-

Metaplanet expands BTC holdings, securing 108.78 more Bitcoin amid bullish market sentiment.

U.S. Bitcoin ETFs now hold 4.6% of the supply, which is nearing Satoshi’s total holdings.

As a seasoned crypto investor with a decade of experience under my belt, I must admit that the recent market dynamics have been quite exhilarating. The consistent strategy adopted by Metaplanet, often referred to as “Asia’s MicroStrategy,” in expanding its BTC holdings is indeed noteworthy.

The latest movements in Bitcoin’s (BTC) price have generated interest, with the value dropping from approximately $66,000 at the end of September, only to fall further to $60,000 on October 1st, followed by a rebound.

Currently priced at $63,480 and climbing by 2.3% in the past day, as reported by CoinMarketCap, this cryptocurrency exhibits robustly optimistic tendencies.

Metaplanet’s new Bitcoin accumulation

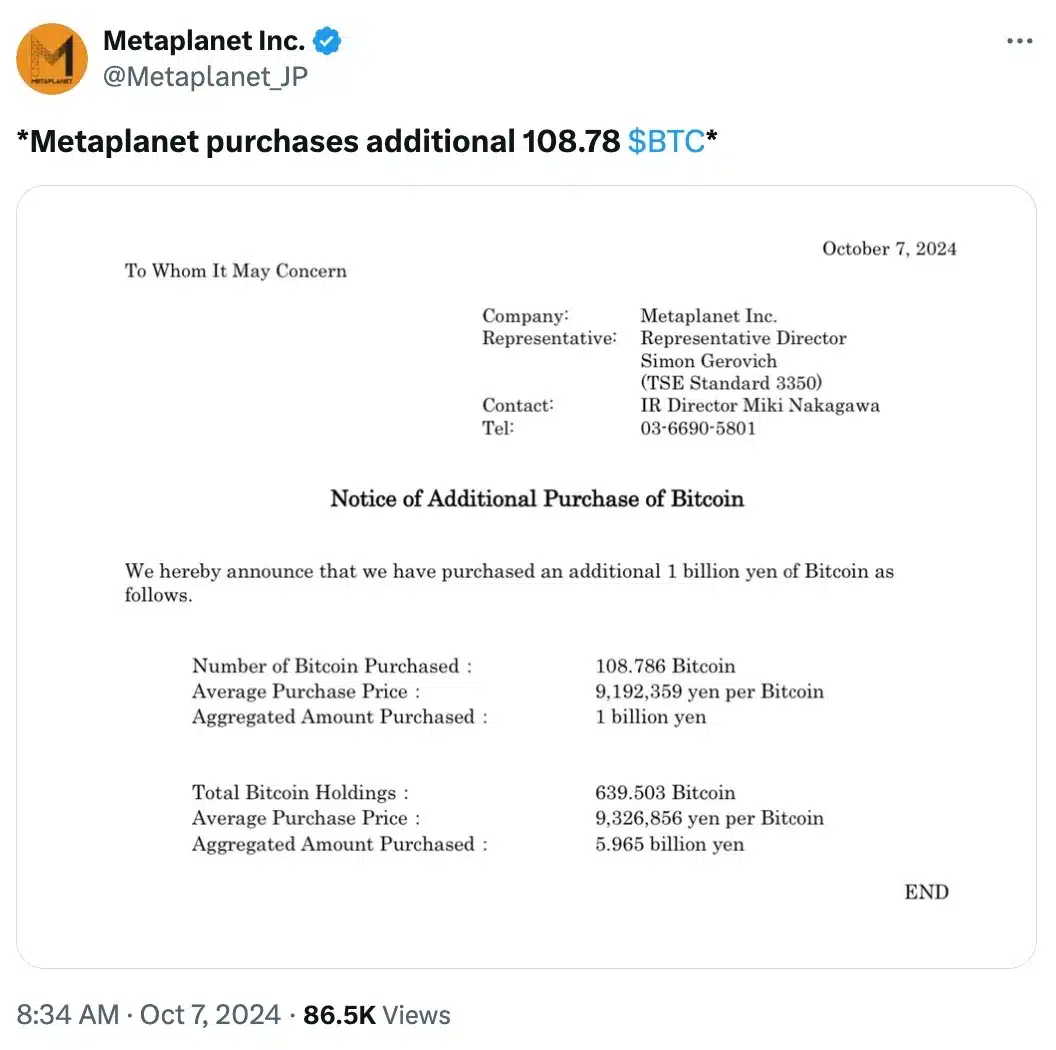

Building on the current trend, Metaplanet, a Japanese investment firm, has purchased an extra 108.78 BTC for about 6.7 million US dollars or 1 billion yen. This recent purchase increases their overall Bitcoin holdings to approximately 639.5 BTC, currently worth around $40 million.

Remarking on the same an X user noted,

“Nice investment choice!”

Furthermore, it was found through Bitcoin Treasury data that Metaplanet started purchasing Bitcoins on the 23rd of April.

Therefore, the latest acquisition on October 7th represents the 13th purchase in total. This latest acquisition added 107.9 Bitcoin to the collection, which is worth approximately 1 billion Japanese yen or $6.9 million.

Metaplanet’s strategy explained

Lately, Metaplanet has been consistently following a strategy to increase its Bitcoin holdings, as it anticipates a positive trend in the crypto market’s perspective towards the last quarter of this year.

It’s worth noting that Metaplanet has garnered recognition for its aggressive strategy in acquiring Bitcoins, which has led people to compare it to MicroStrategy. As a result, it has been dubbed “Asia’s MicroStrategy,” reflecting its significant institutional dedication to Bitcoin.

Consequently, Metaplanet intends to maneuver through Japan’s complex economy, characterized by low interest rates and large-scale monetary stimulus, by embracing Bitcoin (BTC).

Bitcoin ETFs to surpass Satoshi Nakamoto’s Bitcoin holdings?

It’s clear that the arrival of Bitcoin ETFs signified a significant shift in perspective. This change particularly affected those on Wall Street, causing them to transition from viewing Bitcoin as a risky investment to regarding it as a strategic opportunity.

Following this, there’s been a significant increase in institutional interest towards Bitcoin (BTC). Currently, U.S. Spot Bitcoin ETFs account for around 4.6% of BTC’s total supply, which translates to approximately $58 billion. This is getting close to the holdings of Bitcoin’s largest known owner, Satoshi Nakamoto.

Additional restrictions were imposed due to data from SoSoValue indicating that Bitcoin Exchange-Traded Funds (ETFs) collectively hold $57.73 billion in assets. Notably, BlackRock is responsible for managing an impressive $22.91 billion of these assets within its own Bitcoin ETF.

Remarking on the same, Eric Balchunas, Bloomberg’s Senior ETF Analyst in a recent tweet had noted,

Yesterday was a positive day for Bitcoin ETFs in the U.S., pushing year-to-date inflows to an all-time high of $17.8 billion. Currently, these ETFs are 92% close to owning one million Bitcoins, and they’re also 83% on their way to surpassing Satoshi Nakamoto as the largest Bitcoin holder. Time is ticking…

It’s fascinating to see how the widespread use of Bitcoin may lead to a shift in who holds the most Bitcoin, with Nakamoto currently holding the title. Will he continue to be the top holder, or will things change course?

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-10-07 13:12