- WIF to target the local highs set earlier this month

- A short-term dip to $1.7 could offer a buying opportunity

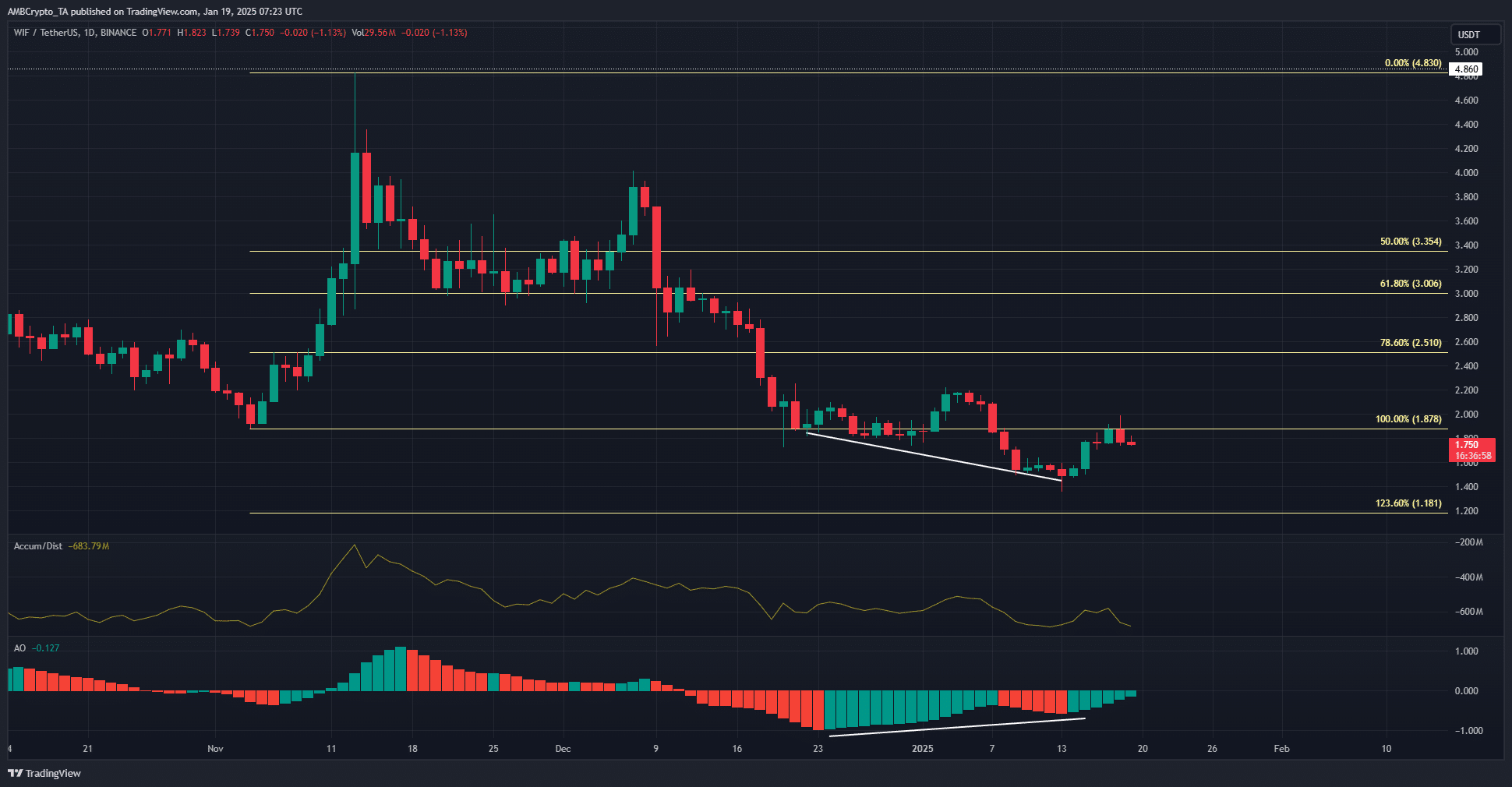

Currently, at this moment, DogeWIF [WIF] is continuing its downward trend on the daily chart. Yet, amidst these consistent losses for the memecoin, there appears to be some potential for recovery. Technical analysis even suggests a bullish momentum divergence might be occurring. However, it’s important to note that while the liquidation heatmaps indicate a price target above $2 for WIF, I haven’t seen significant buying pressure yet.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastCan the bulls drive a recovery, or will it result in a failure to surpass its local highs?

WIF beginning to recover, or preparing for further losses?

More recently, the lowest point in WIF’s recent uptrend occurred at around $2.22 earlier this month. After that, it has dropped even further and touched a new low, before attempting to climb back up towards the $1.878 resistance level. This behavior continues to suggest a bearish outlook for WIF.

As the A/D indicator dropped, it signified that sellers were more active. Meanwhile, the Awesome Oscillator stayed beneath the zero line, hinting at a predominant bearish trend. However, an opposite pattern, known as a bullish divergence, emerged between the oscillator and price movement.

This indicates a potential reversal of the downward trend for dogwhatever starting from November, but it’s crucial for traders to exercise caution as a significant increase in capital investment may not yet be apparent.

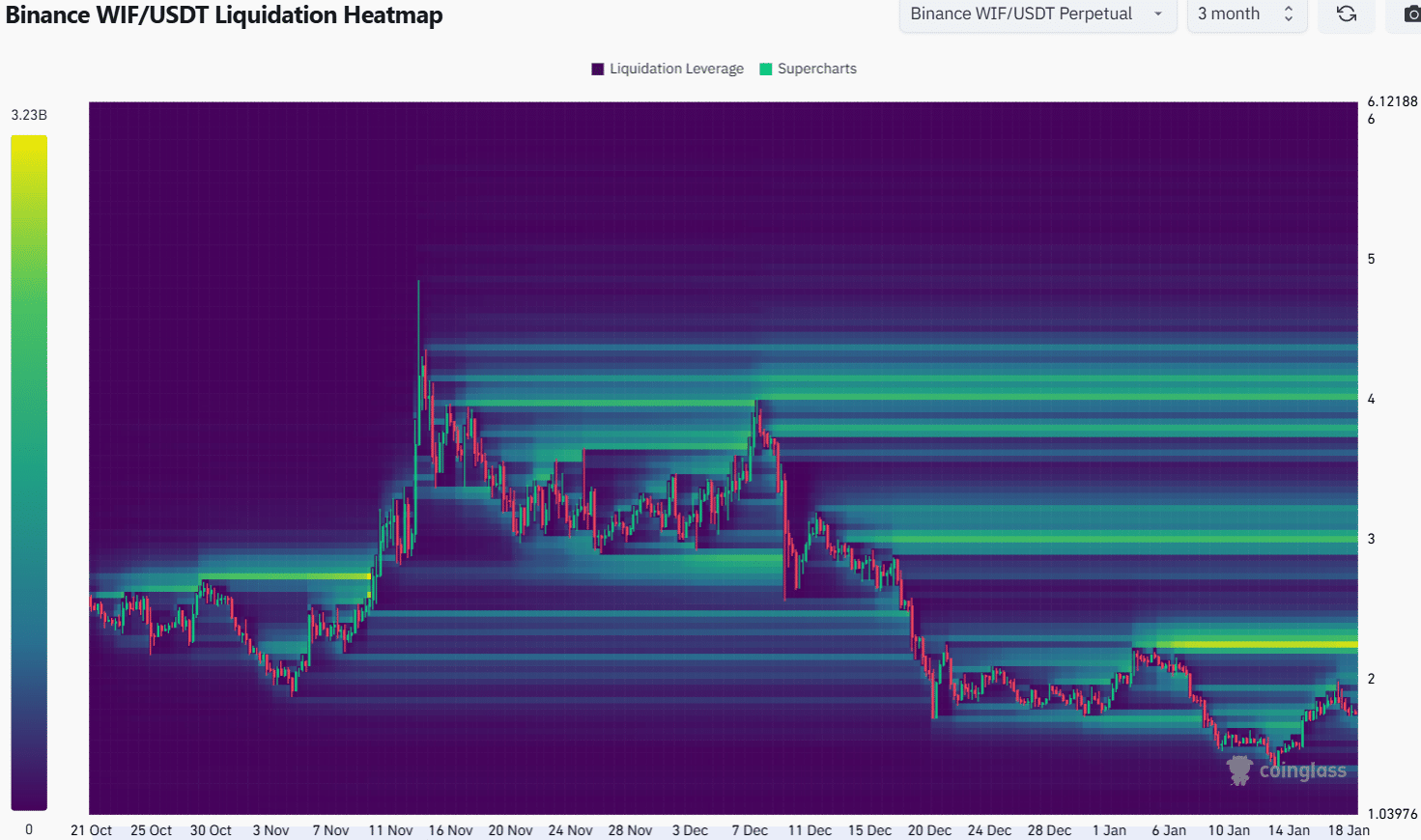

The 3-month liquidation chart identifies the $2.25 area as a significant zone of attraction for liquidations. This region, marked by numerous liquidation points from earlier in January, has become a potential focus due to its concentration of liquidity levels. As price tends towards areas with higher liquidity, this spot is now a likely target.

Beyond $2.3, the $3 zone would be the next medium-term target.

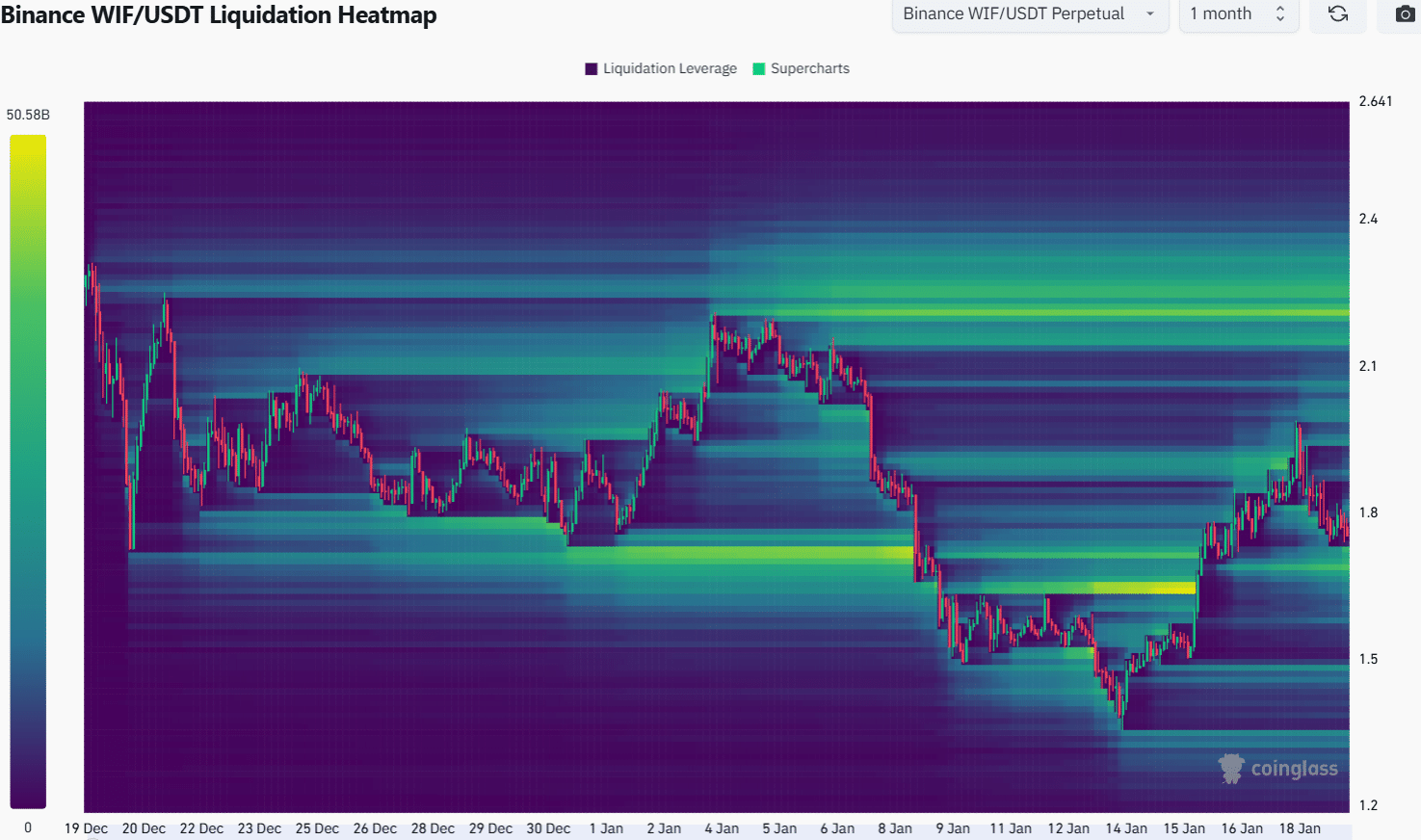

The data from the last month’s liquidations highlights the significance of the $2.25 region as a source of liquidity. Meanwhile, the $1.7 level might catch the attention of traders towards the lower end.

Realistic or not, here’s WIF’s market cap in BTC’s terms

There’s a possibility that the value of WIF might drop to around $1.7 in the near future, but it may subsequently rise towards $2.25. At this point, a surge beyond $2.25 seems improbable given the current absence of significant buying interest. However, this could shift over the upcoming weeks.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-20 02:47