- An unprecedented move by the BOJ is causing a market shift.

- Bitcoin’s bearish sentiment supports overall crypto market decline but still not yet time to sell.

As a seasoned market analyst with over two decades of experience navigating financial landscapes, I’ve seen my fair share of market shifts and trends. The recent move by the Bank of Japan is reminiscent of the dot-com bubble burst in 2001, a time when I was knee-deep in analyzing Yahoo’s stock performance.

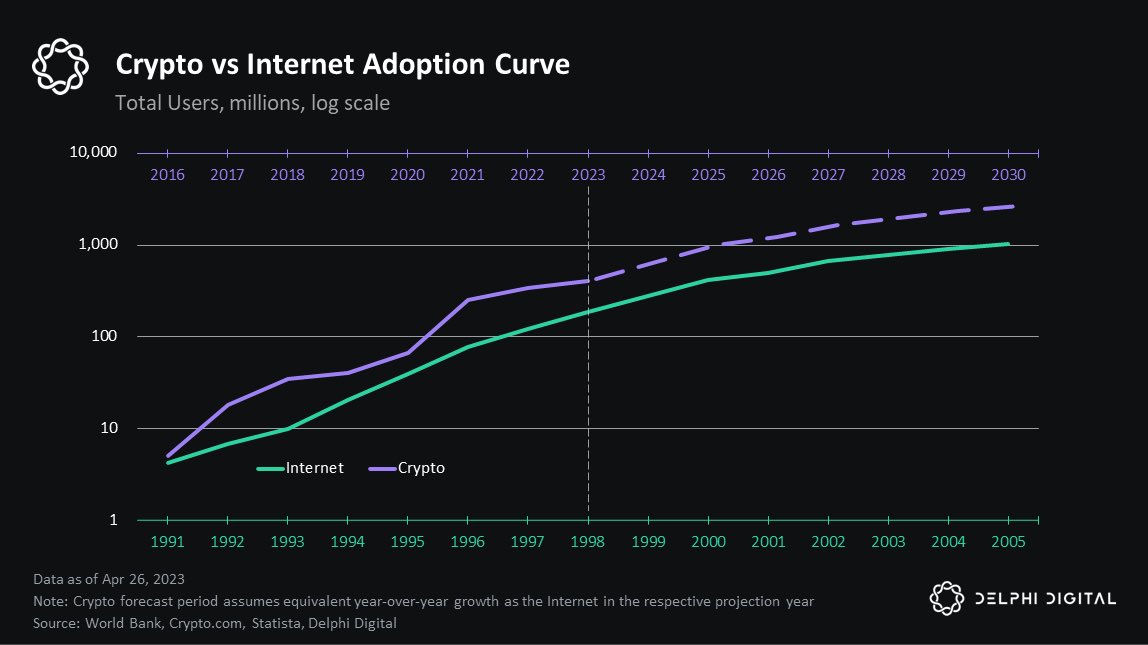

As someone who has been observing and participating in the digital revolution for several years now, I must say that the rapid growth of cryptocurrencies is truly astounding. In my early days online, the internet was still a relatively new phenomenon, with its value and potential yet to be fully realized by many. However, even back then, I could sense the transformative power it held, much like how I feel about cryptocurrencies today.

When cryptocurrencies experience growth, becoming familiar with their complexities keeps you well-informed and prepared for future significant changes.

It’s almost certain that the growth trajectory of cryptocurrencies will outshine other investments in the long run, although temporary setbacks may occur as a result of rising interest rates causing market fluctuations.

Why crypto markets aren’t immune to interest hikes?

3 Decades of Zero Interest Rates in Japan have finally led to a shift, causing me, as an investor, to reconsider my positions in various investments worth around $4 trillion. This global market ripple was highlighted by popular analyst Nicholas Mugalli, and it’s crucial to remember that even the crypto market isn’t impervious to such impacts.

As someone who has been closely watching the financial markets for over two decades, I can attest to the fact that the recent move by the Bank of Japan (BOJ) is creating ripples far beyond Japanese borders. This decision is causing a significant market shift, and as an investor, I have witnessed this firsthand.

The historical backdrop reveals that events resembling those from 2001 and 2008 have previously caused market crashes. Although international strife and Federal Reserve decisions are factors, Japan’s increase in interest rates serves as a major trigger for the current market drop.

Unforeseen action led to mass selling off of assets, causing a series of impacts on global marketplaces and adding to the ongoing economic slump.

What’s happening with Bitcoin?

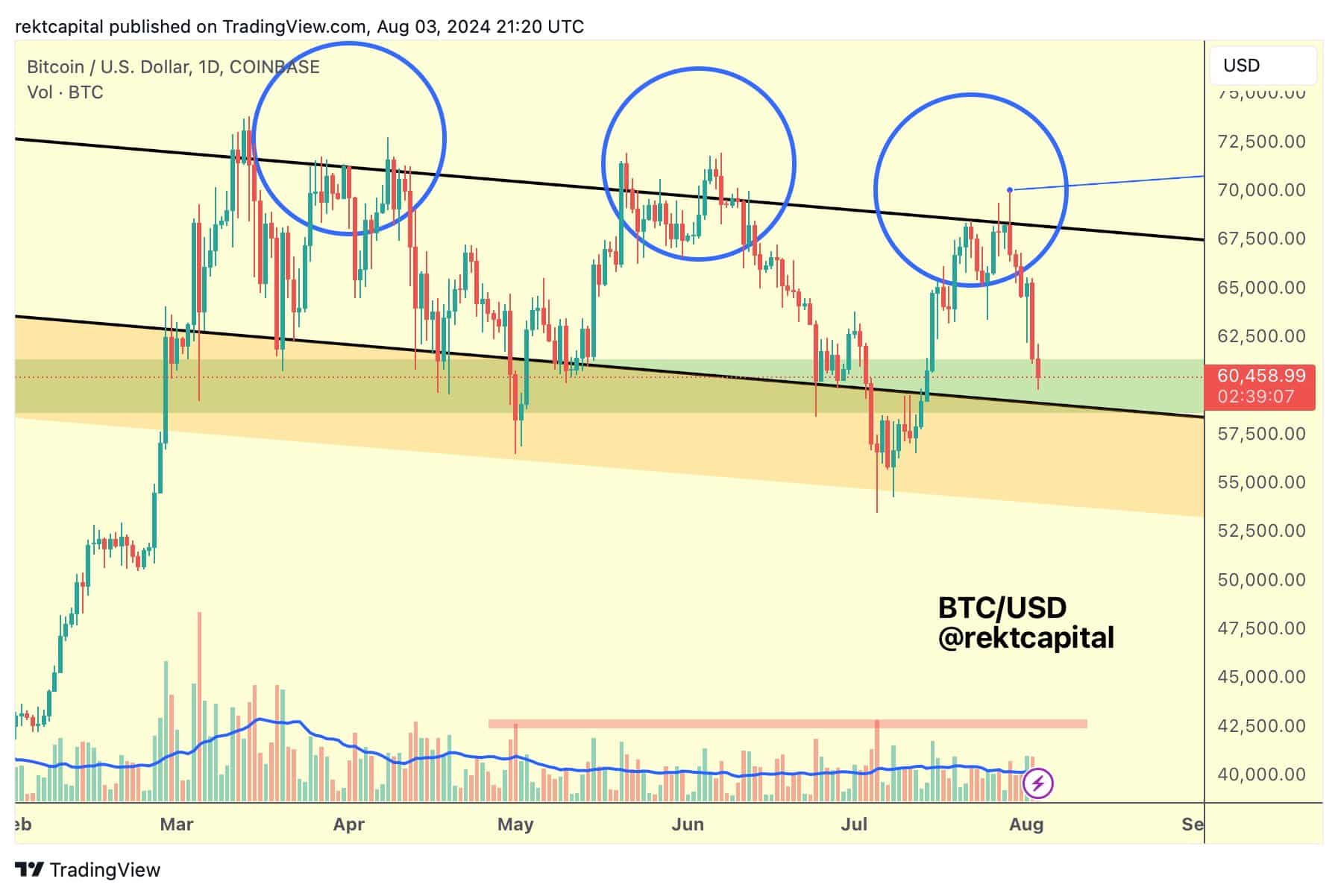

In the past, significant drops in Bitcoin’s price have taken place following higher-than-usual selling activity, which suggests that sellers may be running out of steam.

As an analyst, I’ve noticed a specific pattern indicated by the red boxes on the Bitcoin volume chart, which seems to signal a potential trend for a price drop when met. However, at the moment, we are not seeing the same level of sell-side volume that would trigger this pattern. This implies that there might be more selling pressure building up before we witness a significant decline in Bitcoin’s price.

In simpler terms, when Bitcoin and other cryptocurrencies show high prices along with a pessimistic outlook, it gives us additional clues that a drop in their values might occur soon.

As a researcher examining market trends, I’ve noticed a bearish pattern emerging that underscores the importance of elevated sell pressure to set the stage for a steep price drop, reinforcing a more significant downtrend in the market.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-08-04 17:11