Whispers of financial alchemy have seeped through the digital ether, revealing that crypto’s enfant terrible, Justin Sun, has deposited a veritable mountain of Ethereum into a liquid-staking service, as if hoarding fireflies in a jar.

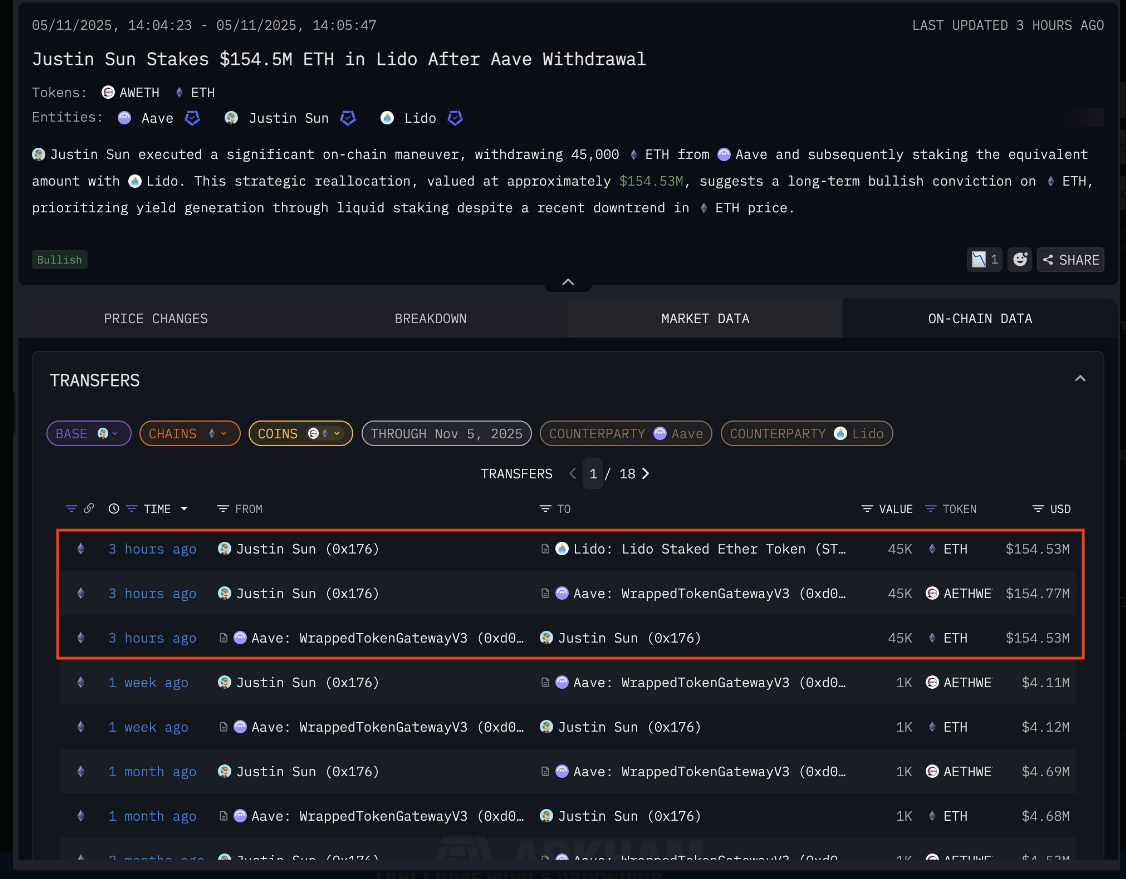

On-chain data, that immutable ledger of the digital age, reveals a sum of 45,000 ETH-approximately $154.5 million, a figure that would make even a Victorian banker weep into his brandy-was spirited away from Aave, that lending protocol of yore, into Lido’s staking pool, a sanctuary for those who wish to keep their coins in a state of perpetual limbo.

The transaction, as public as a scandal in a Parisian salon, drew the attention of the crypto cognoscenti, its scale and timing as notable as a peacock in a henhouse.

Sun’s Public Wallets Grow

The funds, previously languishing on Aave, were then transmuted into Lido, which bestows staked-ETH tokens-essentially, paper promises to a future of yield, though one might argue they are more akin to a magician’s trick.

According to the whispers, Sun’s public wallets now brim with $534 million in ETH, a sum that eclipses his holdings in TRX, the native token of his empire, which hovers near $519 million. A triumph of liquidity over legacy, one might say.

Market sages, those modern-day oracles, posit that this maneuver signals a shift in the tides of capital allocation, though their interpretations are as varied as the colors of a rainbow.

JUSTIN SUN JUST STAKED OVER $150M OF ETH [ARKHAM INSIGHTS]

Justin Sun just withdrew $154.5M of ETH (45,000 ETH) from AAVE and deposited it to Lido Staking. He currently holds $534M of ETH in his public wallets, even more than he holds in TRX ($519M).

We found this through…

– Arkham (@arkham) November 5, 2025

Bigger Stakes, Bigger Questions

Analysts, ever the dramatists, have reacted with the fervor of a crowd at a circus. Some hail this as a testament to ETH’s yield potential and the security of its protocols, while others mutter about the dangers of concentrating power in the hands of a single provider, a scenario as perilous as a lion tamer with a weak grip.

Price, that fickle dance partner, remains as unpredictable as a Russian novel’s plot. Staking, too, is a gamble-smart contract bugs, validator downtime, and slashing events lurk in the shadows, waiting to snipe the unwary.

Market Context And Price Action

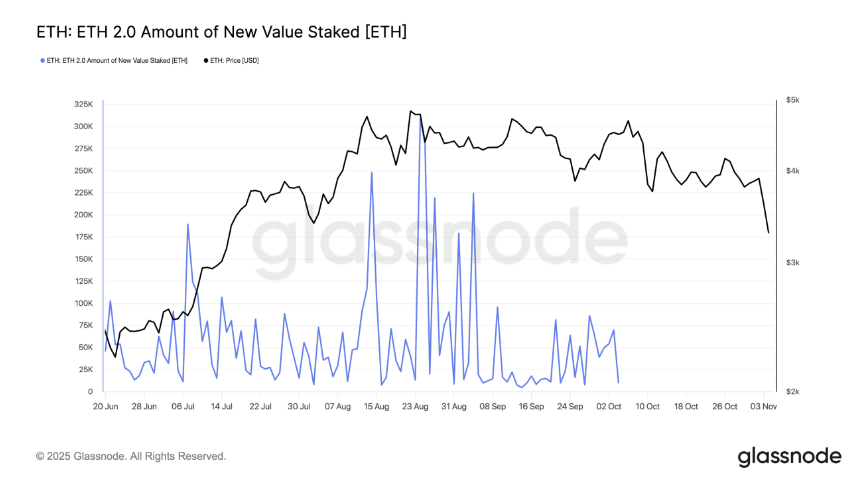

At the time of this transaction, ETH danced at $3,389, having slipped 12% in the preceding week. Such a decline makes large staking flows as visible as a neon sign in a library, especially when the market is in a state of flux.

In the broader crypto landscape, institutional whales and titans have been increasingly drawn to staking, as if seeking solace in the arms of yield-generating alchemy.

Lido, that titan of liquid staking, remains a focal point, its market share scrutinized by traders and researchers alike, as one might examine a painting for hidden symbols.

Sun’s actions, whether a long-term bet, a yield-driven gambit, or a broader portfolio reconfiguration, remain as enigmatic as a Nabokov novel’s final page. Yet, it is but a single thread in the tapestry of a larger narrative, woven with holdings, trades, and trends that elude even the most astute observers.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- The Best Members of the Flash Family

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

2025-11-06 19:30