Well now, gather ’round, folks! Zebec Network (ZBCN) has taken a leap that would make a jackrabbit jealous, soaring a staggering 440% in the last thirty days! It’s like watching a catfish jump out of the water—unexpected and downright impressive! 🐟 But hold your horses, because while the momentum indicators are cooling off like a summer’s day, ZBCN is still strutting its stuff in bullish territory, backed by some sturdy technical structures.

Now, don’t go thinking this is a one-horse show. Short-term consolidation might be on the horizon, but if ZBCN can clear those pesky resistance levels with a bit of gusto, we might just see it gallop onward!

ZBCN Uptrend Still Holds

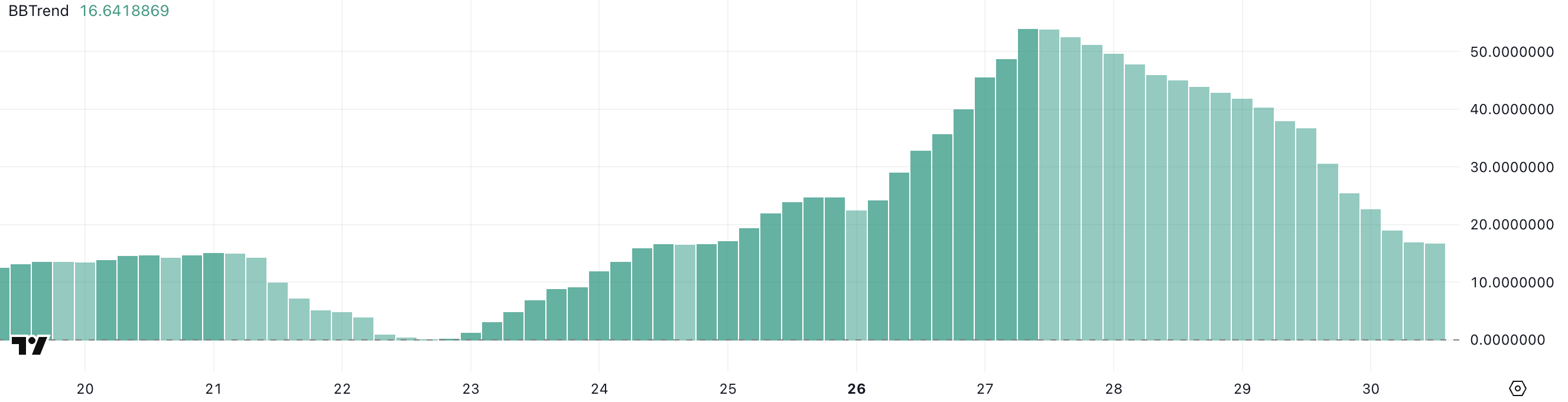

As it stands, Zebec Network’s BBTrend indicator is sitting pretty at 16.64, having maintained positive territory for a whopping 13 days straight—like a stubborn mule that just won’t quit! 🐴 Just three days ago, it peaked at 53.9, signaling some wild volatility and strong directional strength. Now, while the current reading is lower than a snake’s belly, it still shows that the upward trend is hanging on, albeit with a bit of a slowdown.

The fact that BBTrend is still above zero after nearly two weeks suggests our bullish friends are merely catching their breath after that recent sprint. ZBCN has galloped up more than 106% in just the last week, making it the belle of the ball among altcoins! 💃

The BBTrend, or Bollinger Band Trend, is like a trusty compass, measuring the strength and direction of price movements by analyzing the spread between the Bollinger Bands. When it’s above zero, it’s usually a sign of an uptrend, and the higher it goes, the stronger the momentum. A reading below zero? Well, that’s just a sign to put on your raincoat! ☔

Zebec Network’s BBTrend at 16.64 implies it’s still in bullish territory, though it’s lost a bit of its earlier vigor. If it keeps declining, we might be looking at trend exhaustion or a consolidation phase before the next big move. But if it rebounds, well, that’s just the bulls getting their second wind!

ZBCN Bullish Momentum Slows, but Downside Pressure Still Minimal

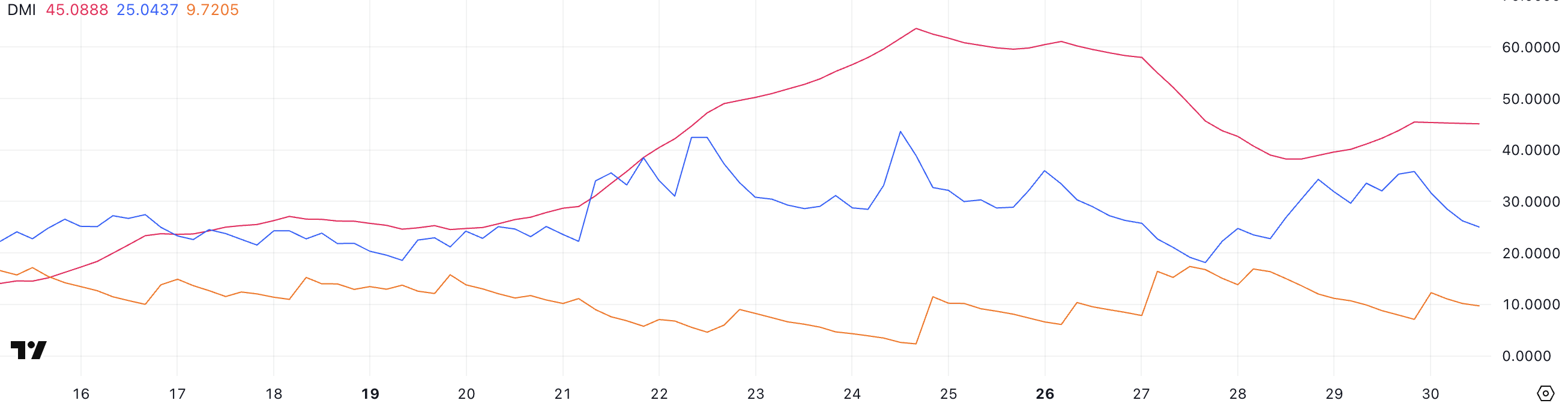

Now, let’s take a gander at Zebec Network’s DMI chart, which reveals its ADX is currently at 45—indicating a strong trend, though it’s taken a slight dip from the 57.9 peak recorded just three days ago. After a tumble to 38.2 two days back, the ADX has steadied itself, suggesting that while the trend’s strength may have cooled, it’s still as firm as a well-cooked biscuit.

The ADX, or Average Directional Index, measures the strength of a trend, no matter which way it’s headed. Values above 25 signal a strong trend, and readings above 40? Well, that’s just a party! 🎉 Zebec’s current ADX reading of 45 shows that the ongoing trend still has some serious traction in the market.

Backing that trend bias, the +DI line—which tracks bullish momentum—is at 25, though it’s slipped from 35.8 the day before. Meanwhile, the -DI is hanging around at a lowly 9.7, showing that bearish pressure is about as minimal as a mouse at a cat convention. 🐭

The combination of a strong ADX and a +DI that still significantly outweighs the -DI suggests Zebec Network’s price may continue to ride the uptrend, even if the bullish intensity has taken a little nap. If the +DI stabilizes or starts to climb again, we might just see buyers regaining their strength; but if it keeps falling while ADX declines, well, that could signal a shift toward consolidation or a weakening of bullish momentum.

Zebec Network EMA Structure Remains Bullish as Price Eyes Breakout

Now, let’s talk about Zebec Network’s EMA structure, which is currently as bullish as a rodeo star, with short-term moving averages sitting high above the long-term ones and a noticeable gap between them—an indication of strong upward momentum. This setup reflects consistent buying pressure and trend strength, suggesting the bulls are firmly in control. 🐂

If ZBCN can push through resistance at $0.0069, it could pave the way for a breakout toward $0.0080, marking fresh all-time highs and confirming continued bullish dominance in the market. But hold your horses—if sentiment shifts, we might see some downside risk come into play. If support at $0.00536 is tested and fails to hold, it could trigger a deeper correction, sending ZBCN down to $0.00384.

In the event of sustained bearish pressure, the price could tumble further toward $0.00196, with an extended move possibly reaching $0.00146. So, keep your eyes peeled, folks! 👀

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2025-05-30 21:31