- Recently, JUP encountered a significant hurdle as it failed to break above a key resistance level, leading some traders to sell.

- Despite this, bullish sentiment remains strong, helping JUP avoid a sharp decline amid recent selling activity.

As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I’ve seen my fair share of bull markets and bear markets. The performance of Jupiter (JUP) has caught my attention lately, and I must admit, it’s been quite the rollercoaster ride.

As a researcher observing the cryptocurrency landscape, I must acknowledge the striking market performance of JUP (Jupiter). Compared to other tokens, it has managed to gain ground significantly. Over the past month alone, its value has soared by an impressive 45.85%. Furthermore, within the last 24 hours, it has demonstrated further growth, climbing an additional 5.89%.

On the other hand, it remained unclear if this rally would continue because some market participants chose to buy, whereas others opted to sell.

Jupiter’s bullish potential could drive price to $1.8

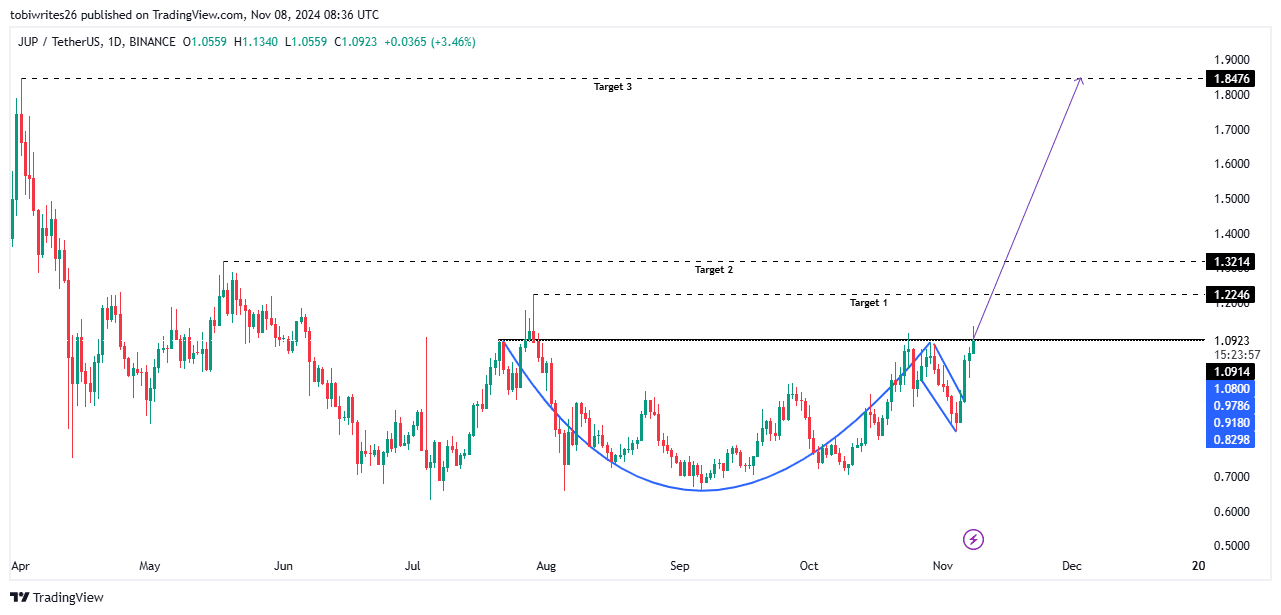

According to the graph, JUP exhibited optimistic indicators, shaping a “cup and handle” configuration (highlighted in blue on the following image). This pattern, which typically suggests an imminent price increase, was observed.

To see an upward trend for JUP, it needs to initially surpass the significant resistance point at $1.0914. This level might be filled with strong selling activity. Once this hurdle is crossed, there are three potential price points to watch: $1.22, $1.32, and a long-term goal of $1.8.

Further analysis indicated a strong likelihood that this rally could unfold.

Accumulation continues, supporting bullish momentum

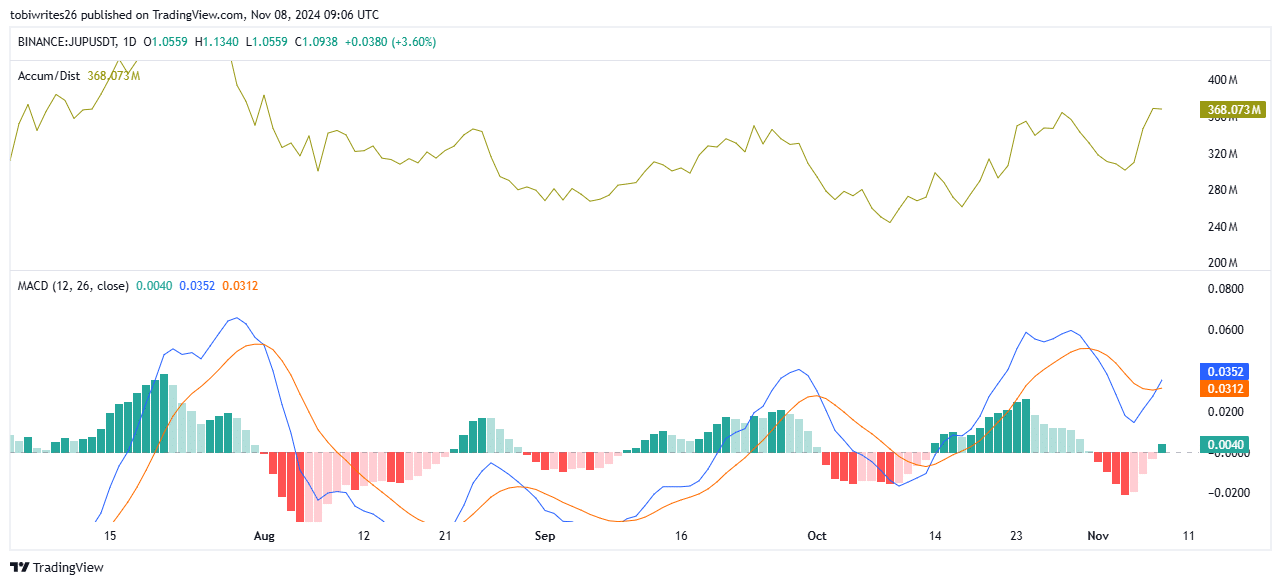

As a researcher, I’m observing an escalating accumulation that seems poised for potential growth. At the moment, the trading volume sits at approximately 367.829 million units, suggesting robust purchasing activity.

The A/D indicator quantifies the rate at which assets are being bought or sold based on the inflow and outflow of volumes. By merging price and volume data, this tool allows traders to evaluate the strength of buying or selling activity within the market, thus providing insights into market sentiment.

At the same time, the Moving Average Convergence Divergence (MACD) was climbing too, entering the positive zone, a sign that suggested a favorable or optimistic viewpoint for the market.

In simpler terms, the MACD (Moving Average Convergence Divergence) has created a “Golden Cross” configuration, meaning that the blue MACD line moved above the orange Signal line. Historically, this pattern indicates an upcoming strong upward trend, possibly propelling JUP towards its anticipated price level of $1.8.

Boosting this positive trend was the Open Interest, representing the count of unresolved contracts within the market. At present, there’s a higher number of long contracts, which has grown by 17.17%, totaling approximately $139.51 million as reported by Coinglass.

Selling pressure could stall JUP’s rally

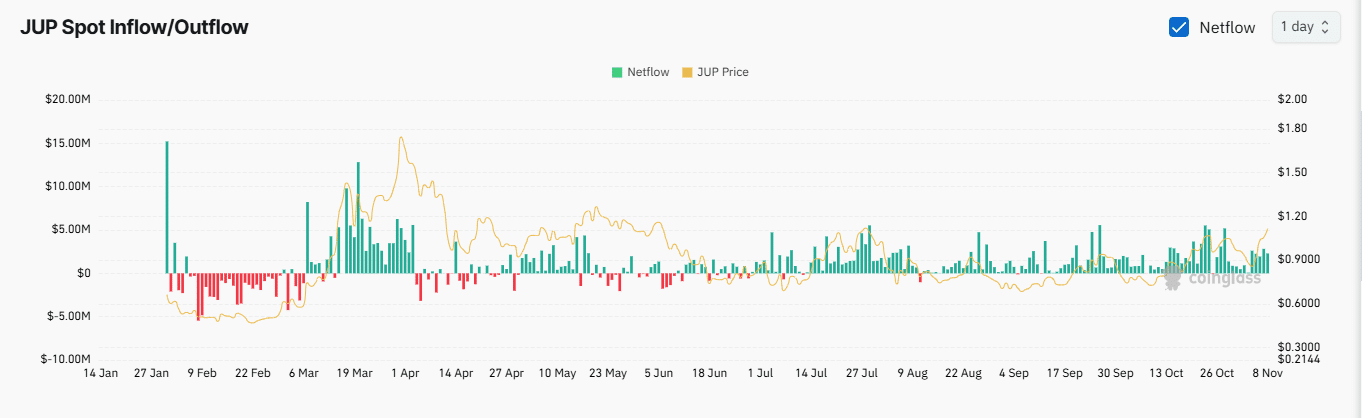

According to AMBCrypto, there’s been substantial selling action on the cryptocurrency JUP, which might slow down its upward trend. Evidence of this selling pressure comes from factors like the unfavorable Funding Rate and the positive Exchange Netflow.

Currently, as I’m typing this, the Funding Rate has fallen to -0.0007, which means that those holding short positions are paying those with long positions to keep their trades active. Moreover, the Exchange Netflow has consistently been positive across all periods, ranging from hourly to weekly.

Realistic or not, here’s JUP’s market cap in SOL terms

As a seasoned trader with years of experience under my belt, I have noticed that certain patterns can indicate significant market movements. In this case, the surge of Jupiter tokens being deposited into exchanges over the last seven days strikes me as a sign that spot traders are positioning themselves to sell. This could put downward pressure on the asset’s price, potentially making it a less attractive investment for those holding onto their JUP. It’s important to stay vigilant and adapt one’s trading strategy accordingly based on these market signals.

As a crypto investor, I can see that the current metrics seem to be pushing prices lower, with selling continuing to dominate. It appears that the trend for JUP’s price may be heading downwards if this pattern persists.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-09 01:44