- On the bullish side, the emergence of a head-and-shoulders pattern points to a potential upside.

- However, caution prevails due to a notable imbalance in long liquidations over the past 24 hours.

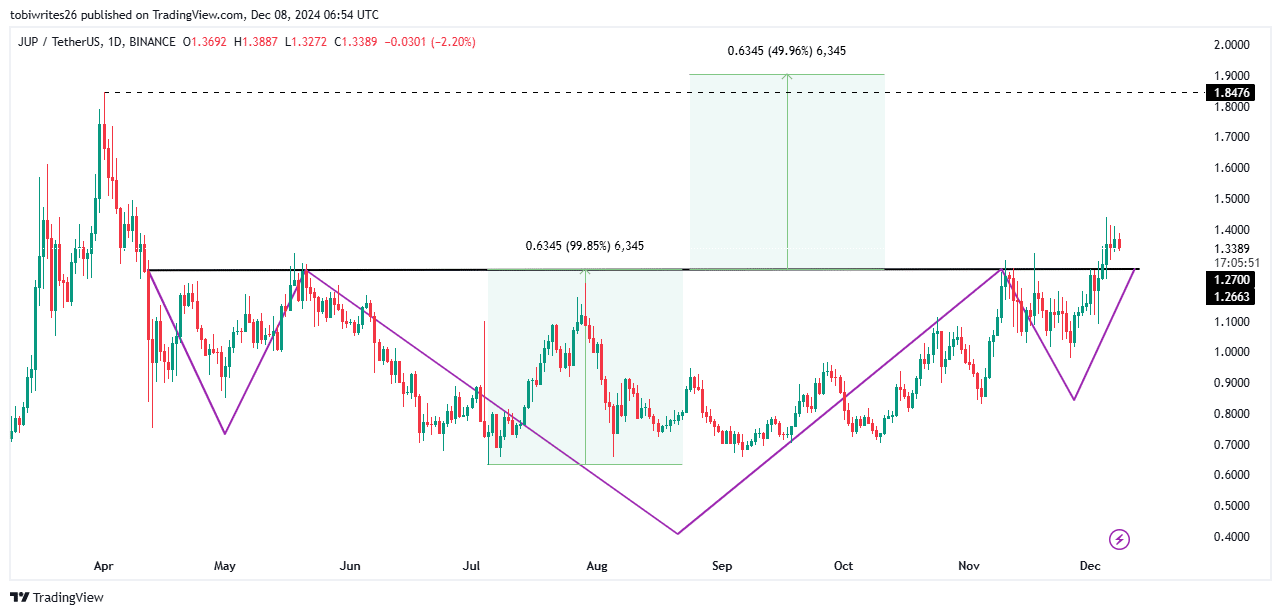

As a seasoned analyst with over two decades of market experience under my belt, I find myself in a fascinating position when it comes to Jupiter [JUP]. On one hand, the emergence of a head-and-shoulders pattern and the subsequent breakthrough of its neckline at $1.2663 offers tantalizing prospects of an imminent 49.96% upside rally, potentially taking JUP to new market highs of $1.90.

Over the past seven days, I’ve observed a robust 15.65% surge in Jupiter’s [JUP] performance. However, the pace of market activity surrounding this asset seems to have decelerated lately. Today, Jupiter slipped by 0.24%, suggesting some weak bearish pressure. This minor dip has sparked concerns about a potential decline in momentum that I’m keeping a close eye on.

For now, uncertainty dominates, with no clear indication of where the asset is headed next.

Bullish sentiment builds around JUP

It seems like optimistic trends are emerging for the stock JUP. This trend is strengthened by a decrease in the number of shares being exchanged on the market (Exchange Netflow) and an increasing number of open trades (Open Interest) over the past few days, suggesting growing investor interest.

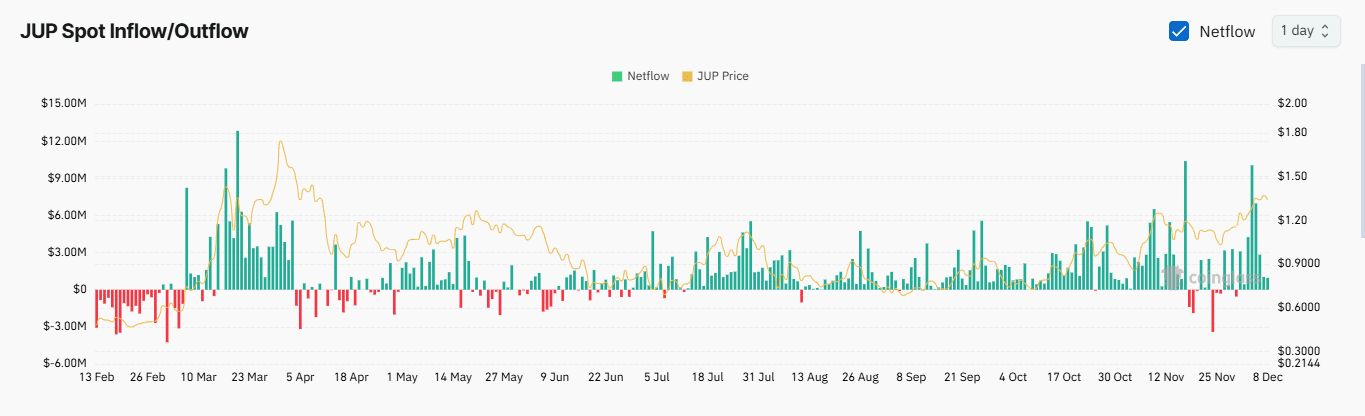

Tracking buying and selling activity through Netflow, a tool that measures the movement of assets on and off exchanges, provides valuable insights about market sentiment.

New data suggests a decline in the number of JUP deposits on trading platforms, implying that investors prefer to keep their holdings instead of selling them. Such actions help bolster JUP’s standing by limiting the amount of it available for trade on those platforms.

Over the last day, Open Interest grew by 2.62%, amounting to $169.02 million. This expansion strengthens optimistic feelings among investors because it signifies more pending contracts, primarily in the hands of long-term traders, suggesting a growing bullish trend.

Combined, these elements point towards a positive outlook for the market, but wider patterns could yet influence JUP’s path forward.

JUP set to establish a new market high

The price of JUP surpassed the key resistance level of $1.2663, which marks the upper boundary of a traditional cup-and-handle formation. This breakout may indicate the commencement of an extended upward trend.

As I analyze the current trend, it appears that if the ongoing pattern persists, JUP could potentially increase by approximately 49.96%, taking its price to around $1.90. This forecasted growth would surpass its previous record high of $1.85. The robustness of this projected move is supported by the strong pattern evident on the chart.

However, bearish sentiment persists in the market and could delay JUP’s upward momentum.

Imbalance in market liquidations

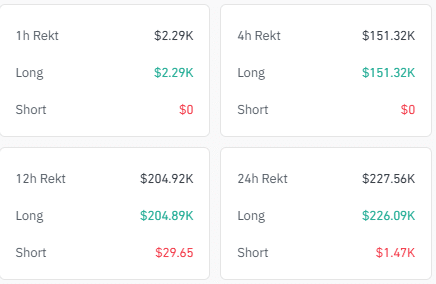

Over the past 24 hours, there has been a notable imbalance in market liquidations. At the time of writing, long liquidations totaled $226,090, while short liquidations were significantly lower, amounting to just $1,470.

Read Jupiter’s [JUP] Price Prediction 2024–2025

As a crypto investor, I notice when there’s a significant difference between long and short liquidations – it suggests the market sentiment is heavily leaning towards one direction. In this instance, it seems the sentiment is tilted towards the bearish side, favoring those who believe prices will fall.

If this ongoing pattern continues, the market may likely keep falling unless powerful upward-pushing factors step in to reverse it.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-12-08 15:03