-

XRP’s Fear and Greed index flashed ‘fear’

Market indicators and metrics pointed to a trend reversal

As a seasoned crypto investor, I’ve seen my fair share of market volatility and price swings. With XRP‘s Fear and Greed index flashing “fear” and market indicators pointing to a trend reversal, I can’t help but feel a glimmer of hope for this token.

I’ve analyzed the cryptocurrency market this week and noticed that most coins experienced a downturn, with XRP being no exception. The decline in its price may have instilled fear among investors. However, there are signs of optimism as a bullish pattern is emerging on XRP’s daily chart.

A bull pattern on XRP’s chart

As a crypto investor, I’ve noticed that my XRP holdings didn’t yield any profits last week due to the token’s significant price decrease of over 4%. Currently, XRP is being traded at $0.4775 according to CoinMarketCap, and its market capitalization surpasses $26.5 billion. Consequently, the profit potential from my XRP investment has taken a hit as well.

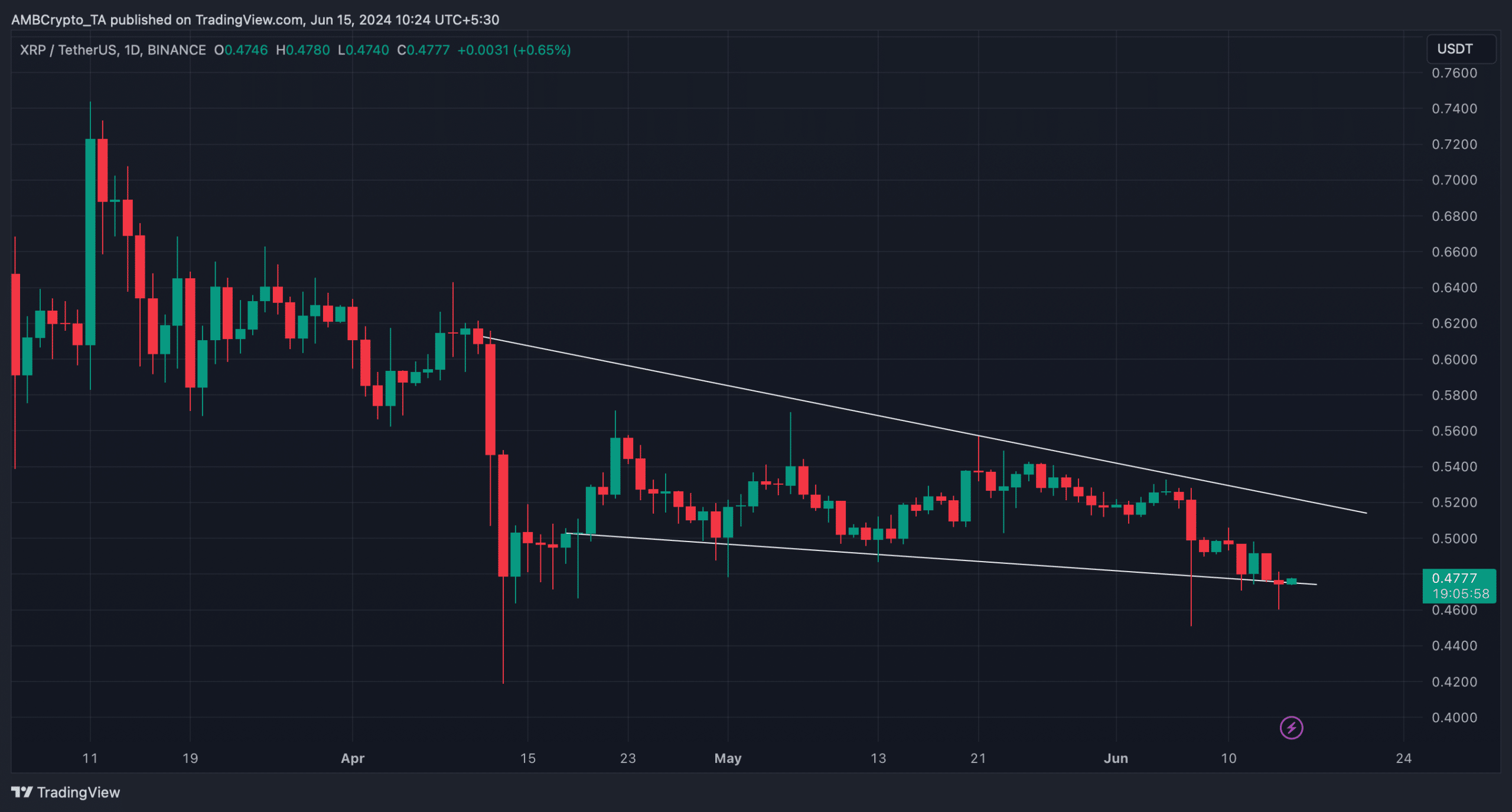

As of the current news update, approximately 69.8 billion XRP tokens are currently generating profits. Yet, it’s important to remember that setbacks can occur in any investment. However, as an analyst, I’ve noticed an intriguing development in XRP’s price chart: a bullish falling wedge pattern has emerged. This technical indicator suggests potential for a significant price increase, which could be a sign of an upcoming pump for XRP investors.

After a significant price drop in mid-April, XRP‘s cost has been moving within a declining wedge formation. Currently, it is poised for an upward trend that could potentially lead to a rupture beyond the pattern. Should this breakout occur successfully, XRP may regain its losses from April.

In fact, if everything falls into place, then XRP might soon retest its March highs too.

Is a bull rally inevitable?

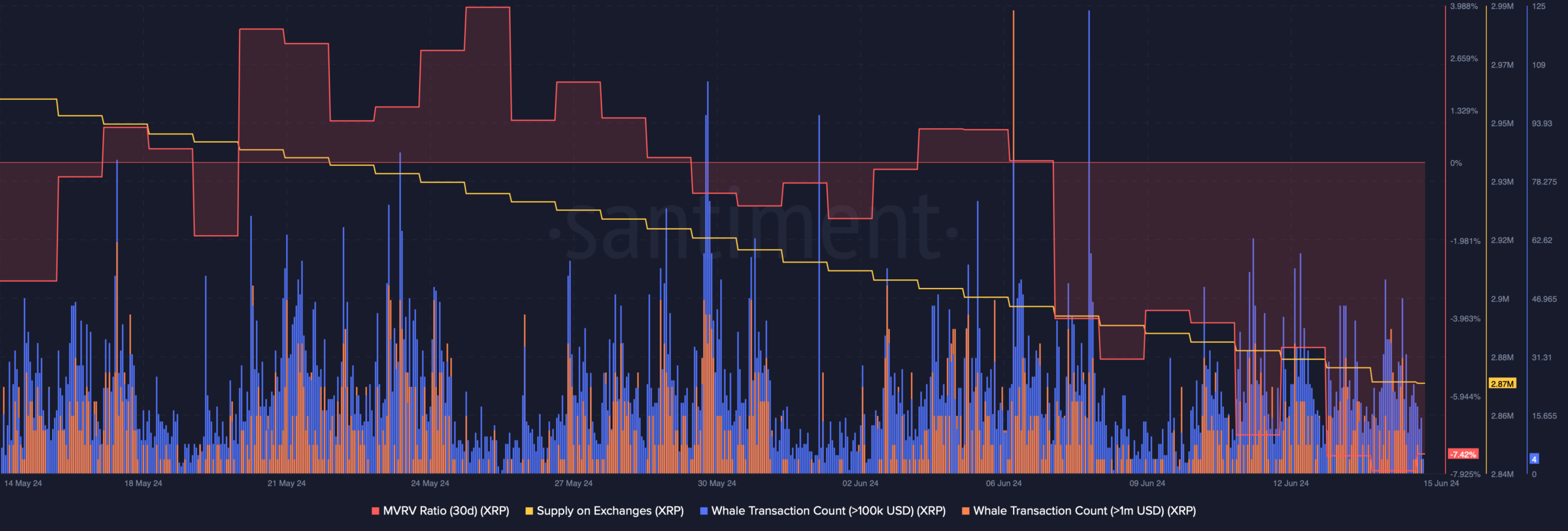

An analysis by AMBCrypto using Santiment’s data revealed that XRP‘s MVRV ratio had reached a 30-day low. This potentially signifies an imminent bullish surge for XRP.

The amount of XRP available on exchanges decreased as well, allowing investors to acquire more tokens during this period. Furthermore, significant XRP transactions by large investors, or “whales,” continued to occur frequently.

At present, according to AMBCrypto’s analysis, XRP‘s fear and greed index stood at 37%. This figure signifies that the market is in a “fear” condition. historically, when this indicator reaches such levels, it suggests that there is a significant possibility of a trend shift.

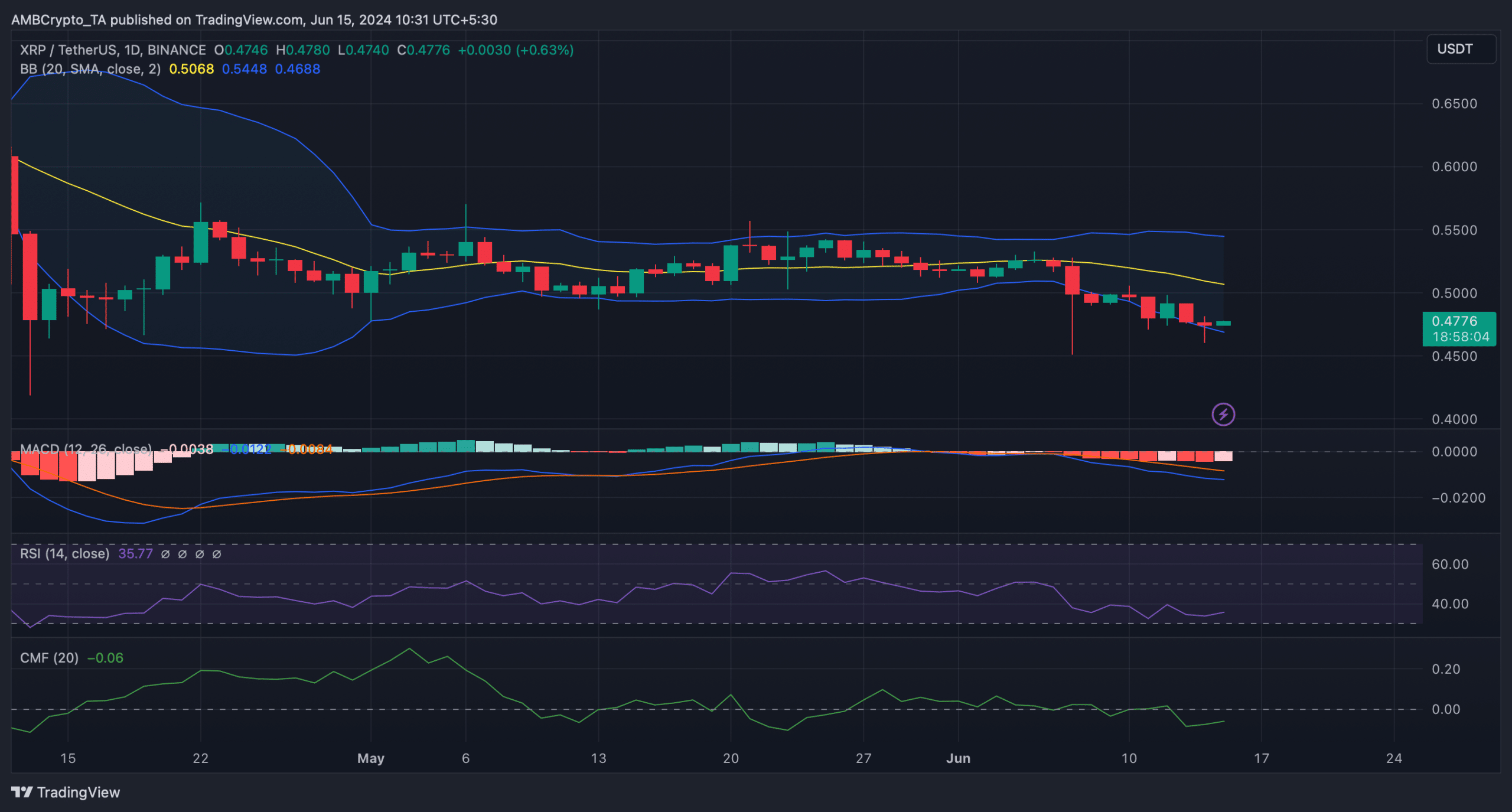

As a researcher studying the financial markets, I delved deeper into examining the daily price chart of XRP to gain insights into its potential future trends. Based on my analysis with AMBCrypto, I discovered that when the price of XRP reaches the lower boundary of the Bollinger Bands, historical data suggests it tends to rebound and experience price increases.

Realistic or not, here’s XRP’s market cap in BTC terms

Additionally, the RSI and CMF indicators of the asset showed minor increases.

As a researcher studying market trends, I’ve noticed some indicators pointing towards a potential reversal of the bullish trend. However, it’s important to keep in mind that the Moving Average Convergence Divergence (MACD) still indicates a bearish edge for traders. This means that despite the hints of a trend shift, the market conditions continue to lean towards selling opportunities.

Read More

2024-06-15 18:15