- Alas, the once-promising H4 bullish order block has crumbled, leaving us to ponder the depths of despair for VIRTUAL‘s price prediction.

- As the OBV descends into the abyss, the CMF has declared a reign of bearish dominance, as if the market were a tragic play unfolding before our very eyes.

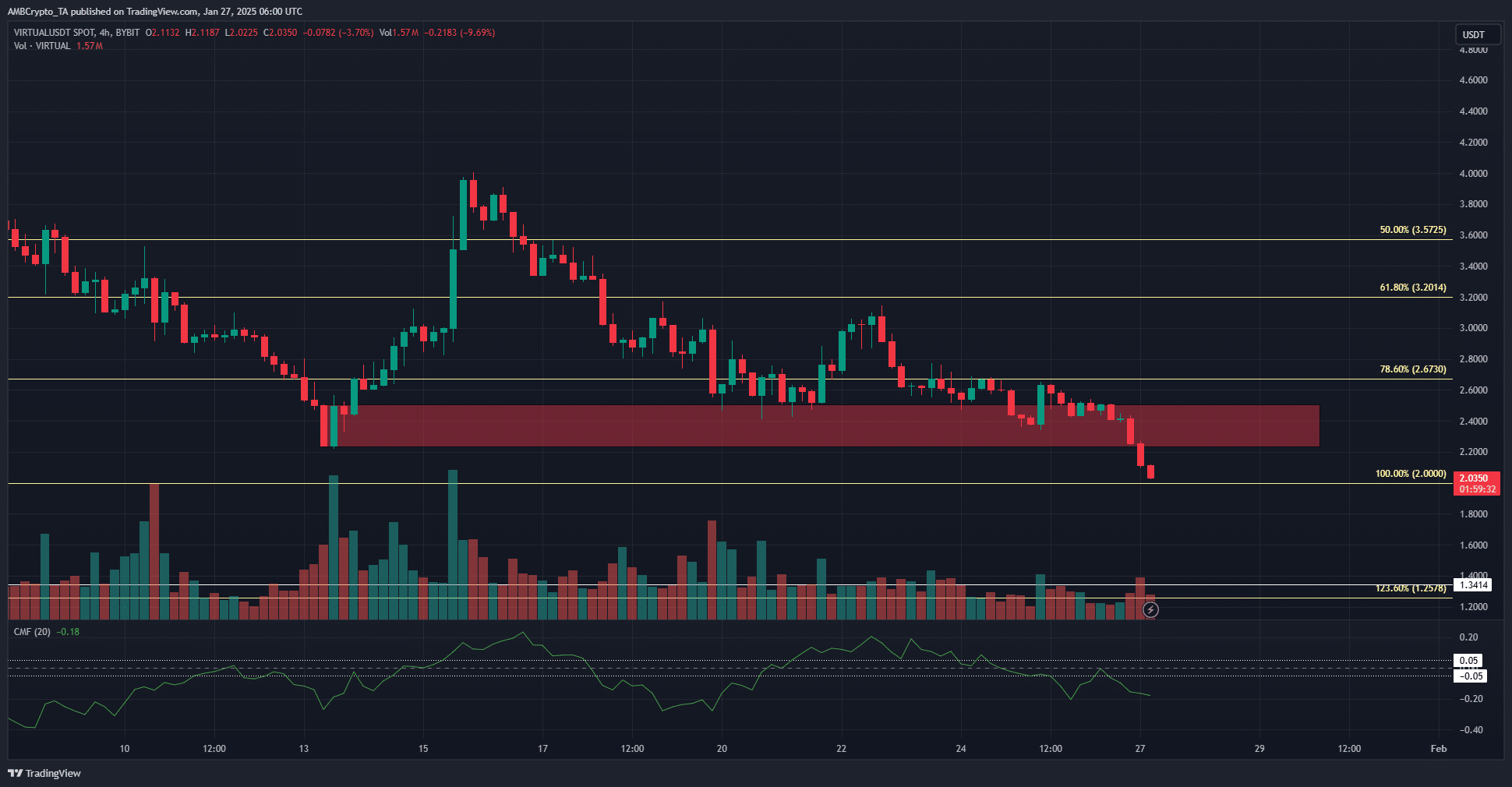

In the grand theater of the cryptocurrency market, Virtuals Protocol [VIRTUAL] has been on a downward spiral for the past three weeks. What was once deemed a healthy pullback has now transformed into a somber tale of loss, particularly after the fateful day of January 19th, when the 78.6% Fibonacci retracement level at 2.67 was lost like a forgotten dream.

Since that fateful moment, the sellers have taken great pleasure in compounding the bulls’ misfortunes. Meanwhile, Bitcoin [BTC] has danced with volatility, a capricious partner in this tragic waltz.

Despite a fleeting BTC pump, VIRTUAL found itself unable to rise significantly, as if tethered by invisible chains, while Bitcoin’s losses dragged the entire altcoin market into the depths of despair.

Virtuals price prediction reveals a stormy horizon ahead

The Fibonacci retracement levels, once a beacon of hope, were drawn from the uptrend that VIRTUAL exhibited in the merry month of December. As we stand at this juncture, VIRTUAL hovers just above the 100% retracement level, like a tightrope walker on the edge of a precipice.

The failure to maintain the 78.6% level has transformed what was once a pullback into a downtrend, a tragic twist in our narrative.

The market structure, akin to a gloomy novel, is decidedly bearish, with the daily RSI plunging below the neutral 50 mark earlier this month, a clear indication that the bears have seized the narrative. This unfortunate reality remains unchanged.

Even more disheartening is the relentless decline of the OBV, which has been making lower lows throughout January, a reflection of the steady selling volume that echoes through the market like a mournful dirge.

The H4 chart, a harbinger of doom, reinforces this bearish outlook. The bullish order block at $2.4, once a sanctuary, has been breached, now standing as a formidable resistance zone.

Thus, the Virtuals price prediction paints a picture of a sustained downtrend in the days to come, a tale of woe that seems all but inevitable.

The CMF languishes below -0.05, and the breach of the bullish order block suggests that the $2 mark will soon be put to the test. Should it fall, the bears are poised to drive prices down to the 23.6% southward extension at $1.25, a level that coincides with a horizontal support level at $1.34, as if the market were conspiring against the hopeful.

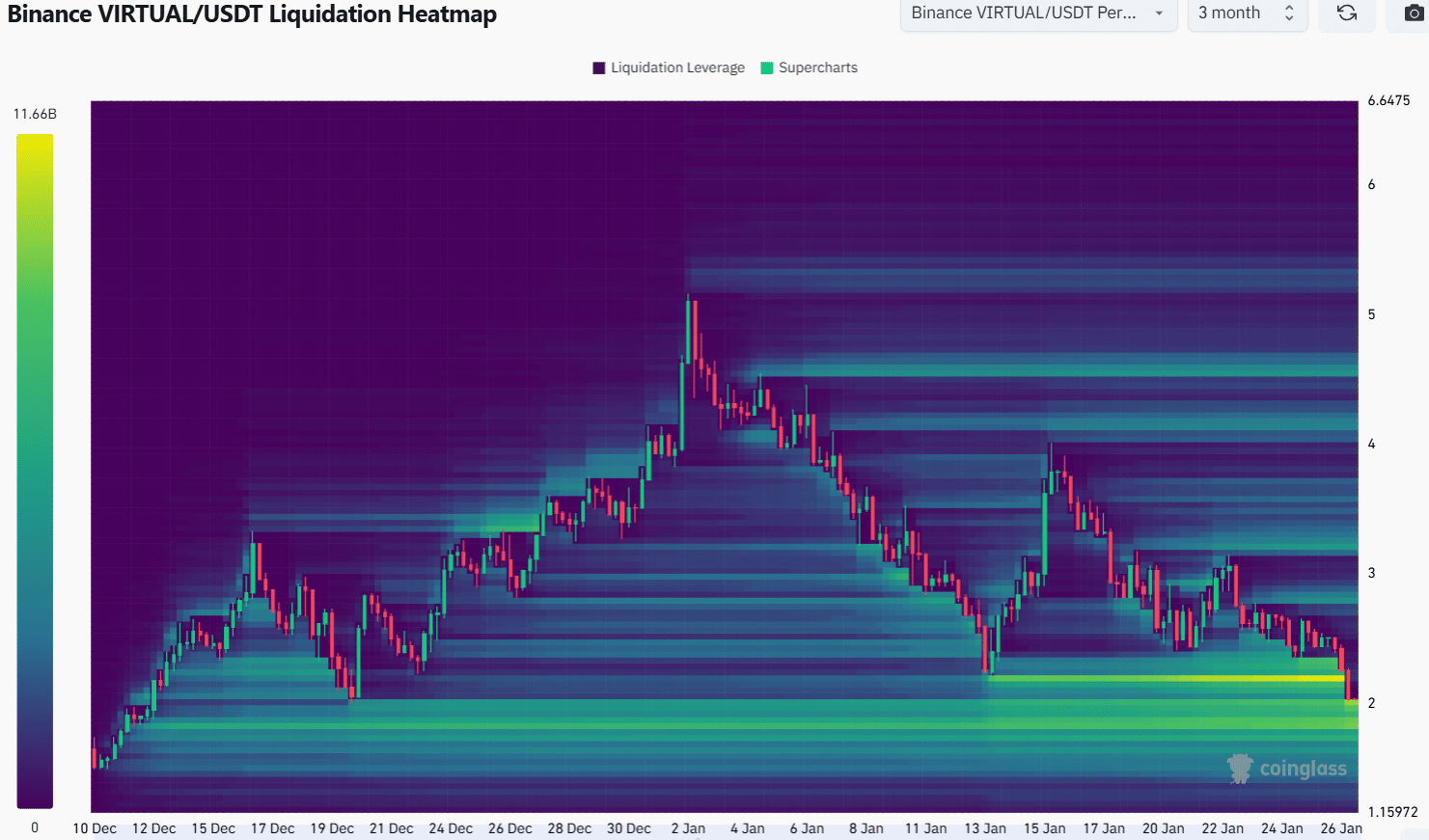

The liquidation heatmap reveals that the $2.2 and $1.95-$1.85 regions are potential candidates for a bullish reversal, though the price action of the past 24 hours suggests that $2.2 has been swept away, leading to a cascade of liquidation that has pushed prices lower, like a tragic hero meeting their demise.

Bearish pressure, it seems, is unlikely to relent in the coming days. A descent to $1.85 could commence this week, and whether a bullish reversal could occur hinges precariously on capital inflows and the fickle sentiment surrounding BTC.

With BTC languishing below $100k, the Virtuals price prediction remains firmly entrenched in the realm of the bearish, casting a long shadow over the short to medium term.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2025-01-27 16:11