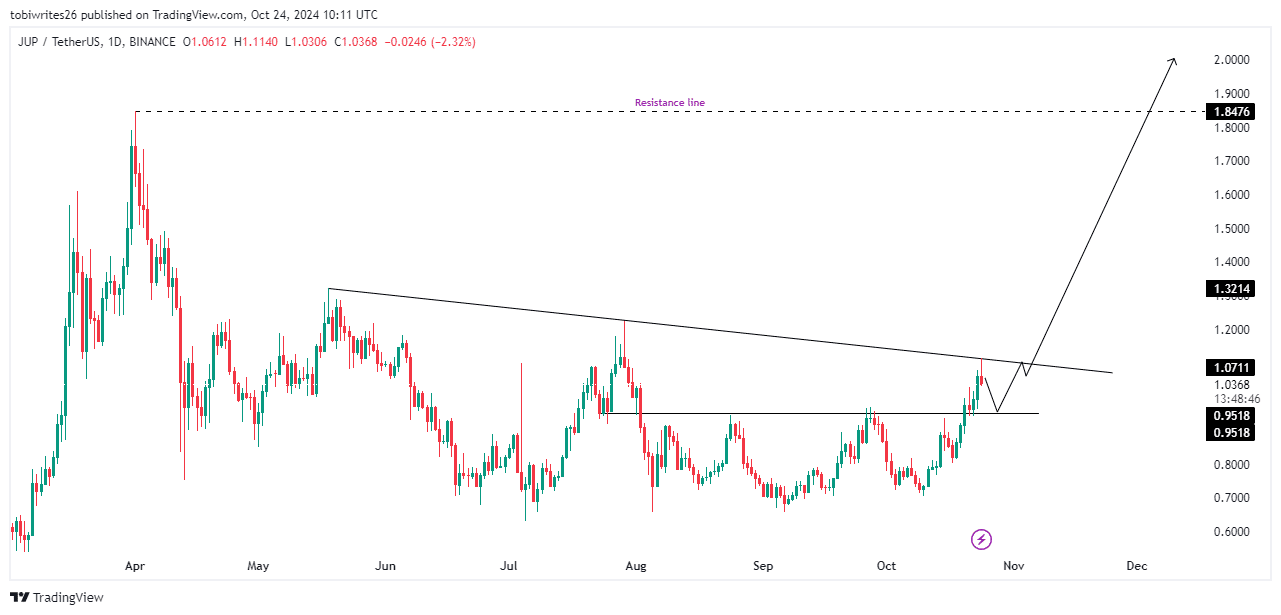

- The primary challenge for JUP is a descending trendline that has triggered three consecutive pullbacks.

- However, after an expected brief dip, JUP could see a 100% surge, targeting the $2 level.

As a seasoned researcher with over two decades of trading under my belt, I find myself intrigued by the dynamics of JUP. The descending trendline and subsequent pullbacks have been a recurring theme, but I remain optimistic about its potential for growth. With a 31.72% gain in the past month and an additional 11.30% increase yesterday, it seems that JUP’s momentum could extend further, as suggested by AMBCrypto’s analysis.

For about a month now, Jupiter (JUP) has experienced a significant surge, rising by approximately 31.72%. Notably, its daily chart indicates a steady growth trend, with an added boost of around 11.30%. This suggests the possibility of a potential spike or breakout in the near future.

According to AMBCrypto’s assessment, if JUP maintains crucial support zones and market indicators keep pointing towards a bullish trend, its positive momentum might continue to grow.

JUP market dynamics: Leg down then run up

Based on today’s data from JUP, it appears that the asset is poised for an upward surge, even though it faced resistance during its third failed attempt to advance, causing a slight dip instead.

Nevertheless, it’s anticipated that this slump will continue for some time due to heightened selling activity potentially driving JUP lower towards the support zone of 0.9158. This area is thought to be strengthened by substantial buy orders waiting in the wings.

If JUP hits this potential support point, it might lead to a bounce-back, enabling the asset initially to surmount the resistance posed by the downward-sloping trendline.

As a researcher, I’m observing a possible scenario where we might encounter resistance at approximately 1.847. If this resistance is breached, there’s a potential for a further movement towards my projected target of $2.

To predict if this potential situation might occur, AMBCrypto examined various technical signals.

Market greed suggests a potential drop for JUP

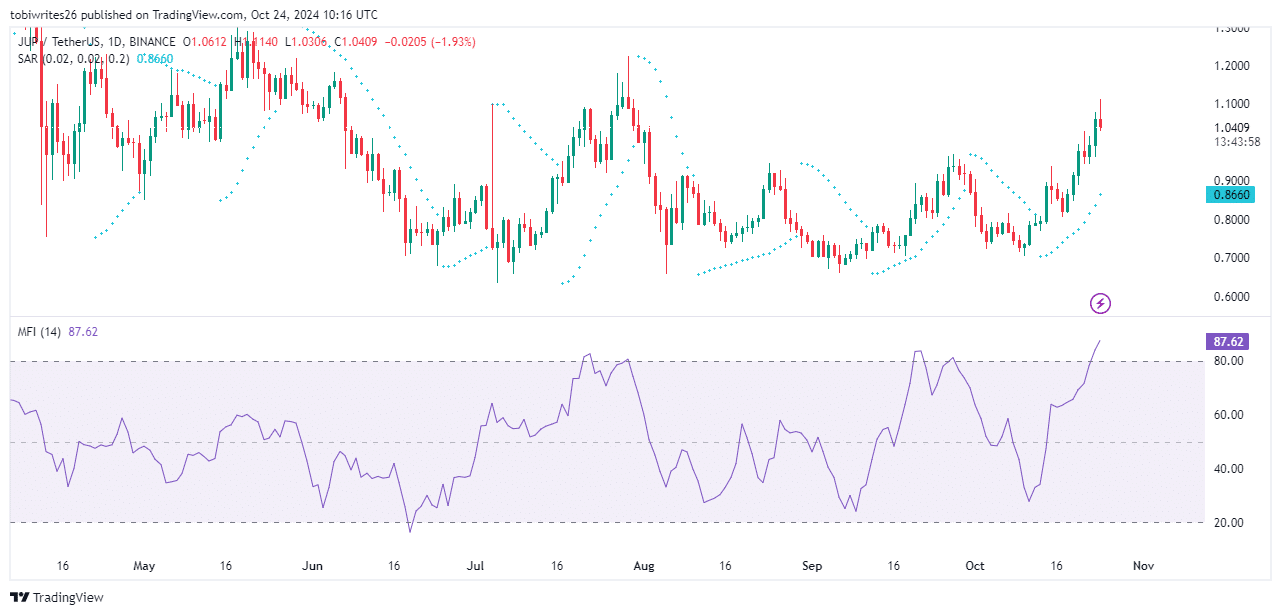

Based on the Money Flow Index (MFI), an indicator that measures the inflow and outflow of funds into assets to analyze market activity, it’s predicted that JUP might undergo a temporary decrease in value.

In simpler terms, the Money Flow Index (MFI) has surpassed 80, which suggests excessive optimism or ‘greed’ among investors. To counterbalance this, a period of correction or price decrease might occur.

The decrease should either halt at the earlier-mentioned resistance point, causing a potential price adjustment, or continue until there’s a new upward trend.

Despite any panic caused by the current downturn, the Parabolic SAR (Stop and Reverse) indicator suggests that overall market sentiment remains optimistic towards JUP’s stock. This is indicated by a sequence of dots appearing beneath JUP’s price level.

In summary, the anticipated drop is likely to be short-term before an upward movement resumes.

Open interest for JUP continues to rise

According to Coinglass data, the total value of Open Interest for Jupiter (JUP) has grown by approximately 13.89%, now standing at around $126.25 million.

Realistic or not, here’s JUP’s market cap in SOL’s terms

As an analyst, I can say that Open Interest serves as a reflection of market participants’ actions. In the current context, this data suggests an upward trend in new long contracts and the preservation of existing long positions.

This suggests that the market is maintaining its overall bullish sentiment.

Read More

2024-10-25 03:35