-

XRP’s dominance and monthly volatility say price is set to go higher

XRP’s monthly MACD indicator turned bullish as whale accumulation intensified

As a seasoned researcher with over a decade of experience in the crypto market, I find myself increasingly intrigued by XRP‘s recent price action and technical indicators. The consolidation phase we are currently witnessing on the monthly Bollinger Bands could be setting the stage for a significant rally, given XRP’s dominance chart that has consistently shown outperformance in the market.

⚡ URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastAs a researcher, I find myself intrigued by the current dynamics of XRP‘s market movements. The recent hints from the SEC seem to indicate potential substantial fluctuations in its price chart, making it an exciting subject for close observation.

At the moment, it appears that the Bollinger Bands on the monthly chart are narrowing down, suggesting that XRP is presently undergoing a phase of consolidation.

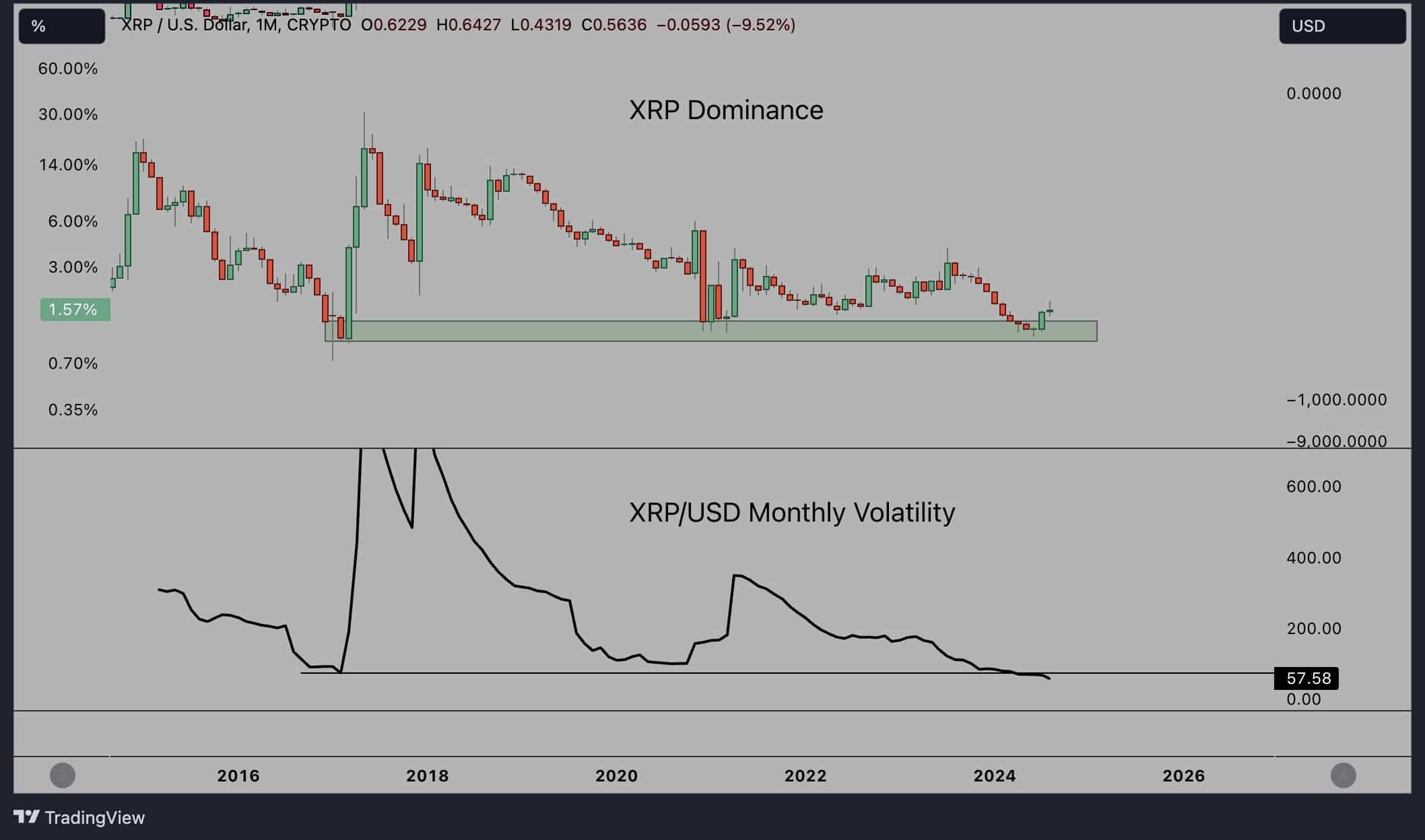

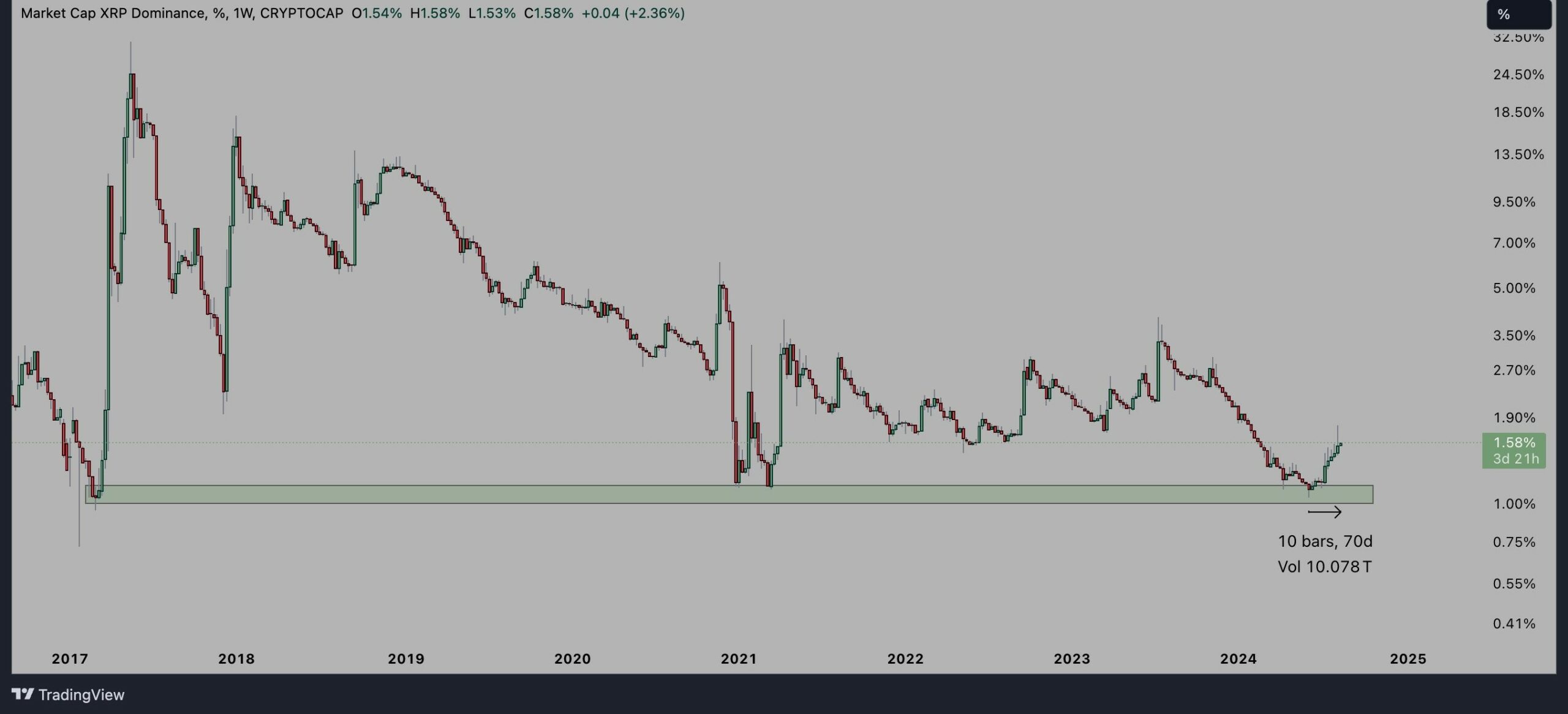

Looking at XRP‘s market dominance graph can help separate the signal from the noise in terms of XRP/USD pair. Interestingly, it indicates superior market performance, even turning back at levels usually associated with impending significant surges.

Given record-low monthly volatility and these signs pointing towards a base, it’s possible that XRP could be poised for an upward trend soon. If this holds true, XRP could potentially become one of the most promising cryptocurrencies in the market over the short term.

Moreover, over the past ten weeks, XRP‘s performance on a weekly basis has surpassed the broader market – Indicating a promising prospect for an uptrend in the XRP/USD pair’s graph.

As a researcher observing the current standstill in the XRP/USD pair, I find it compelling to highlight the robustness and sustainability of XRP’s total market capitalization. Essentially, this persistent outperformance seems to hint at potential future growth for XRP. This assertion is fortified by its solid market metrics, implying that XRP could be a promising investment opportunity moving forward.

MACD indicator analysis flashed green

Currently, XRP is displaying a Wave 3 pattern on its monthly chart, potentially reaching prices of $1.88, $5.85, $18.22, and $36.76 in the upcoming Wave 5, as per Dark Defender’s analysis on their platform.

If XRP surpasses the $0.66 threshold, it could potentially soar towards $1.03, indicating a midpoint objective. Maintaining positions above $1.03 suggests an exceptionally optimistic phase, exceeding the Ichimoku Cloud’s levels.

Furthermore, the MACD (Moving Average Convergence Divergence) Monthly Indicator has transitioned into a bullish stance, and the appearance of a Dragonfly Doji indicates an increase in buying power.

Given the impact of these technical markers and the effects of the latest SEC updates, it seems that XRP could potentially meet its predicted goals.

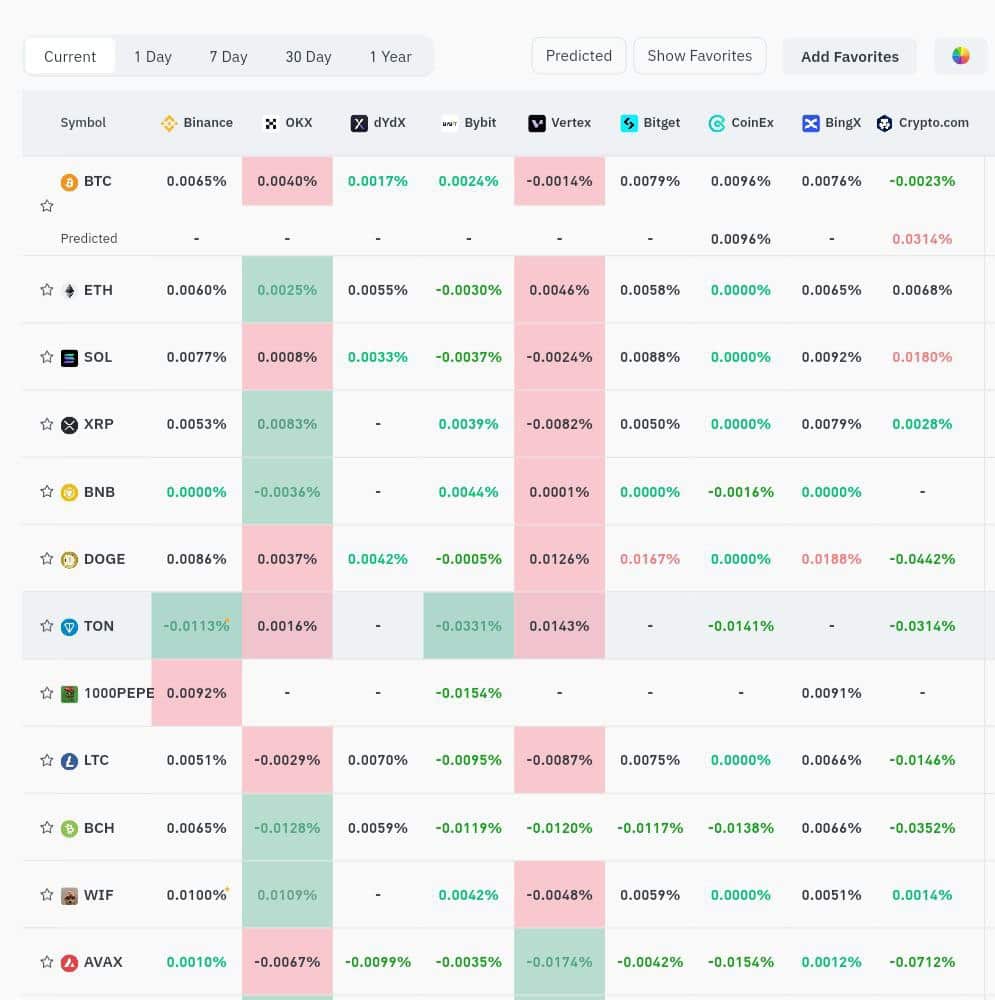

Whales accumulate as funding rates bleed

It’s noteworthy to mention that the number of whale activities increased significantly when a significant XRP holder recently acquired an additional 7 million XRP, worth approximately $4.1 million, from UPBIT in just 24 hours. This move boosted their overall XRP holdings to around 5.553 million XRP, which is currently valued at approximately $3.25 million.

A large gathering of whales could signal an impending surge in XRP‘s price, suggesting a bullish trend might be on the horizon over the next few months. This is particularly noteworthy given that prominent investors are consistently increasing their XRP investments.

To summarize, when cryptocurrency funding rates turn negative, it often indicates an excellent time for purchasing. Moreover, with increasingly favorable signs emerging, XRP‘s influence in the market could expand significantly, possibly leading to an increase in its price and making it a promising investment option over the next few months.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-17 05:11