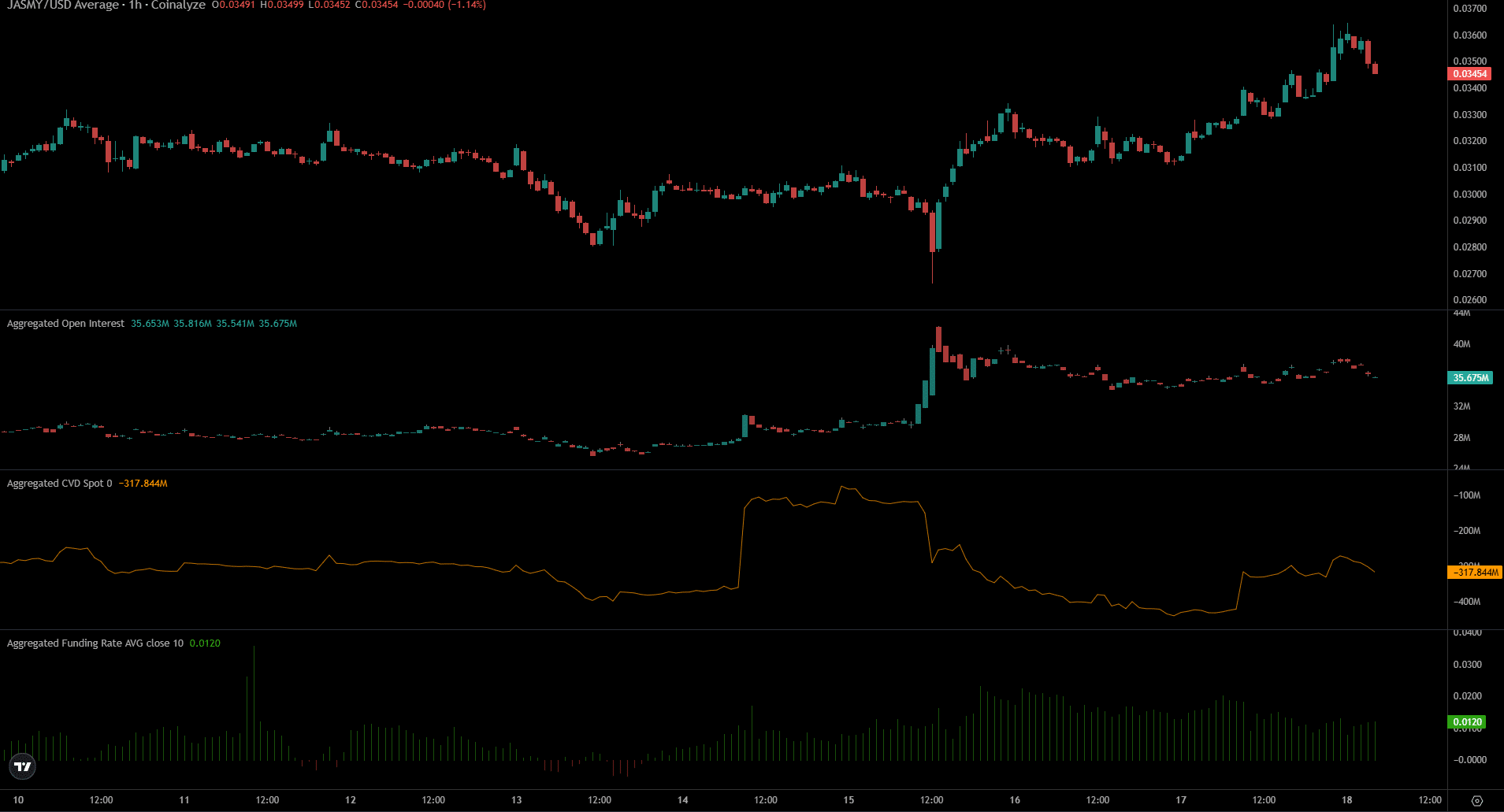

- JasmyCoin made a new lower low on Wednesday, 15 January, making the structure bearish

- Lower timeframe weakness in Open Interest revealed bullish sentiment was feeble

Over the past month, JasmyCoin (JASMY) has dropped by 18.66% from its opening price. Despite showing signs of a decline in trend since November and a temporary halt in December, it didn’t stop, and interestingly, there were indications of accumulation.

As a researcher examining the price action charts for JASMY, I’ve identified two crucial price points that could shape its future trajectory. Although there was a setback in pricing a week past, the optimistic JasmyCoin supporters still hold potential to orchestrate a comeback.

Range extremes are still important for JasmyCoin

On the daily graph, JASMY exhibited a bearish trend. From December and into early January, its price movement resembled a range, roughly fluctuating between approximately 0.032 USD and 0.04 USD. However, Bitcoin‘s [BTC] decline to $92k in the second week of January caused JASMY to fall below its support at 0.032 USD.

Following this, the price seemed to reach a fresh low in the last couple of days; however, it has not been officially confirmed yet. Trading activity has been relatively low since the latter part of December, but the recent rally from $0.03 last week did spark a slight increase in trading volume.

If the current increase in volume for JasmyCoin continues, there could be a shift in its trend from downward to upward at this point. However, it’s currently showing a negative trend, as indicated by the bearish crossover of the 20-day moving average (DMA) and the 50-DMA. Contrarily, the A/D indicator is gradually increasing, suggesting an accumulation of buying pressure.

Lack of bidding in the short-term a concern

For the past two days, JasmyCoin’s price has increased by approximately 12%. However, the Open Interest increase was just 3.4%. This modest rise in the speculative market suggests a somewhat bearish trend.

Realistic or not, here’s JASMY’s market cap in BTC’s terms

As a researcher, I’m pleased to report that the funding rate has maintained a positive trend over the past day, with the spot Cardiovascular Disease Value (CVD) showing an upward movement. While these slight bullish indicators are encouraging, they fail to outweigh the absence of significant speculative trading activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-18 12:07