- Banks shift to Bitcoin investments, signaling changing views.

- US House passes bill easing SEC guidelines, showing crypto acceptance.

As an analyst with a background in finance and experience following the cryptocurrency market, I’ve witnessed firsthand the evolving attitudes of banks towards Bitcoin investments. The recent moves by J.P. Morgan and Wells Fargo to invest in Bitcoin ETFs on behalf of their clients represent a significant shift in perspective.

J.P. Morgan disclosed in a recent Form F13 submission that it had made a $731,246 investment in a Bitcoin spot ETF for the benefit of its clients.

In their investment plan, they assigned a large portion, equal to $477,425, towards IBIT in BlackRock’s portfolio, while also putting resources into Bitwise’s BITB, Fidelity’s FBTC, and Grayscale’s GBTC.

Joining the fray was US banking giant Wells Fargo, holding 2,245 shares of GBTC valued at $121,207.

As I pen down these words, Bitcoin (BTC) is currently exchanging hands at $60,864, representing a 3.34% decrease from its previous value. However, it’s important to note that investor sentiment towards BTC has been changing notably lately.

More banks join in

Around the beginning of April, Europe‘s second largest bank, BNP Paribas, acquired 1,030 IBIT shares for approximately $41,684. In the first quarter of 2024, each share was predicted to cost around $40.47. This is significantly less than the current value of a single Bitcoin.

Back in September 2022, I, as a crypto investor, was intrigued to hear Sandro Pierri’s stance on Bitcoin. He, being the Head of the fund management group at BNP Paribas Asset Management, shared his skepticism towards Bitcoin’s potential. Similar to Dimon, he voiced his opinions against it.

“We are not involved in cryptocurrencies and we don’t want to be involved.”

These changes represent a significant change in attitude from various banks, suggesting a burgeoning curiosity and receptiveness towards Bitcoin as a potential investment option.

The tides are turning

In the opening month of the year, Jamie Dimon, the CEO of J.P. Morgan, took a firm position against Bitcoin [BTC] in an interview on CNBC’s “Squawk Box.” He expressed his views by stating:

“Among cryptocurrencies, some offer unique functions that could potentially hold value. However, there’s one that seemingly offers no value whatsoever, which I refer to as a ‘digital pet rock.’ Bitcoin serves as an example for this category.”

However, he did note,

“It has some use cases. Everything else is people trading among themselves.”

Bitcoin: What are the metrics saying?

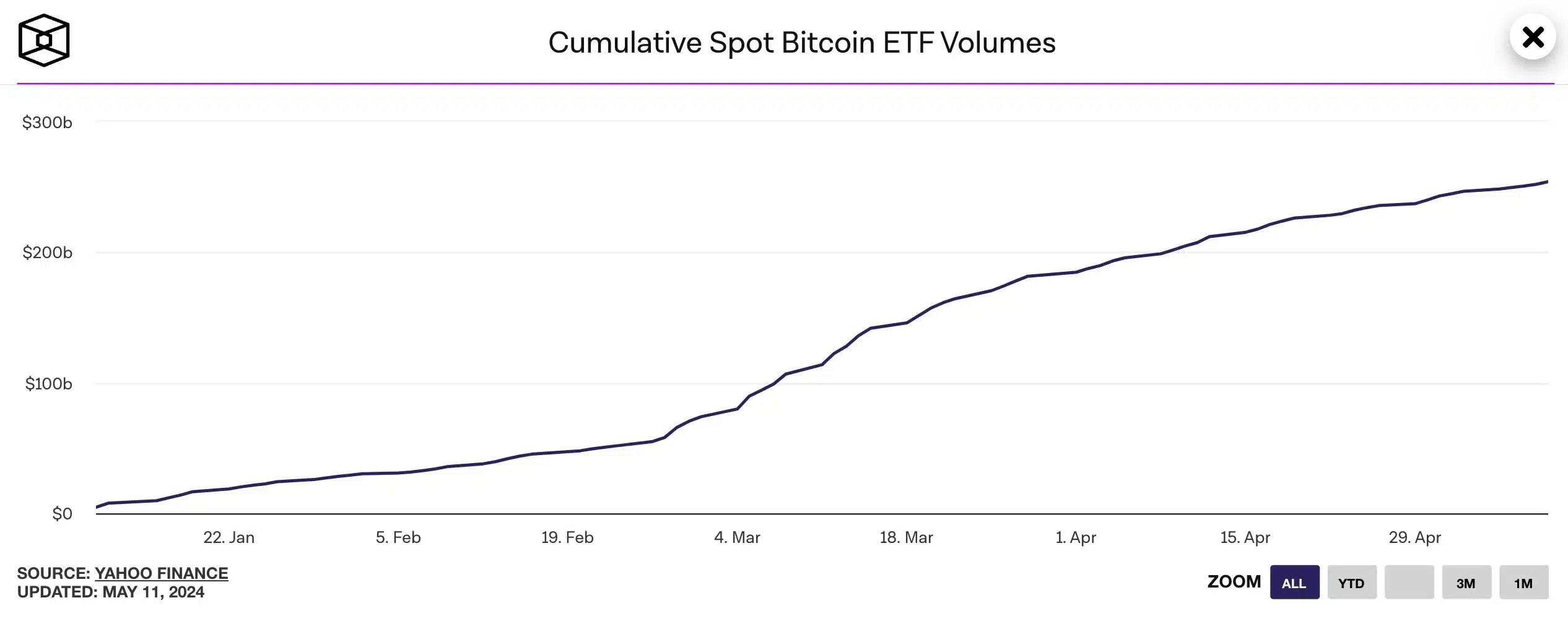

The growing total trading activity in spot Bitcoin ETFs, as indicated by rising cumulative volumes, underscores this confirmation. This figure encompasses all transactions executed within a specific timeframe for these exchange-traded funds focused on Bitcoin.

The US House recently approved a legislation intended to loosen Securities and Exchange Commission (SEC) regulations, indicating a burgeoning openness towards cryptocurrencies in the face of banks’ traditional reluctance toward digital assets.

The Biden Administration has threatened to reject the bill if it makes it through the Senate.

As a crypto investor, I believe it’s important for regulatory bodies like the SEC to have the necessary flexibility to establish safeguards and manage any potential future challenges related to crypto-assets. Therefore, I would advise against unreasonably limiting the SEC’s power to maintain financial stability in this evolving market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-05-11 23:03