- Metaplanet goes all-in, buying $53.4M worth of Bitcoin like it’s on sale at a Black Friday event.

- Plans to set up shop in Miami with a modest $10 million Treasury Corp (because who doesn’t love Miami?).

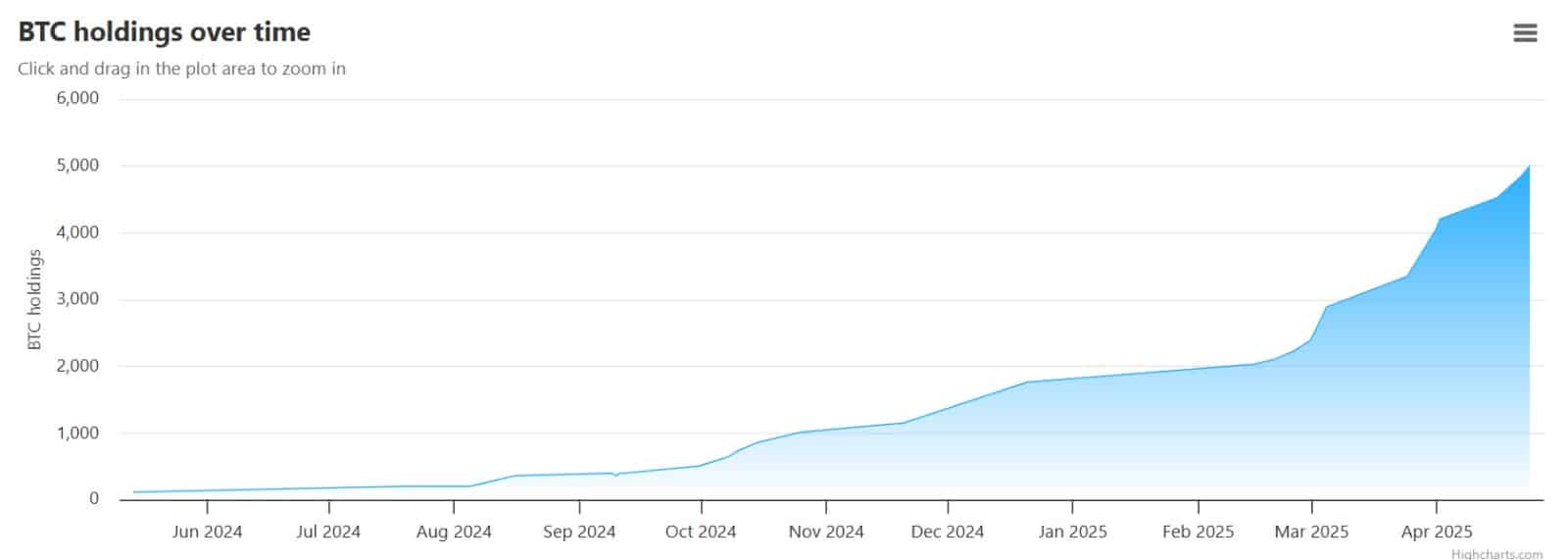

So, apparently, the institutional world has caught the Bitcoin bug, and no one does it quite like Metaplanet, a firm out of Japan that’s been on a buying spree like a kid in a candy store. Over the last five months, they’ve added a jaw-dropping 555 Bitcoin to their portfolio, shelling out $53.4 million for this shiny digital treasure.

This hefty purchase brings their total Bitcoin stash to 5,555 BTC, valued at around ¥71.76 billion (yes, that’s $465 million—more than most small countries’ GDP). The average price they paid for this digital gold? A modest $86,672 per coin. But hey, who’s counting when you’re buying Bitcoin like it’s Monopoly money?

Since rolling out its crypto strategy in April 2024, Metaplanet has been gobbling up Bitcoin like it’s the last dessert at the buffet. The plan? To amass 10,000 BTC by the end of 2025. They’ve still got 4,445 to go, so get ready for more wallet-draining purchases.

But wait, they didn’t stop there. Oh no. They issued $25 million worth of ordinary shares to fund this latest spree. That’s right, this marks their 13th round of fundraising. Clearly, they’ve figured out that printing shares is the perfect side hustle to their Bitcoin addiction.

And if that wasn’t enough, Metaplanet’s got their eyes on Miami—because who doesn’t want a little slice of sunshine and crypto in Florida? They’re setting up a Treasury Corp with a $10 million starter pack and a goal to grow it to $250 million. No big deal.

As of now, Metaplanet is the largest public company holding Bitcoin in Asia. Move over, Alibaba.

Everyone’s Flocking to Bitcoin, and Metaplanet’s Leading the Charge

Clearly, Metaplanet’s Bitcoin obsession is paying off. The company’s aggressive acquisitions aren’t just boosting their balance sheet; they’re fueling investor confidence. Apparently, institutions have decided Bitcoin is no longer the wild, risky investment it used to be. No, now it’s considered a safe and lucrative long-term bet. Because, you know, digital currency backed by, well, nothing, is totally stable.

And Metaplanet’s not alone. Institutions are hopping back into the Bitcoin market, and their return is reflected in the Coinbase Premium Index, which is looking rather healthy these days.

Meanwhile, Metaplanet’s stock has skyrocketed by 11.45%—because what investor wouldn’t want to put their faith (and money) in a company that’s hoarding Bitcoin like it’s going out of style?

At this point, Metaplanet’s Bitcoin stash is no longer just a line on their balance sheet; it’s the golden goose laying eggs of investor confidence. Keep an eye on them—they’re not slowing down anytime soon.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-05-07 15:51