- Ah, the daily chart, a veritable oracle, reveals a bearish price structure despite the grand gains since November!

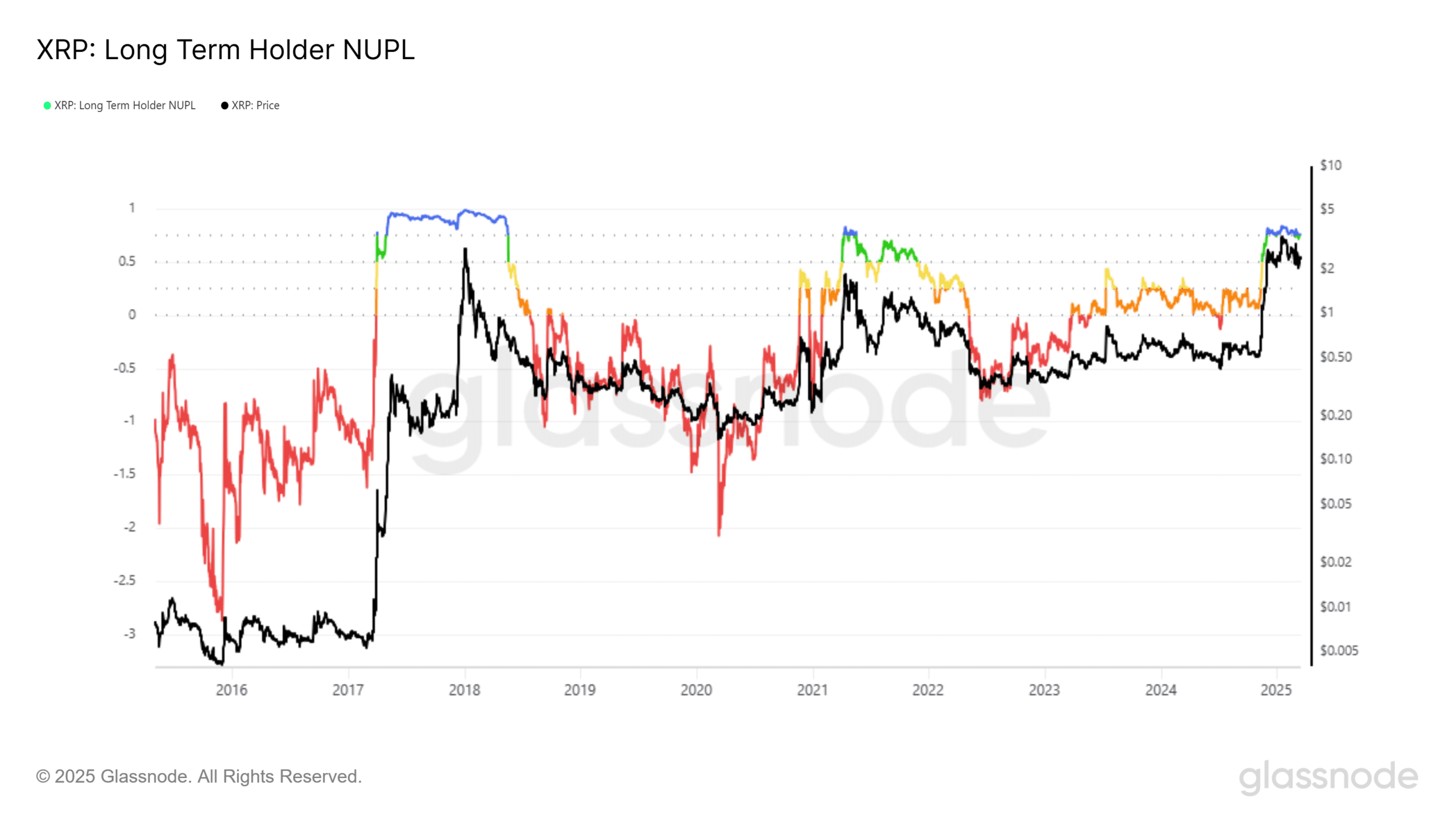

- Long-term holders, clutching their unrealized profit/loss metrics, are reminded of the 2021 cycle top—how delightful! 🎭

In the grand theater of cryptocurrency, the on-chain signals behind XRP‘s meteoric rise over the past six months are as mixed as a poorly brewed potion. The supply in profit is high, as one might expect from a well-fed cat, yet the sentiment surrounding this token is as gloomy as a rainy day in Moscow.

Indeed, the net unrealized profit/loss metrics whisper eerie tales reminiscent of April 2021, sending shivers down the spines of the bulls. 🐂

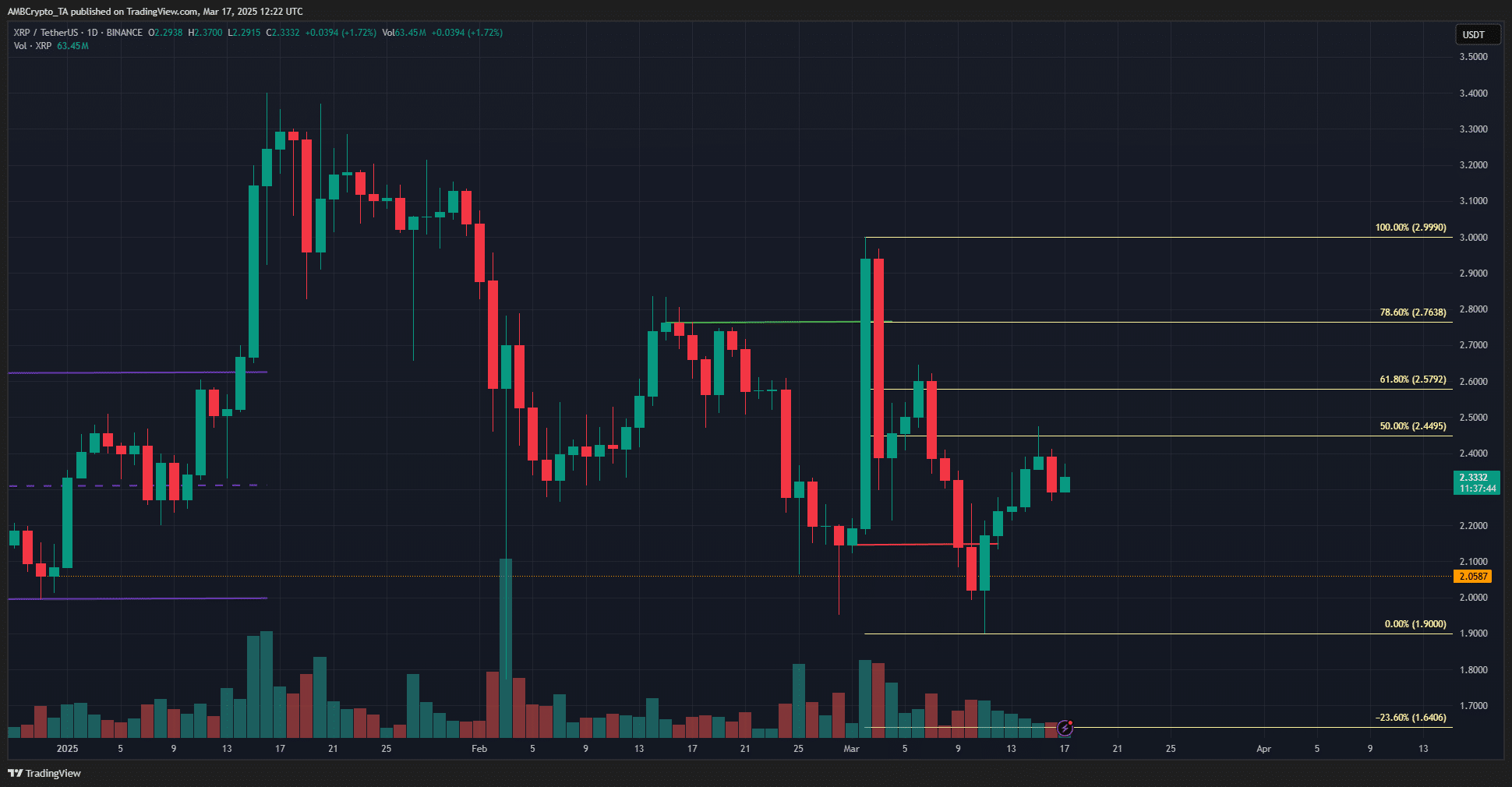

Our dear altcoin’s 1-day price action has taken a turn for the worse, revealing a bearish structure on the daily chart. This shift, marked in red like a warning sign, occurred just a week ago when XRP slipped below the $2.19 level. After a dramatic fall to $1.9, it has bravely rebounded to test the $2.45 level as resistance—oh, the audacity!

This level, a mere 50% retracement of the grand move from $2.99 to $1.9, has become a fortress of bearish pressure. Despite the astonishing 370% rise since the U.S. Presidential Elections, the sellers seem to be the ones throwing the grandest parties. 🎉

High Network Activity: A Silver Lining or Just Fool’s Gold?

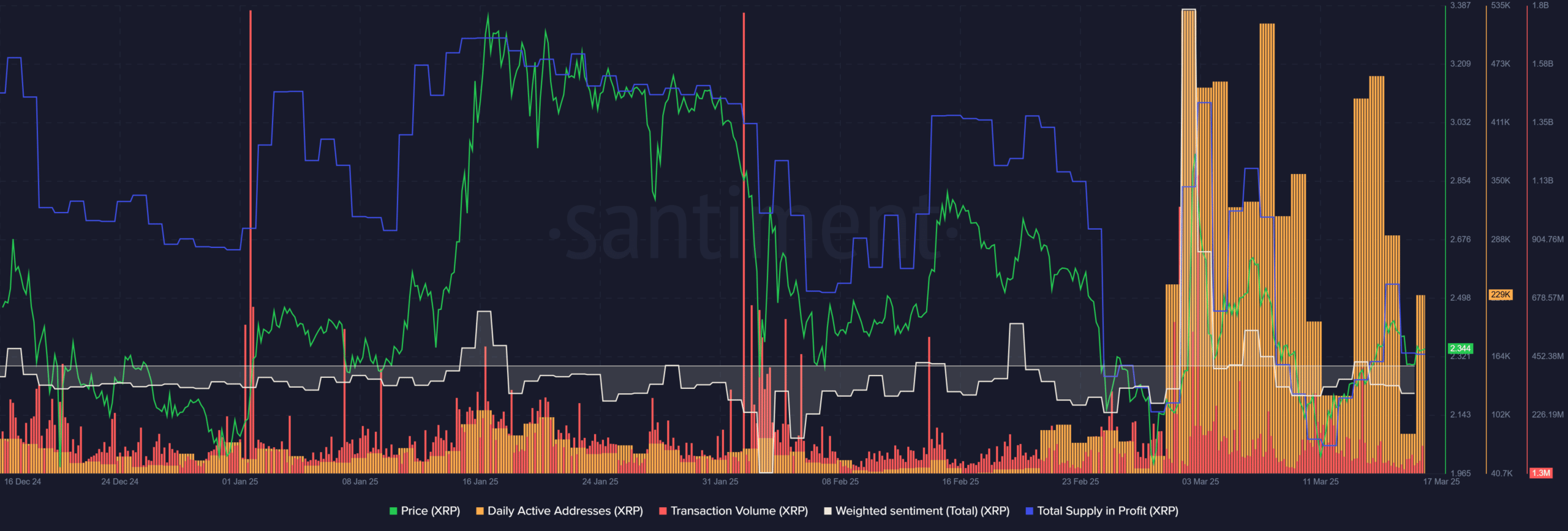

Data from the oracle known as Santiment offers a glimmer of hope for investors. The total supply in profit has been falling alongside the price since January, yet it remains significantly higher than the dismal levels of October and November 2024. A true rollercoaster of emotions! 🎢

However, the weighted sentiment, that fickle mistress tracking social media engagement, has been decidedly negative. For three long months, it has languished in the depths, with only a few fleeting moments of positivity—like a bad joke that only a few get. 😅

In March, the daily active addresses soared to the heavens! Though the numbers have receded somewhat, they remain much higher than in recent months. The transaction volume trends, however, are as predictable as a Russian winter—unchanged from the preceding three months.

While Santiment’s metrics hint at a rise in on-chain activity and potential demand, the long-term holder net unrealized profit-loss (LTH NUPL) reveals a market teetering on the edge of euphoria and greed. Over the past few months, this metric has hovered just above the 0.75 level, like a cat on a fence.

Here, the NUPL measures the delicate balance between unrealized profits and losses among holders whose tokens have aged like fine wine—at least 155 days old. Positive values suggest that investors are, on average, basking in profits. A value of 0.75 indicates that 75% of the market capitalization is in the green. 🍀

In the summer of 2021, this metric soared above 0.75, marking the cycle top for XRP. In 2017, it surged beyond 0.9 and lingered there for weeks, back when the asset was as fresh as a daisy. 🌼

Alas, XRP may have already reached its cycle top. Investors, take heed! It might be wise to partially cash out your holdings before the market decides to take a nosedive into the abyss for the next two years. 🕳️

Read More

2025-03-18 10:17