As a seasoned crypto trader with over a decade of experience navigating the volatile and ever-evolving digital currency landscape, I must admit that the latest entrant into the memecoin community – Just a Chill Guy – has certainly piqued my interest.

In this thriving cryptocurrency landscape, with Bitcoin scaling unprecedented heights and Ethereum experiencing a notable surge, it’s the memecoins that continue to captivate us with their groundbreaking digital offerings – as a researcher immersed in this dynamic field, I can’t help but be intrigued.

The newest internet humor trend caters to budding cryptocurrency investors, particularly those who explore unconventional blockchain assets on the Solana platform, by depicting a laid-back individual – often referred to as simply “Chill Guy.

It’s likely that CHILLGUY will challenge well-known meme coins such as BONK and dogwifehat, following notable endorsements and strategic listings which are expected to bolster its longevity.

What’s The Hype Behind Just a Chill Guy Meme?

Just a chill guy has become a famous internet joke circulating across social media and meme creators and, of course, made its way to the crypto community.

On November 20th, a new cryptocurrency, modeled after the “just a chill guy” meme, was launched. Remarkably, it has managed to break into the top 250 cryptos among the 10,000 listed on Coinmarketcap’s tracking list in a short span of time.

Approximately 1 billion tokens make up the total supply, all of which are currently in circulation. This distribution strategy has been criticized as being shortsighted by some. However, numerous individuals have reaped significant profits due to the high volatility in the value of the laid-back coin.

One meme coin millionaire hit the jackpot with over $6 million profit from buying CHILLGUY tokens two weeks ago.

Just a Chill Guy Price Performance

Initially, the relaxed fellow’s price saw significant ups and downs, reaching a staggering 30% volatility on its debut day. Interestingly, after this turbulent start, it settled around the $0.44 and $0.40 price points.

Over the subsequent period, I observed a significant decrease that took the price down to around $0.30 – $0.40. However, on the 21st of November, an all-time high was reached with a closing price of $0.5036.

24 hours saw a significant jump in the token’s value on the 24th of November, climbing from $0.29 to $0.476. This surge offered numerous traders attractive profits.

On the 27th of November, CHILLGUY experienced a further surge, peaking at $0.70 before ending the day at $0.565.

CHILLGUY Price Analysis

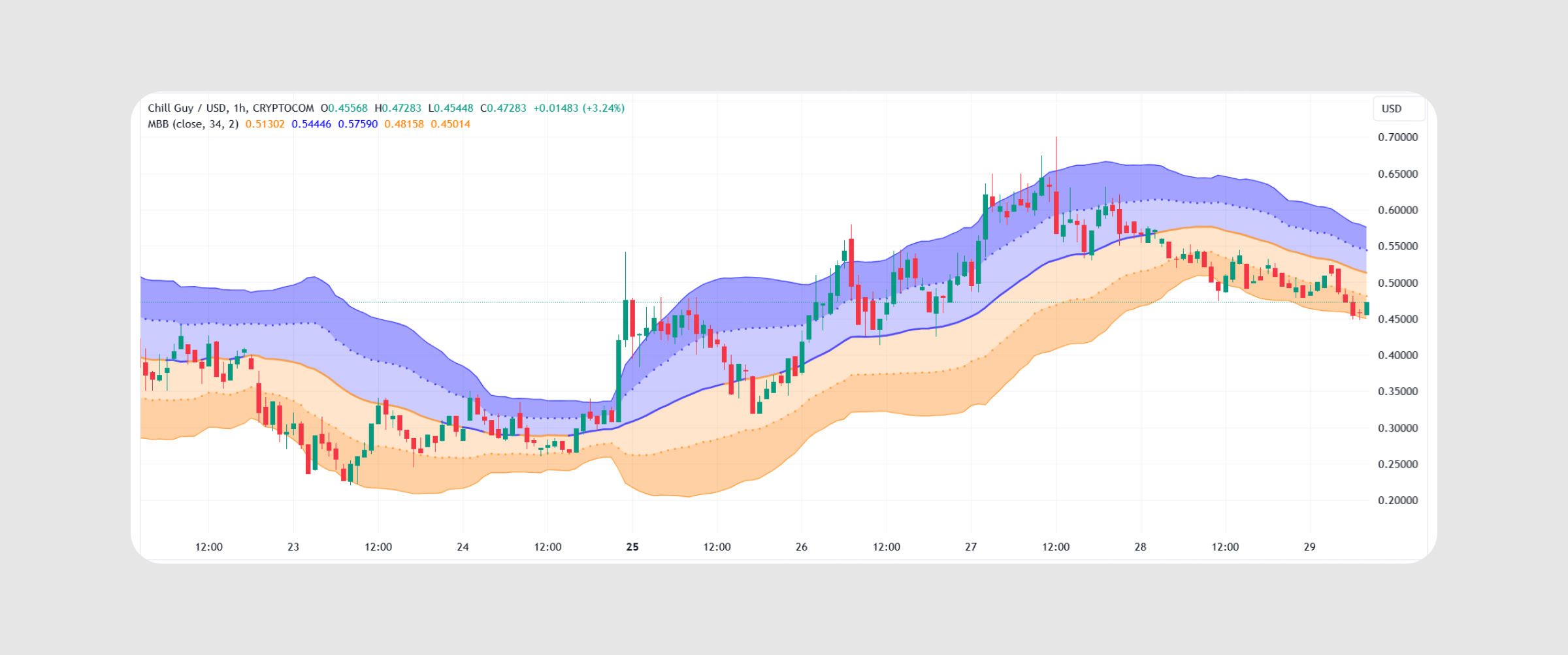

Let’s analyze just a chill guy price and predict future trajectories using the Bollinger bands.

On the 28th and 29th of November, the market price appears to fall beneath the midpoint line, indicating that the CHILLGUY is currently trading for less than its average value.

On the 29th of November, the price trended downwards towards the lower limit, suggesting heavy selling and potential for a price increase. Interestingly, in the subsequent hour, the price rose by about 3%, as signaled by a green candlestick.

The price of coins could potentially maintain its trend, experiencing a dip following an earlier rise, suggesting that the current downward slide, along with reaching the lower limit, might signal an approaching bullish phase in the market.

Conclusion

A new meme-based cryptocurrency, simply called “Just Chill,” has made its debut, noticeably boosting the current bullish trend in the crypto market and generating wealth through its unpredictable fluctuations.

Initially, the CHILLGUY token made a powerful debut, securing key placements on prominent exchanges and receiving endorsements that generated significant buzz. But as traders are engaging in both buying and selling activities, there’s speculation about whether CHILLGUY coin could surpass DOGE and claim the title of the foremost meme cryptocurrency.

Note: The contents of this piece are meant for educational purposes solely. They should not be used to guide financial decisions, nor should they be taken as professional investment advice. Conduct thorough research and seek counsel from a financial expert prior to making any investments.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

2024-12-02 13:19