- Jupiter, at press time, was trading at a demand zone, but buying pressure was lethargic

- Further losses can be anticipated as the price moves towards the next key liquidity zone

As a seasoned analyst with years of market observation under my belt, I find myself cautiously bearish on Jupiter [JUP] at this juncture. The token’s recent performance, coupled with dwindling trading volume and buyer apathy, paints a grim picture in the short term.

It appears that the Jupiter [JUP] cryptocurrency is facing a challenging period in the market. Over the past fortnight, its value has plummeted by a significant 26%, and just within the last day, trading volume has dipped by 18%. This suggests a prevailing bearish sentiment among traders.

As a researcher, I’ve noticed that the Solana liquidity aggregator hasn’t been drawing in many buyers lately, despite the token being traded within an appealing demand zone. The question now is: will the bulls manage to counteract the sellers and potentially reverse this trend, or should we anticipate a further decline?

The 78.6% retracement level might not hold

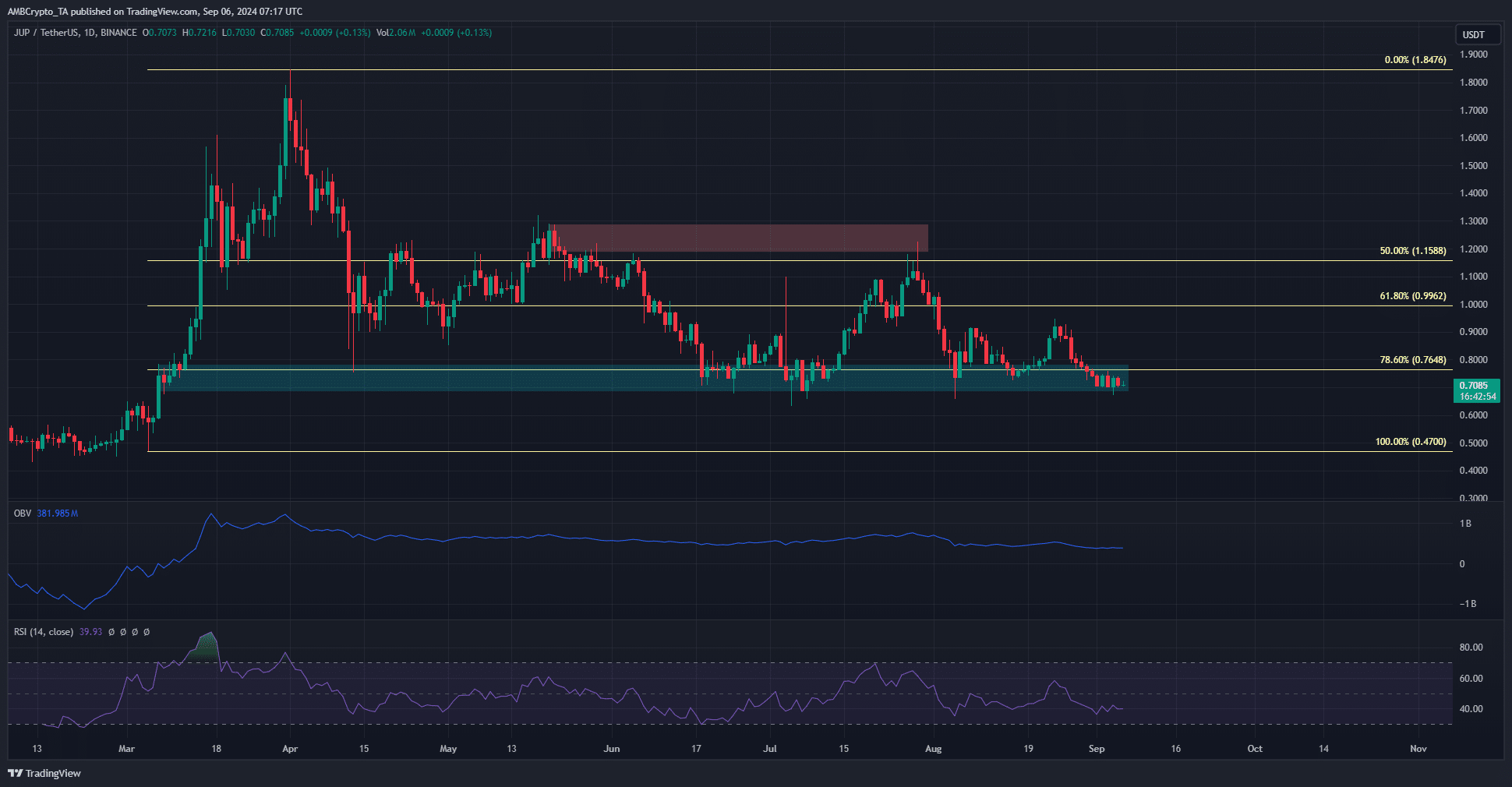

On a daily basis, the market’s trend exhibited bearish tendencies again. During this period, Jupiter seemed to establish a range spanning from $0.736 to $0.913. However, recent trading activities have caused it to dip below the lower boundary of this range.

For several months starting from April, the price range between $0.69 and $0.78 served as a significant demand area, being tested repeatedly. Furthermore, on numerous occasions, daily closures have occurred below the 78.6% Fibonacci retracement level at $0.76.

If the price drops slightly below the lows of August 5 at $0.658, it could indicate that the next potential price target is around $0.47. Over the last six weeks, the On-Balance Volume (OBV) has been decreasing gradually, suggesting a weakening buying pressure. Lastly, the Daily Relative Strength Index (RSI) shows bearish momentum with a reading of 40, indicating that the price may continue to decline.

Bullish reversal potential for Jupiter under the retracement level

If a cryptocurrency like Jupiter surpasses its current level by more than 78.6%, it often indicates that the next target could be reaching the full 100% retracement level. However, AMBCrypto has pointed out that this pattern might not hold true for Jupiter in this specific instance.

Realistic or not, here’s JUP’s market cap in BTC’s terms

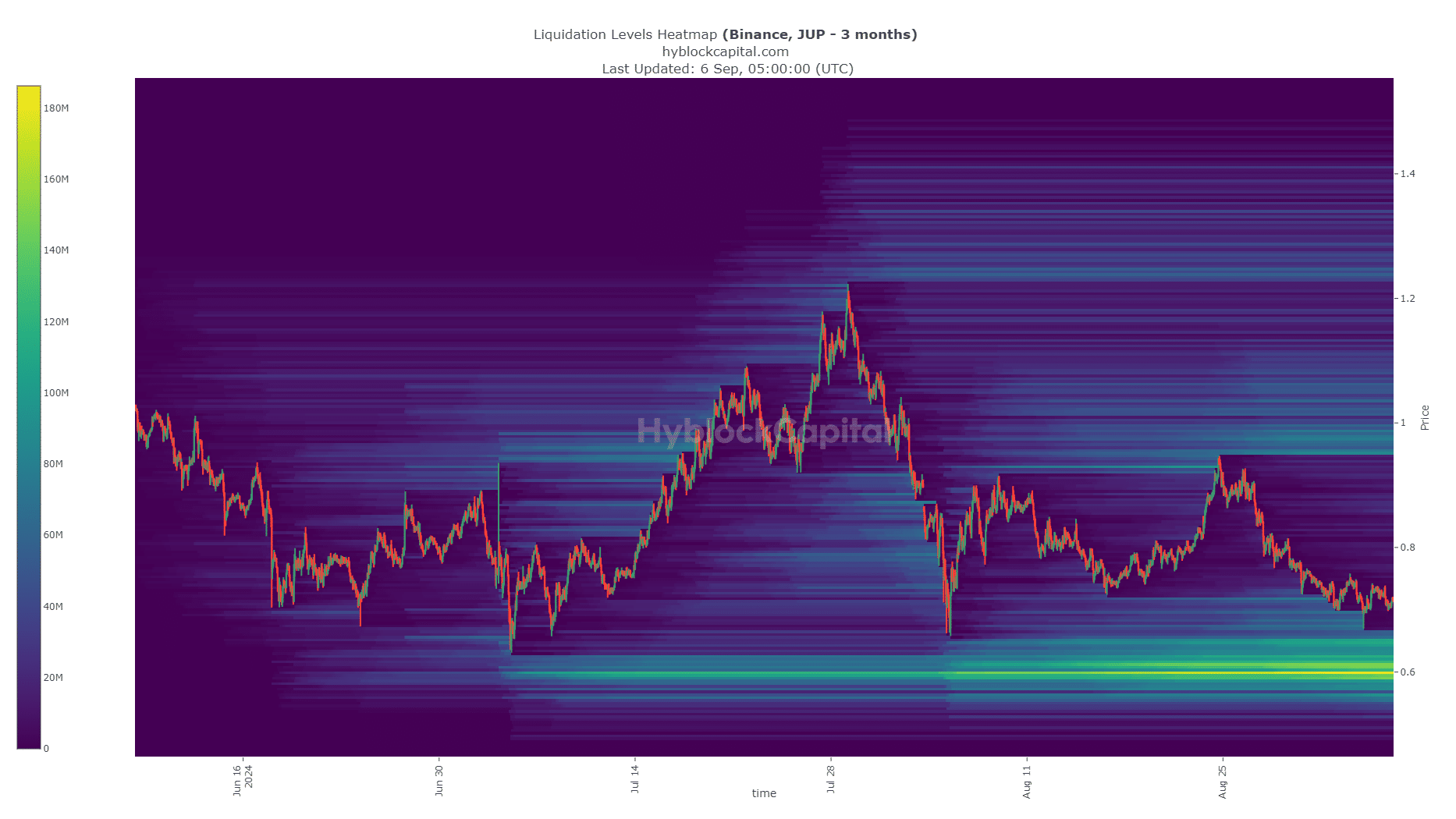

Due to an accumulation of substantial liquidity around the $0.6 level over the last 3 months, it’s possible that a dip to this point could trigger a quick recovery in JUP‘s price as it attracts and absorbs this liquidity.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-09-07 02:15