- Jasmycoin saw a vast surge in whale activity as prices formed a local high at $0.059.

- While profit-taking was seen, the long-term uptrend might not be ending right away.

As a seasoned researcher with extensive experience in the crypto market, I find the recent developments of Jasmycoin [JASMY] intriguing. The surge in whale activity and the subsequent price movement have caught my attention.

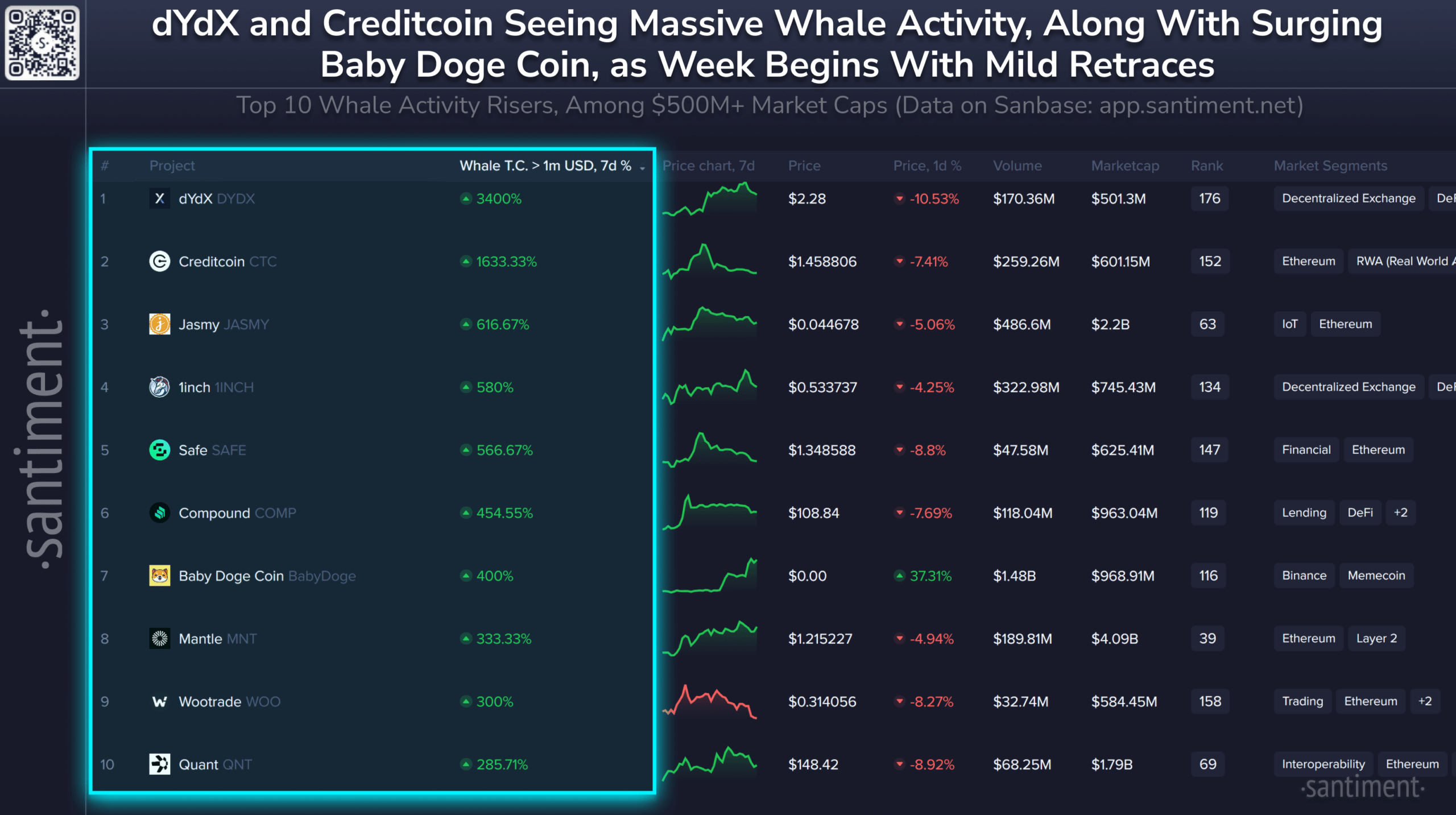

Over the last week, transactions involving Jasmycoin (JASMY) significantly increased among large investors, or “whales.

According to a recent Santiment Insights post, user Brianq highlighted that JASMY is one of the ventures exceeding a market capitalization of half a billion dollars.

Surging whale activity and the implications

Jasmycoin saw a significant rise of 616% in transactions involving large investors (whales), defined as those spending over a million dollars. This substantial surge in whale activity might indicate either a large-scale selling off for profit or a significant buildup of holdings, contingent upon the coin’s price trend.

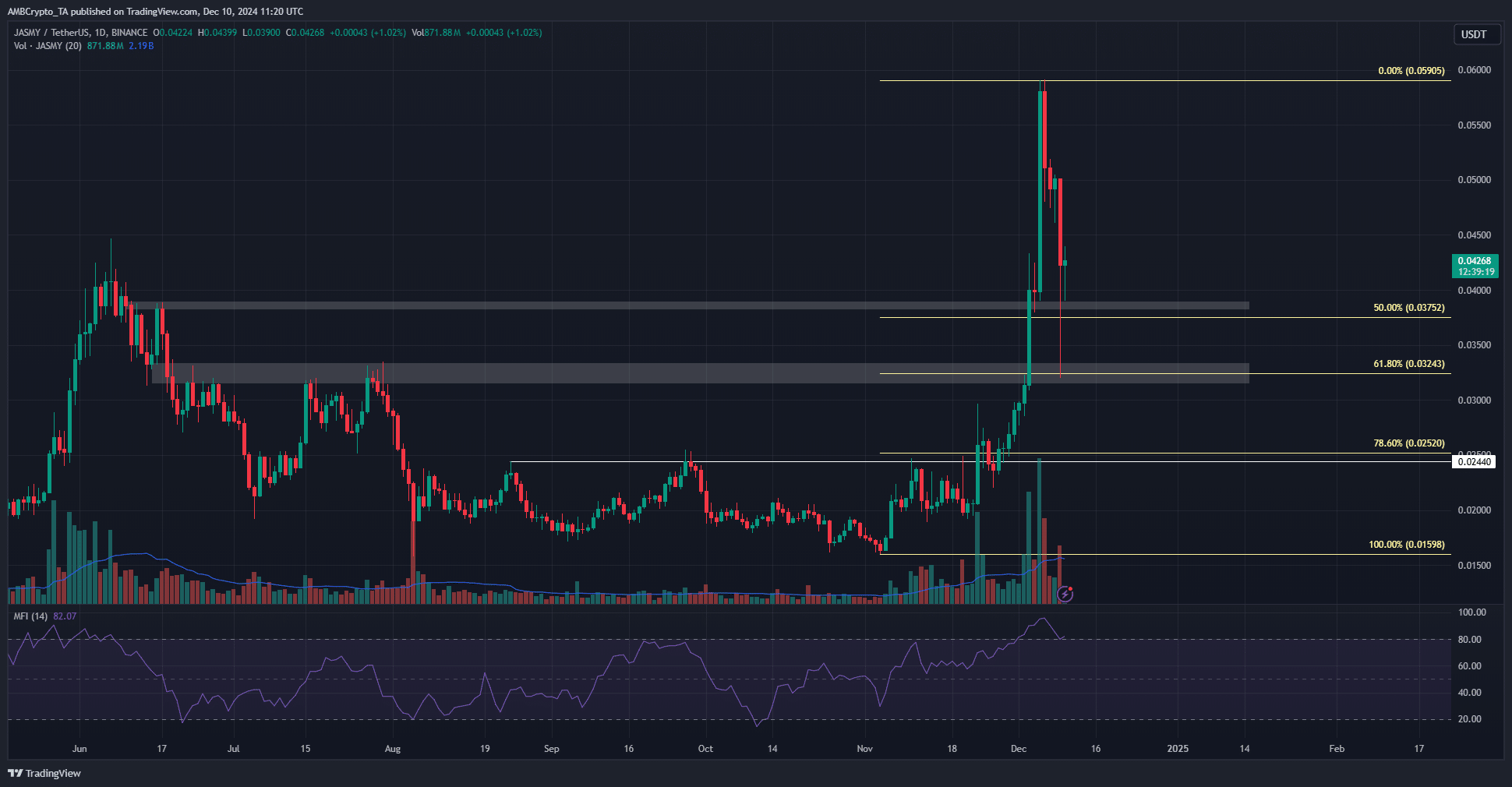

Over the last five days, Jasmycoin reached local highs of $0.059 and since then, it has pulled back to touch a support level at $0.032.

Earlier this year, two possible support levels at $0.032 and $0.04, determined by the price movement, were pinpointed. Throughout the recent downturn, the supporters of JASMY have successfully guarded these zones.

The whale behavior indicated a mix of cashing in at the peaks and stockpiling around approximately $0.04.

According to AMBCrypto’s examination on the daily scale, the overall market trend seemed optimistic. At this point, the Money Flow Index (MFI) hadn’t indicated any divergence.

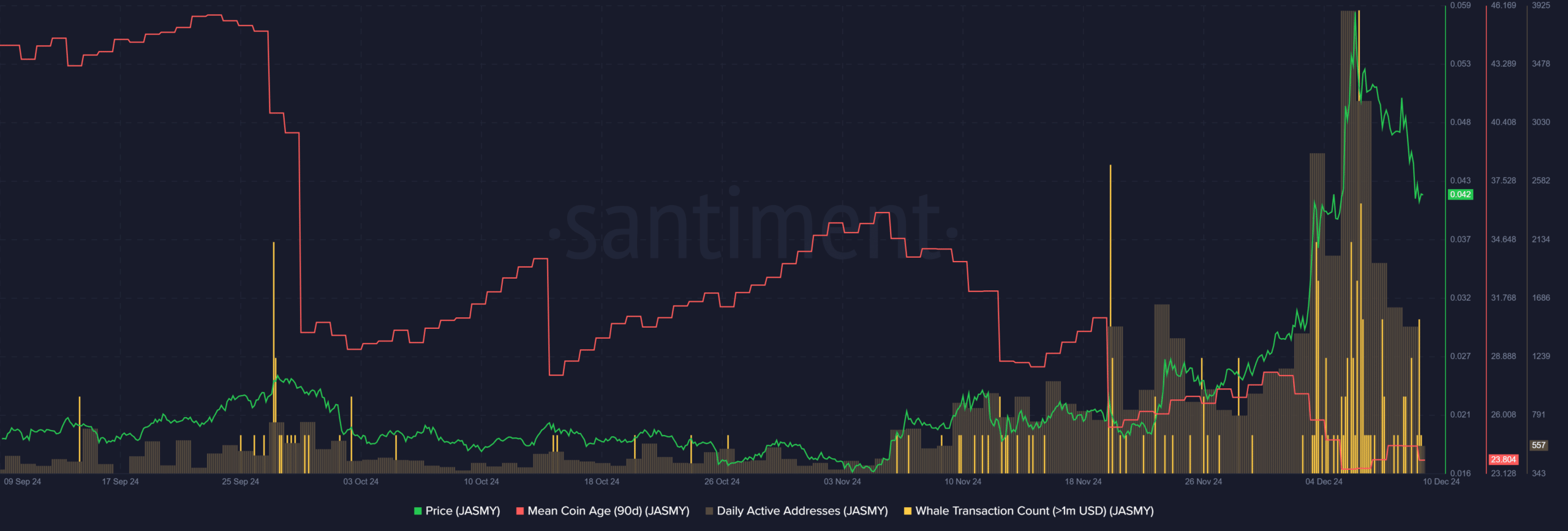

In simpler terms, the heavy trading activity seen in December has decreased during this recent downturn. For the market to keep rising, trading activity needs to increase again.

Profit-taking during the uptrend

In November and December, there was a significant increase in the number of daily active participants, with JASMY surpassing its previous six-month highs. This rise was anticipated, given that escalating prices tend to attract more public interest.

Additionally, it has noticed a decrease in the average age of coins, particularly over the last six weeks. This isn’t surprising since significant surges often trigger profit-taking.

What caught our attention were the increases in whale activities related to transactions. These occurrences have been quite frequent during the last week, coinciding with JASMY hitting its local peaks.

On December 9th, JASMY resumed its activity as it hovered around the $0.032 and $0.04 price levels where there was strong buying interest.

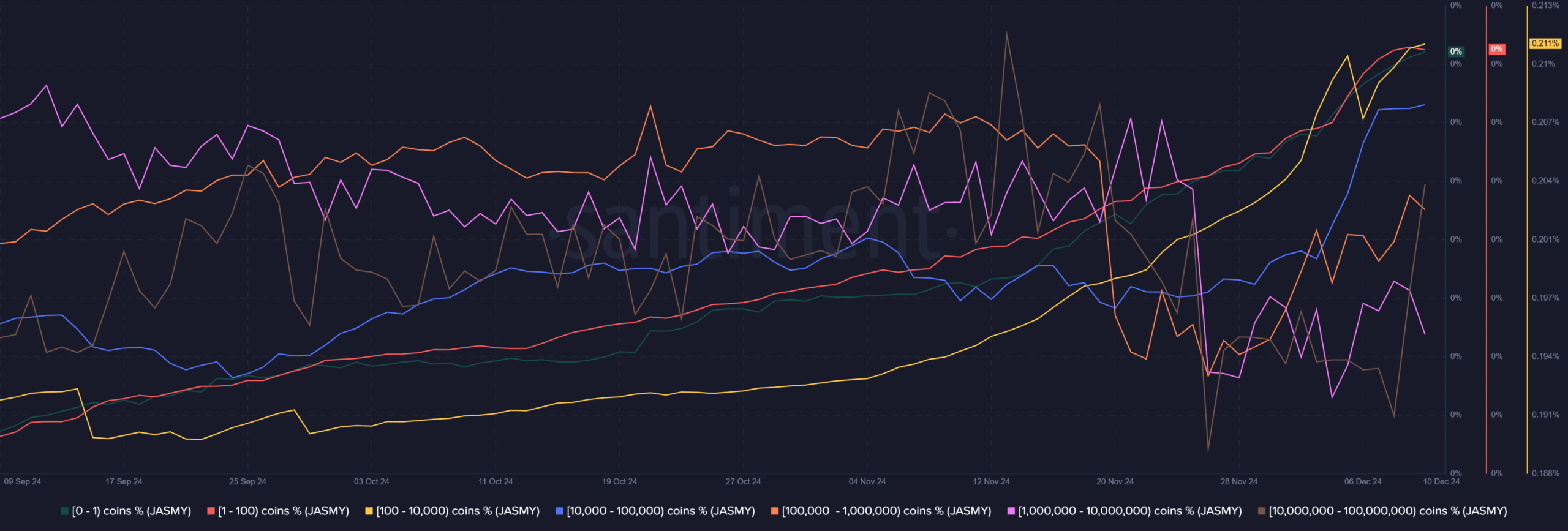

The distribution of supplies backed up the concept that distribution was continuing until late November. Various groups of owners started purchasing Jasmycoin during various timeframes over the last ten days.

The 10k-10M band began on the 29th of November.

Realistic or not, here’s JASMY’s market cap in BTC’s terms

Over the course of ten days up to December 8th, over 10 million wallets sold off their holdings. However, starting from Monday, these wallets started accumulating more assets in their possession.

In summary, although there was increased whale activity, Jasmycoin seemed to maintain a robustly optimistic forecast. There might be a phase of stabilization ahead before another upward trend occurs.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-11 04:07