- JUP has been trading within an ascending channel – A pattern often preceding a downturn

- Market indicators supported this bearish outlook, owing to declining Open Interest and a hike in Exchange Netflows

As a seasoned crypto investor with over a decade of experience navigating market cycles, I must admit that the current outlook for JUP is giving me a sense of déjà vu. The ascending channel pattern and the bearish indicators are reminiscent of similar situations I’ve encountered in the past, often preceding downturns.

Following a brief surge that took JUP beyond $1, the asset has since begun to fall, reducing its monthly growth to approximately 14.69%. Notably, within the past day, JUP has decreased by 2.33%.

According to AMBCrypto’s examination, it seems likely that the value of JUP could decrease even more in the future. This is particularly true given its current trend, which appears to be heading downwards for an extended period.

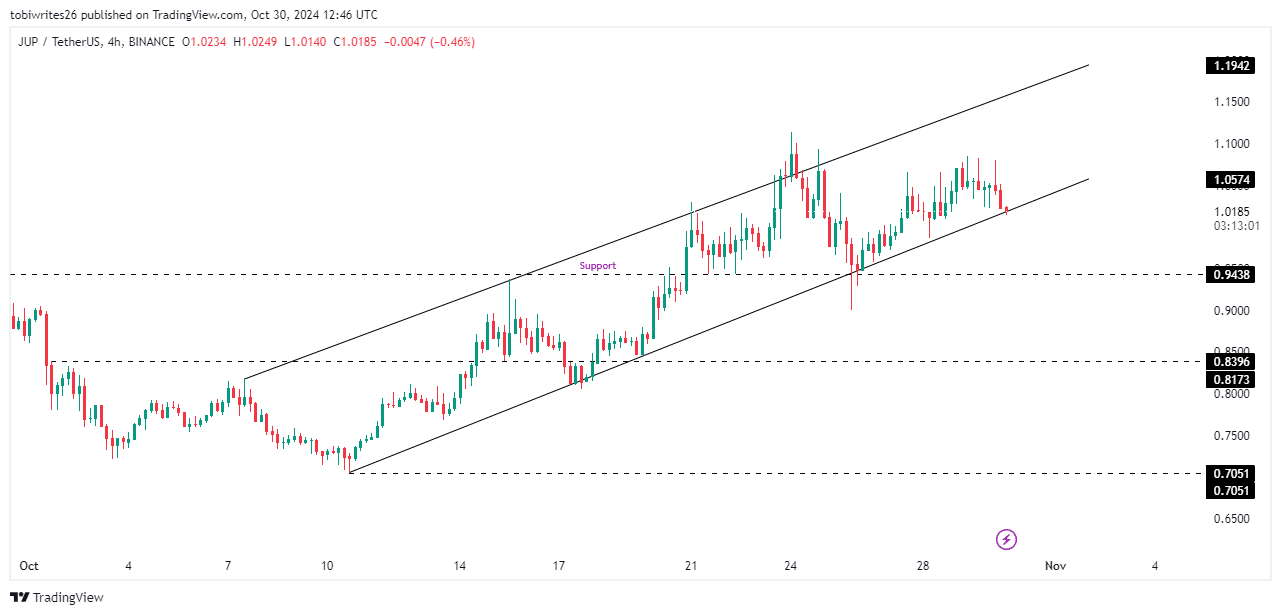

Bearish pattern could trigger JUP’s decline

Currently, at the point of composition, it appears that JUP is exchanging within an uptrending band – a figure in which the prices fluctuate within a specific boundary, generally moving upward, often preceded by a significant drop.

On the lower end of this trading channel, the digital asset JUP might reassess its strength near a supportive price point approximately $0.9438. This could trigger a brief recovery in the short term.

As a researcher studying the trends of JUP, it’s important to note that a potential breach at the current level might trigger a slide towards lower price points. Should this occur, we could expect a temporary rebound around $0.8396 before a further decline to the support level of the ascending channel at approximately $0.7051.

An examination by AMBCrypto found an increase in on-chain selling actions, which supports the idea that prices might continue to drop.

Lack of confidence drives JUP’s sell-off

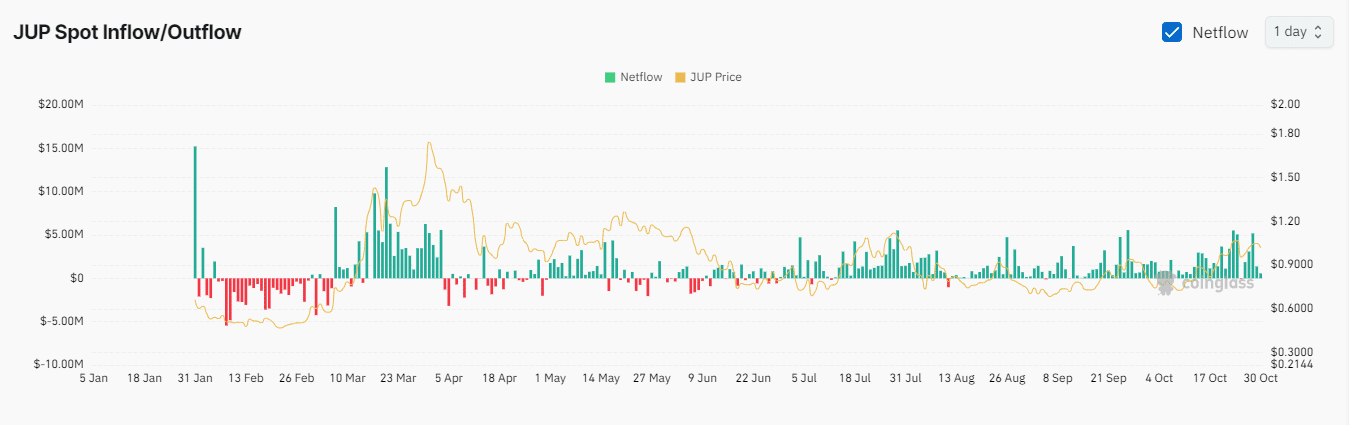

It seems that investors’ trust in JUP is waning, as indicated by the recent increases in daily and weekly outflows from the exchange.

Currently, as I’m typing this, Exchange Netflows have displayed a daily positive figure of $565,590 and a weekly one of $7.01 million. This suggests that investors are transferring assets from personal wallets to exchanges, which can be an indicator of selling pressure, predicting potential future price drops.

Moreover, Coinglass indicated a decrease of 4.13% in the Open Interest (OI) of JUP, amounting to $135.18 million. This trend implies an increase in the number of short positions being established and upheld.

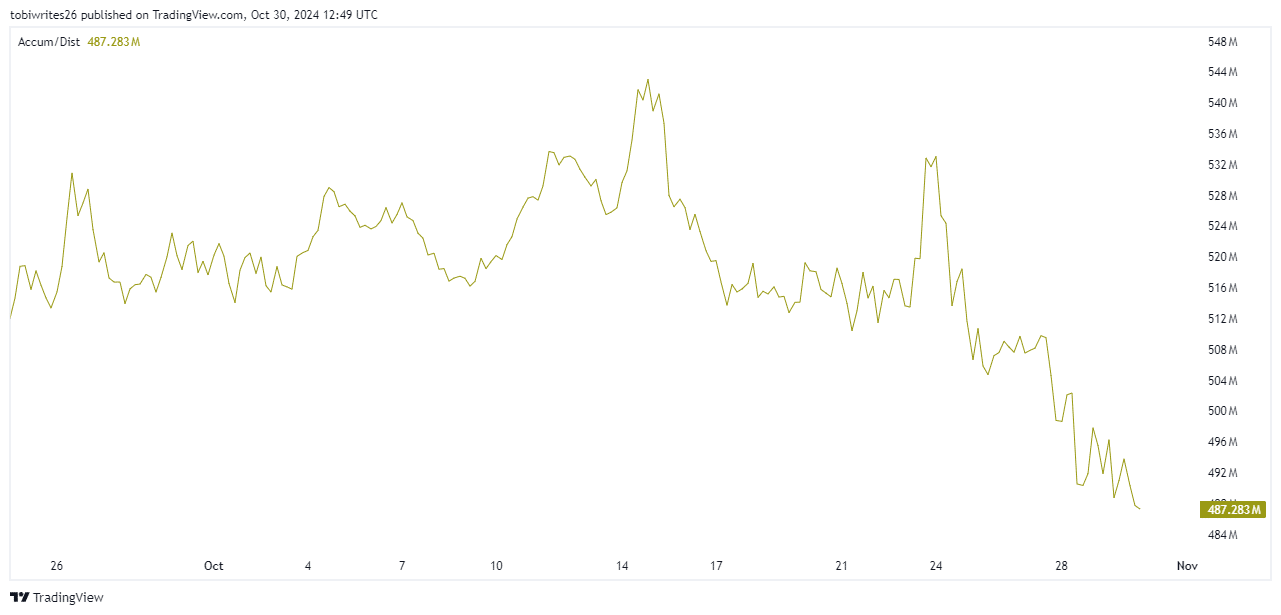

Based on two indicators showing a decline, it’s clear that the Accumulation/Distribution (A/D) line is signaling persistent selling actions within the market.

More selling activity detected

Lastly, consider examining the Accumulation/Distribution (A/D) index as well. This tool measures market supply and demand by considering both price and trading volume. It tends to increase when there’s strong buying and decrease with significant selling – a possible indication of impending trend changes.

Since October 24th, the JUP indicator has dropped sharply. At the moment of reporting, it stood at 485.311, demonstrating substantial selling activity on the graphs.

Should the current downward trend continue, it seems plausible that JUP might break down from its rising channel, possibly causing the price to fall towards the lower goal of approximately $0.7051.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-31 12:08