- Jupiter’s breakout from a descending triangle and surging TVL signal strong bullish momentum.

- Social dominance spikes while liquidation data highlight accelerating interest and sustained upward pressure.

As a seasoned researcher with years of experience navigating the complexities of the crypto market, I can confidently say that Jupiter [JUP] is on an impressive upward trajectory. The TVL surpassing $2 billion and the total transaction volume exceeding $374 billion underscore its growing influence in decentralized finance.

Jupiter (JUP) – the premier Decentralized Exchange (DEX) aggregator on Solana – has hit a significant achievement, as its Total Value Locked (TVL) now stands above $2 billion. Additionally, the total transaction volume handled by this protocol has soared to an impressive $374 billion, underscoring its expanding influence within the decentralized finance sector.

Additionally, it’s worth noting that JUP’s price rose by 10.09%, reaching $1.24 at the present moment. Simultaneously, its 24-hour trading volume soared by a massive 196.50% to an impressive $443.68 million. As a result of this extraordinary surge, JUP has attracted considerable interest from both traders and analysts.

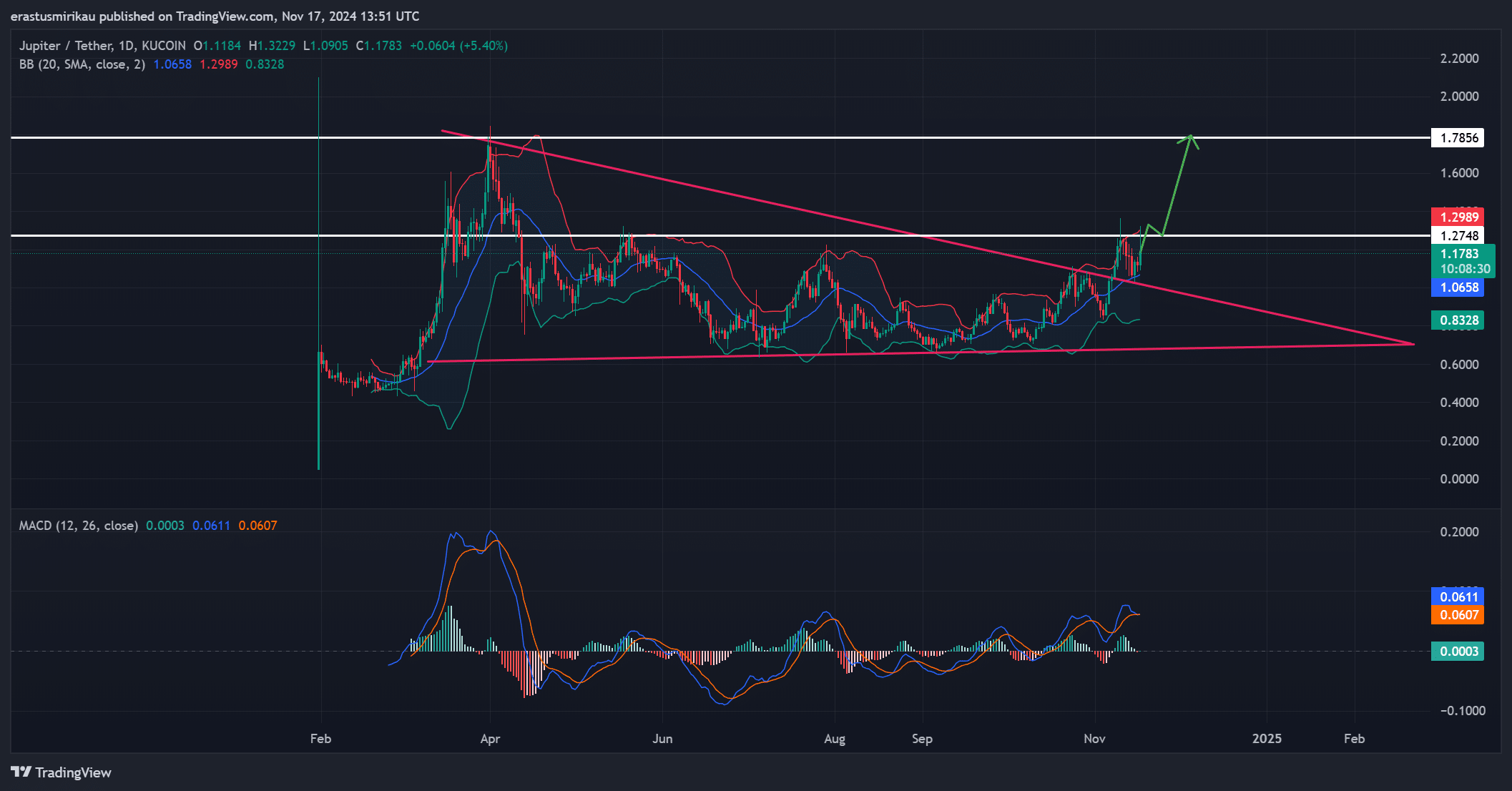

JUP technical analysis reveals bullish momentum

The cost of Jupiter has surged beyond a downward-sloping triangle pattern, suggesting robust optimism among buyers. Reaching a peak of $1.3229 during the day, the price subsequently stabilized at $1.24, continuing to trend upward.

Bollinger Bands (BB) suggest increasing market volatility, as JUP’s price has broken through the upper limit, which typically signals robust buying interest.

Furthermore, the Relative Strength Index (RSI) is now at 70, signifying significant buying activity. However, this could indicate that the asset may be overvalued temporarily, suggesting potential for a correction in the near future.

Furthermore, the Moving Average Convergence Divergence (MACD) supports a bullish outlook since the momentum line surpasses the signaling line. Consequently, it seems that JUP is poised for additional gains, with the next substantial resistance likely to be at $1.7856.

However, short-term retracements cannot be ruled out, given the current overbought conditions.

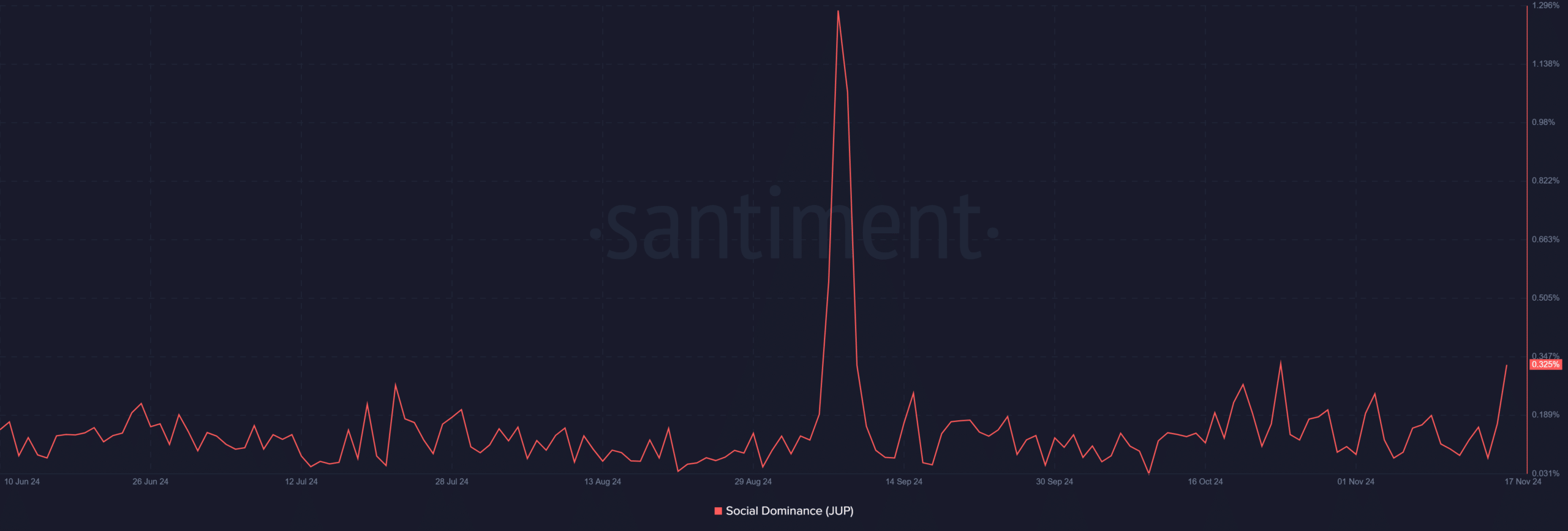

JUP social dominance spikes as interest grows

The surge in Jupiter’s value isn’t the sole sign of its recent prosperity. In fact, its influence or dominance has more than doubled from 0.166% to 0.329%, which suggests a significant spike in online conversations and interactive community involvement, as demonstrated by increased activity on digital platforms.

As an analyst, I’ve noticed a correlation between rising public engagement on social issues and increased retail involvement, which in turn amplifies market dynamics. This trend seems to boost the profile of JUP, indicating growing faith in its ecosystem and the possibility of persistent demand.

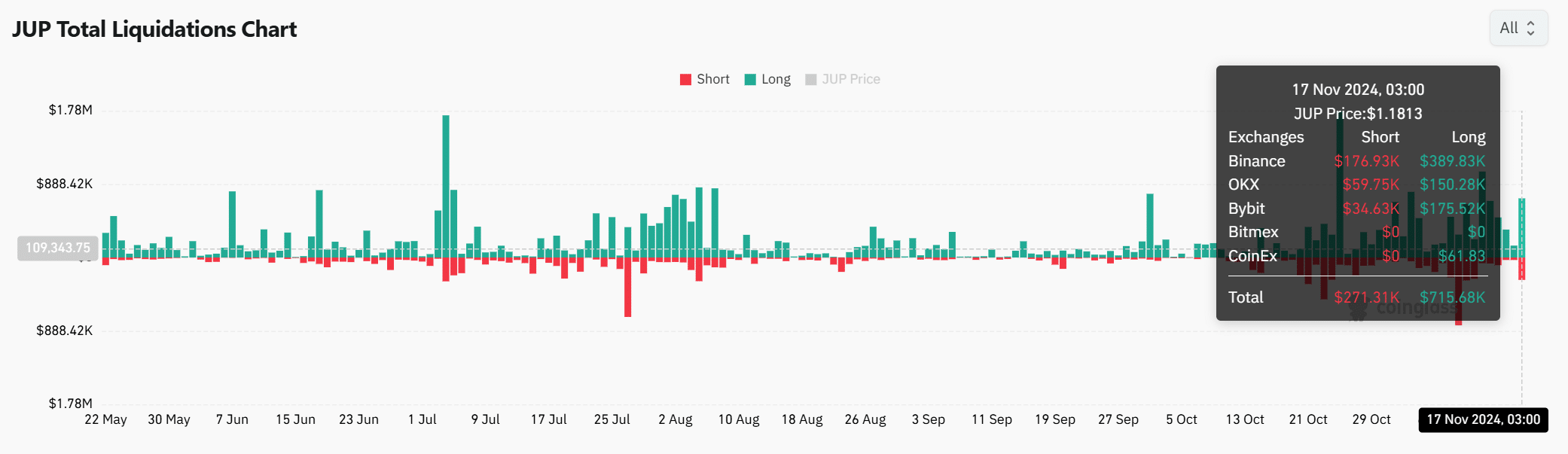

Liquidation data reveals bullish momentum

The data from the liquidation process offers another persuasive reason for JUP’s surge. In the past 24 hours, long liquidations amounted to $715,680, contrastingly, short liquidations were $271,310. This disparity indicates a strong push in the upward direction, as the liquidated short trades contributed to the market’s buying strength.

As a crypto investor, I’ve noticed that such occurrences usually spark increased speculation and market turbulence, leading to rapid price fluctuations in the near future.

Realistic or not, here’s JUP’s market cap in SOL terms

JUP shows clear signs of strength

The increasing total value locked in Jupiter, a spike in transaction volumes reaching new records, and a price surge indicate a rapid increase in its usage. Given its bullish technical signs and active on-chain behavior, it seems that JUP is poised for even more expansion.

Although temporary caution might be appropriate given the overbought indicators, breaking through significant resistance hints at a continued bullish trend. This surge indicates that Jupiter could be taking the lead in the Decentralized Finance (DeFi) sector.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-11-18 11:19