- Altcoin reached the lower boundary of an ascending channel – A key level supported by the Bollinger Bands’ lower range

- Other indicators, such as the Accumulation/Distribution, pointed to a possible upward move alongside rising buying activity

As a seasoned crypto investor with scars from the 2017 bull run and subsequent bear market, I’ve learned to read between the lines when it comes to market signals. The recent dip in JUP, despite the monthly gains reduction, has me intrigued, not alarmed. With JUP hitting the lower boundary of an ascending channel supported by the Bollinger Bands’ lower range, and other indicators such as Accumulation/Distribution pointing towards a possible upward move, I see this as a potential buying opportunity.

Over the past day, Jupiter’s (JUP) value has plummeted noticeably, causing its monthly growth to shrink to only 13.24%. Those who invested during this timeframe experienced a decline of 12.08%, highlighting the severity of the market’s recent slide.

As an analyst, I am observing a steady buildup of interest from market participants towards JUP and an overall positive shift in sentiment. Such trends might trigger a turnaround for JUP, potentially marking a reversal of its recent downturns.

Support levels align for a potential JUP rally

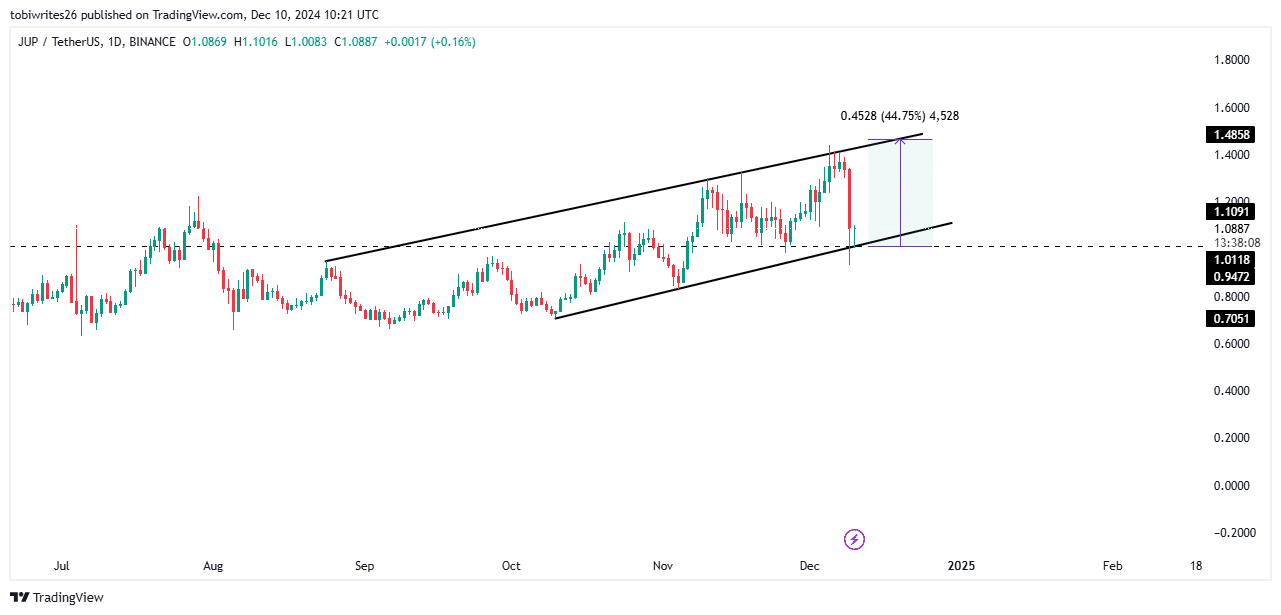

Over the past period, JUP’s price movement has been contained within a rising trendline, and it dropped following a touch of the channel’s upper boundary – the resistance level.

A rising trend line, shown here, is characterized by prices steadily increasing while being confined between a top limit of resistance and a bottom limit of support.

Its latest drop brought JUP to the channel’s lower support boundary, which coincided with another critical support level at $1.0118. The token has already shown a positive reaction at this level. If this trend continues, JUP could rise to $1.46, marking a potential gain of 44.75%.

According to AMBCrypto’s examination, various indications point towards a positive perspective, such as investors amassing more assets, potentially leading to an even stronger upward trend.

Potential reversal ahead?

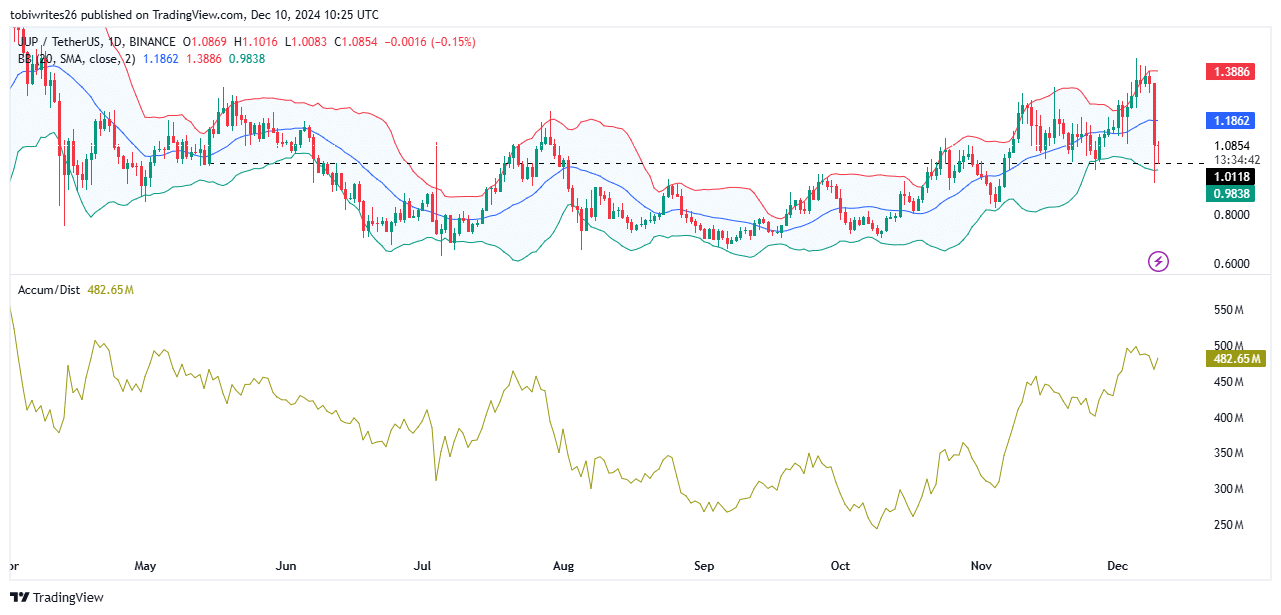

The latest drop in JUP’s performance has positioned it at the minimum level of the Bollinger Bands, suggesting a possible shift or reversal in its value trend.

Bollinger Bands represent a popular tool for measuring volatility, consisting of two boundaries positioned above and below a moving average line. When the price moves upwards towards the upper boundary, it suggests that an asset is overbought or overvalued, whereas when it approaches the lower boundary, it indicates that the asset may be oversold or undervalued.

At present, I’m observing that JUP is hovering close to its lowest point. This could imply that the asset has been overbought, possibly reducing the selling pressure and opening up opportunities for a potential rebound.

The Accumulation/Distribution indicator reinforced this perspective, highlighting an increasing accumulation pattern, which suggests that the market is moving towards a period of increased purchases.

The increase in accumulation suggests that the overall market opinion about JUP is becoming more positive, possibly setting it up for a rebound following its recent setbacks.

JUP sell-off risk declines as confidence returns

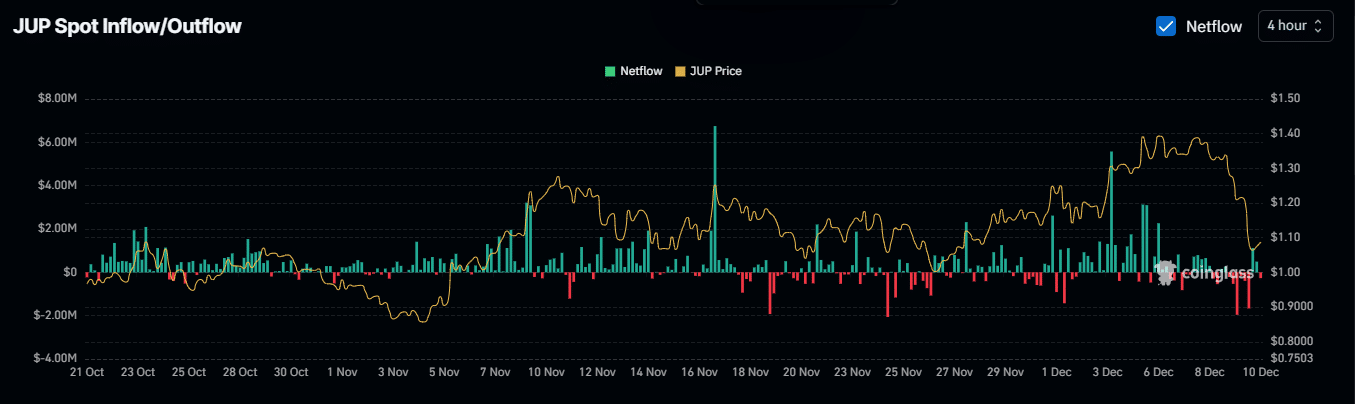

As a researcher, I’ve found intriguing insights from my examination of Coinglass’ data that hint at a decrease in market participants offloading their JUP holdings. This conjecture is bolstered by the fact that the four-hour Exchange Netflows have shifted to negative figures, suggesting less selling activity in this timeframe.

The flow of money in exchanges shows an increase in withdrawals of JUP rather than deposits, which is indicative of increased market trust following its recent 24-hour decline. Typically, this pattern leads to less JUP being available on exchanges, a situation that often means reduced selling pressure.

If the current trend persists, it’s possible that the value of JUP could grow more significantly due to increased demand stemming from a shortage of available units on trading platforms. As the accumulation of this asset increases, the scarcity might lead to a rise in its price.

Read More

2024-12-11 08:07