-

Justin Sun downplayed risk USDD fears after withdrawing its 12K BTC collateral.

Despite the reassurance, an analyst viewed Sun as a likely risk factor in the space.

As a seasoned analyst with over two decades of experience in the financial markets, I have learned to read between the lines and assess situations from multiple angles. Justin Sun’s recent actions involving USDD and WBTC have raised eyebrows in the crypto community, and for good reason.

As a seasoned cryptocurrency enthusiast with years of experience under my belt, I find myself intrigued by the recent developments surrounding Justin Sun and Tron [TRX]. The news that he withdrew Bitcoin [BTC] used as collateral for the Tron-based stablecoin, Decentralized USD [USDD], has certainly grabbed my attention. It’s a fascinating turn of events, given my own experience with the ever-evolving landscape of digital currencies and their founders. The dynamics at play here are complex, but it serves as yet another reminder that the world of crypto is anything but predictable or stagnant.

He pulled 12K BTC, worth over $700 million based on press time market prices, without any approval from Tron DAO.

As someone who has witnessed the collapse of several cryptocurrencies, I can’t help but feel a sense of unease when I hear whispers of liquidation fears. The memory of Terra Luna’s downfall is still fresh in my mind, and the thought of history repeating itself sends a chill down my spine. It’s not just about losing money; it’s about the uncertainty and instability that comes with such events. I remember the sleepless nights spent worrying, wondering if I had made a mistake investing in something so volatile. So, while I am always eager to explore new opportunities in the crypto world, I also tread carefully, heeding the lessons of the past to navigate the treacherous waters of today.

Justin Sun defends himself

Nevertheless, Sun took a reassuring stance and justified his single-action as “basics of DeFi,” implying that part of his post on X (previously known as Twitter) explained this.

As an analyst, I’d rephrase that statement as follows: ‘If the value of my collateral surpasses the prescribed limit by the system, typically ranging from 120% to 150%, I have the liberty to withdraw any desired amount at will, without requiring approval from anyone else.’

Sun mentioned that the liquidation risk would become active only if the collateral’s value fell below 110%, as it would then require additional funds to be added (replenished).

In simple terms, if the value of the collateral you’ve pledged falls below a specific threshold (usually less than 110%), it needs to be increased; otherwise, there’s a risk that your collateral could lead to liquidation. This is one of the fundamental principles in DeFi education.

Consequently, according to Sun’s explanation, since USDD held collateral worth 300% of its value, he had no requirement for approval before taking action, as this action didn’t pose a risk of liquidation.

Fears still exist

Although the Sun tried to assure people, some users remained skeptical. Notably, well-known market analyst Marty Party identified him as a significant risk to the cryptocurrency sector.

“I also reported Sun and WBTC are the second largest risk in crypto.”

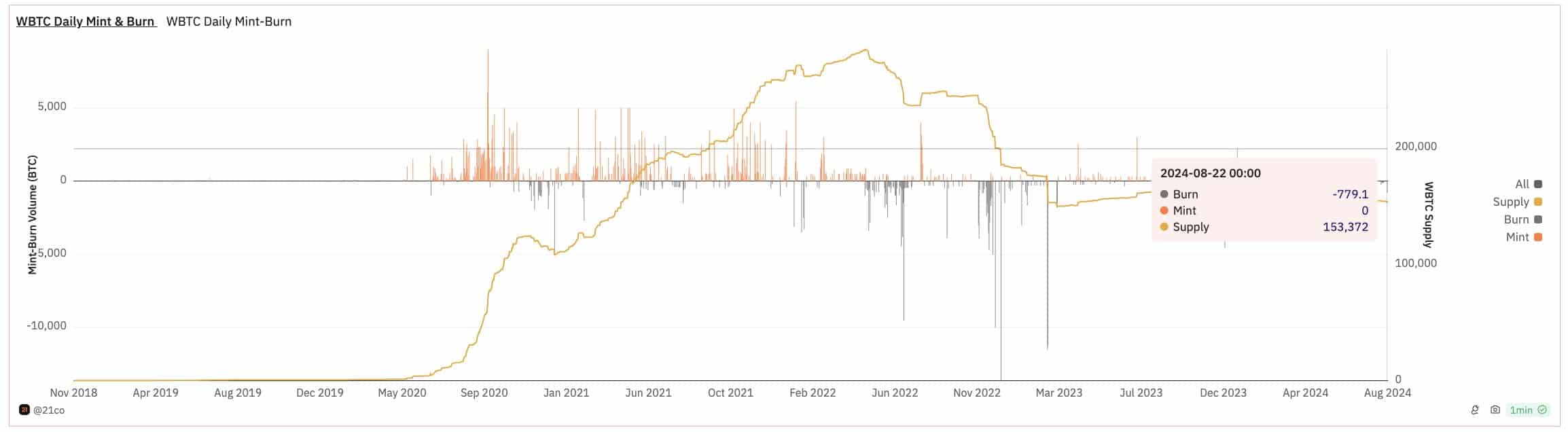

For context, last week, wrapped BTC (WBTC) custody changes also raised fears after Justin Sun was mentioned as being involved in its operations.

After the reveal of the custody changes, I’ve noticed a redemption of $90 million from WBTC. Interestingly, around half of that ($45M) was redeemed just within the past 24 hours. This could suggest that investors are seeking a ‘reliable alternative,’ as anticipated by my analysis.

“Since Bitgo’s announcement, approximately $90 million worth of WBTC has been cashed out. The community and the industry are actively seeking a more dependable, top-tier solution.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-24 03:04