As the Federal Reserve’s annual Jackson Hole soiree looms-a masquerade of economic grandeur-nearly $5 billion in Bitcoin and Ethereum options expire today, like clockwork ghosts haunting the markets.

This circus of volatility sees Bitcoin (BTC) and Ethereum (ETH) teetering on a tightrope, juggling Fed whispers and the grotesque puppetry of expiring contracts. Traders, dear reader, are playing chess with dynamite. 🧨

A $4.7 Billion Gamble: Bitcoin’s Options Battlefield

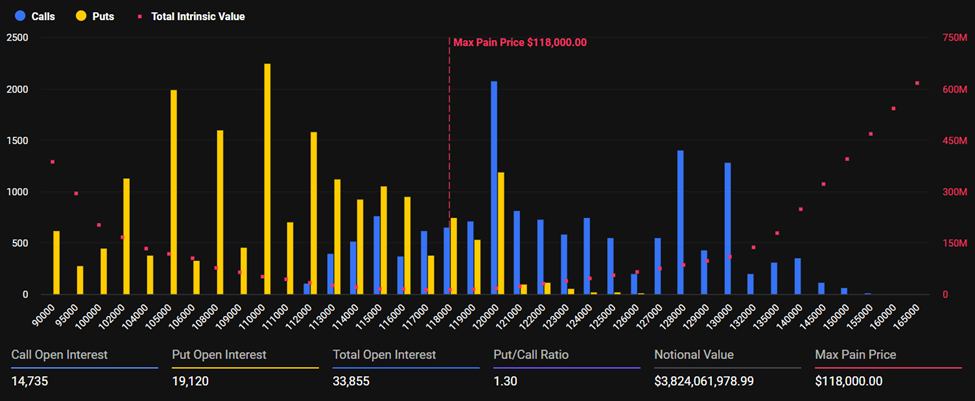

Data from Deribit, that digital oracle of derivatives, reveals Bitcoin’s open interest at 33,855 contracts-a notional value of $3.82 billion, enough to make a central banker weep into their coffee. ☕

The put-to-call ratio (PCR) of 1.30 suggests traders are hedging like a drunk man clutching a umbrella in a hurricane. Desperate, but not without flair.

The max pain point-a price where collective losses scream loudest-is perched at $118,000, a cruel joke above Bitcoin’s current $113,019. A phantom price, like a mirage in a desert of liquidity. 🐉

Deribit’s analysts, those modern-day Nostradamuses, whisper that Bitcoin’s expiries are put-heavy. A grim omen, or merely the market’s way of saying, “Surprise me!”

Options Expiry Alert

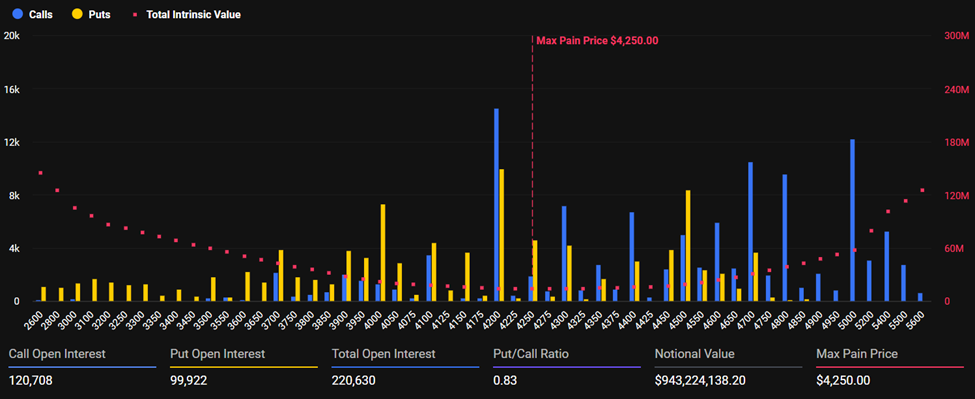

At 08:00 UTC tomorrow, over $4.8B in crypto options are set to expire on Deribit.$BTC: $3.83B notional | Put/Call: 1.31 | Max Pain: $118K$ETH: $948M notional | Put/Call: 0.82 | Max Pain: $4,250BTC expiry tilts put-heavy, while ETH call interest…

– Deribit (@DeribitOfficial) August 21, 2025

Ethereum’s options, meanwhile, play a different tune. Open interest hums at 220,630 contracts, a $943 million notional value. A modest sum compared to Bitcoin’s antics, but no less theatrical. 🎭

The put-to-call ratio of 0.83 hints at call demand, a fragile hope that Ethereum might yet defy gravity. Its max pain level lurks at $4,250, slightly below its $4,284 price-a precarious balancing act. 🤹

The stakes? A surreal ballet of momentum and macro headwinds, where prices must either waltz or collapse under the weight of hedging flows. A tragedy in five acts, perhaps.

Jackson Hole: The Fed’s Grand Opera of Uncertainty

Greeks.live, that bard of volatility, claims ETH traders are “cautiously bullish,” as if optimism is a rare spice to be rationed. One strategy? Wait for a $4,100 pullback-a mere 5% drop-to re-enter calls. A gamble for the faint of heart. 💸

“Key focus is on ETH’s outperformance relative to BTC, with traders managing risk by taking profits on calls while maintaining some delta exposure through short puts,” they noted.

Meanwhile, the Fed’s Jackson Hole symposium looms-a stage for Jerome Powell to deliver a speech that could send markets into a tizzy or a yawn. Traders, like vultures, circle for clues about interest rates. 🦅

“There is much attention to any hint from the Fed, particularly this Friday’s speech at the Jackson Hole symposium in Wyoming…Markets will be looking to the Fed speech for direction on the future of monetary policy,” Nic Puckrin, Founder of Coin Bureau, said in a statement to BeInCrypto.

Greeks.live adds that block bullish and bearish trades hit $1.61 billion and $1.14 billion respectively-two-thirds of daily turnover. A financial gladiatorial match, with derivatives as the arena. 🏛️

With the Fed’s Jackson Hole Meeting approaching, opinions in the options market are divided. Today, block bullish and bearish trades amounted to US$1.61 billion and US$1.14 billion respectively, accounting for two-thirds of the total turnover for the day.

Trading was mainly…– Greeks.live (@GreeksLive) August 21, 2025

Short-term implied volatility (IV) has dipped, a surprising calm before the storm. Perhaps institutions are betting on a Fed speech as dull as a tax audit. 📄

Yet the convergence of $5 billion in expiring options and Jackson Hole’s spectacle creates a stage for drama. Bitcoin must climb $118,000-a 4.4% climb-while Ethereum clings to its “bottomed” narrative like a lifeline. 🎬

Whether Jackson Hole erupts into chaos or remains a snoozer, traders are perched like cats in a thunderstorm-hedged, watchful, and ready to pounce. Or run. Or both. 🐱

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- USD JPY PREDICTION

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

2025-08-22 09:28