC has significantly increased its presence, showing a substantial rise in trading volume from $9 billion in 2023 to $23B in 2024. Additionally, the market capitalization of USDC has noticeably grown over the last year.

In 2023, the fall of SVB caused USDC’s market value to drop from $48 billion to $24 billion. But after that, it regained a significant portion of its market share, growing by more than 12%, bringing its current market value up to around $34 billion.

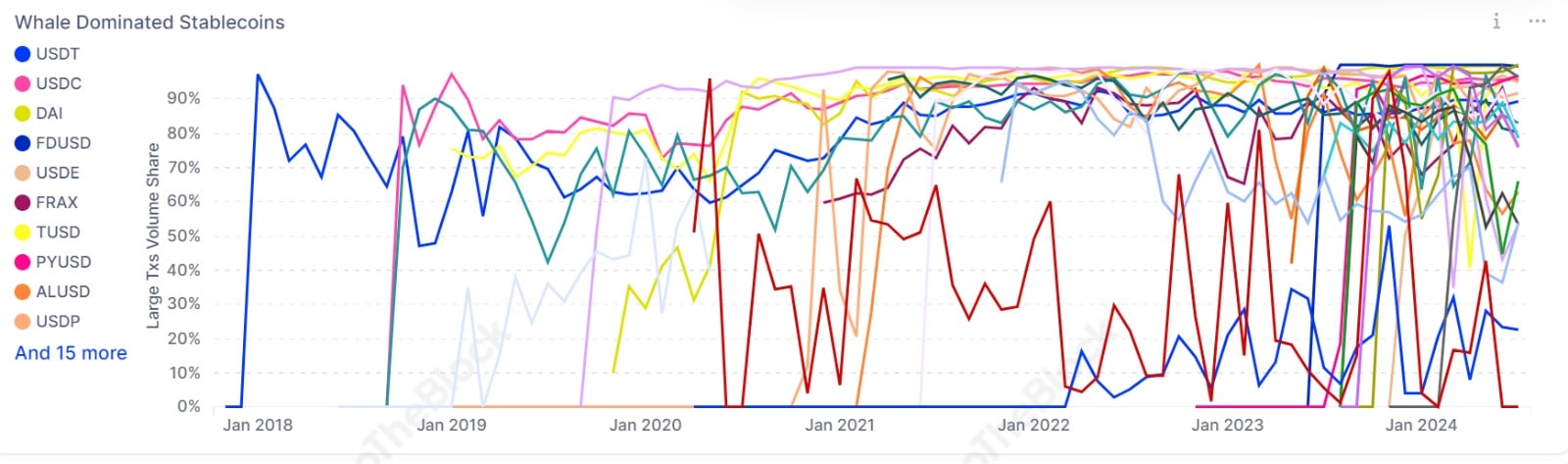

After meeting MiCA regulation requirements, USDC has emerged as a popular choice among investors seeking regulated stablecoins. This increased demand has resulted in USDC accounting for approximately 95% of large transaction volume in the stablecoin market.

As a crypto investor, I’m noticing a growing influence from institutional players and whales, as they are increasingly turning towards regulated stablecoins, which suggests a stronger grip on the market dynamics.

Adhering to MICA regulations has provided USDC with a competitive edge over Tether and other stablecoins, consequently expanding its presence in the European market.

Stablecoins market dominance

Without a doubt, the rising popularity of USDT and USDC indicates a growing interest in stablecoins. The cryptocurrency market seems to be leaning positively towards these stable digital currencies, as they have consistently demonstrated robust growth.

As reported by Defillama, the total value of stablecoins currently stands at approximately $160 billion. This figure has been gradually increasing from a low of around $123 billion back in 2023, with Tether (USDT) accounting for about 70% of that market share.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-01 01:12