-

JASMY posted +25% gains after breakout from a multi-month price consolidation.

Apparently, the breakout happened due to speculation about Japan’s national ID system.

As a researcher with experience in cryptocurrency markets, I’m excited about Jasmy coin’s [JASMY] recent price breakout and the potential implications for investors. On May 30th, JASMY surged above its multi-month price range, posting impressive gains of +25%. This bullish trend was fueled by speculation regarding Japan’s ‘My Number’ national ID system and Jasmy’s involvement in private data security and blockchain integrations.

On 30th May, Jasmy coin [JASMY] broke above its multi-month price range and posted +25% gains.

The bullish breakout occurred due to anticipation surrounding Apple’s intended incorporation of Japan’s “My Number” system, a national initiative aimed at simplifying administrative tasks like social security and taxes for Japanese residents.

It’s been rumored among traders that Jasmy, being a prominent Tokyo-based company specializing in private data security and blockchain integrations, could be involved in Japan’s “My Number” project. However, the firm has yet to make an official announcement regarding their participation in this initiative.

Jasmy coin price prediction: What are the next key targets to watch?

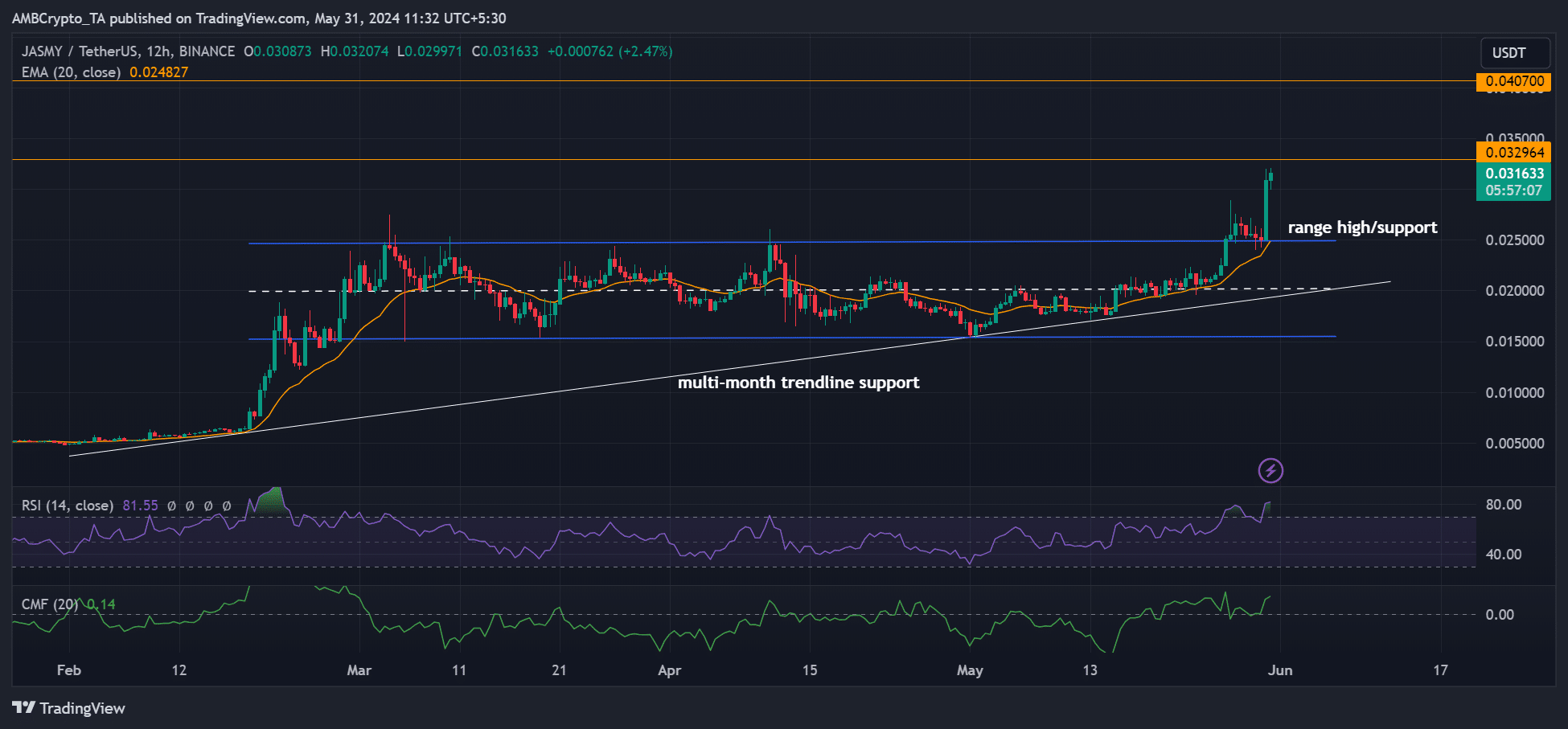

As of the current moment, significant price signals on the 12-hour chart were pointing towards a bullish trend. The buying force was robustly present, evidenced by the RSI’s oversold condition.

The elevated Chaikin Money Flow (CMF) value indicated that substantial investment inflows have been observed in JASMY during the recent hours.

As an analyst, I’ve observed that the price of the breakout encountered a significant resistance level at $0.033, which previously functioned as support back in March 2022. If the “My Number” narrative in Japan were to lose steam, overcoming this hurdle could pose a formidable challenge for bulls.

If that’s the case, JASMY may find its way back to the intersection of its previous high point and the 20-day Exponential Moving Average (EMA), or it could reach the support level indicated by a long-term trendline.

However, an extended rally could see JASMY bulls grab +20% gains if they hit $0.04.

JASMY long-term holders were profitable – Will they sell?

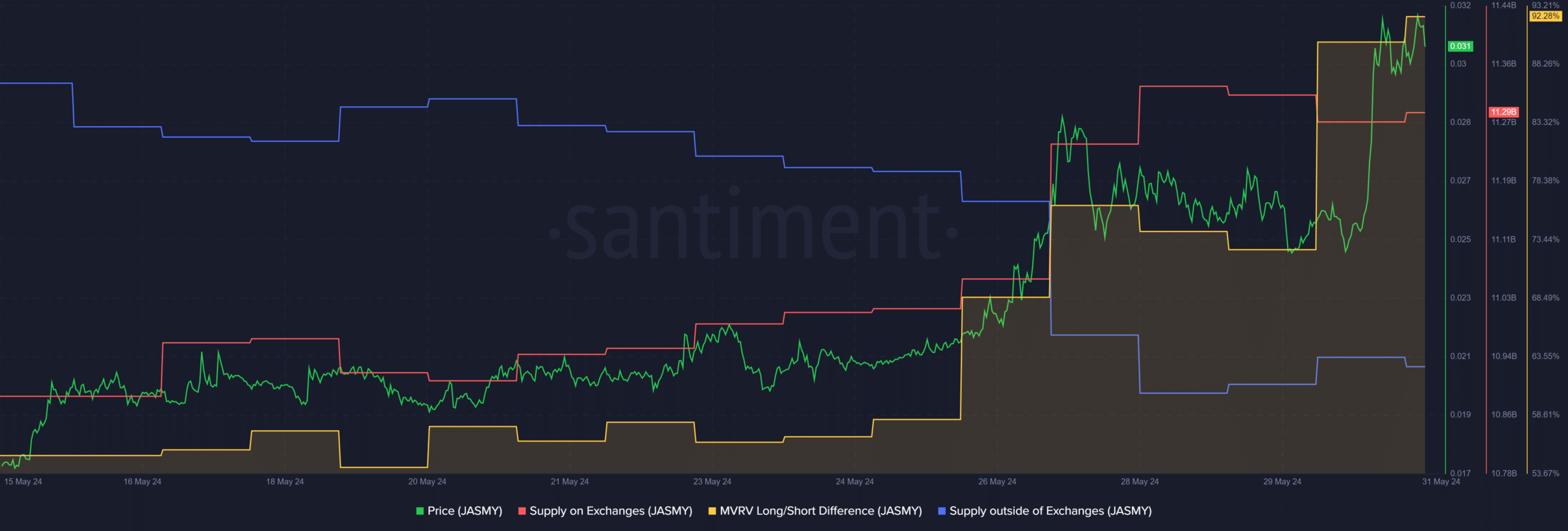

At the end of May, there was a significant increase in interest for JASMY, indicated by a consistent rise in Supply off the exchanges (represented by the blue line). This trend suggested that investors were amassing larger holdings during that timeframe.

Similarly, sell pressure eased, as demonstrated by the declining Supply on Exchanges (red line).

Read Jasmycoin [JASMY] price prediction 2024-2025

As a researcher examining the data, I observed that the Market Value to Realized Value (MVRV) ratio stood at 1.92. This signified that on average, long-term investors had realized gains that were less than 58% of their current holdings’ value. In simpler terms, most long-term investors were in profit and might be considering cashing out some profits.

If the Low Temperature Hydrocarbons (LTH) group chose to prioritize profits, the proposed downturn situation could become realistic, implying that the $0.025 mark is significant and worth monitoring closely.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-31 17:12